Are you struggling to keep up with your installment loan payments? If you find yourself in this situation, requesting a modification can be a game-changer for your financial wellbeing. By reaching out to your lender, you may be able to lower your monthly payments or extend the loan term, making it easier to manage your budget. Curious about how to craft the perfect request for your loan modification? Read on for tips and a handy template that will guide you through the process!

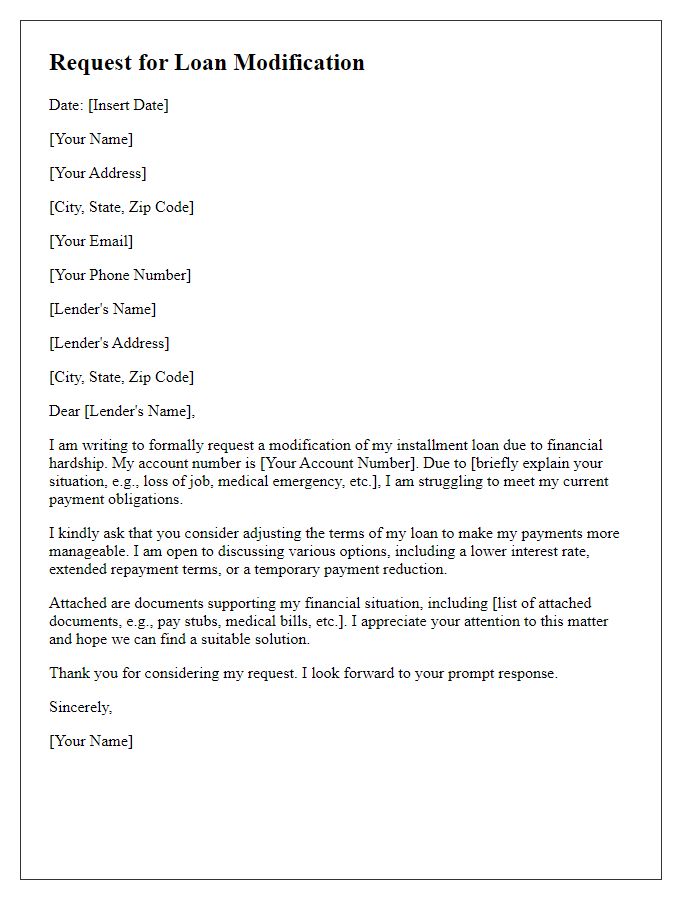

Borrower's contact information and account details.

Borrowers seeking an installment loan modification often need to provide specific contact information such as full name, mailing address, phone number, and email address. Account details like loan number, current balance, original loan amount, and monthly payment amount must be included for proper identification. Additional context may involve reasons for the modification request, including financial hardship due to events like job loss or medical expenses. Clarity in communication with lenders, such as banks or credit unions, enhances the chances of a favorable outcome in loan restructuring efforts.

Clear explanation of financial hardship.

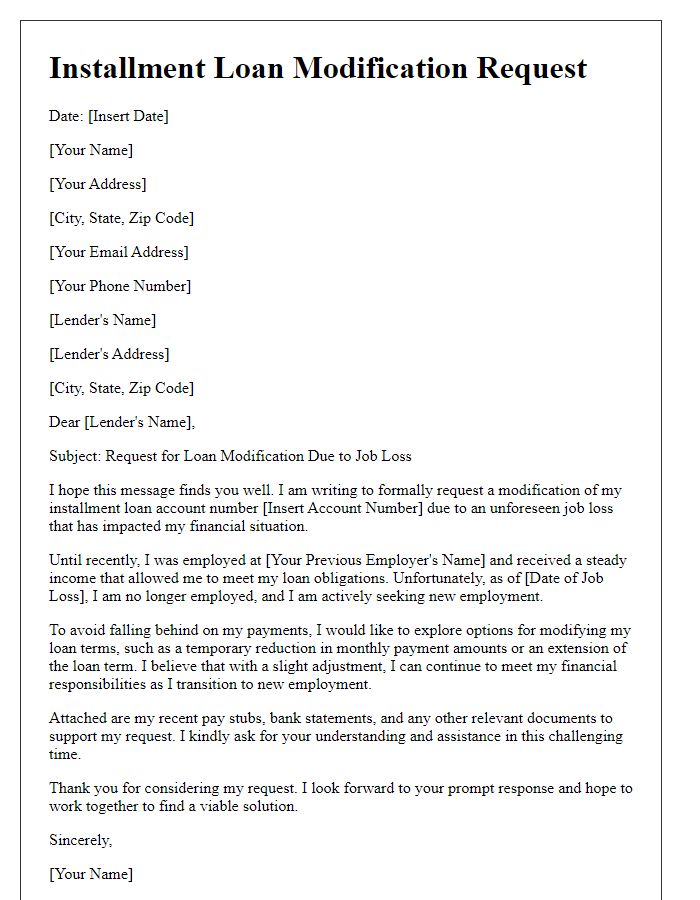

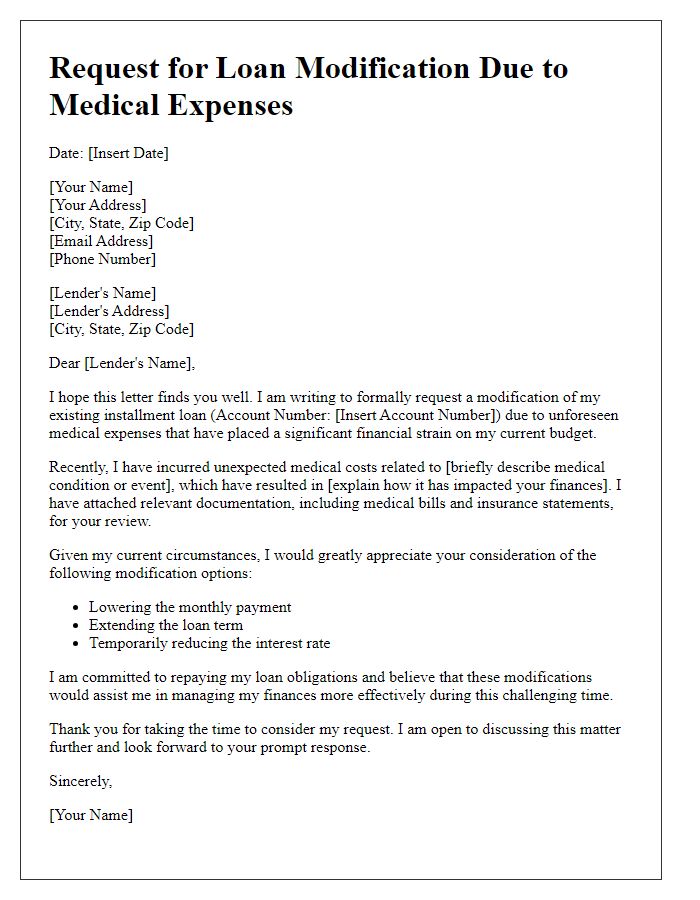

Financial hardships, such as unexpected medical expenses, job loss, or significant reduction in income, can impede the ability to maintain timely payments on an installment loan. These challenges might lead to a situation where individuals struggle to meet contractual obligations, risking potential defaults. For instance, a sudden medical emergency could lead to bills exceeding thousands of dollars, diverting funds from essential living costs and loan repayments. Furthermore, job loss in sectors heavily affected by economic fluctuations--like hospitality or retail--can dramatically alter monthly cash flow. Such circumstances necessitate a formal request for a loan modification, allowing for adjusted payment terms and providing relief during financial recovery periods. Addressing these issues is crucial to ensure long-term financial stability and prevent further complications.

Proposed modification terms and reasoning.

An installment loan modification request might include adjustments to the original repayment terms to better suit the borrower's financial situation. Proposed modifications could specify extending the loan term from 5 years (60 months) to 7 years (84 months), thereby reducing monthly payments significantly. Another option could be lowering the interest rate from 6% to 4%, which dramatically decreases the total interest paid over the life of the loan. The reasoning for these adjustments often stems from personal circumstances such as recent job loss or unexpected medical expenses. Additionally, borrowers may highlight their intention to maintain financial responsibility and continue meeting obligations despite current challenges. Implementing these modifications could prevent default situations and maintain a positive lender-borrower relationship.

Supporting financial documents.

When requesting a modification for an installment loan, it's essential to include supporting financial documents to strengthen your case. Essential documents include recent bank statements, typically covering the last three months, which provide insight into income and expenses. Pay stubs or proof of income from your employer serve to demonstrate financial stability or current challenges. A budget worksheet detailing monthly expenses compared to income can clarify your financial situation. Additionally, tax returns from the last two years highlight income trends and provide a comprehensive view of your financial health. If applicable, include documentation of any sudden changes, such as medical records indicating unexpected expenses, which might bolster your request for modification.

Request for lender's consideration and contact information for follow-up.

A formal loan modification request outlines the need for adjusted repayment terms due to financial hardship, emphasizing the borrower's commitment to fulfilling their obligations. Providing personal details such as the loan number and the borrower's contact information is essential for identification and follow-up. Key aspects include a clear statement of reasons for the modification request, such as unemployment or medical expenses, which may aid in the lender's consideration. Furthermore, indicating willingness to discuss alternatives during a scheduled call or meeting demonstrates proactive engagement in resolving the issue collaboratively.

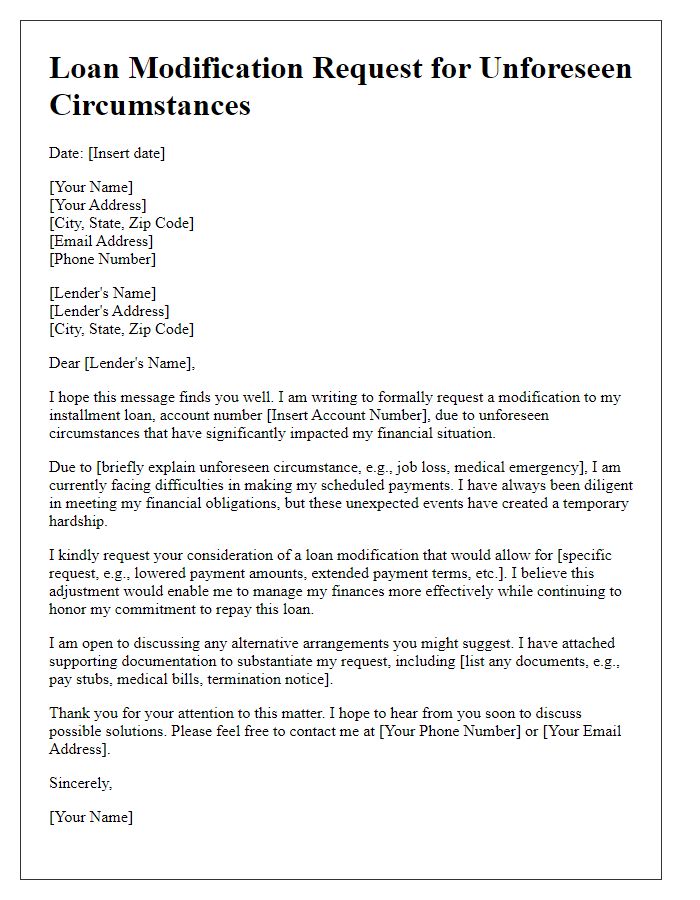

Letter Template For Installment Loan Modification Request Samples

Letter template of installment loan modification request for financial hardship.

Letter template of installment loan modification request due to job loss.

Letter template of installment loan modification request for medical expenses.

Letter template of installment loan modification request for divorce settlement.

Letter template of installment loan modification request after income reduction.

Letter template of installment loan modification request for unexpected bills.

Letter template of installment loan modification request for temporary unemployment.

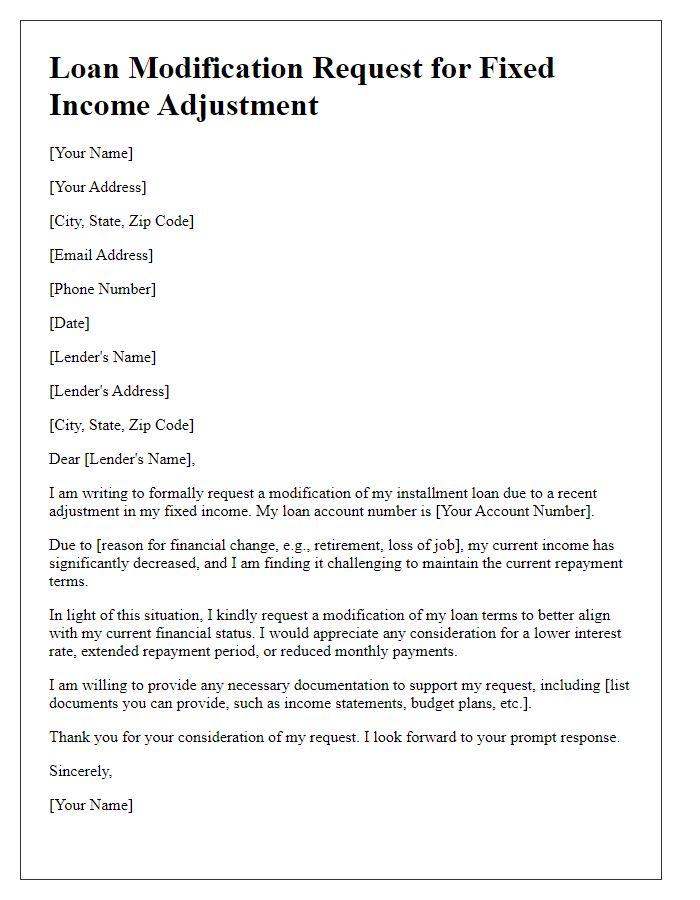

Letter template of installment loan modification request for fixed income adjustment.

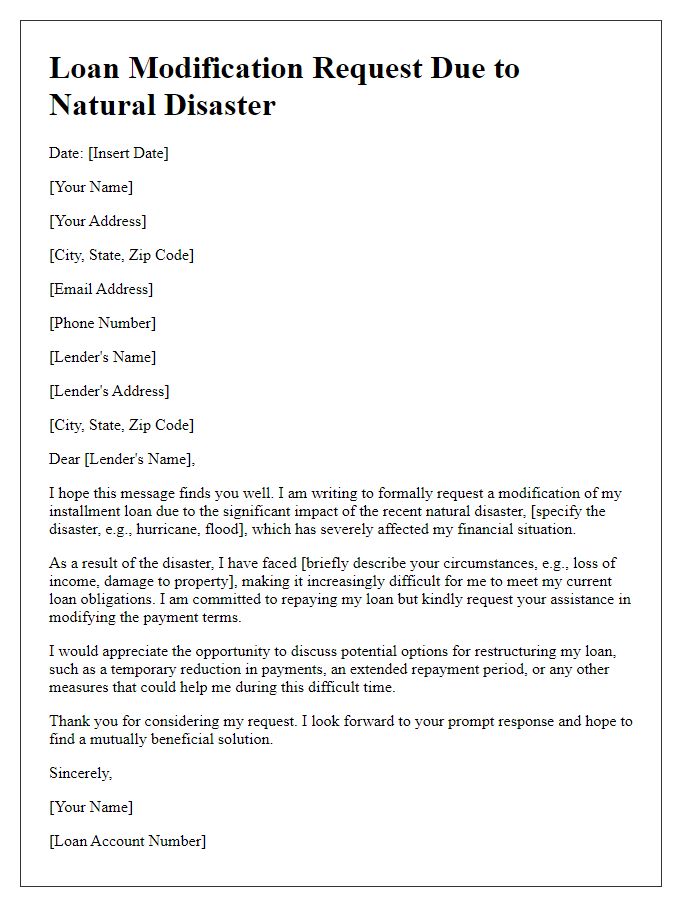

Letter template of installment loan modification request due to natural disasters.

Comments