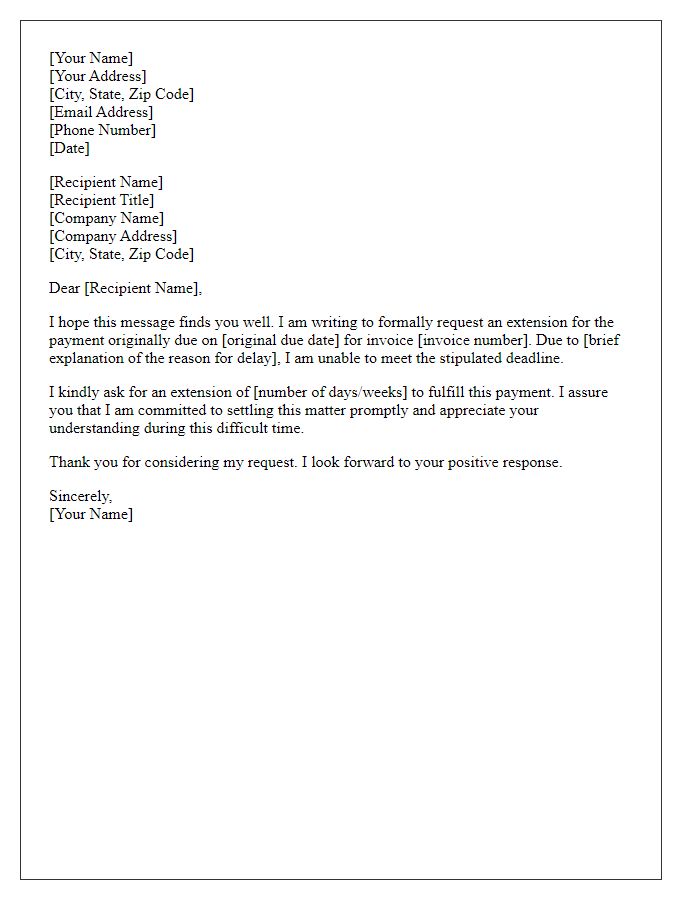

In today's fast-paced world, delays can happen to anyone, including timely payments. Whether it's an unexpected expense or a temporary cash flow issue, it's essential to communicate these matters clearly to maintain trust and understanding. In this article, we'll explore how to craft a thoughtful and effective letter explaining a delayed payment, ensuring you address the situation with professionalism and empathy. So, let's dive in and discover the best practices for navigating this delicate conversation!

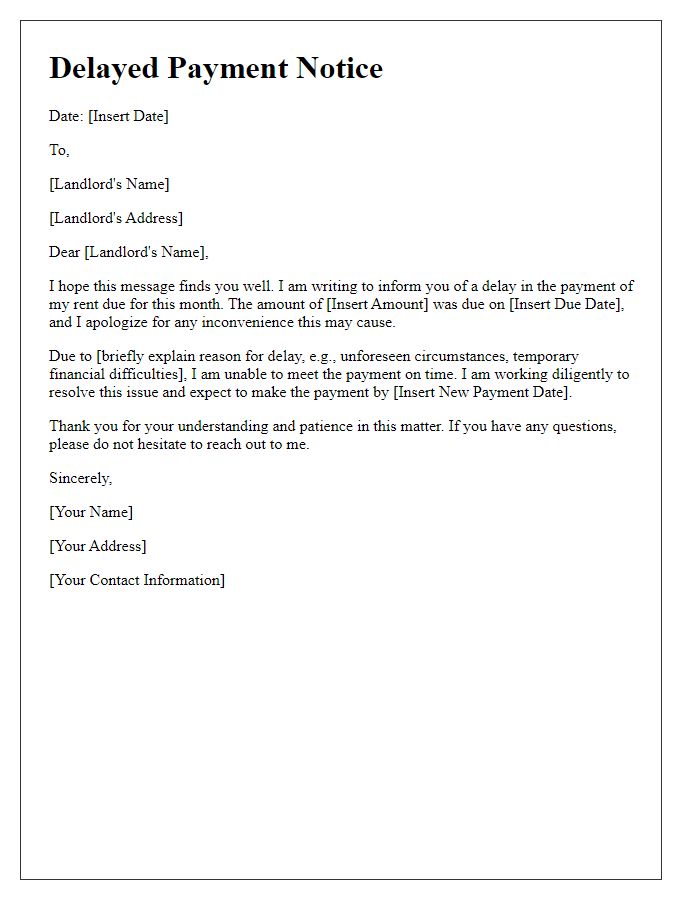

Explanation of Delay

Delayed payments can significantly impact small businesses, particularly those that rely on cash flow for daily operations. Factors like unexpected client insolvency or economic downturns can result in payment delays, affecting supplier relationships and employee wages. In particular, late payments from significant clients can disrupt the financial stability of companies, especially those operating in industries such as construction, where payment terms can stretch up to 30, 60, or even 90 days. Furthermore, businesses in regions with economic fluctuations, like Southern Europe, face additional challenges in maintaining liquidity. Understanding these dynamics is crucial for managing business expectations and planning future cash flow strategies.

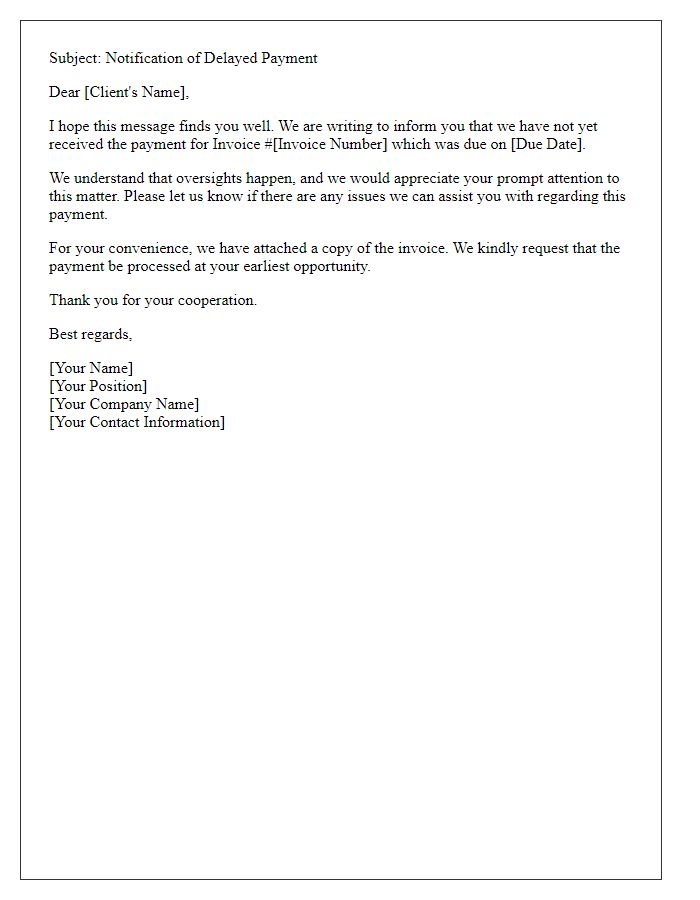

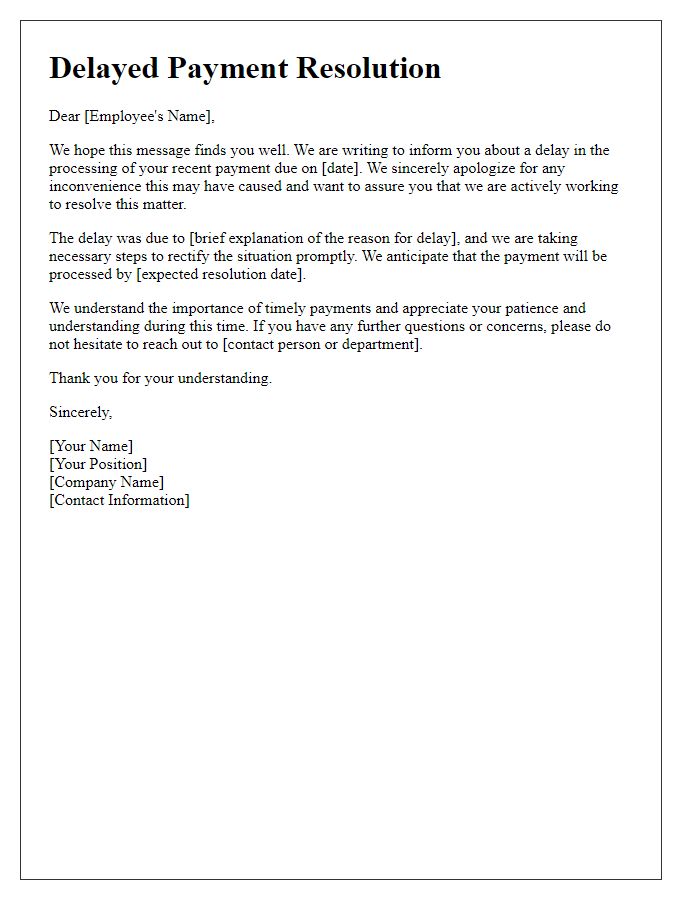

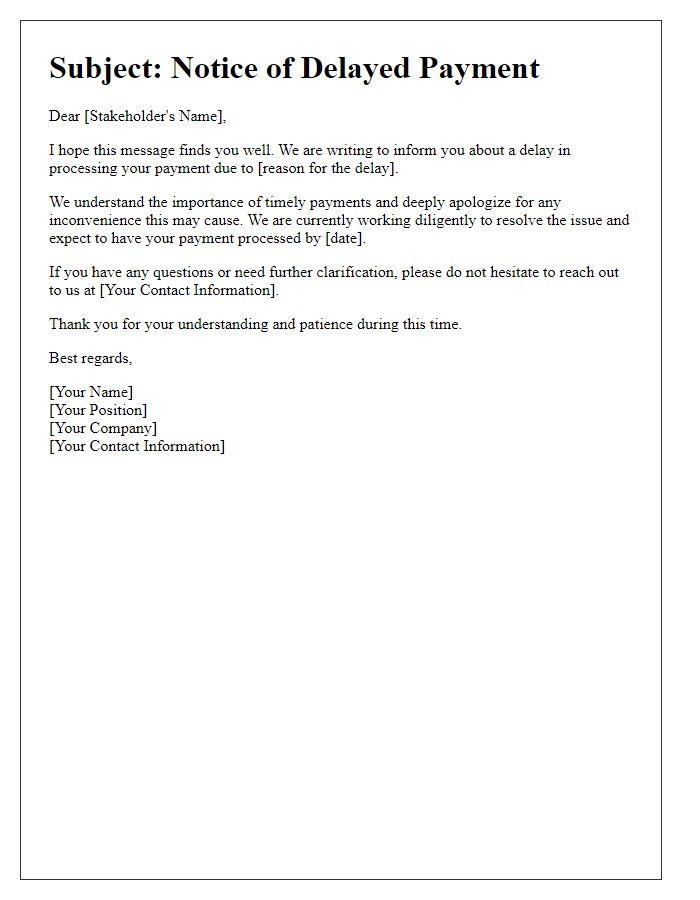

Apology for Inconvenience

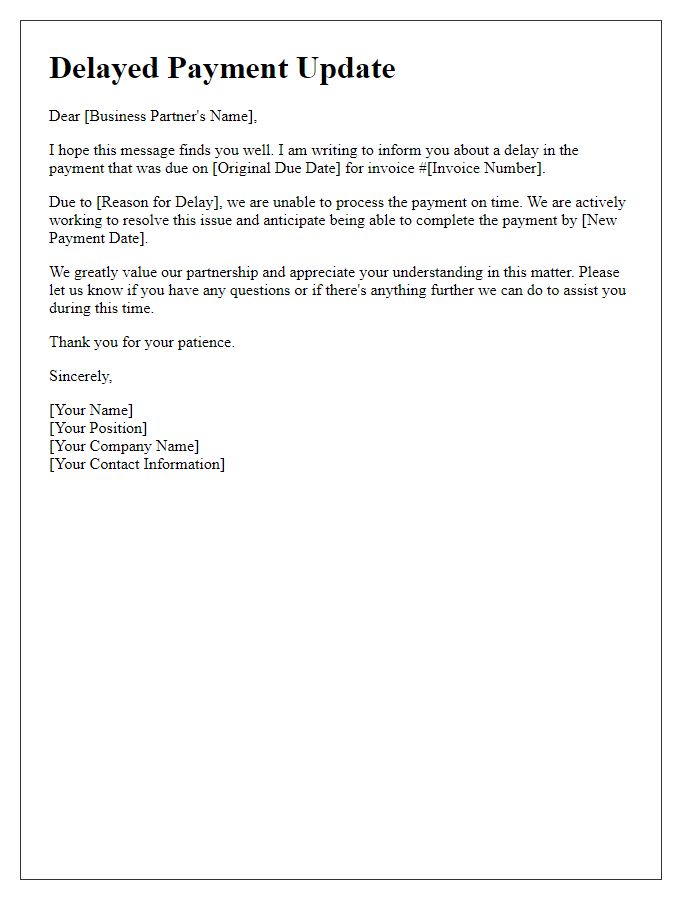

Delays in payment processing can significantly impact business operations and client relationships. Common factors contributing to payment delays include administrative errors, banking holidays, or unexpected financial issues. Communication with affected parties, such as vendors or clients, is critical to maintaining trust. For instance, a company may experience a delay due to a recent merger that necessitated system integration, causing temporary disruptions in their billing cycle. Such challenges underline the importance of prompt and transparent communication in managing expectations and resolving issues. Taking proactive steps to rectify the situation can demonstrate commitment to maintaining professional relationships in challenging times.

Commitment to Settle

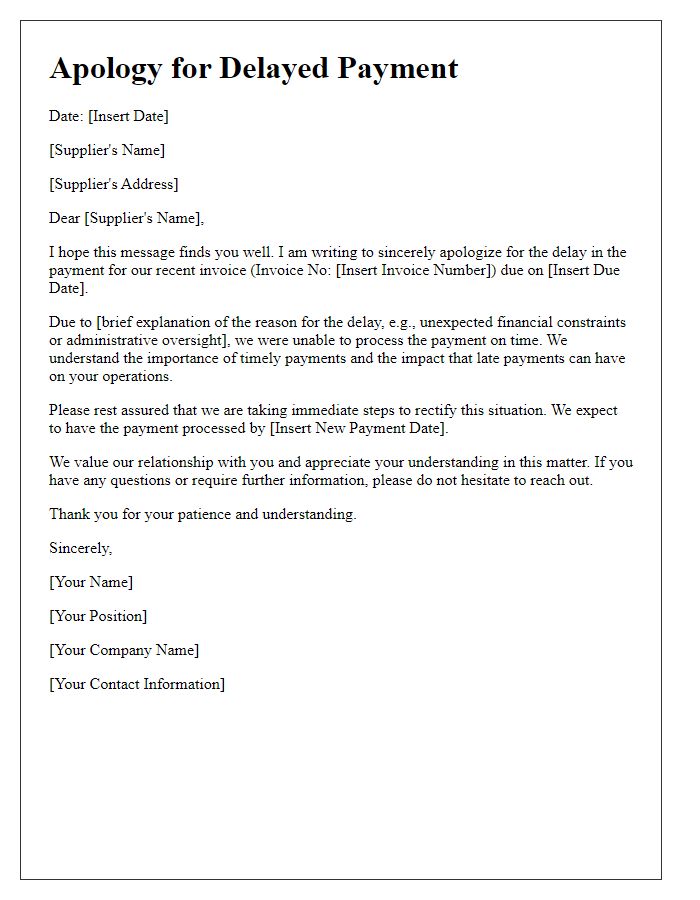

Delayed payments can occur due to various reasons, often impacting business operations significantly. Factors such as cash flow issues, unforeseen expenses, or administrative errors can lead to late settlements. Businesses like small enterprises often rely on timely payments to maintain operations and pay suppliers. In a recent case involving a payment due to a service provider, the financial strain was exacerbated by unexpected expenditures due to a supply chain disruption. Clear communication is essential in these situations, ensuring that all parties are aware of the status and timeline for resolution. Establishing a commitment to settle outstanding debts, alongside proposed payment plans, can help restore trust and maintain healthy business relationships.

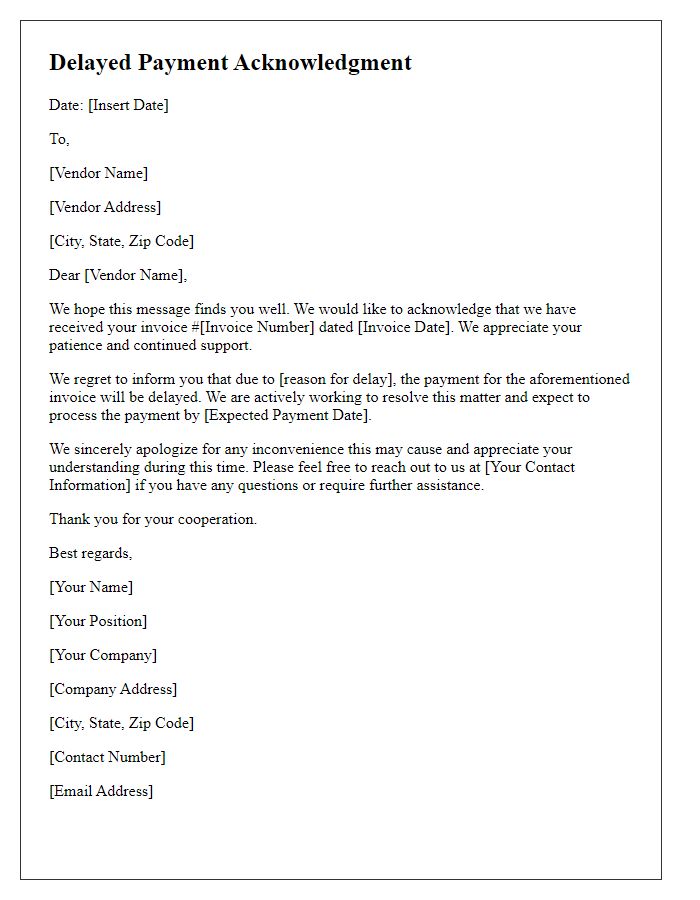

Revised Payment Schedule

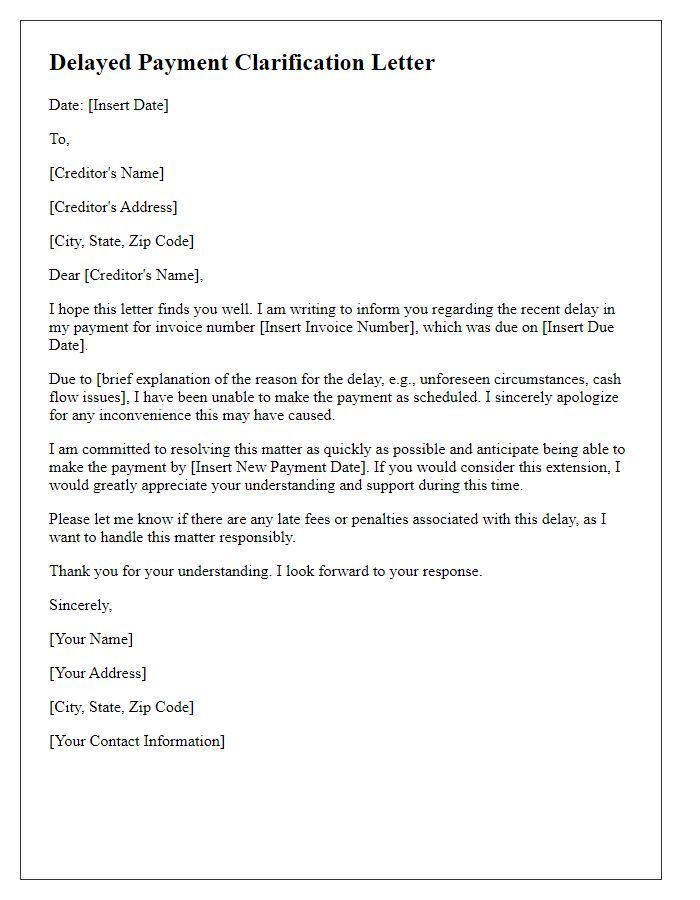

A detailed explanation for delayed payments often includes key factors like economic circumstances, regulatory changes, or unforeseen events. The revised payment schedule frequently outlines specific dates and amounts due, ensuring clear communication. Such clarity helps maintain strong relationships between parties involved, like clients and service providers. Additionally, referencing previous agreements or contracts can provide necessary context. Notably, transparency in these situations builds trust and facilitates better financial planning.

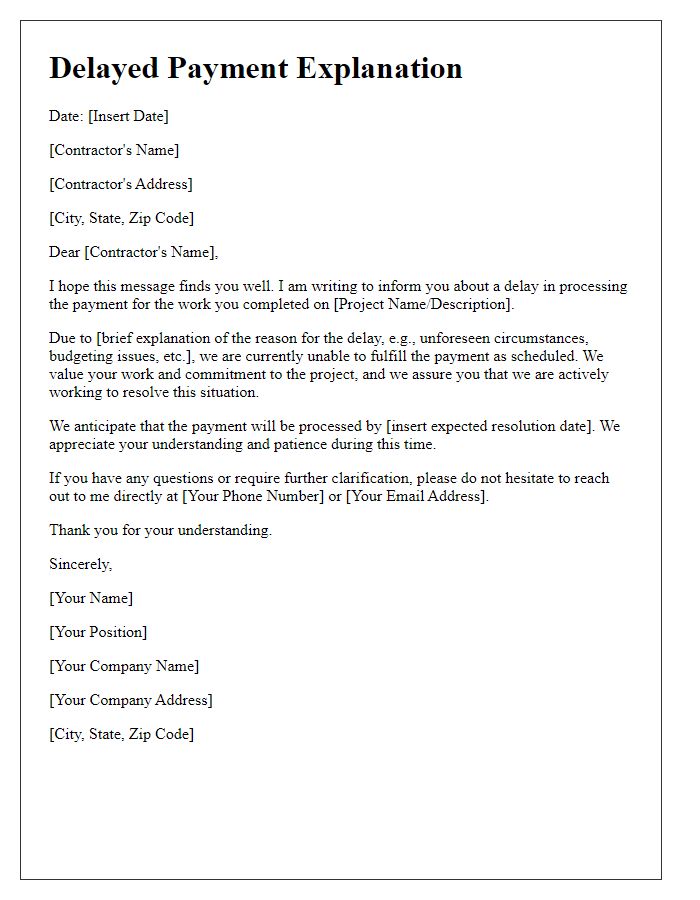

Assurance of Future Compliance

Delayed payments can strain business relationships, especially in transactions involving services such as consultancy or product supply. Companies often encounter unforeseen issues, like unexpected expenses or cash flow discrepancies, that lead to late payments to vendors or partners. For example, a company may experience delays in client payments or seasonal fluctuations that impact revenue streams. Effective communication about these issues is essential; providing a sincere explanation and outlining steps taken to prevent future occurrences fosters trust. Commitment to timely payments in the future, possibly backed by restructuring financial protocols or setting new accounts payable practices, can reassure stakeholders and maintain strong partnerships despite minor setbacks.

Comments