Are you considering partnering up for a significant purchase but feeling overwhelmed by the intricacies of a joint loan? Crafting a solid proposal can pave the way for a smooth agreement between you and your potential co-borrower. In this article, we'll walk you through the essential elements of a joint loan agreement letter, ensuring you cover all the bases while maintaining a friendly, professional tone. So, let's dive in and explore how to make your joint loan proposal a success!

Purpose and Scope of the Loan

A joint loan agreement serves to consolidate financial resources for various significant purposes such as acquiring real estate, initiating business ventures, or funding substantial projects. This collaborative financial arrangement allows multiple parties, often individuals or organizations, to share the financial burden. The purpose of the loan can vary greatly; for instance, purchasing a residential property might require a loan amounting to hundreds of thousands of dollars, while opening a small business could necessitate a smaller sum, like $50,000. The scope of the loan typically includes the specific terms, such as interest rates, repayment schedules, and the duration of the agreement, often ranging from 5 to 30 years. It is essential to outline these details clearly to ensure all parties involved understand their obligations and expectations during the loan's lifespan.

Terms and Conditions

A joint loan agreement outlines the specific terms and conditions governing the collaboration between multiple parties seeking financial assistance, such as a mortgage or a personal loan. Key elements include the total loan amount, which could range from thousands to millions of dollars, and the interest rate, typically between 3% to 10% depending on credit scores and lender stipulations. Repayment terms often specify a schedule, typically spanning 10 to 30 years, focusing on monthly installments. Parties involved must also agree on liability, meaning any default could impact all signatories' credit ratings. Additional clauses might involve collateral requirements, such as property deeds or vehicle titles, outlined in state-specific regulations, for securing the loan. Stipulations for early repayment, penalties, and arbitration in cases of dispute are crucial for clarity in legal frameworks. Professional advice from financial institutions and legal experts could also be sought to ensure compliance with local loan laws, protecting all parties' interests throughout the loan's duration.

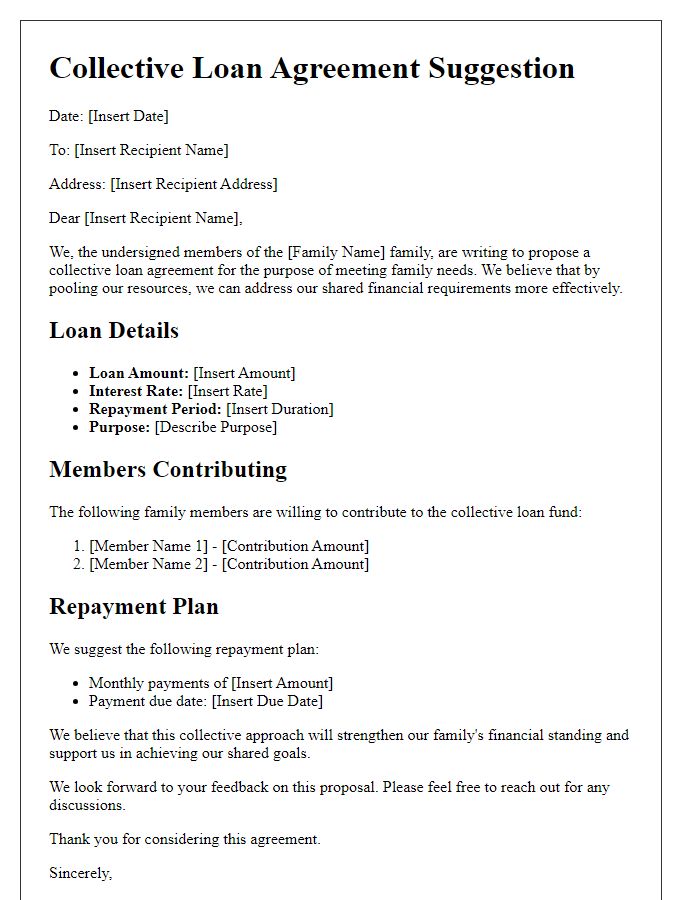

Roles and Responsibilities

In a joint loan agreement, establishing clear roles and responsibilities is crucial for all parties involved. Each applicant should be fully aware of their financial obligations, including the total loan amount, interest rate, and repayment schedule, ensuring transparency throughout the loan term. Additionally, each party must define their respective contributions towards monthly payments, such as income allocations or asset collateral. Responsibilities should also include maintaining clear communication regarding any changes in financial situations that may affect the ability to meet payment deadlines. Furthermore, tasks such as monitoring loan balances, managing correspondence with financial institutions, and resolving any discrepancies in payment records should be assigned to specific individuals, fostering accountability and minimizing misunderstandings. By outlining these roles and responsibilities, all parties can work collaboratively towards successful loan management.

Payment and Repayment Schedule

A joint loan agreement outlines the payment and repayment schedule for the borrowers involved. Detailed repayments (monthly), including the initial loan amount, interest rate (percentage per annum), and total duration (typically ranging from 1-30 years), must be clearly stipulated. The agreement includes specifics on installment amounts, due dates, and any potential penalties for late payments. It is crucial to define responsibilities for both parties, especially in cases of default or changes in financial circumstances. Notably, the agreement should include clauses addressing possible refinancing options if interest rates fluctuate significantly during the loan period. It is vital to consult legal experts specializing in finance to ensure compliance with local regulations and protections for both borrowers in the process.

Confidentiality and Privacy Policies

Confidentiality and privacy policies play crucial roles in safeguarding sensitive information throughout joint loan agreements. These policies delineate the responsibilities of all parties involved, ensuring that personal details, financial statements, and credit histories remain protected according to relevant laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). The parties must implement data encryption and access controls to prevent unauthorized access. Regular audits should be conducted to ensure compliance, and any data breaches must be reported within a specified timeframe, typically 72 hours. Additionally, clear guidelines defining data retention periods and procedures for data disposal are essential for maintaining privacy after the loan agreement concludes.

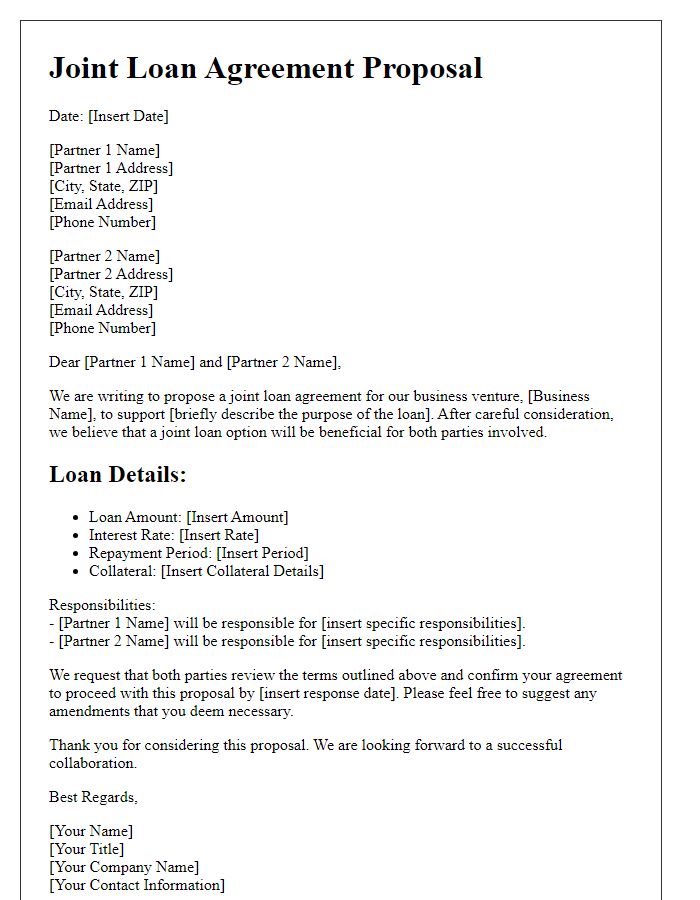

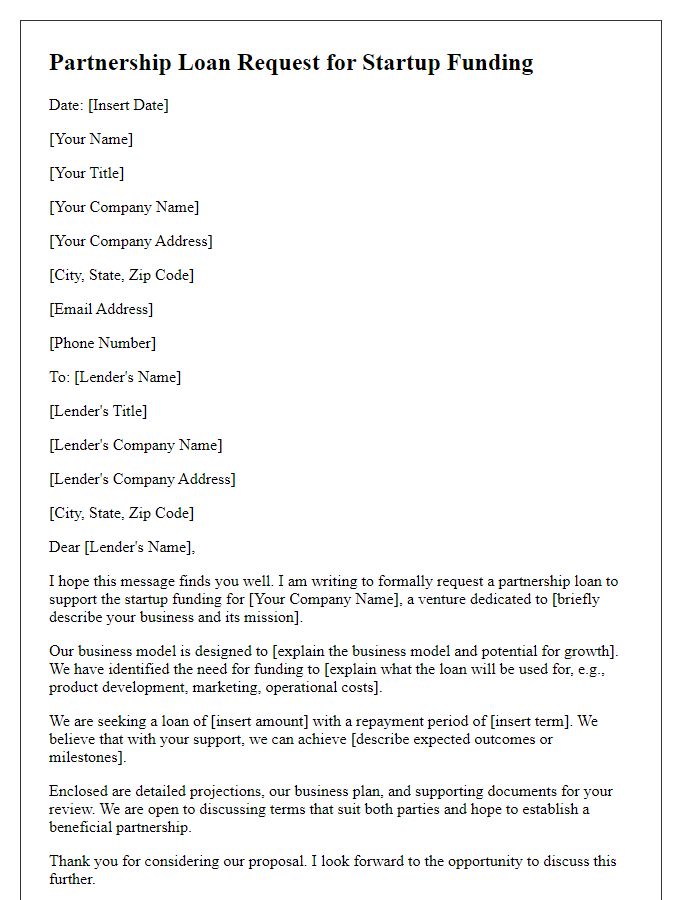

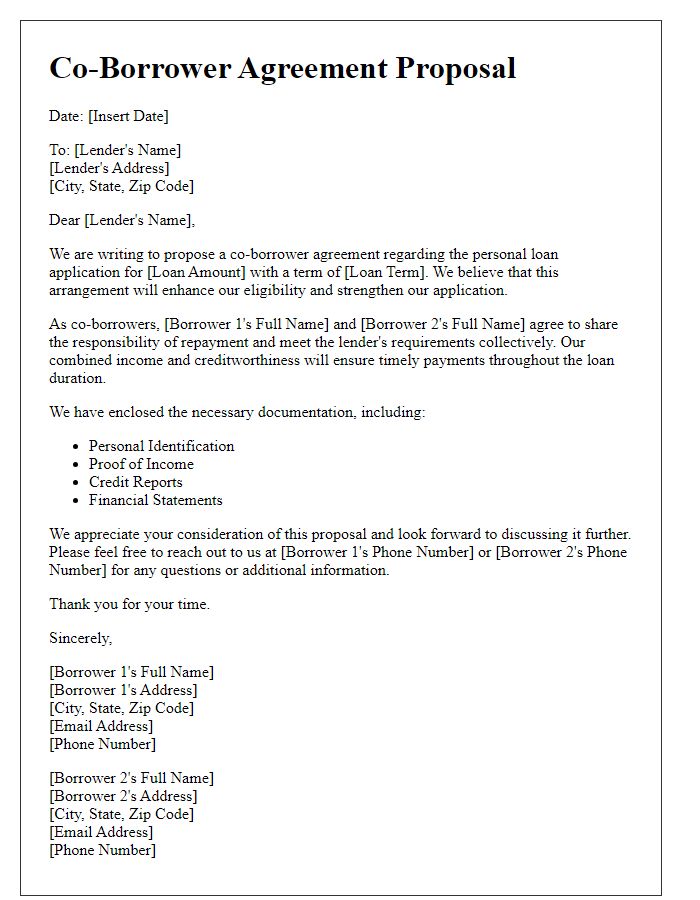

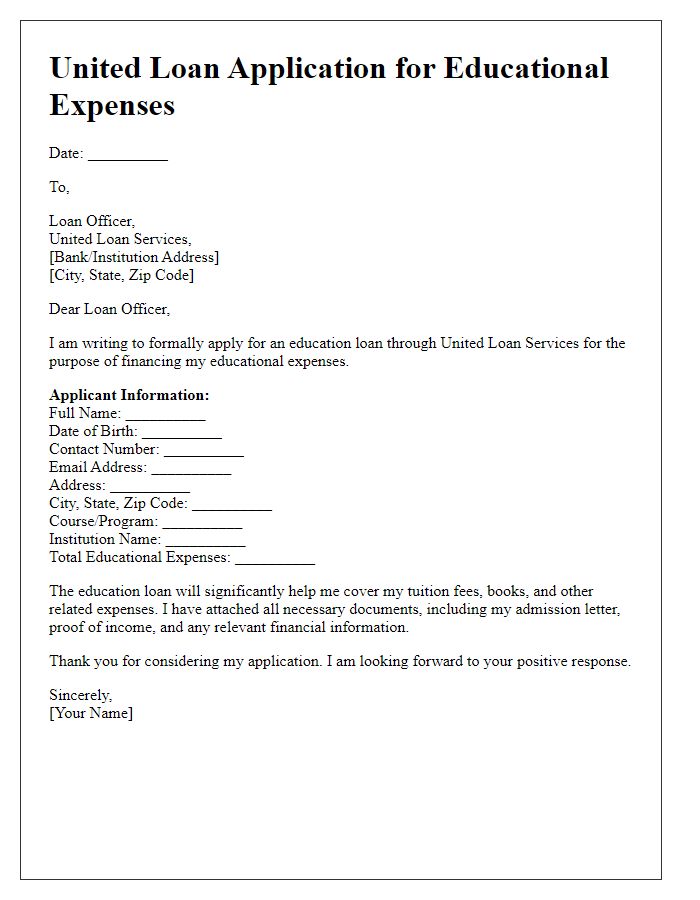

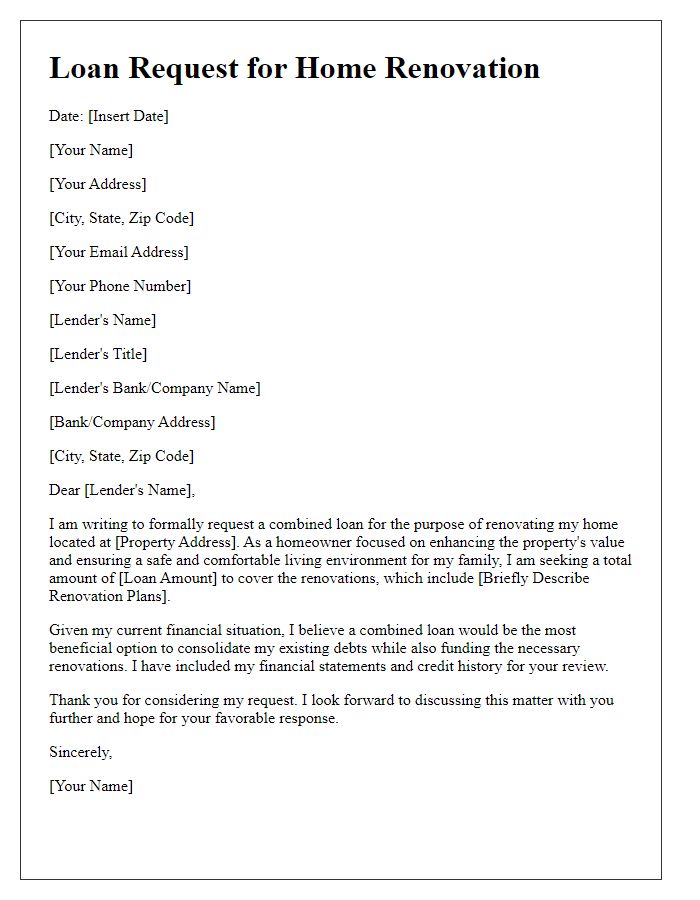

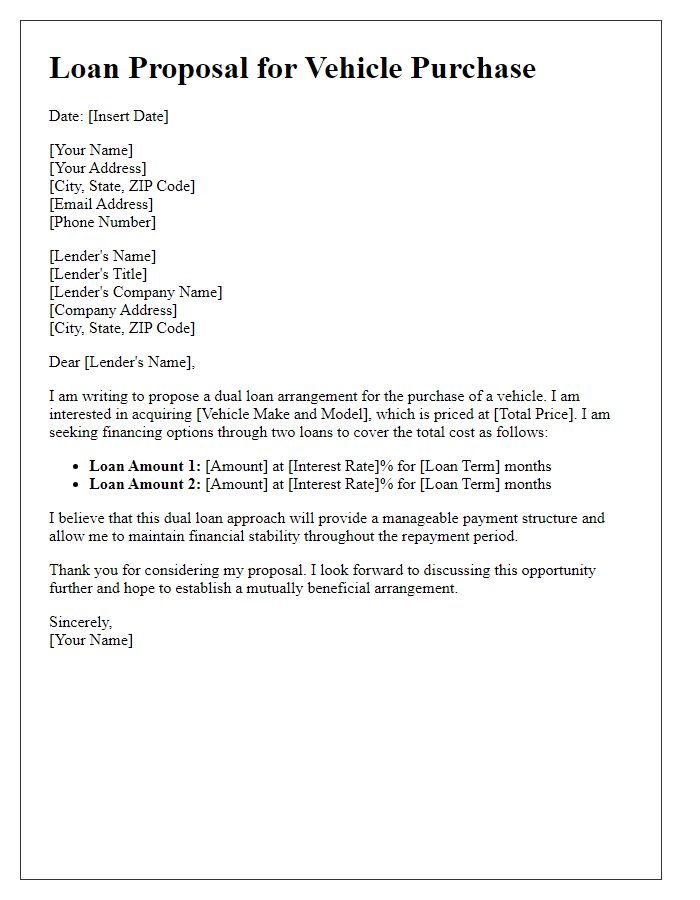

Letter Template For Proposing Joint Loan Agreement Samples

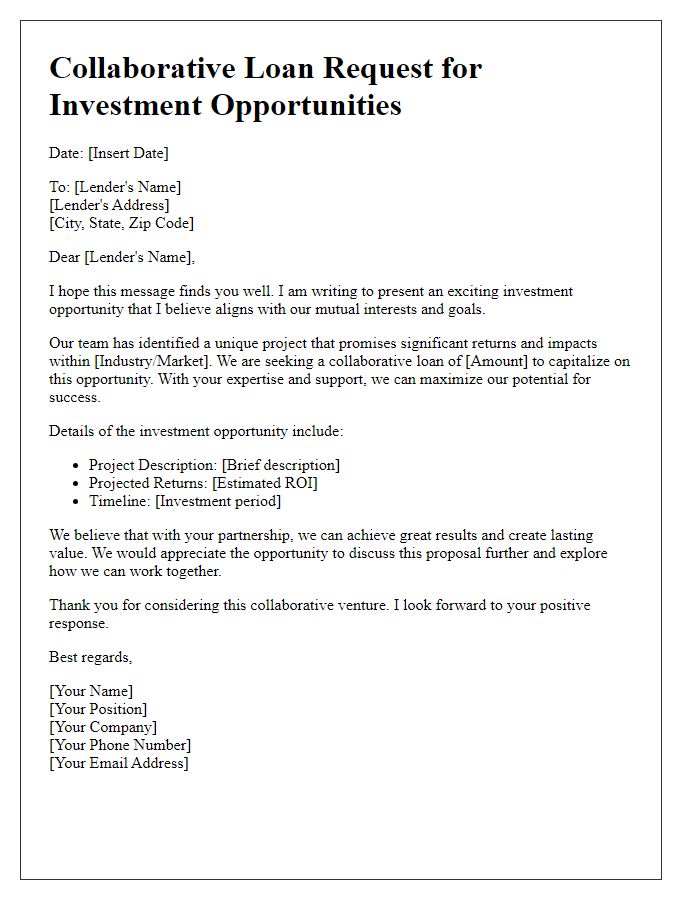

Letter template of collaborative loan request for investment opportunities.

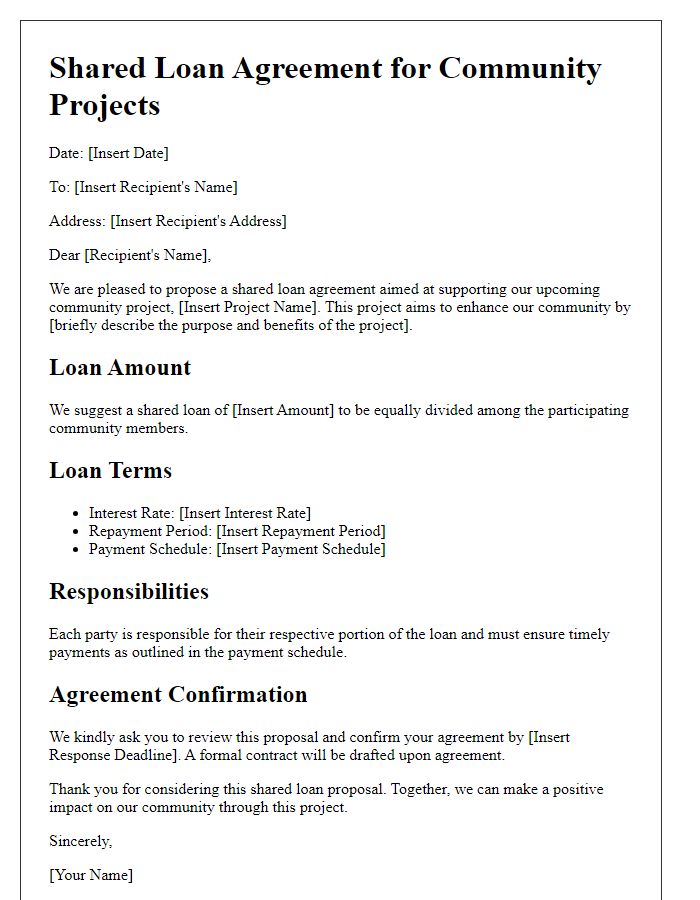

Letter template of shared loan agreement suggestion for community projects.

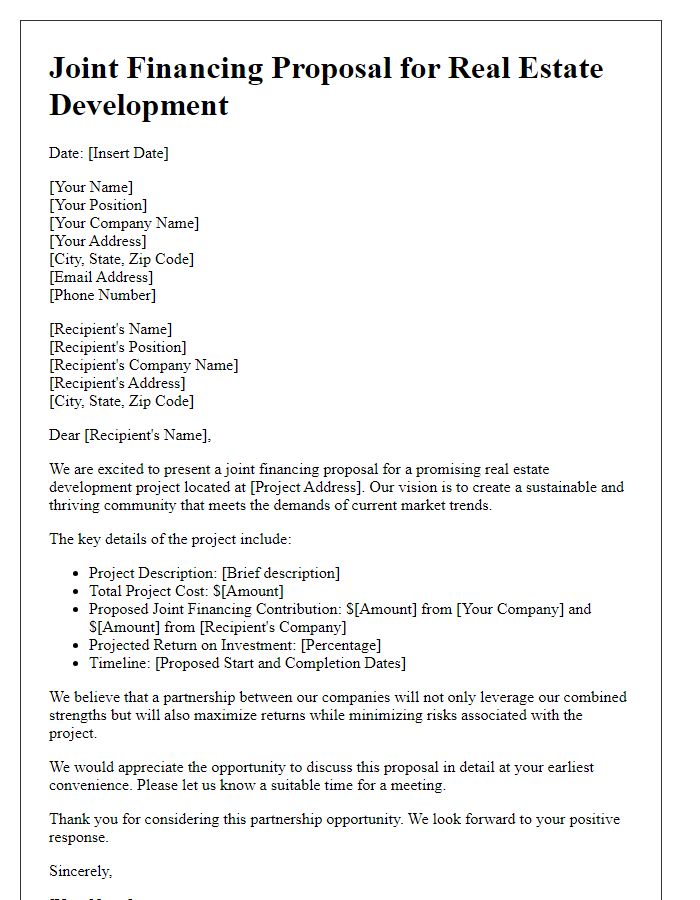

Letter template of joint financing proposal for real estate development.

Comments