Hey there! Have you ever found yourself wondering about the steps after submitting a loan application? It's always a relief to receive confirmation, knowing that your request is in the right hands. This article will guide you through the essential elements of a loan application receipt letter, ensuring clarity and professionalism. So, if you're ready to dive deeper into how to craft the perfect confirmation letter, keep reading!

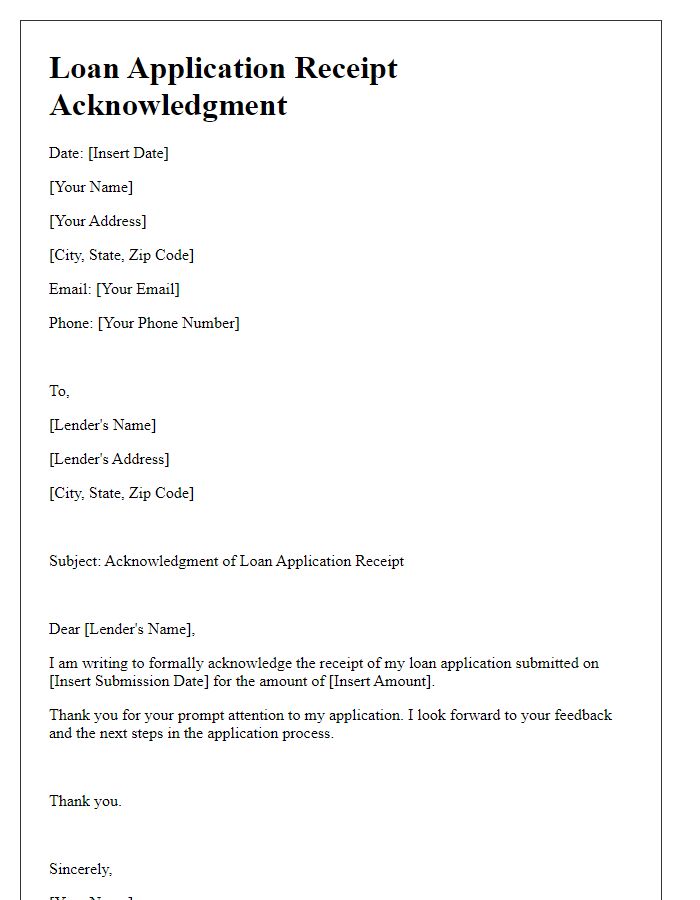

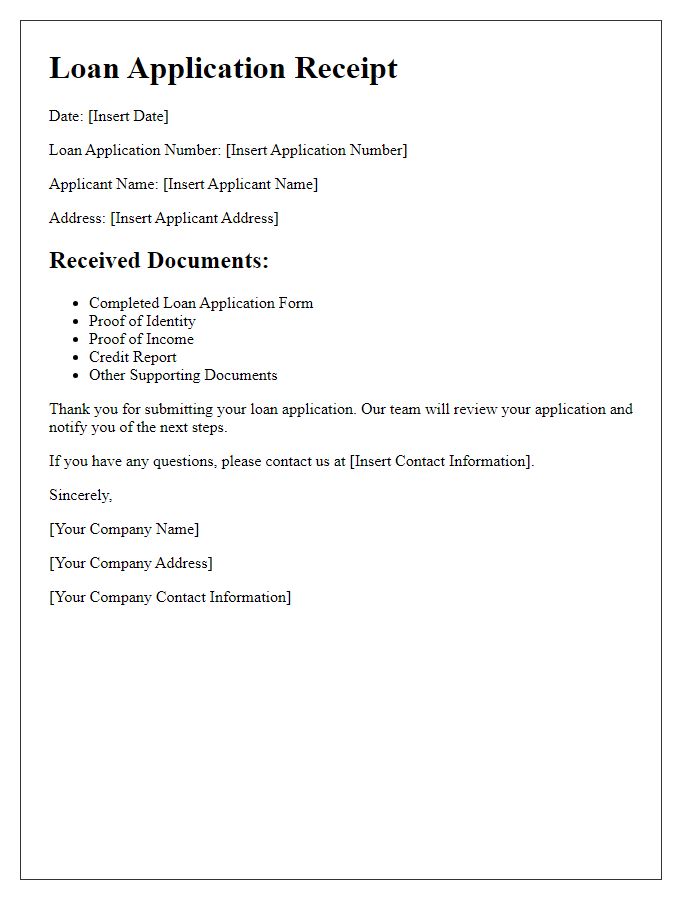

Applicant's Full Name and Contact Information

The loan application submission process often begins with the receipt confirmation, providing reassurance for applicants. For instance, a confirmation might include the applicant's full name, such as John Doe, residing in New York City. Contact information like a valid email (johndoe@example.com) and a phone number (555-1234) should be noted for easy communication. This acknowledgment ensures the applicant is informed that their application, submitted on the firm's online portal, has been successfully received and will be reviewed in due course. Typically, processing time ranges from 5 to 10 business days before the applicant receives further instructions or updates on their loan status.

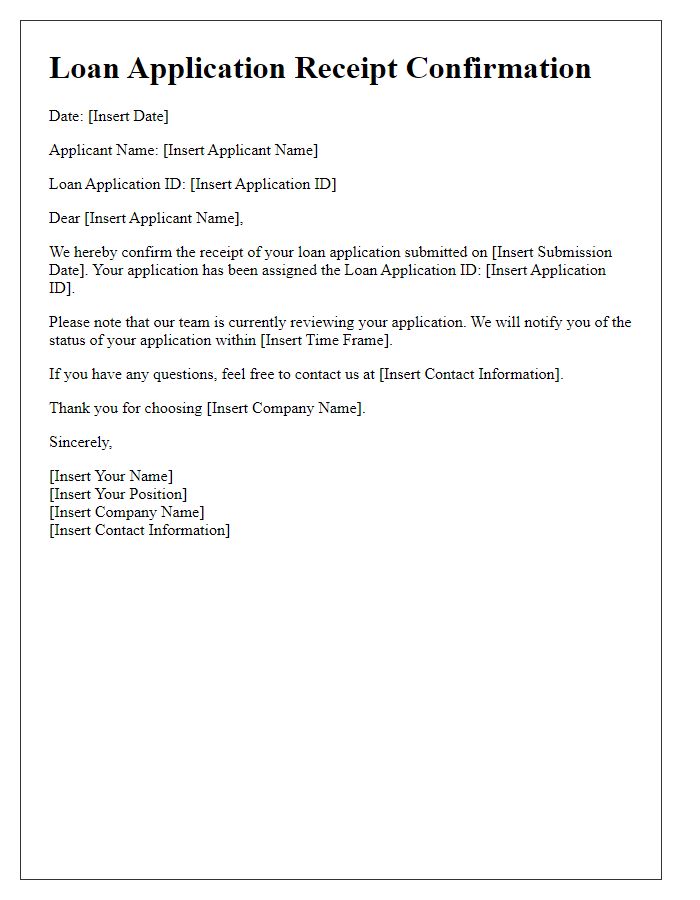

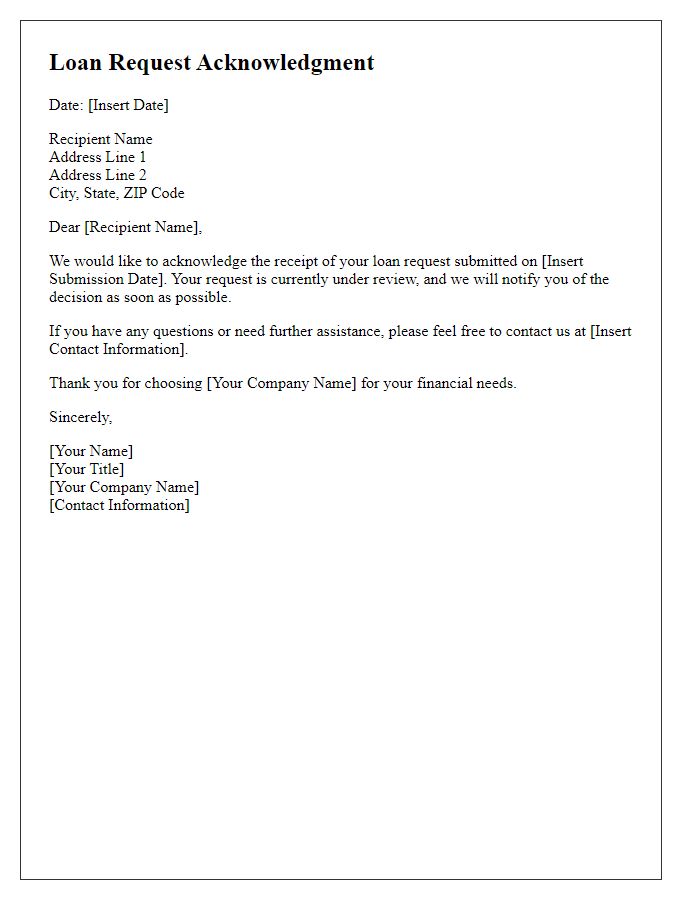

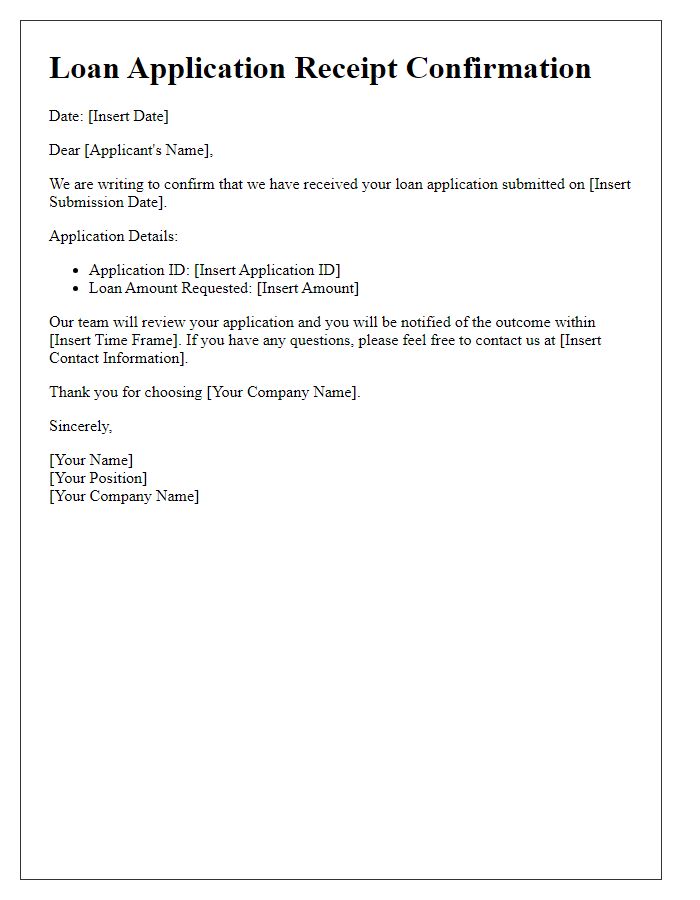

Loan Application Reference Number

The confirmation of loan application receipt is essential for keeping applicants informed about their financial requests. Upon submission of a loan application, such as a Personal Loan or Mortgage, applicants receive a unique Loan Application Reference Number, which serves as an important identifier throughout the approval process. Financial institutions, such as banks or credit unions, generally send an acknowledgment email or letter within a few business days, ensuring applicants know that their documents are under review. This confirmation typically outlines the next steps, estimated processing times, and contact information for questions, offering reassurance as the applicant waits for decisions on their financial support request.

Confirmation of Receipt and Date of Submission

Loan applications submitted to banks often include key details such as applicant names, loan amounts, and submission dates. The confirmation receipt serves to acknowledge that a financial institution has received the application document, typically noting the date of submission, which is crucial for tracking processing timelines and deadlines. The document may also include application reference numbers for efficient identification and follow-up communication. Furthermore, specific loan types, such as personal loans or home mortgages, are categorized to streamline processing and assessment procedures within the institution.

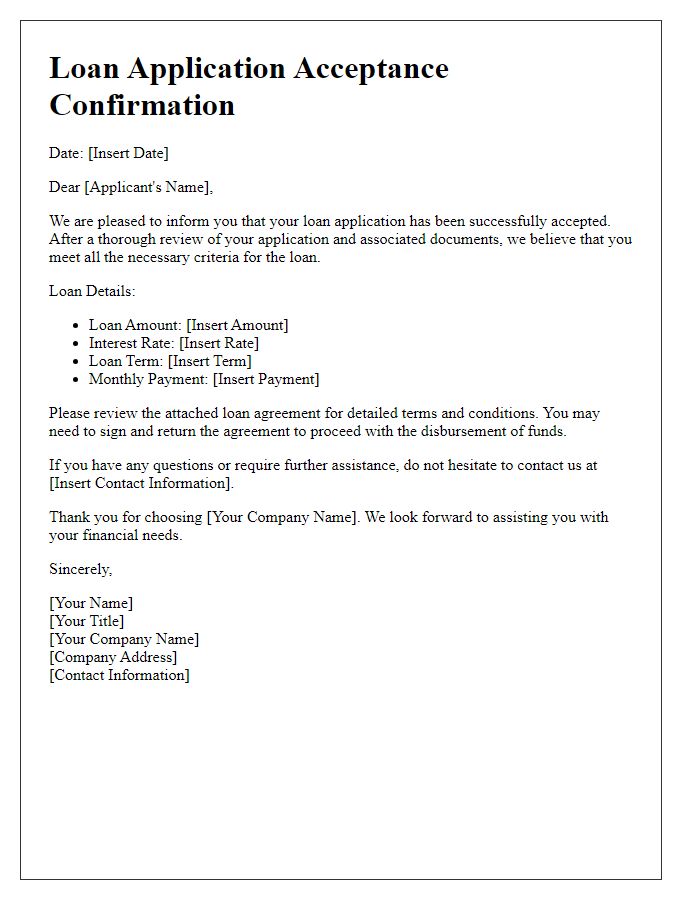

Next Steps in the Application Process

Upon receiving your loan application, we initiate a comprehensive review process to ensure all necessary documentation and information are complete. This involves assessing your financial history, employment details, and credit score for eligibility. Important documents include recent pay stubs, tax returns, and bank statements, which may need to be submitted for verification. Typically, our team processes applications within 5 to 7 business days, after which we will communicate the status of your application via email or phone. Successful applicants can expect a formal loan offer, including terms and interest rates, typically within 14 days. If any additional information is required, our loan officers will reach out directly.

Contact Details for Further Inquiries

Loan applications often require meticulous documentation and timely communication. Receipt confirmation typically includes significant information such as the applicant's name, loan amount requested, application date, and unique reference number. These details facilitate tracking and processing within financial institutions. Inquiries can be directed to designated contact personnel, usually a loan officer or customer service representative, who can be reached via email or phone. It's essential to provide specific contact hours to ensure applicants can obtain necessary updates regarding their applications promptly. Clear communication channels enhance customer experience and foster trust between borrowers and lenders.

Comments