Are you feeling overwhelmed by student loan debt? You're not alone, as many graduates are seeking relief through student loan forgiveness programs. Understanding how to navigate the application process can make all the difference in achieving financial freedom. Join us as we delve into essential tips and a comprehensive letter template to guide you through your student loan forgiveness application journey!

Applicant's personal information

Student loan forgiveness applications typically require personal information from the applicant, including full name (such as Johnathan Smith), Social Security number (like 123-45-6789), date of birth (January 15, 1995), and current residential address (e.g., 456 Elm Street, Springfield, IL 62704). Additional details often include phone number (555-0123-4567) and email address (johnsmith@email.com) for communication purposes. Employment information may also be needed, such as employer name (XYZ Corporation), address (789 Oak Avenue, Springfield, IL 62704), and job title (Customer Service Representative). This information is crucial for verifying eligibility and ensuring accurate processing of the loan forgiveness request.

Loan account details

Submitting an application for student loan forgiveness requires detailed information about the loan account. Specific loan account numbers, typically issued by the servicer, are essential for accurate identification and processing. Loan amounts, such as the total principal owed, provide context for the request. Borrower details, including name, social security number, and contact information, ensure the application is linked to the correct individual. It is also pertinent to note the type of loans involved, for instance, Direct Subsidized, Direct Unsubsidized, or PLUS loans, as each may have different eligibility criteria under forgiveness programs like the Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment (IDR) forgiveness.

Reason for seeking forgiveness

The pursuit of student loan forgiveness often stems from financial hardship, which can be exacerbated by circumstances such as unemployment rates reaching as high as 14.7% during economic downturns, affecting job stability. For many graduates, particularly those from public universities like the University of California system, the burden of federal loans can exceed $30,000, amplifying stress and financial struggles. Additionally, factors such as medical emergencies, household expenses, or the unpredictable nature of the gig economy introduce further challenges in meeting monthly repayment obligations. These scenarios contribute to a compelling case for seeking student loan forgiveness under programs designed to alleviate the financial strain on borrowers who are committed to public service or who demonstrate economic necessity.

Demonstration of eligibility criteria

Student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF), require borrowers to meet specific eligibility criteria. This includes working in eligible public service jobs, making 120 qualifying monthly payments, and being enrolled in an eligible repayment plan, such as an income-driven repayment plan. Eligible public service jobs include full-time roles at government organizations, certain non-profit entities, and other qualifying institutions. Borrowers must track their employment history and payments meticulously, as documentation is crucial for proving eligibility. By meeting these strict guidelines, participants can have their remaining federal student loan balance forgiven after fulfilling the necessary commitments.

Supporting documentation and evidence

The process of applying for student loan forgiveness often requires comprehensive supporting documentation and substantial evidence to substantiate eligibility. Applicants must gather records such as tax returns from the previous year, specifically IRS Form 1040, as well as proof of employment verified through a recent pay stub or an employer's letter detailing job responsibilities and confirmation of qualifying public service. Additional documents may include the Federal Student Aid (FSA) ID needed for access to loan information, loan servicer statements illustrating outstanding balances of federal loans, and documentation that explicitly confirms any disability status if applying under the Total and Permanent Disability Discharge program. Proper organization of these documents ensures a smooth and efficient application process.

Letter Template For Student Loan Forgiveness Application Samples

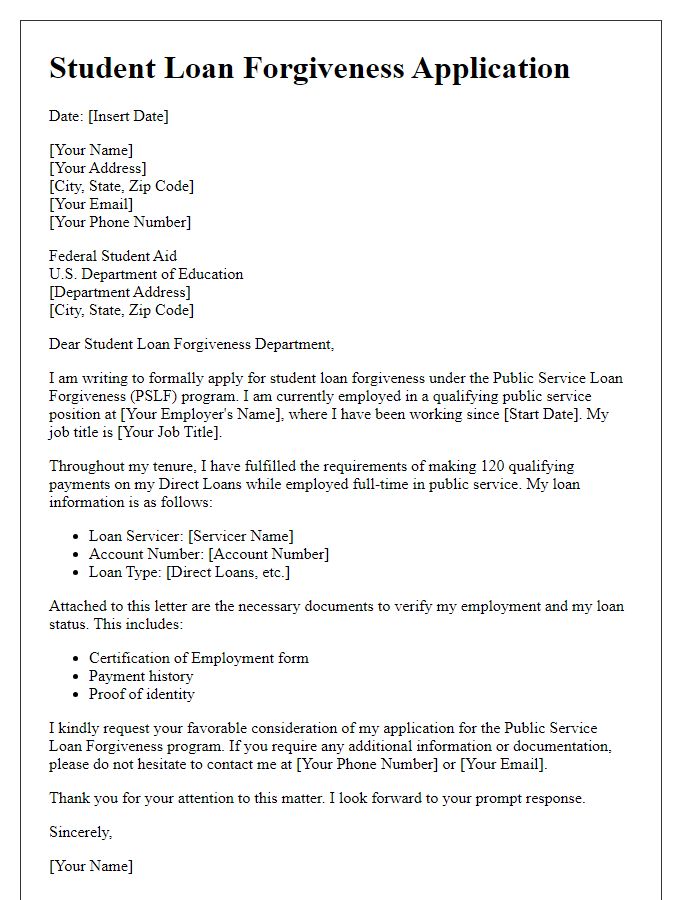

Letter template of student loan forgiveness application for public service employees

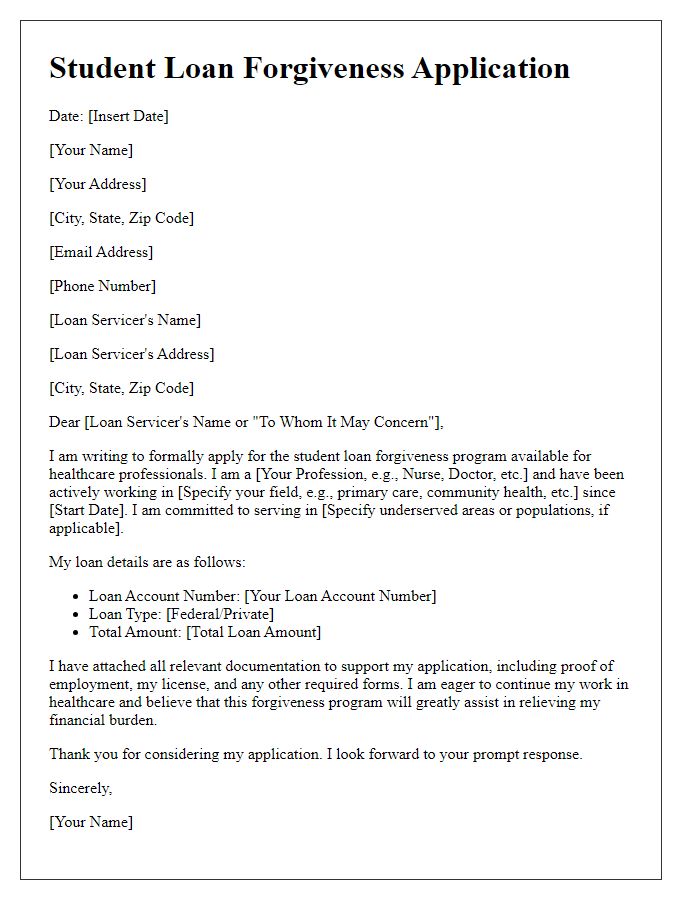

Letter template of student loan forgiveness application for healthcare professionals

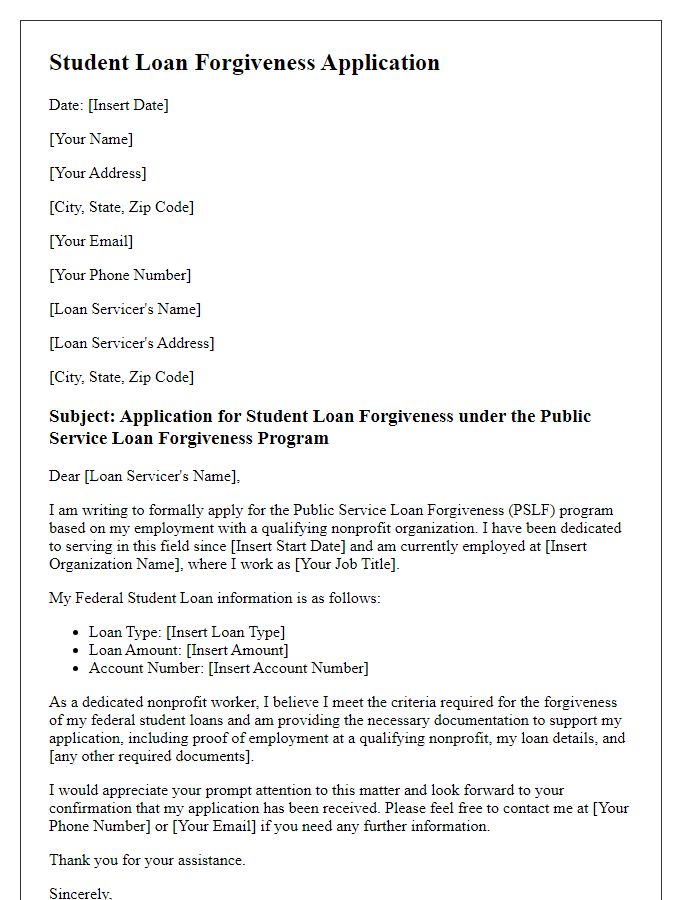

Letter template of student loan forgiveness application for nonprofit workers

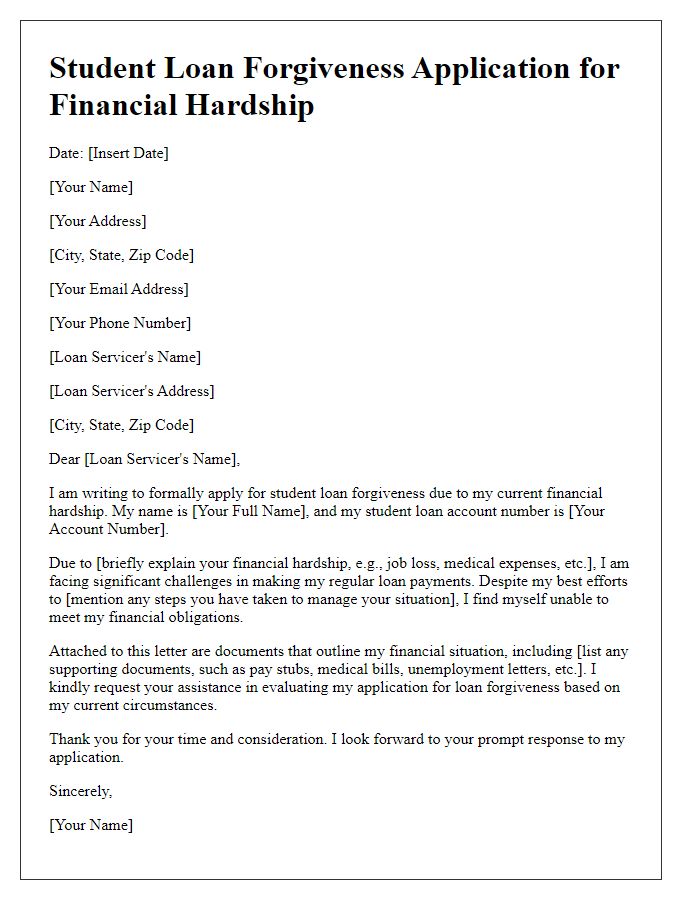

Letter template of student loan forgiveness application for borrowers with financial hardship

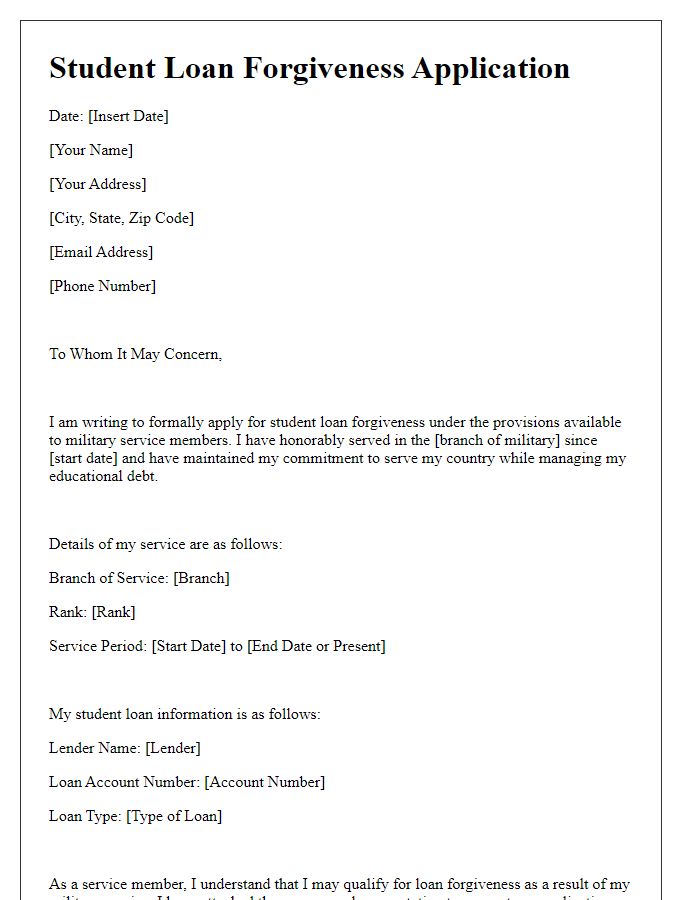

Letter template of student loan forgiveness application for military service members

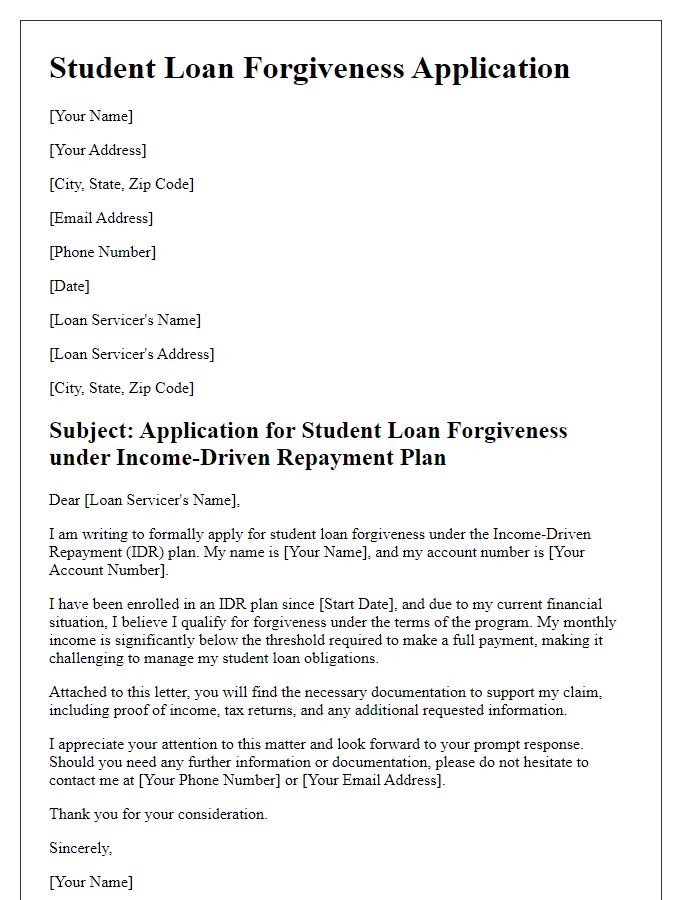

Letter template of student loan forgiveness application for income-driven repayment plan candidates

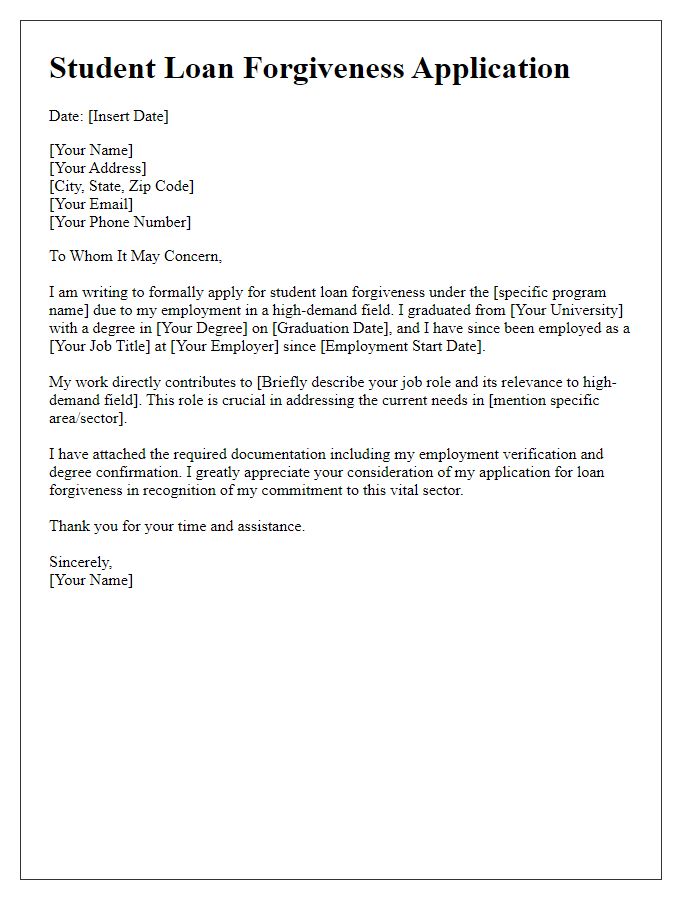

Letter template of student loan forgiveness application for graduates in high-demand fields

Comments