Facing redundancy can be a daunting experience, especially when it impacts your financial stability and ability to make mortgage payments. It's important to know that you're not aloneâmany individuals find themselves in similar situations and may qualify for a mortgage payment holiday. This temporary relief can provide the much-needed breathing room during tough times, allowing you to focus on securing new employment. If you're interested in learning more about how to apply for this support and navigate the process, keep reading!

Clear Subject Line

A mortgage payment holiday can provide financial relief for individuals facing redundancy in employment. This temporary suspension of mortgage payments allows homeowners to alleviate immediate financial pressure while seeking new employment opportunities. Typically, lenders may offer payment holidays ranging from one to six months, depending on the individual's financial circumstances and the lender's guidelines. During this period, interest may still accrue on the principal balance, potentially impacting future payments. Homeowners should communicate their situation clearly, providing necessary documentation such as redundancy letters from employers, to ensure a smooth application process. Understanding the terms and conditions of the mortgage agreement is crucial, as it outlines the implications of entering a payment holiday.

Personal Details

A mortgage payment holiday, or temporary suspension of payments, can be requested by individuals who find themselves in a difficult financial situation, such as redundancy. This situation often arises during economic downturns or company layoffs. Homeowners facing these conditions may consider reaching out to their mortgage lender to discuss potential options for relief. Redundancy, typically defined as involuntary termination of employment due to economic factors or job elimination, affects numerous individuals across various sectors, including retail, manufacturing, and services. By detailing personal circumstances such as job loss, income reduction, and payment history, borrowers can strengthen their case for obtaining a payment holiday. Additionally, local laws and guidelines regarding mortgage relief programs will vary, influencing the options available to individuals.

Reason for Request

Many homeowners face financial challenges during times of redundancy, particularly when experiencing involuntary unemployment. A mortgage payment holiday can provide temporary relief, allowing individuals to prioritize essential expenses such as housing, utilities, and food during this challenging period. Redundant workers may seek this respite through mortgage lenders, especially if they have demonstrated a good payment history prior to the job loss. Lenders typically assess the length of employment, the reasons for redundancy, and financial ability to resume payments post-holiday. Mortgage payment holidays can last for a specific period, often ranging from three to six months, depending on lender policies and individual circumstances.

Duration of Request

A mortgage payment holiday provides temporary relief for homeowners facing financial difficulties, such as redundancy. During a payment holiday, the borrower can suspend monthly mortgage payments for a specified duration, typically ranging from three to six months, depending on the lender's policy. This option can help alleviate immediate financial pressure, allowing individuals to manage their expenses without the added burden of mortgage obligations. Homeowners should be aware that interest may continue to accrue, which can increase the total amount owed once the payment holiday ends. Engaging with the lender to discuss these terms is crucial for making informed financial decisions during trying times.

Contact Information

Applying for a mortgage payment holiday can provide financial relief during unexpected job loss. Redundancy, defined as the termination of employment due to a company's need to reduce its workforce, often places individuals in a precarious financial situation. In the United Kingdom, individuals can request a payment holiday for up to six months, impacting the existing mortgage balance and potentially the overall loan term. Relevant contact information must include the mortgage lender's customer service department, typically available via phone or email, ensuring timely communication and assistance. Additional documentation such as proof of redundancy, such as a termination letter or employment contract, may be necessary to expedite the process and facilitate approval.

Letter Template For Mortgage Payment Holiday Due To Redundancy Samples

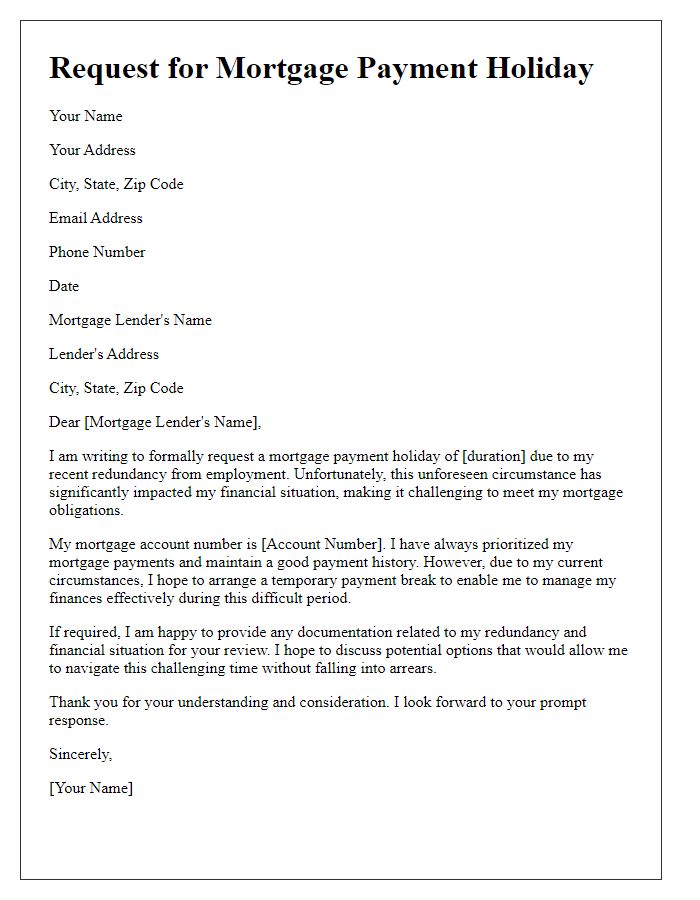

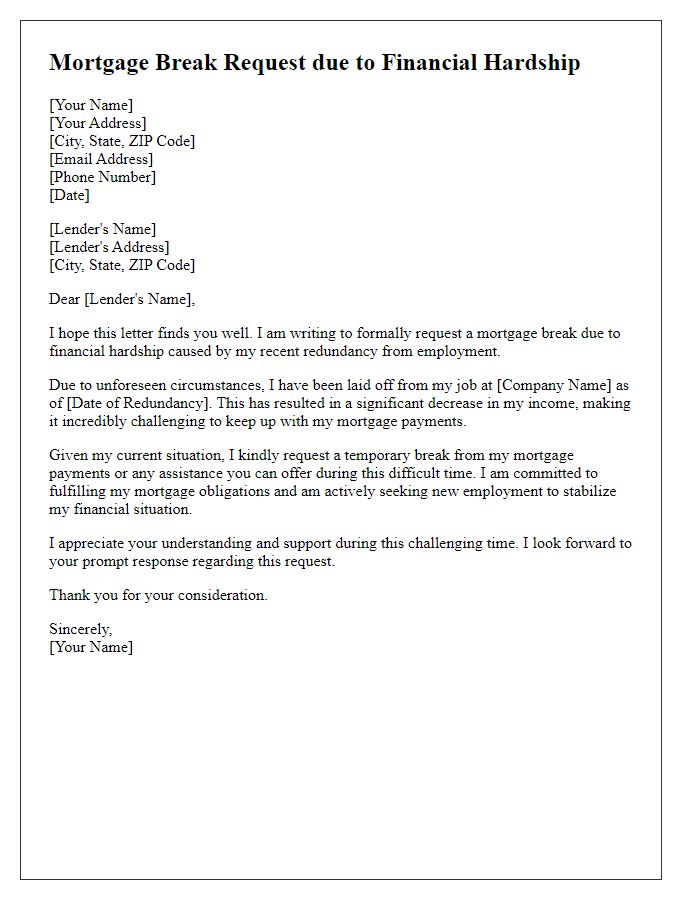

Letter template of request for mortgage payment holiday due to redundancy.

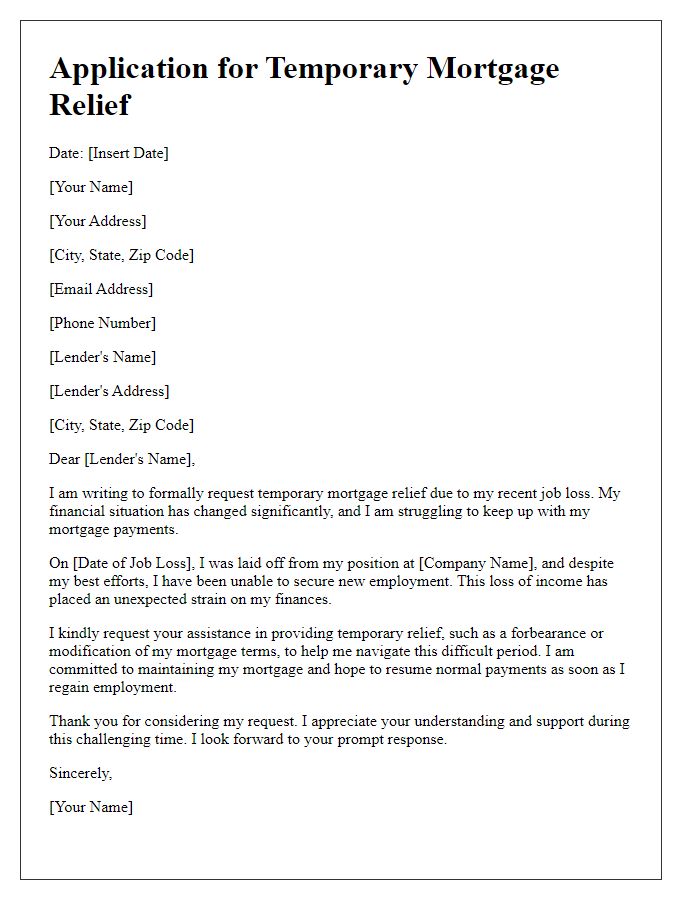

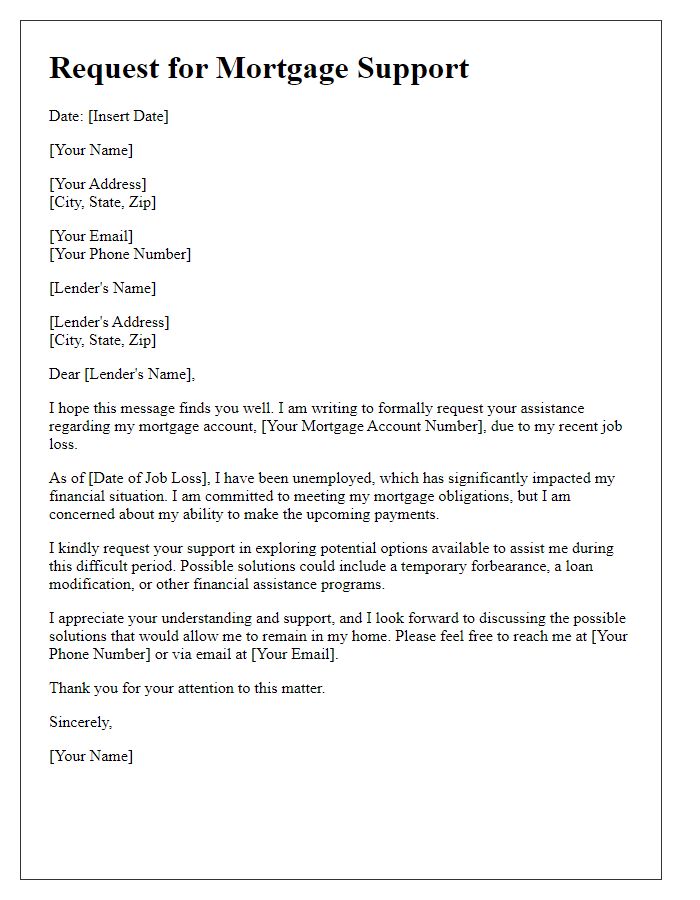

Letter template of application for temporary mortgage relief after job loss.

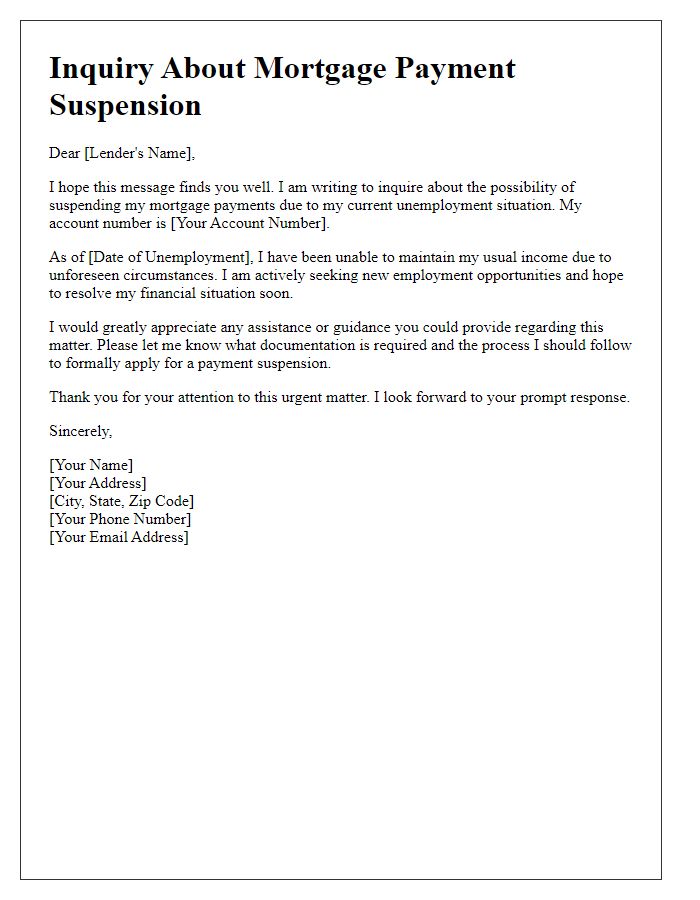

Letter template of inquiry about mortgage payment suspension due to unemployment.

Letter template of notification for mortgage deferment following redundancy.

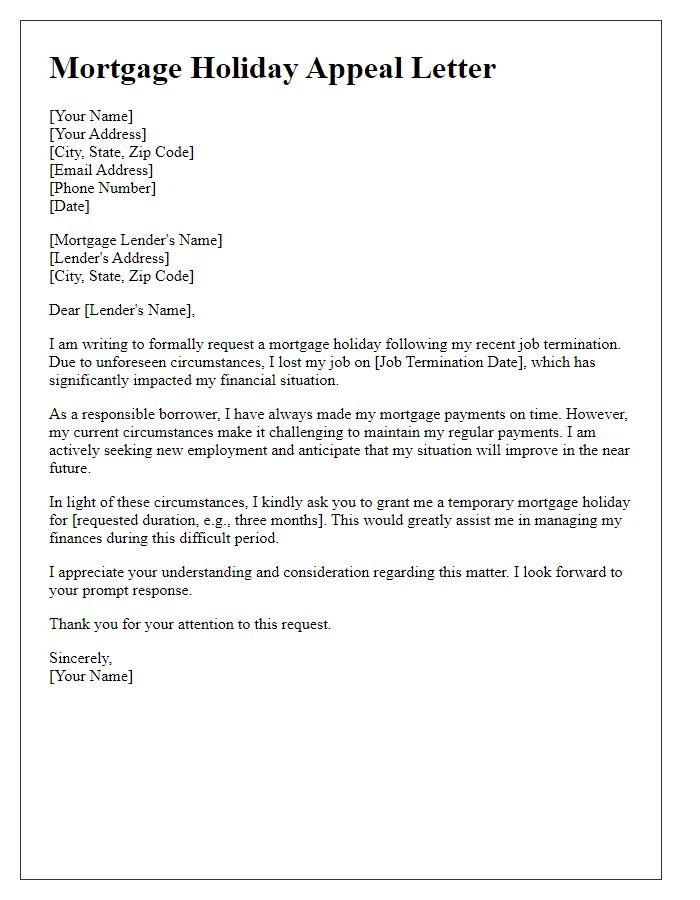

Letter template of appeal for mortgage holiday in light of job termination.

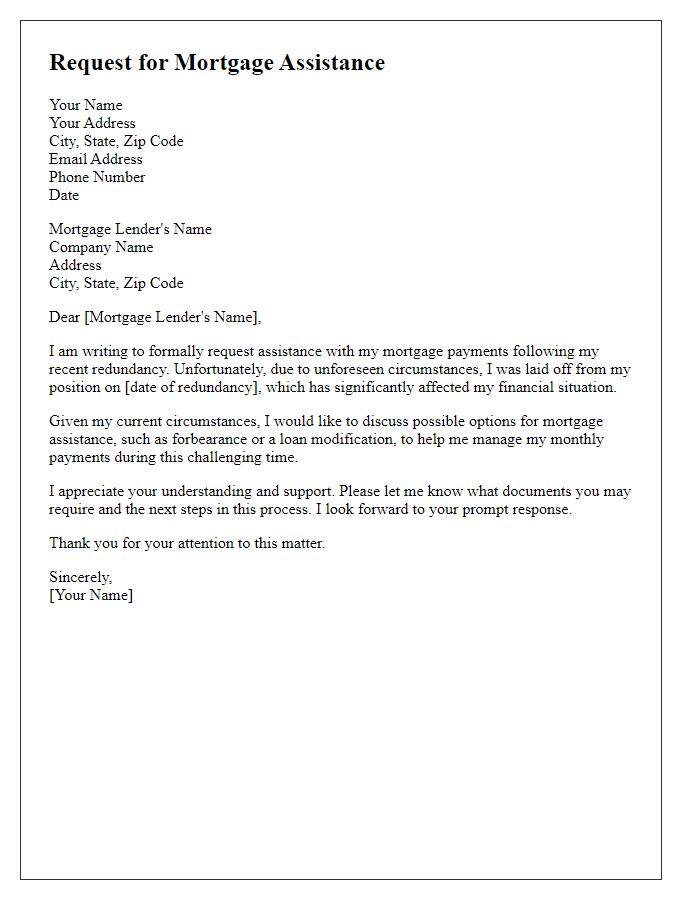

Letter template of formal request for mortgage assistance after redundancy.

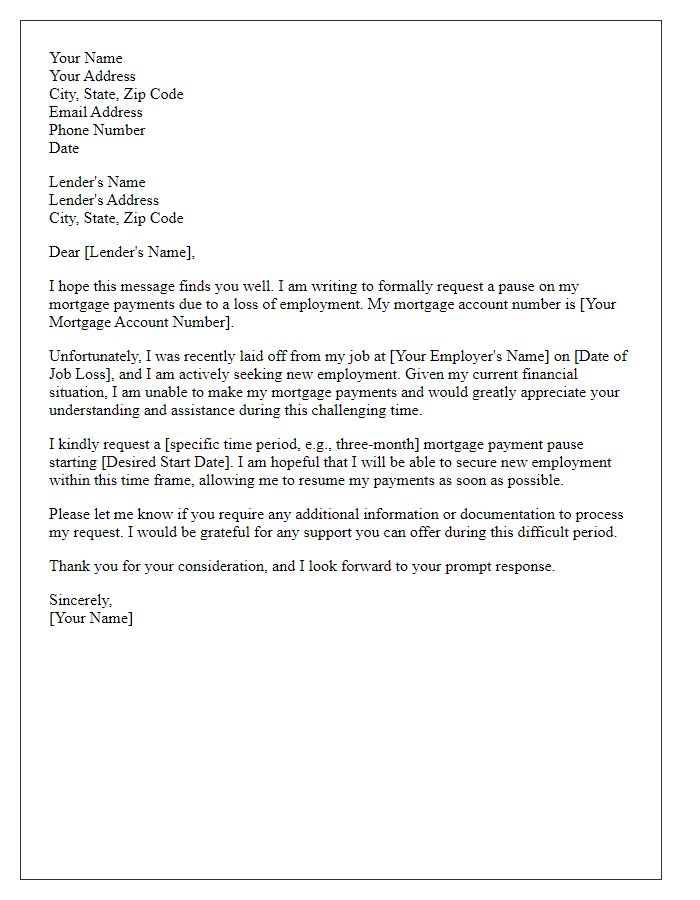

Letter template of correspondence for mortgage payment pause due to loss of employment.

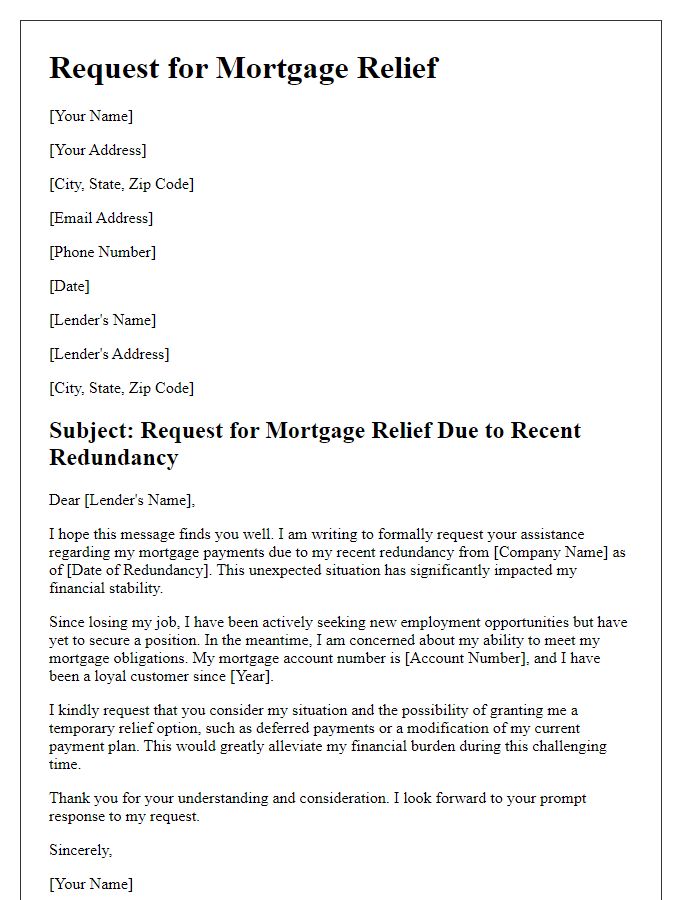

Letter template of explanation for needing mortgage relief after being made redundant.

Letter template of request for a mortgage break due to financial hardship from redundancy.

Comments