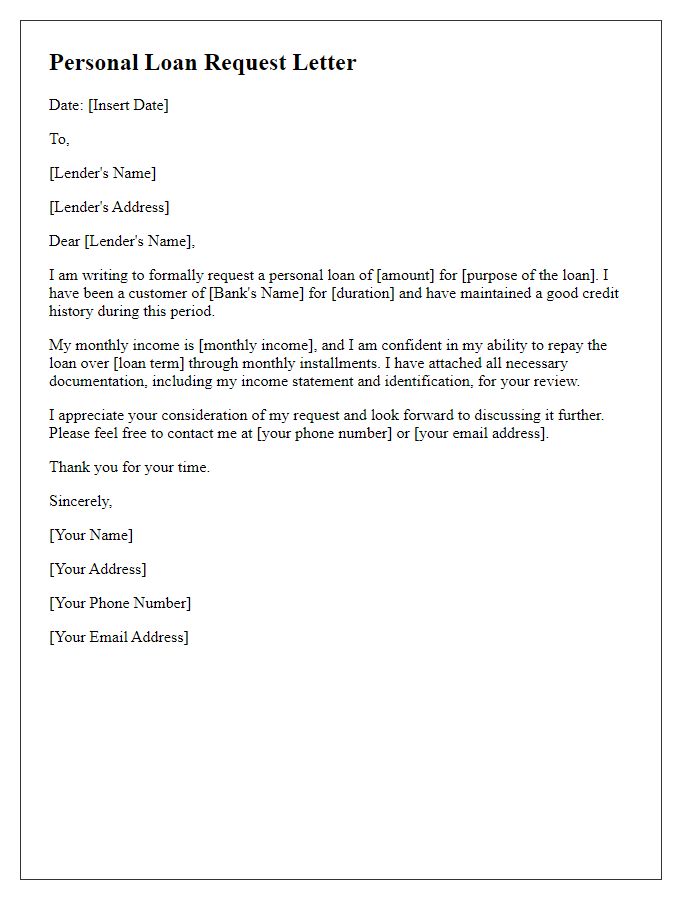

Are you considering applying for a loan but unsure how to present your proposal effectively? Crafting a comprehensive loan proposal can be the key to securing the funding you need. In this article, we'll break down the essential components of a successful loan proposal, making the process feel manageable and less intimidating. Ready to learn more about how to create a standout loan proposal? Let's dive in!

Executive Summary

A comprehensive loan proposal must begin with a compelling Executive Summary, encapsulating the core aspects of the loan request. This summary outlines the financing necessity, detailing the required amount (for example, $150,000) and intended use, such as purchasing equipment or expanding business operations. The summary should highlight the business background, emphasizing the industry (e.g., retail, technology), operational history (perhaps five years since establishment), and market position (such as being the leading provider in a specific region like California). Additionally, financial projections may include expected revenue growth (for instance, a 20% increase over the next year), cash flow estimates, and repayment plans, ensuring lenders understand the viability and stability of the business. The tone must reflect confidence and clarity, encouraging further review of the detailed proposal.

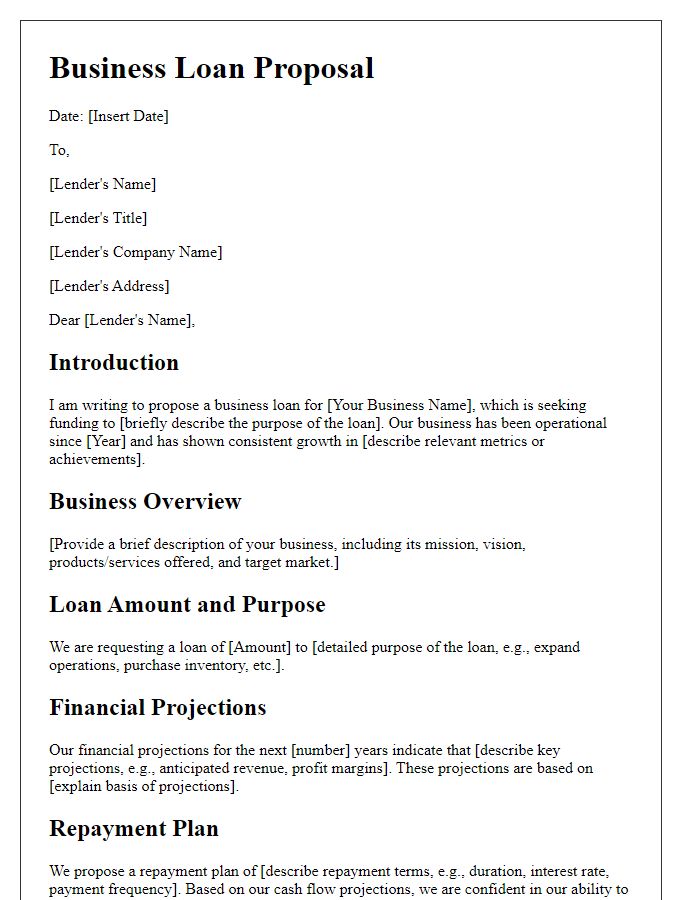

Business Overview

A comprehensive loan proposal begins with a clear business overview, detailing essential elements such as the company name, established year, and industry focus. For instance, Alpha Tech Innovations, founded in 2018, specializes in advanced software development solutions targeting small to medium-sized enterprises (SMEs). This section should include specifics about the company's mission statement, which emphasizes delivering customer-centric technological solutions to enhance operational efficiency. Furthermore, highlighting unique selling propositions (USPs), like patented software algorithms and exceptional customer support, solidifies the business's competitive edge in a crowded marketplace. Including current financial statistics, such as annual revenue figures of $2 million or projected growth rates of 15% per annum, provides lenders with a solid understanding of the financial health and prospects of the business.

Financial Projections

A comprehensive loan proposal requires detailed financial projections to demonstrate the viability and profitability of the project or business in question. Accurate revenue forecasts, typically projected over a three to five-year period, should reflect anticipated sales, market trends, and growth rates specific to the industry, such as technology or retail. Operating expenses must include fixed costs, variable costs, and overheads, ensuring a thorough breakdown of each category for clarity. Additionally, include cash flow statements illustrating inflows and outflows, highlighting key points such as expected funding needs for operations and marketing. Profit and loss statements further detail projected income versus expenditures, underlining potential profitability. Finally, a detailed capital requirements section should outline the total amount of funds needed, specifying the purpose of the loan, whether for equipment purchases, facility upgrades, or working capital.

Loan Details and Terms

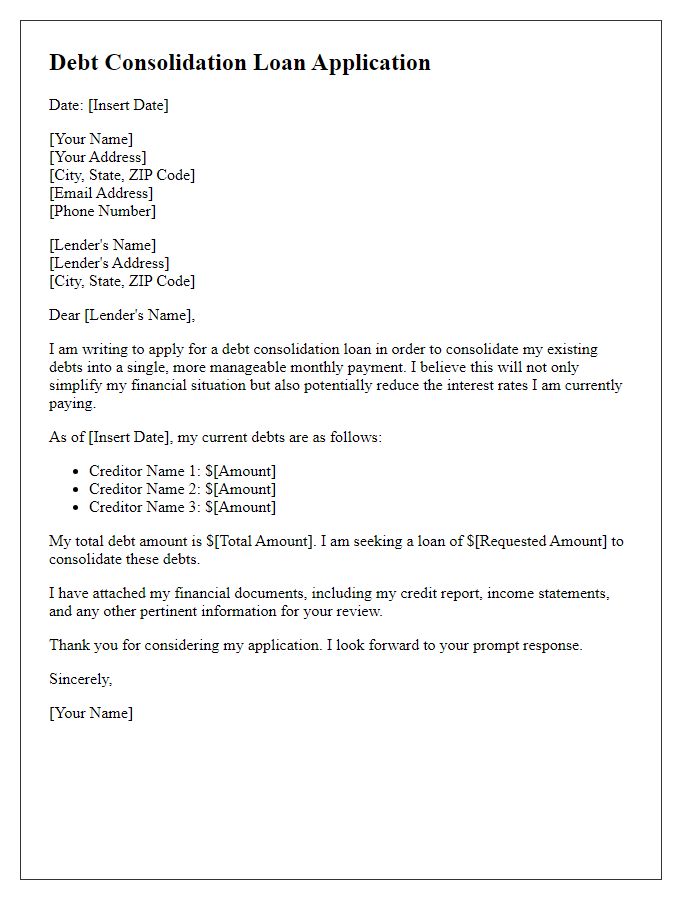

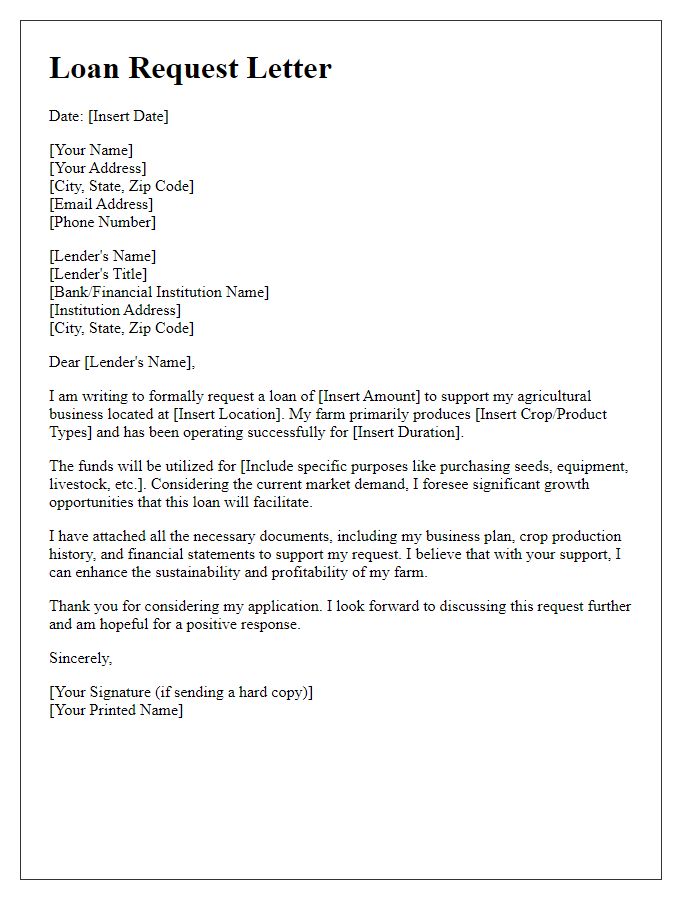

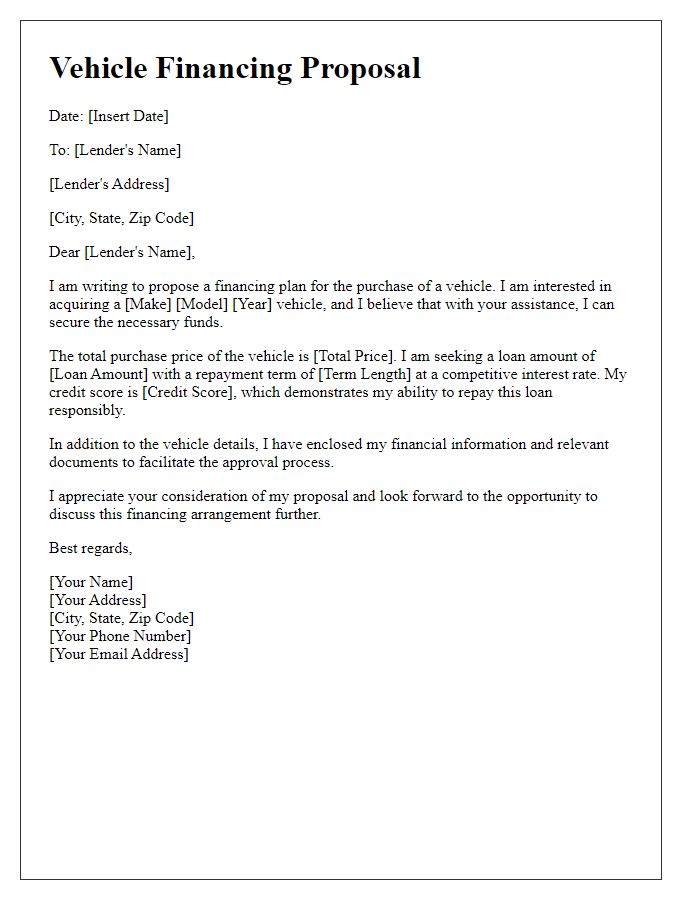

A comprehensive loan proposal includes essential details such as loan amount, interest rate, repayment period, and purpose of the loan. The loan amount, typically between several thousand to millions of dollars, should be explicitly stated to align with financial requirements. Interest rates may vary; for instance, current rates can range from 3% to 7% depending on the lender's policies and the borrower's creditworthiness. The repayment period can span from a few months to several years, with common durations being 10, 15, or 30 years. Furthermore, it's crucial to specify the purpose of the loan, such as financing a business expansion, purchasing real estate, or consolidating debt, as this provides the lender with context for evaluating the proposal's viability. Financial projections, repayment plans, and collateral offered are also integral components that enhance the strength of the loan proposal.

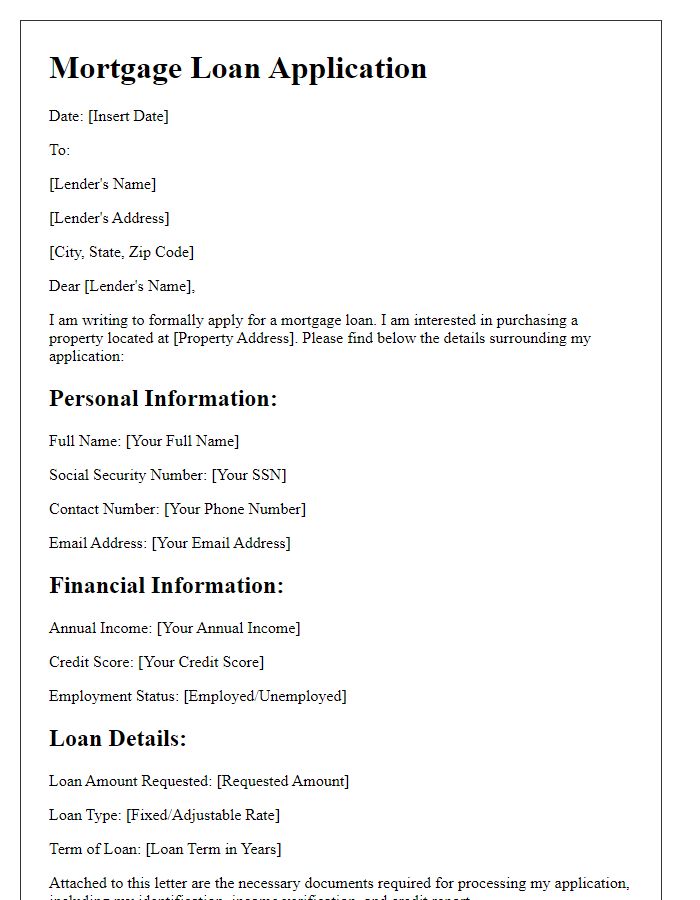

Risk Assessment and Mitigation Strategies

A comprehensive loan proposal focuses on the critical aspects of risk assessment and mitigation strategies vital for lenders. In the context of finance, risk assessment involves evaluating potential risks associated with the borrower's business operation, creditworthiness, and the overall economic landscape. Key indicators such as the borrower's credit score (typically ranges from 300 to 850), debt-to-income ratio (should ideally be below 36%), and historical profit margins (average margins may hover around 10% to 20% depending on the industry) are significant. To address these risks, mitigation strategies could include securing the loan with collateral (like real estate or equipment) to reduce lender risk, implementing robust financial management practices, or taking out insurance policies (e.g., credit insurance protecting against defaults). Additionally, the proposal may outline contingency plans to ensure loan repayment during adverse conditions, such as diversifying revenue streams or establishing a reserve fund for unexpected expenses or downturns.

Comments