Congratulations on your graduation! As you step into this exciting new chapter of your life, it's crucial to revisit your student loan situation to ensure you're on the right financial path. Adjusting your student loans post-graduation can open doors to favorable repayment options that suit your current circumstances. Curious about how to navigate this process? Read on to discover useful insights and tips!

Loan details and student information

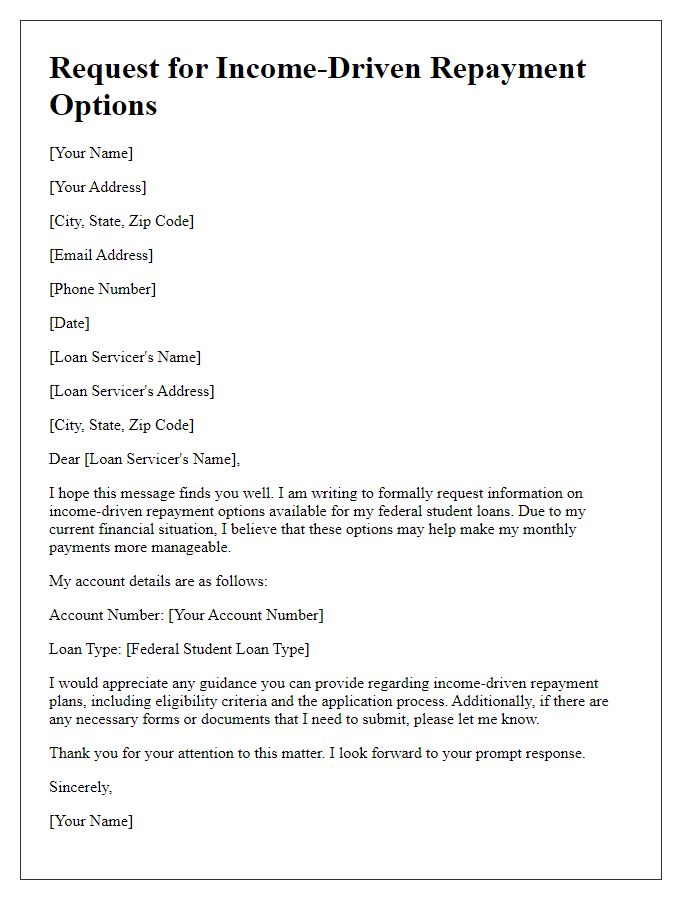

Post-graduation adjustments to student loans, such as Federal Direct Stafford Loans or Private Education Loans, are essential for managing repayment. Graduates must be aware of the interest rates associated with their loans, which range from 2.75% to 7% depending on the loan type and disbursement date. Borrowers should also note their repayment term, typically spanning 10 to 25 years. Additionally, understanding the grace period, usually six months for federal loans, is crucial for planning the first payment. Most importantly, students should keep their contact information updated with their loan servicer to receive important notifications regarding repayment options, such as Income-Driven Repayment Plans or deferment opportunities, which can provide financial relief based on income fluctuations post-graduation.

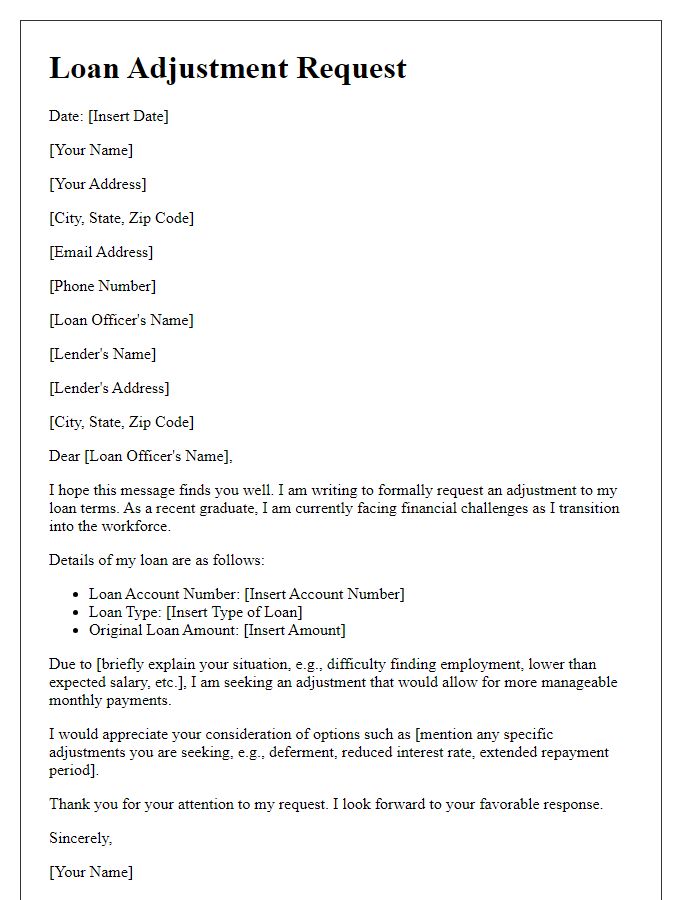

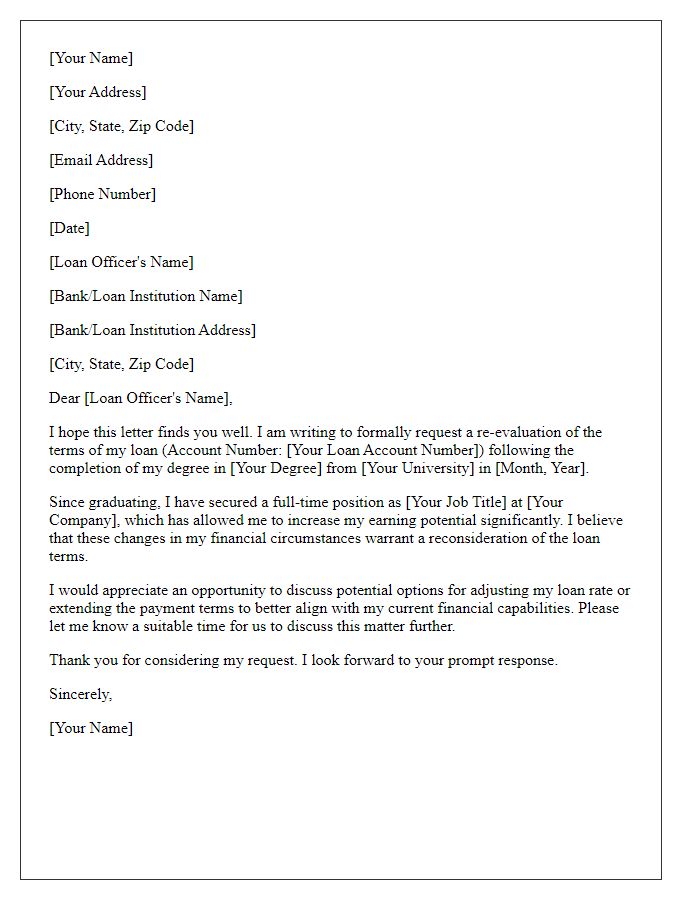

Request for loan term adjustment or deferment

Post-graduation loan term adjustments can significantly impact repayment strategies for students like John Smith, who graduated with a Bachelor of Arts degree in May 2023 from the University of California, Berkeley. With a total loan amount of $30,000, he is seeking adjustments to the repayment framework due to recent employment challenges. The Federal Direct Loan Program facilitates such alterations, allowing borrowers to request deferment on loans for up to 36 months under specific circumstances. Providing documentation of income, or lack thereof, can strengthen his case, potentially leading to a modified repayment plan aligning with his current financial situation. Understanding the implications of interest accumulation during this period is essential to making informed decisions that will affect future financial stability.

Reason for adjustment request with supporting evidence

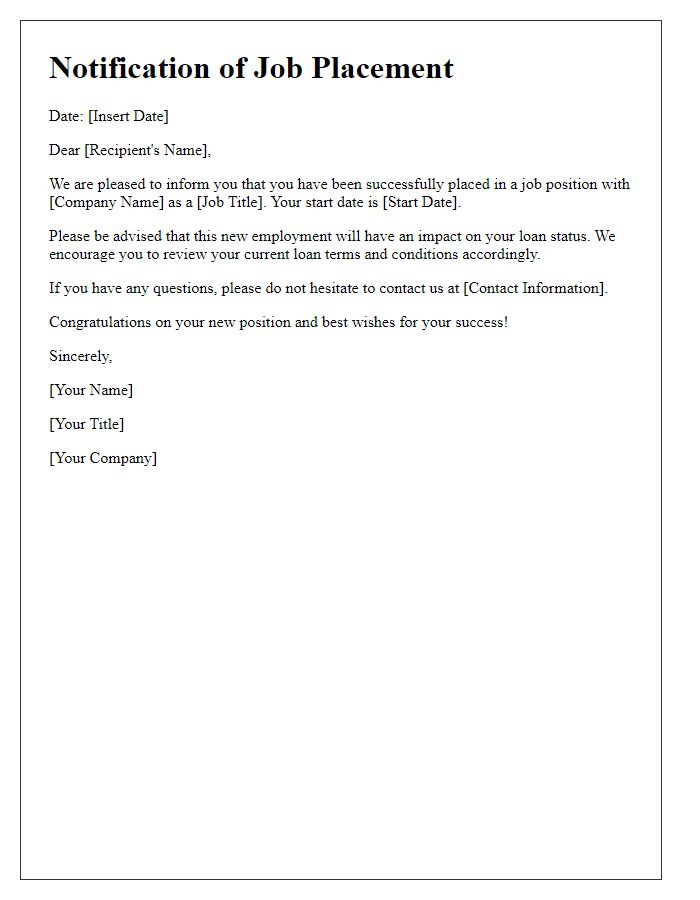

Recent graduates often seek adjustments to their student loan repayments due to changes in financial circumstances. For instance, recent employment data indicates an average entry-level salary of $50,000 for graduates in fields such as marketing and engineering. Many graduates experience a delay in job placement, with approximately 15% remaining unemployed for more than six months post-graduation. Supporting evidence for a loan adjustment may include pay stubs showing reduced income or offer letters that specify salary terms. Additionally, documentation such as budget statements highlighting living expenses in cities with high costs of living, like San Francisco or New York, can bolster the case for adjusting repayment plans to ensure financial stability during the transition from education to employment.

Proposed new payment plan or schedule

Recent graduates often seek to adjust their student loan payment plans to accommodate new financial circumstances. A revised payment schedule, such as a 10-year repayment plan, might provide lower monthly payments through income-driven repayment options like Revised Pay As You Earn (REPAYE). For example, a borrower who previously owed $30,000 in federal student loans might benefit from a new plan that reduces monthly payments from $350 to $220, based on their current income and family size. Additionally, consolidating multiple loans under Direct Consolidation can simplify payment management and extend terms up to 30 years, offering significant relief for those facing immediate financial challenges after college.

Contact information for further discussion or clarification

Post-graduation adjustments to student loans often require careful consideration of loan terms (such as interest rates and repayment schedules) and personal financial situations. It's crucial to contact the loan servicer, typically a specialized financial institution managing student loans, for specific details on any changes required. Important information includes the loan servicer's name, phone number (generally a toll-free number), and email address to facilitate communication. Provide personal identification such as the Social Security number or account number for accurate tracking. Additionally, keep records of conversations and documents for reference. Understanding federal regulations around deferment, forbearance, and repayment plans ensures informed decisions regarding loan management.

Letter Template For Student Loan Adjustment Post-Graduation Samples

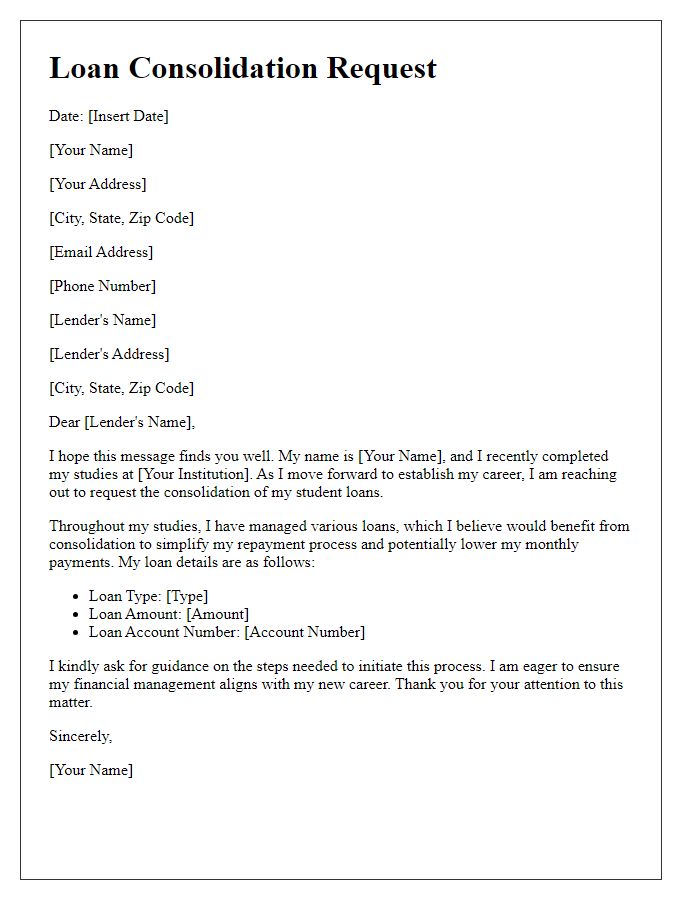

Letter template of request for loan consolidation after completing studies

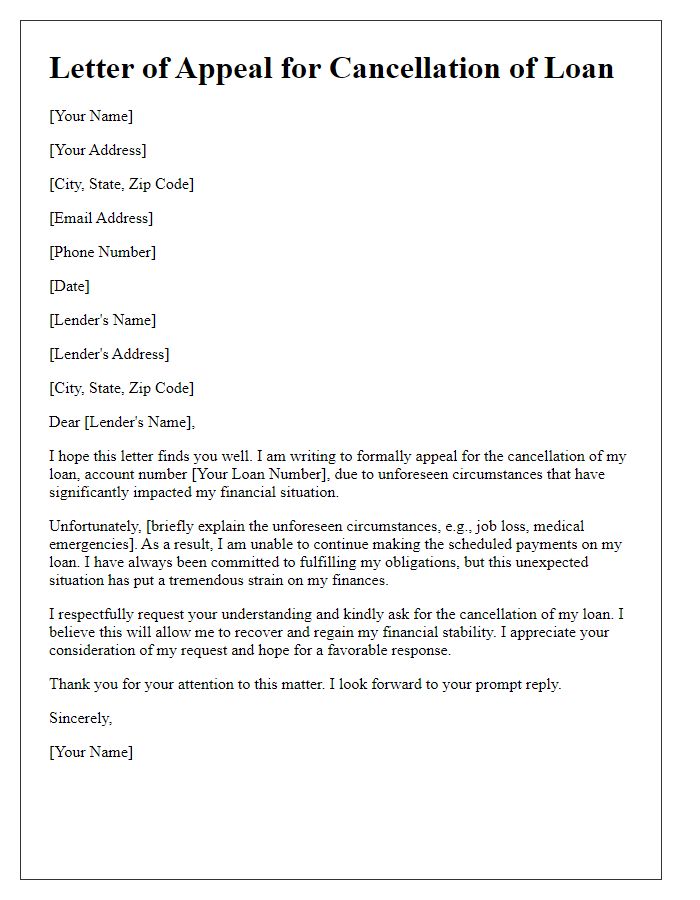

Letter template of appeal for cancellation of loan due to unforeseen circumstances

Comments