Hey there! If you're thinking about updating your business loan terms, you're certainly not alone. Many entrepreneurs find themselves in need of more favorable conditions to boost their growth and accommodate changing financial landscapes. In this article, we will explore some practical strategies for drafting a compelling letter to propose new loan terms to your lender. So, stick around to discover how you can enhance your negotiation game!

Business Overview and Objectives

The proposed new business loan terms aim to enhance operational efficiency and capitalize on growth opportunities for XYZ Corporation, a technology solutions provider established in 2015 in San Francisco, California. With a current annual revenue of $1.5 million and a dedicated workforce of 25 employees, our key objectives include expanding product offerings in artificial intelligence and machine learning sectors, targeting a 20% increase in market share over the next three years. To achieve this, we seek a $500,000 loan to invest in advanced software development tools and marketing strategies, ultimately positioning XYZ Corporation as a leader in innovative technology solutions within the competitive landscape of Silicon Valley.

Loan Amount and Purpose

A new business loan of $150,000 is proposed to facilitate the expansion of a retail outlet located in downtown Chicago, Illinois. This financial support aims to renovate existing facilities and enhance inventory, specifically focusing on sustainable and locally-sourced products, which align with current consumer trends. The planned renovations will include upgraded shelving systems and improved lighting to create an inviting shopping atmosphere. Additionally, the funds will provide initial operating capital for marketing campaigns targeting eco-conscious consumers, ultimately increasing foot traffic and sales.

Proposed Repayment Terms

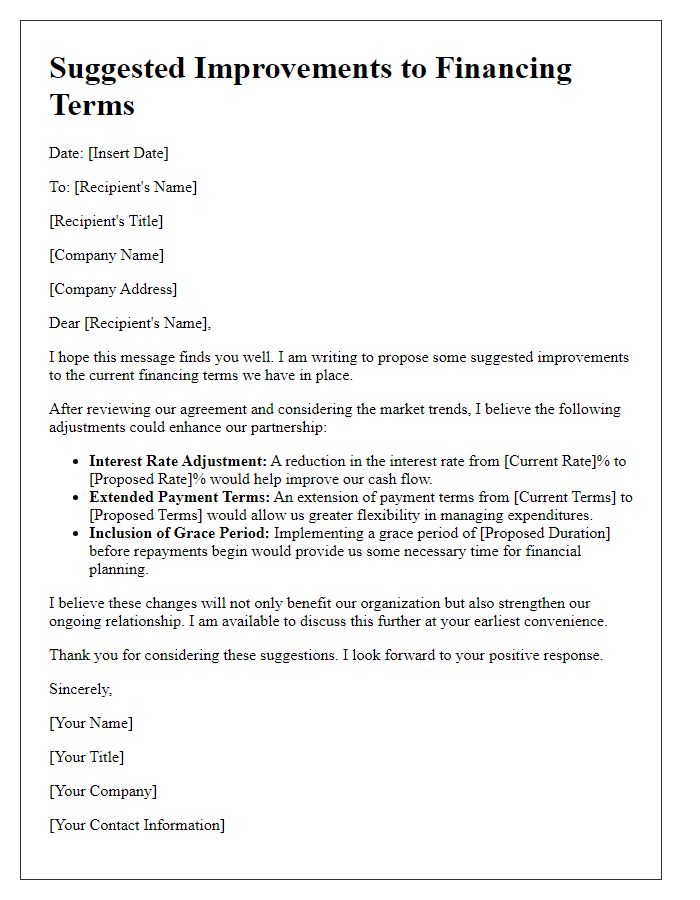

Proposed repayment terms for a business loan often include a clear outline of the principal amount, interest rates, repayment schedule, and any collateral issued. For example, a principal amount of $100,000 at a 5% annual interest rate can result in monthly repayments of approximately $1,887 over a period of five years. Additionally, the loan may include a balloon payment option at the end of the term for remaining principal balances. It's crucial to detail any grace periods, such as a six-month deferral after disbursement, allowing the business sufficient time for cash flow stabilization before repayments commence. Furthermore, specifying the consequences of missed payments enhances understanding of obligations and encourages compliance with terms. A clear communication channel for renegotiation of terms can also be beneficial in adapting to unexpected financial changes within the business landscape.

Financial Projections and Analysis

In the context of your proposal for new business loan terms, it's vital to present meticulous financial projections and comprehensive analysis. Forecasted revenue growth rates, estimated at 15% annually, can illustrate potential profitability. Detailed monthly cash flow projections for the next 24 months provide insight into liquidity status, aiding in assessing loan repayment capabilities. Additionally, historical financial statements from the previous three years reveal trends in expenses and income, particularly highlighting a reduction in operating costs by 10% through strategic management initiatives. Market analysis of the industry, referencing sources such as IBISWorld, can affirm the viability of proposed business operations in the current economic climate, particularly in regions showing a significant increase in consumer demand. Engaging investors and financial institutions through transparent financial modeling can gain confidence in your capacity to adhere to new loan terms.

Risk Mitigation and Collateral

Proposing new business loan terms requires careful consideration of risk mitigation strategies and adequate collateral to ensure both the lender's and the borrower's interests are protected. Risk mitigation strategies can include implementing comprehensive insurance policies, establishing a solid cash reserve of at least three months of operating expenses, and maintaining a strong credit score above 700. Additionally, collateral, such as commercial real estate valued at over $500,000, inventory worth $250,000, or other tangible assets, can provide the lender with a safety net. The proposal should clearly outline these measures to foster confidence and transparency during negotiations, ultimately leading to more favorable loan terms for the business.

Comments