Are you curious about how your credit score can impact your financial life? Understanding the intricacies of credit scores is essential for making informed decisions regarding loans, mortgages, and even job applications. In this article, we'll break down the factors that influence your credit score and what steps you can take to improve it. Join us as we explore these crucial aspects in detail and empower you to take control of your financial future!

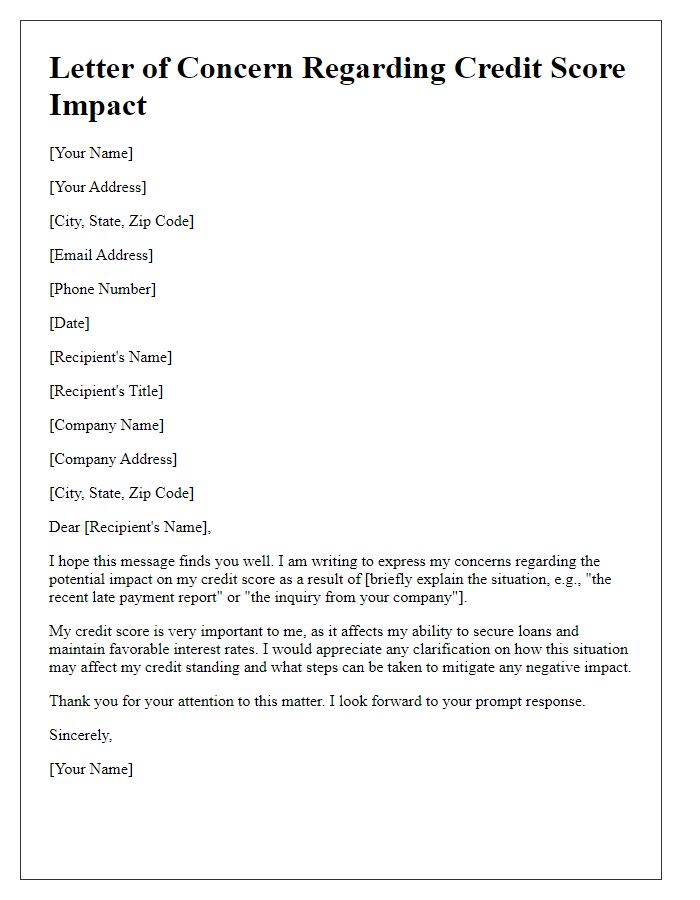

Personal Information (Name, Address, Contact Details)

Personal information can influence credit scores significantly. Key factors include payment history (35% of the score), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit inquiries (10%). Essential details such as name may impact identity verification processes, while address can associate credit reports with specific geographic areas, affecting local lending practices. Contact details are crucial for communication with credit bureaus, such as Experian or TransUnion, and for resolving discrepancies that may arise. Understanding how each component interacts with credit scoring models, like FICO or VantageScore, is vital for maintaining a healthy credit profile.

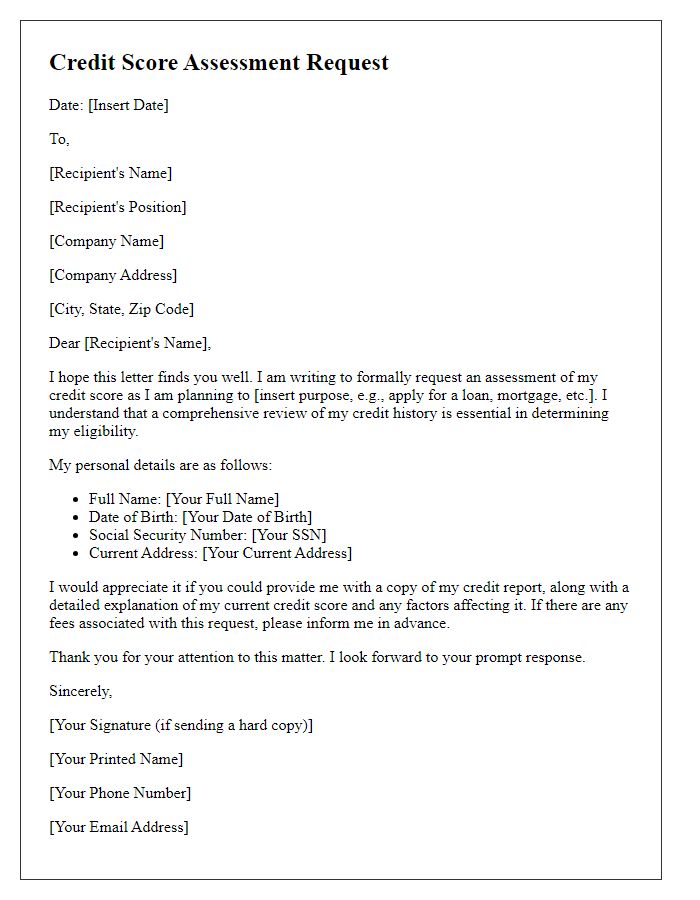

Account Details (Account Number, Creditor Information)

Credit scores play a critical role in personal finance management, influencing interest rates and loan approvals for consumers. An individual's credit report details account information, including account numbers, creditor names such as major banks or credit unions, and payment history. Missed payments or defaults can lower the score significantly, while timely payments can enhance it. The three primary credit bureaus--Equifax, Experian, and TransUnion--regularly update these reports, which can be accessed by lenders during credit evaluations. Understanding these elements is essential for consumers seeking to improve their creditworthiness and maintain financial stability.

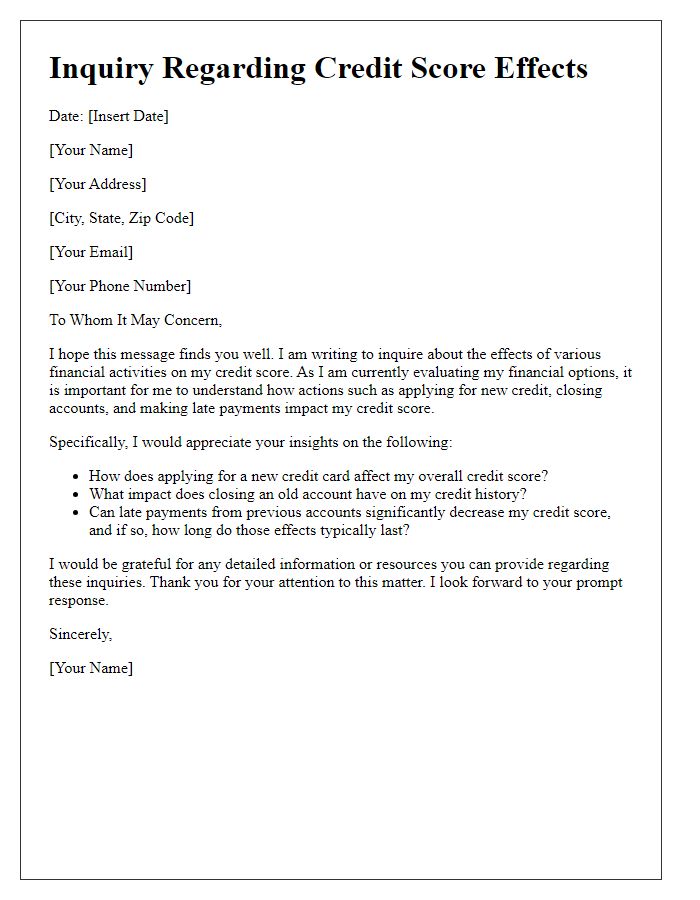

Inquiry Purpose (Clarification on Credit Score Impact)

The impact of multiple credit inquiries can significantly affect an individual's credit score, particularly when dealing with entities such as FICO or VantageScore calculations. Each hard inquiry, often associated with loan applications (such as mortgages or auto loans), can lower a credit score by a few points, especially when inquiries occur within a short timeframe. Generally, inquiries remain visible on a credit report for up to two years, influencing the borrowing capacity during that period. Understanding the precise effect of recent inquiries on a credit score is crucial for consumers in financial decision-making. Locations such as credit reporting agencies (TransUnion, Experian, Equifax) provide resources to clarify these impacts and assist individuals in navigating their credit health effectively.

Request for Detailed Explanation (Factors Affecting the Score)

A credit score reflects an individual's creditworthiness, primarily influenced by five key factors. These include payment history, accounting for approximately 35% of the score, which highlights the importance of timely payments on debts, bills, and loans. Credit utilization, making up about 30%, involves the ratio of current debt to available credit, influencing how lenders perceive spending habits. Length of credit history, representing 15%, considers the age of credit accounts, with longer histories typically favoring higher scores. Types of credit accounts, approximately 10%, involve the diversity of credit used, such as credit cards, mortgages, and car loans, showcasing the ability to manage different credit products. Lastly, new credit inquiries contribute 10%, indicating the recent applications for additional credit, which can suggest risk to lenders when excessive inquiries occur within a short timeframe. Understanding these factors is crucial for individuals seeking to enhance their financial profiles and achieve better lending terms.

Contact Preferences and Follow-up Request

Consumers often inquire about the impact of credit score inquiries on their overall financial health. A soft inquiry, typically done during pre-approval processes, does not affect the credit score, while a hard inquiry, arising from applying for loans or credit cards, may decrease the score by a few points, usually lasting up to two years. Important details surrounding the inquiry frequency should be monitored, especially if multiple hard inquiries occur within a short span, as this can indicate increased credit risk to lenders. Consumers are encouraged to actively check their credit report from annualcreditreport.com to understand the state of their credit profile fully. Furthermore, staying informed about the timing and nature of inquiries allows individuals to better manage their creditworthiness and future borrowing potential.

Comments