Navigating the world of student loans can be a bit overwhelming, especially when it comes to understanding the fine print of your loan agreement. Many students find themselves confused about interest rates, repayment options, and even deferment policies. In this article, we'll break down the essential terms of your student loan agreement in a clear and straightforward way, ensuring you have all the information you need to make informed financial decisions. So, grab a cup of coffee and keep reading to empower yourself with knowledge about your student loans!

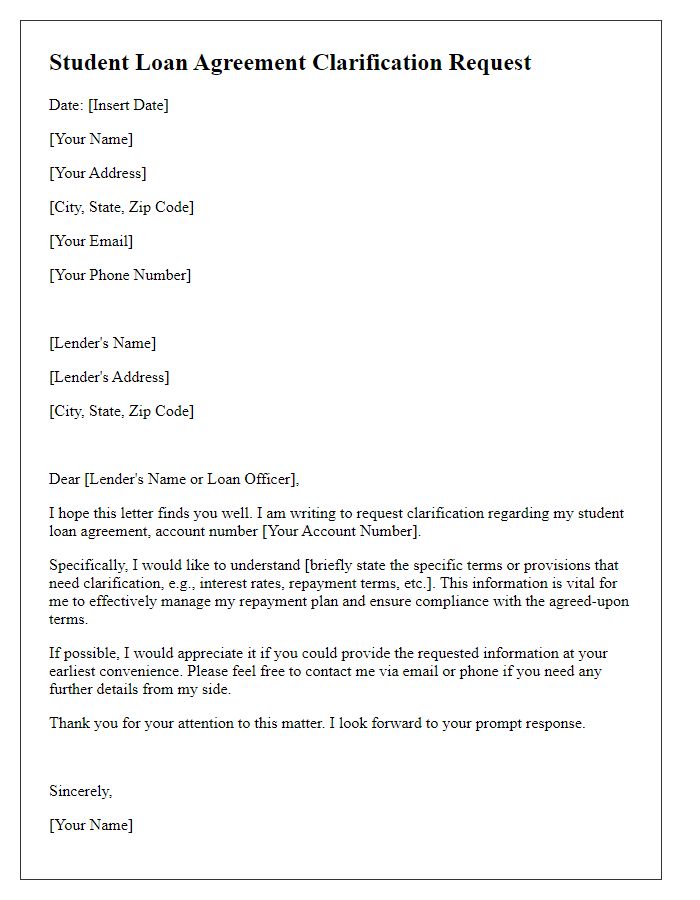

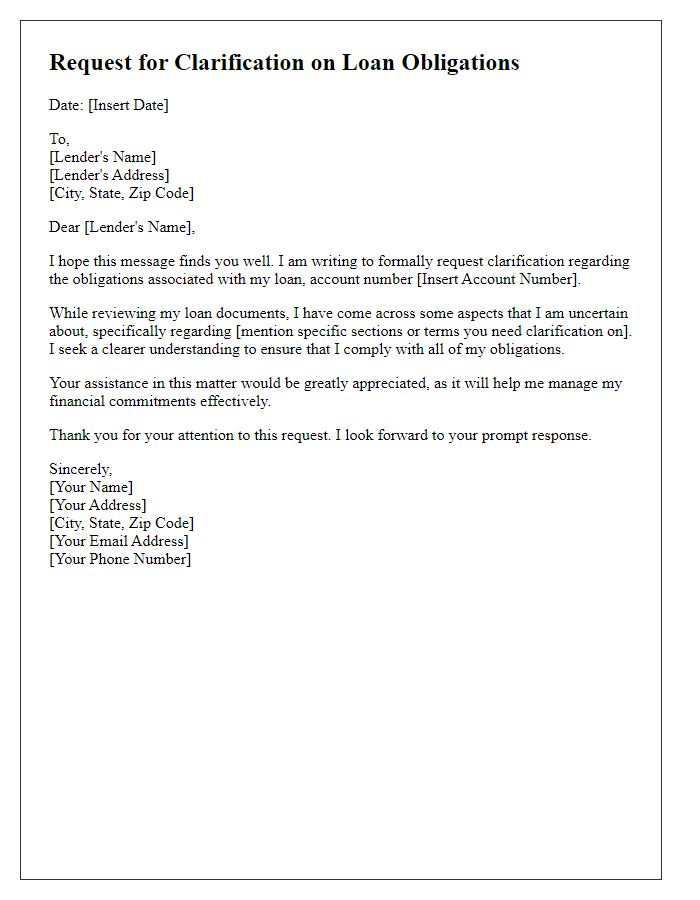

Accurate loan amount and interest rates

Clarifying the terms of student loan agreements is essential for ensuring transparency and mutual understanding between borrowers and lenders. Accurate loan amounts play a critical role in financial planning, as excessive or deficient funding can lead to difficulties in meeting educational expenses. Interest rates significantly impact the total repayment amount over time. For example, a fixed interest rate of 5% versus a variable rate that could climb higher presents varying long-term costs. Borrowers should also be aware of any fees or additional charges that affect the overall amount due. Understanding these components creates a solid foundation for responsible financial management, especially for students navigating their educational journeys at institutions such as universities or colleges.

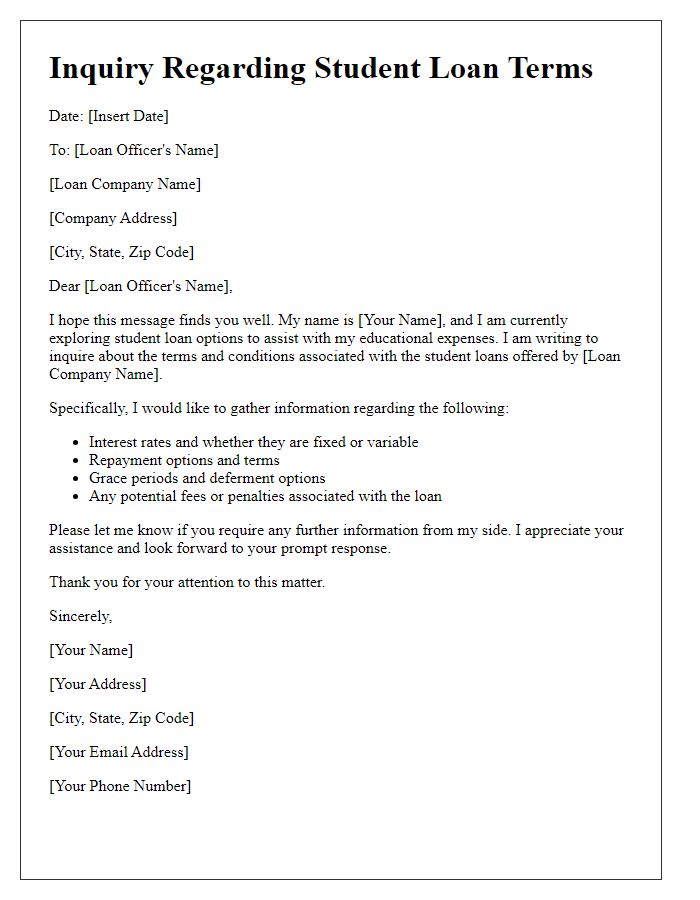

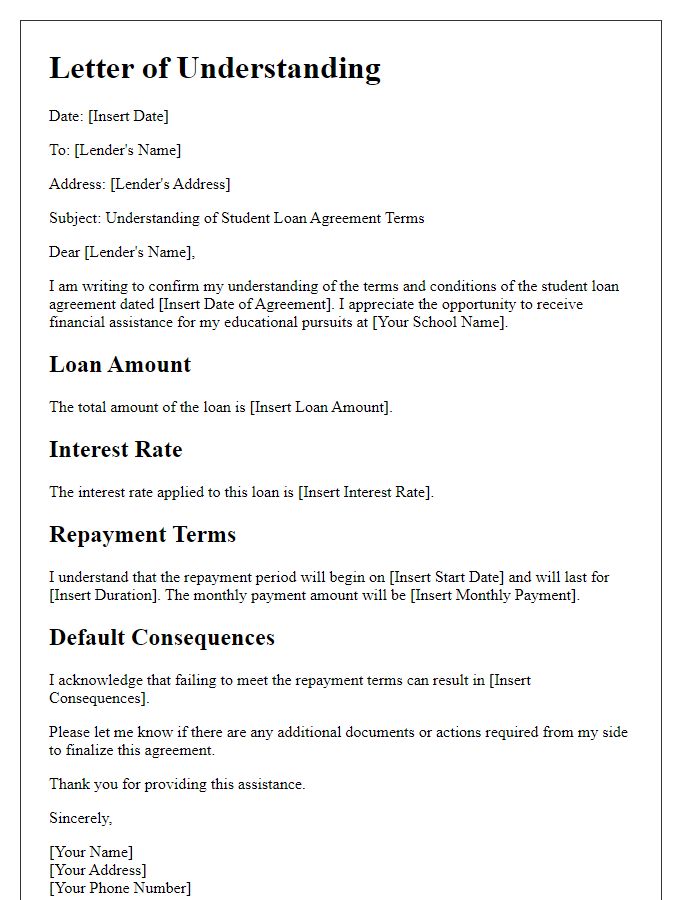

Repayment schedule and terms

A student loan agreement specifies important details like the repayment schedule, which outlines when payments are due and the duration of repayment, typically ranging from 10 to 30 years. Understanding the interest rates, often variable or fixed, is crucial as they significantly impact the total repayment amount. The loan servicer, a designated organization managing the loan, communicates pertinent information about monthly payment amounts and repayment options. Some agreements may include deferment or forbearance conditions, allowing temporary pauses in payments under specific circumstances such as financial hardship or returning to school. Being aware of the grace period, usually six months after graduation, can help manage finances effectively before repayment begins.

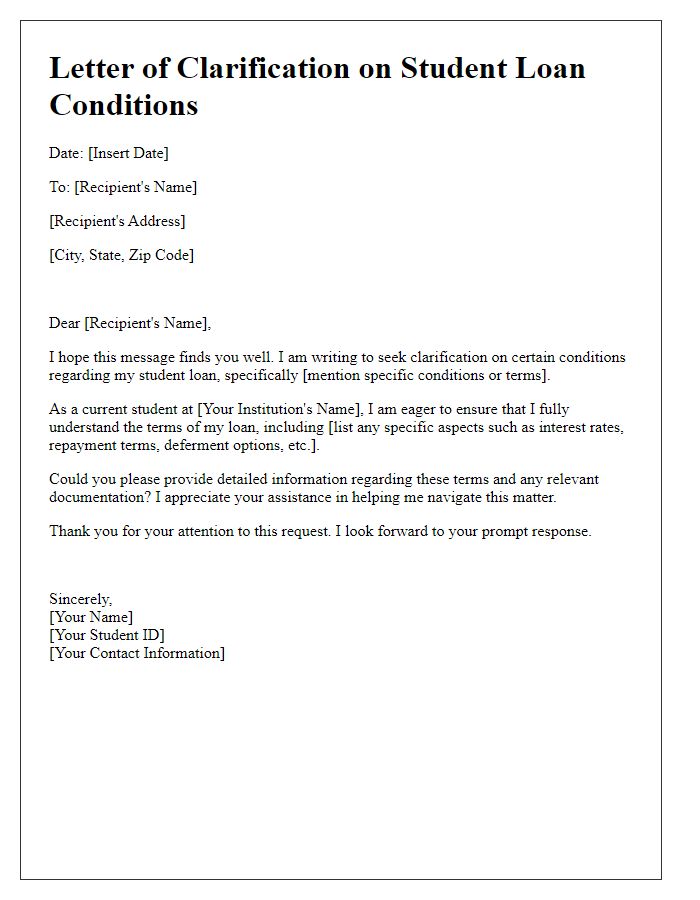

Deferment and forbearance options

Deferment and forbearance are crucial options in student loan agreements, offering relief during financial hardships. Deferment allows borrowers to temporarily pause repayments without accruing interest on specific types of federal loans, such as Subsidized Stafford Loans, for a designated period (usually up to three years). Eligibility requirements include enrollment in school, unemployment, or economic hardship. In contrast, forbearance permits borrowers to halt or reduce payments for a limited time, generally lasting up to 12 months, though interest continues to accumulate on all loans, including Unsubsidized loans. Borrowers may seek forbearance when facing temporary financial distress, such as medical emergencies or job loss. Understanding these provisions is essential for effective loan management and maintaining financial stability.

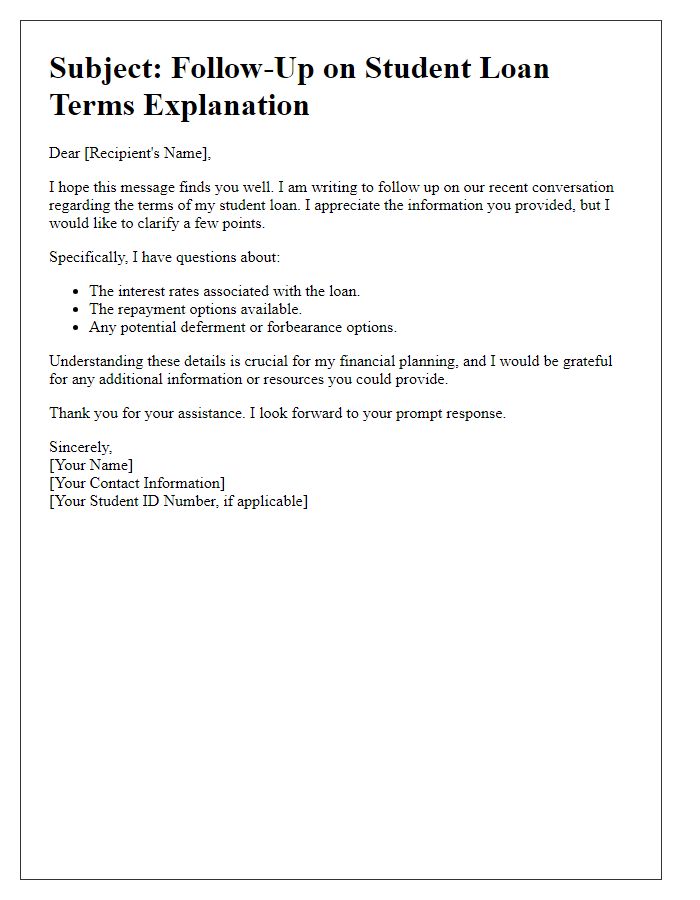

Loan forgiveness criteria

Student loan forgiveness criteria can vary significantly depending on the program, federal or private lender. Programs like Public Service Loan Forgiveness (PSLF) require borrowers to make 120 qualifying monthly payments while working full-time for a qualifying employer, such as a government or non-profit organization. The income-driven repayment plans, including Revised Pay As You Earn (REPAYE) and Income-Based Repayment (IBR), offer forgiveness after 20 or 25 years of qualifying payments. The eligibility criteria may include factors like loan type (federal Direct Loans versus private loans) and employment status. Accurate documentation is crucial; keeping records of employment and payment history ensures compliance with the necessary program requirements to maximize loan forgiveness benefits.

Contact information for support and disputes

The student loan agreement (specific document reference number) outlines crucial terms regarding repayment, interest rates, and conditions applicable to (loan provider name). For support related to the agreement or for disputing any terms, borrowers should reach out to the dedicated customer service team available at (customer service phone number) or through email at (customer service email address). Additionally, the office for dispute resolution, located at (office address), can be contacted for formal complaints or clarification on specific issues related to the agreement. This ensures borrowers have clear channels for assistance and resolution options related to their student loans.

Comments