Are you a service member looking for some financial relief? Understanding the military loan deferment process can help you manage your bills more effectively while you focus on your duty. In this article, we'll break down what a loan deferment is, the benefits it offers, and the steps you need to take to apply. Stick around to learn more and discover how you can ease your financial worries during your deployment!

Reason for Deferment Request

Military personnel often encounter periods of financial strain due to deployment, training, or duty obligations. A deferment request due to military service, specifically related to active duty for combat deployment, can provide temporary relief from loan payments. This deferment can be crucial for service members who are stationed away from home or whose families face increased expenses while they are deployed. The Servicemembers Civil Relief Act (SCRA) offers protections and benefits, including interest rate reductions and payment deferments, for eligible service members. Proper documentation, including deployment orders and a completed deferment application form, is essential to effectively communicate the request to lenders, ensuring adherence to legal protections afforded to military personnel.

Military Service Details

Military service details play a critical role in loan deferment applications, especially for active-duty members of the United States Armed Forces. The Service members Civil Relief Act (SCRA) provides vital protections, including loan deferments, when service commitments disrupt financial obligations. Specific service details include the branch of service (Army, Navy, Air Force, Marine Corps, Coast Guard), rank (Private, Corporal, Lieutenant, Sergeant, etc.), and duration of service, as well as deployment locations (combat zones or overseas assignments) which impact eligibility for deferments. Furthermore, dates of active duty service, including enlistment and anticipated end date, must be precisely documented. These details help lenders assess the individual's eligibility for the statutory protections offered under federal law.

Supporting Documentation

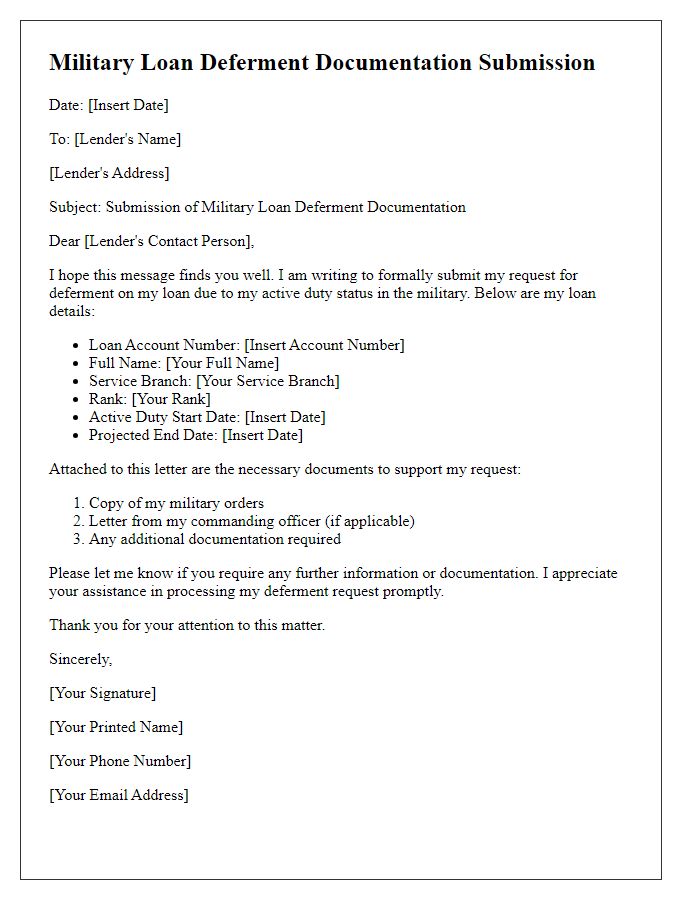

Military personnel often seek loan deferment for financial relief during deployment or active duty. Supporting documentation typically includes a copy of deployment orders issued by the military branch, which outlines the duration and location of service. Additionally, a letter from the commanding officer may be required, confirming the status of the service member and the financial hardship caused by military obligations. Personal identification documents such as a military ID or service record may also be necessary to validate the request. Financial statements, including current bank transactions and any outstanding loan statements, can provide further evidence of the need for deferment while ensuring compliance with lender requirements. Establishing the basis for deferment benefits service members at risk of falling into debt during their commitments.

Contact Information

Military personnel may need to defer loans or payments due to deployment or active duty service. The deferment process often involves contacting the lending institution to provide necessary documentation. Essential contact information includes the lender's phone number, mailing address, and email address. Additionally, service members should provide their own contact details such as rank, service number, and unit information to facilitate communication. Accurate documentation of deployment orders or other related military papers can expedite the deferment approval process. Clear identification of the specific loan type, including account numbers and terms, is crucial for a seamless interaction with the lender.

Expressions of Gratitude

Military loan deferment options provide essential financial relief for service members during deployment or active duty. The Servicemembers Civil Relief Act (SCRA) allows eligible individuals to temporarily postpone loan payments without penalties. It is crucial for borrowers to communicate effectively with their lenders. Proper documentation, such as a copy of deployment orders, is necessary to initiate the deferment process. Lenders, like prominent financial institutions, often have specific protocols to follow for military members. Expressing gratitude towards these organizations acknowledges their support in facilitating this important financial assistance, which enables service members to focus on their duties without undue financial stress.

Letter Template For Military Loan Deferment Samples

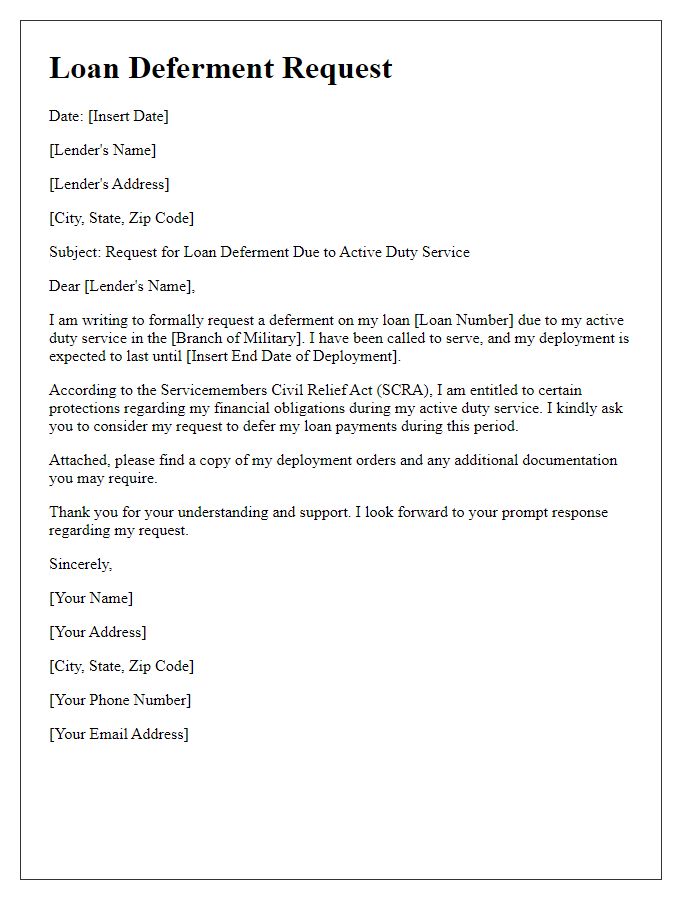

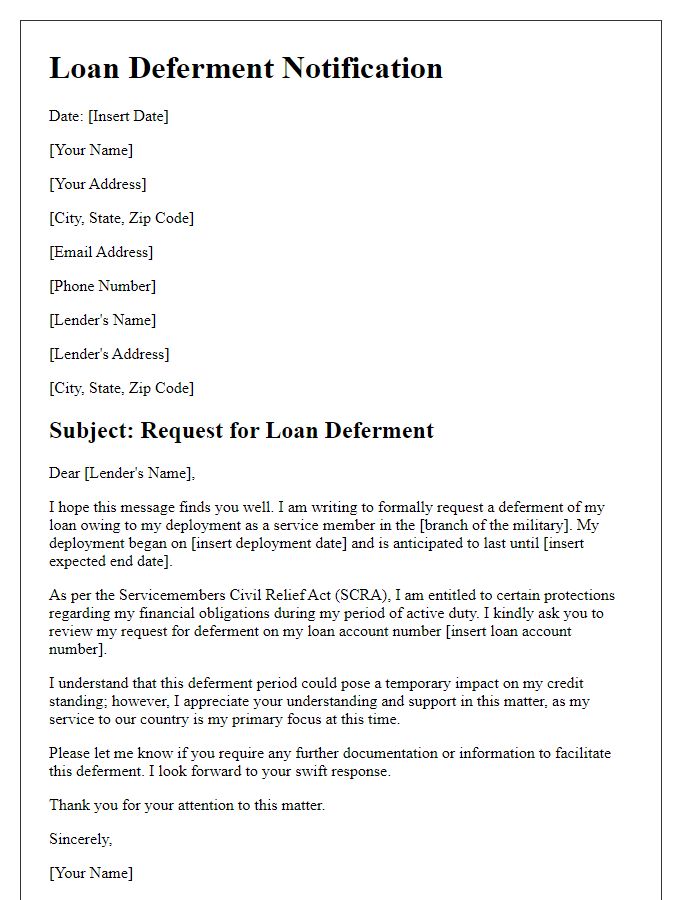

Letter template of military loan deferment request for active duty service.

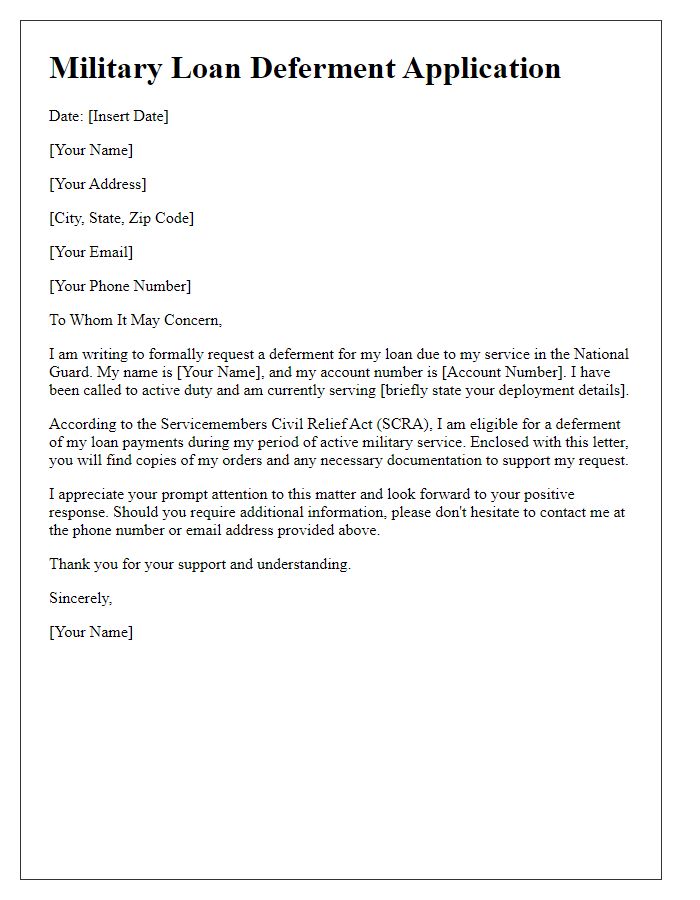

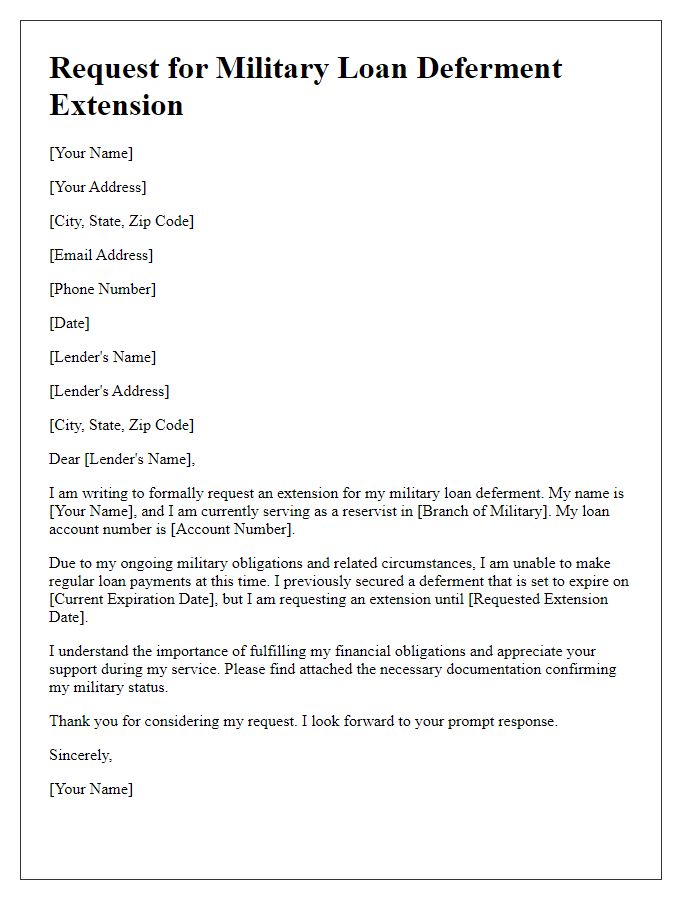

Letter template of military loan deferment application for National Guard members.

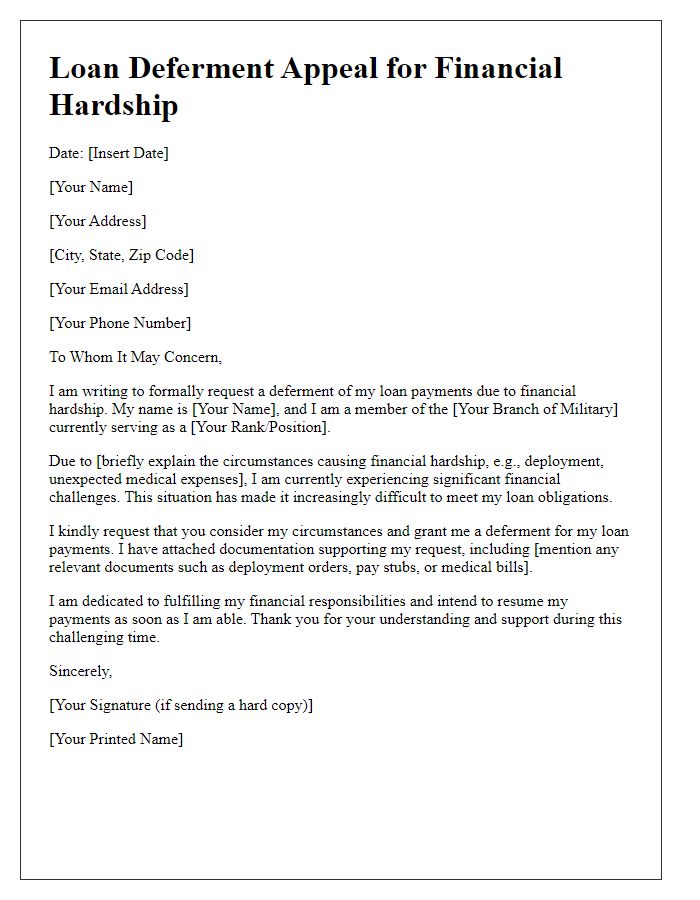

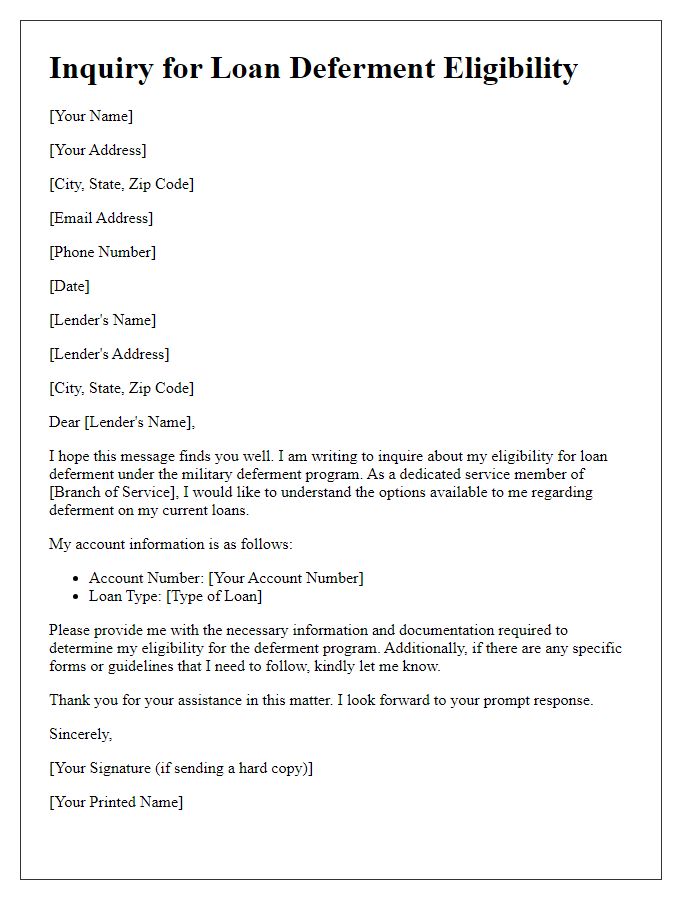

Letter template of military loan deferment appeal for financial hardship.

Letter template of military loan deferment notification for deployed service members.

Letter template of military loan deferment extension request for reservists.

Letter template of military loan deferment inquiry for program eligibility.

Comments