When it comes to securing a loan, demonstrating your repayment ability is crucial. A well-crafted letter can effectively showcase your financial stability and commitment to timely repayments. It's important to highlight your income sources, existing financial obligations, and any savings that bolster your case. Curious about how to structure this letter for maximum impact? Let's dive in!

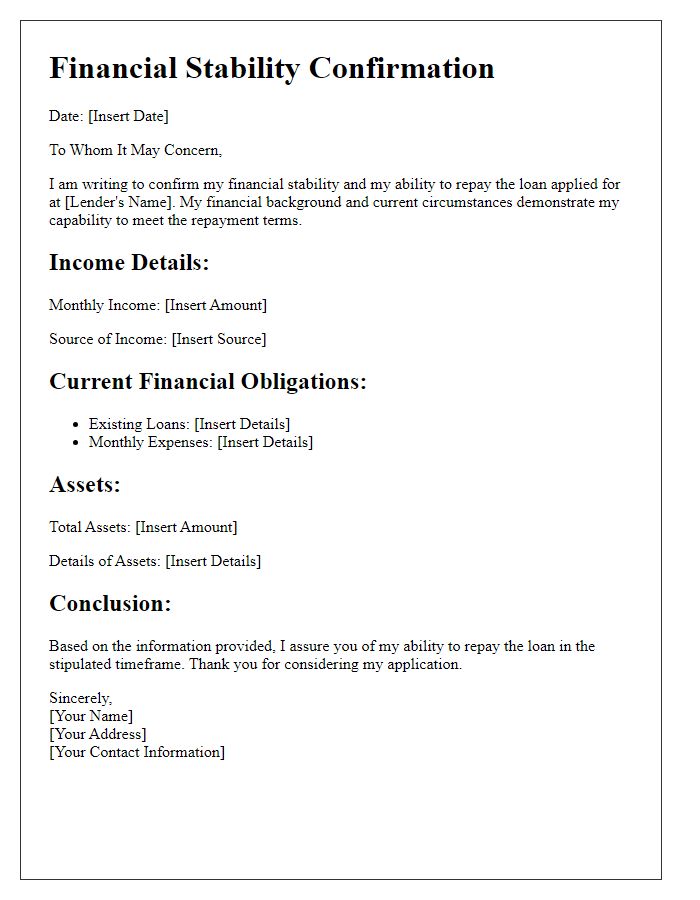

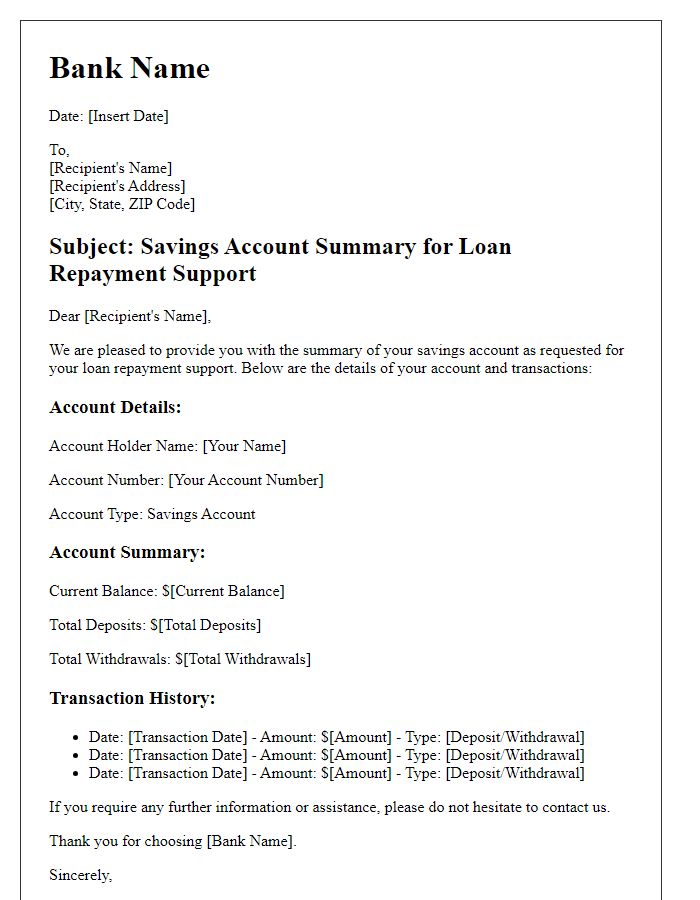

Clear borrower identification and contact details

Demonstrating loan repayment ability involves providing detailed financial information to prospective lenders. Essential components include borrower identification--full name, social security number, and address for verification. Contact details--email address and phone number--facilitate communication between the borrower and the lender. Including income specifics, such as gross monthly income (over $4,000), and employment history (years with current employer) is critical. Additionally, listing existing debts, such as credit card balances (average $5,000 total across three cards) and monthly obligations (like car payments of $300) highlights financial responsibilities. Highlighting credit score insights (above 700 indicates good creditworthiness) further supports repayment capability. Lastly, showcasing savings accounts with balances (at least $10,000) can demonstrate financial stability and readiness to manage loan repayment commitments effectively.

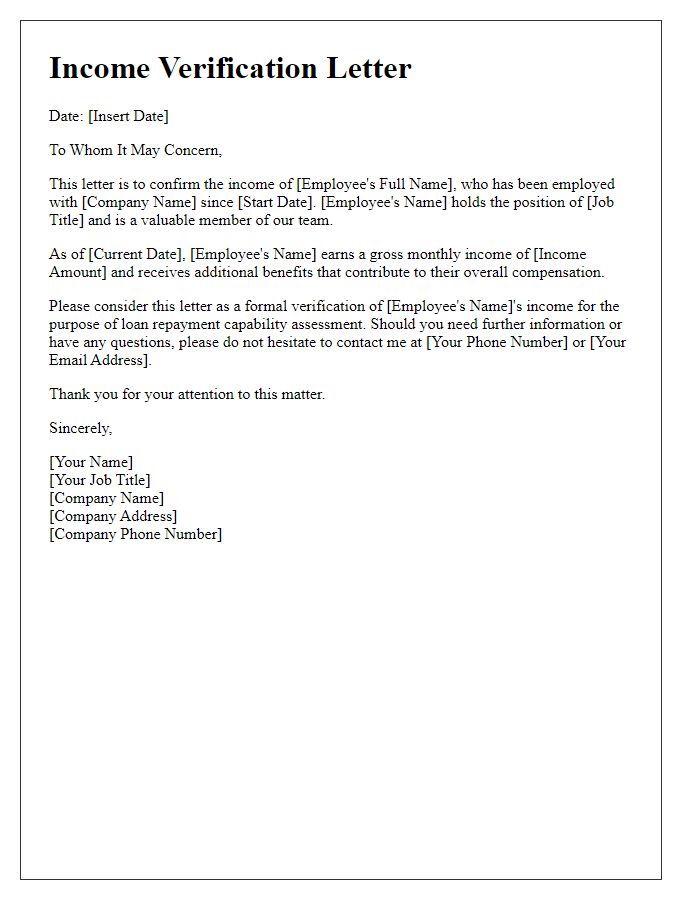

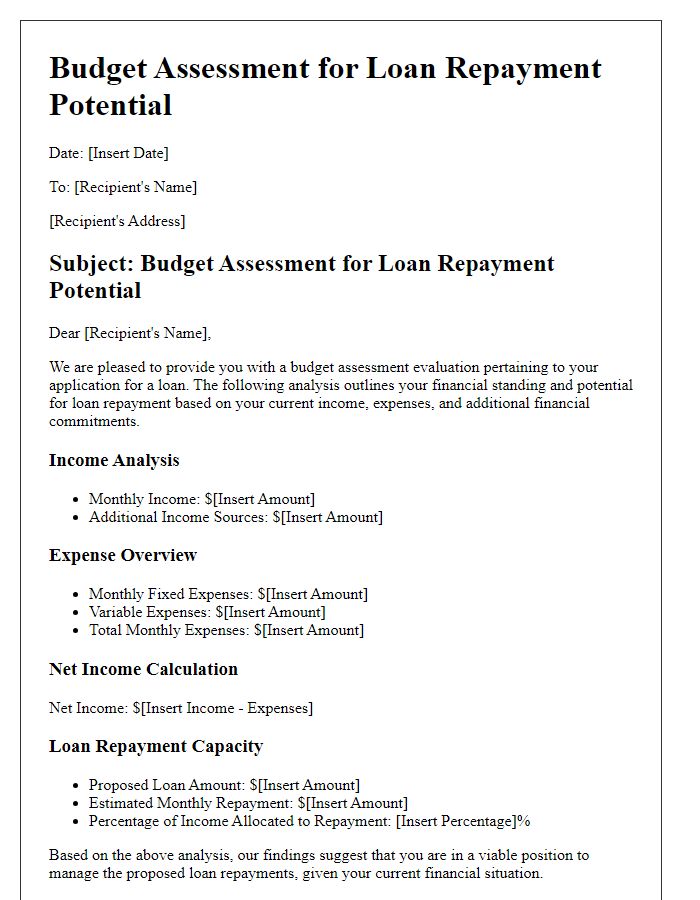

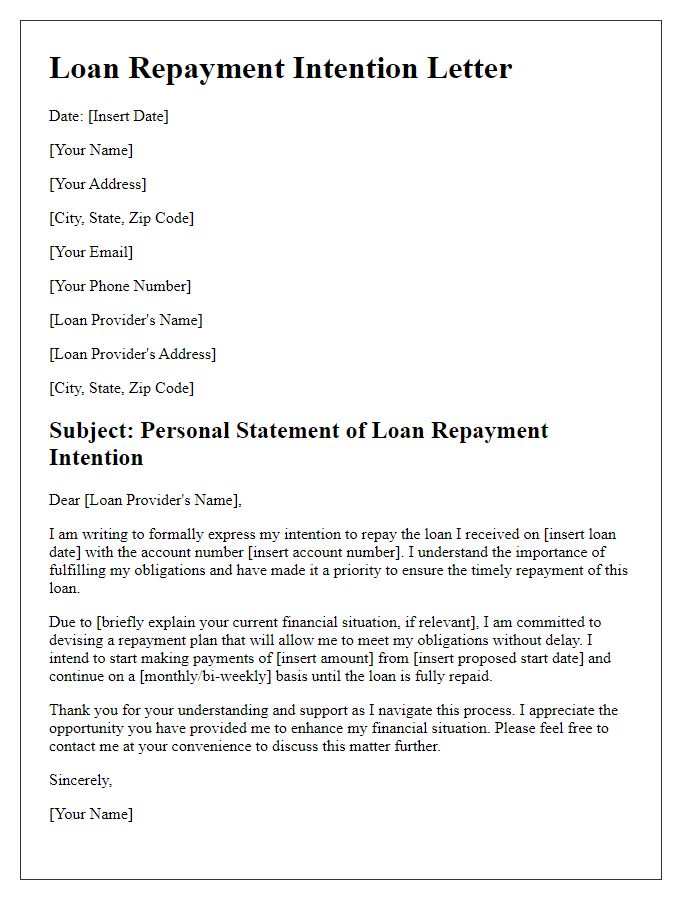

Detailed income statement and employment information

A detailed income statement provides a comprehensive overview of an individual's financial status, essential for demonstrating loan repayment ability. This statement should include gross income, net income after taxes, and various sources of income such as salary from primary employment at XYZ Corporation (annual salary of $75,000), rental income from property in Springfield (monthly income of $1,200), and any additional earnings from freelance work (approximately $2,000 quarterly). Employment information should highlight the stability and duration of current employment, including position as Senior Marketing Manager with over five years at XYZ Corporation, a reputable organization in the marketing sector. It is also important to outline any applicable benefits such as health insurance, retirement contributions, and bonuses that enhance financial security. Lastly, providing a history of consistent income and punctual loan repayments can further solidify the individual's financial credibility to the lender.

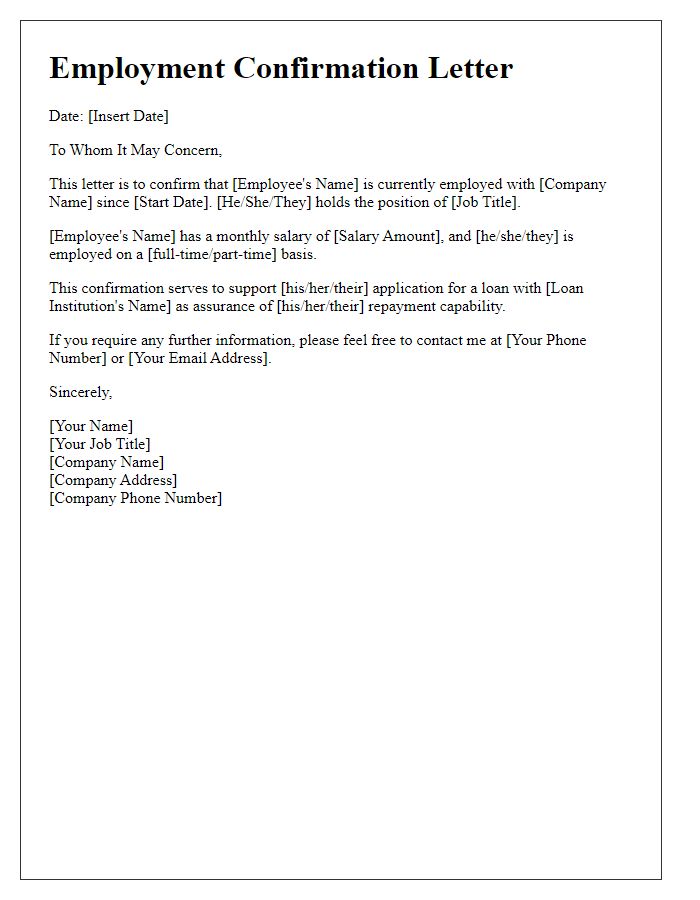

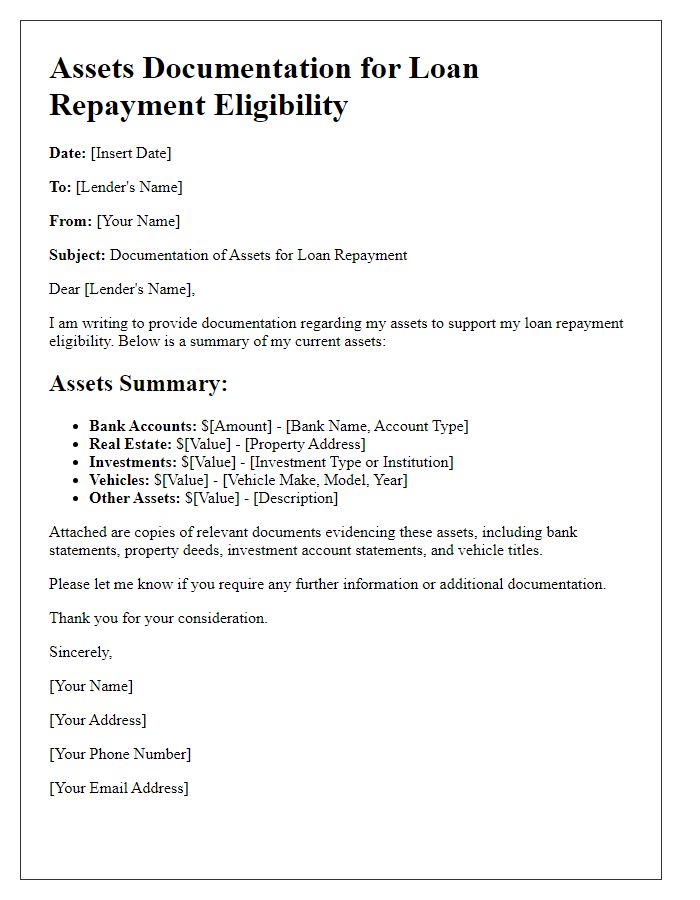

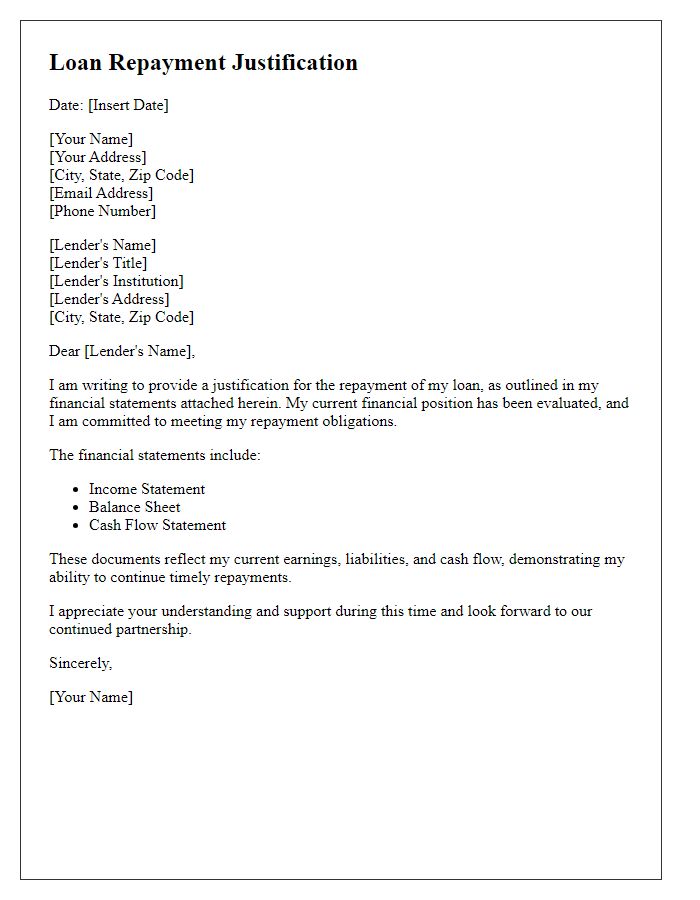

Explanation of current financial obligations and liabilities

Current financial obligations significantly impact an individual's ability to repay loans. Monthly mortgage payments (averaging around $1,500 for a standard property in urban areas) contribute to housing costs. Student loans, which average approximately $30,000 for graduates, require an estimated monthly payment of $300 to $400, depending on repayment plans. Credit card debt, with an average APR of 16%, can lead to monthly payments that vary based on the balance, often costing around $200. Additionally, auto loans ($500 monthly for a standard new car) intensify overall monthly obligations. Utility bills, averaging $250, and insurance premiums (around $100 for health coverage) further strain disposable income. Together, these liabilities must be carefully managed to ensure timely loan repayments and maintain a steady financial status.

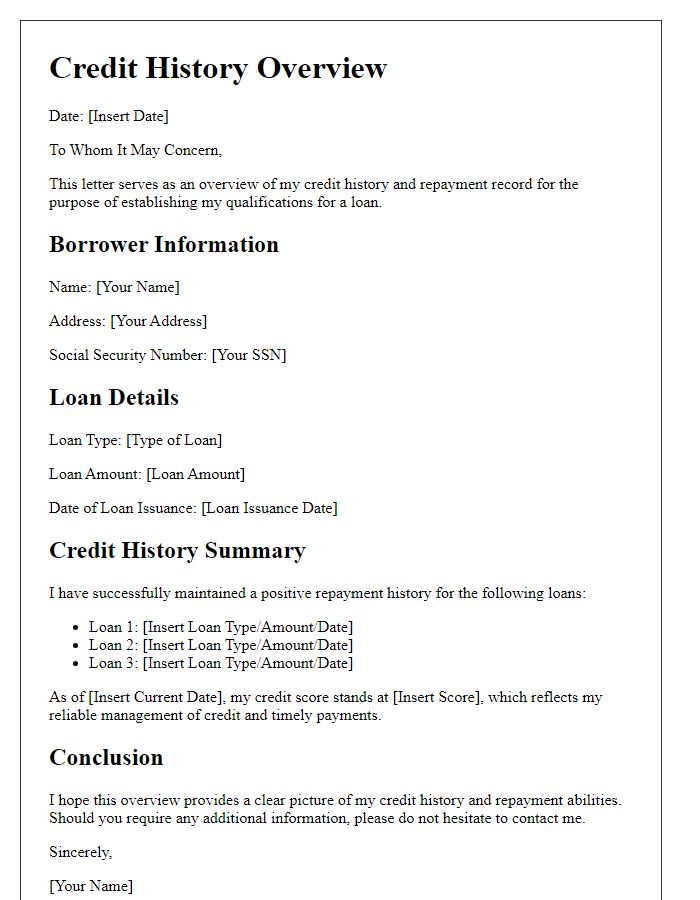

Documentation of consistent payment history

Consistent payment history serves as a crucial indicator of financial reliability for loan repayment. Individuals maintaining a positive record often show a series of timely payments across various obligations, such as credit cards, mortgages, and personal loans. Typically outlined in credit reports by bureaus like Experian, TransUnion, and Equifax, this documentation highlights payment patterns over the last five to seven years. For example, a borrower with a history of making payments on time and utilizing less than 30% of their credit limit is often viewed favorably by lenders. In addition, showcasing a diversified credit mix, including auto loans and student loans, can further enhance a borrower's profile. A strong payment history significantly lowers perceived risk, potentially leading to better loan terms and interest rates.

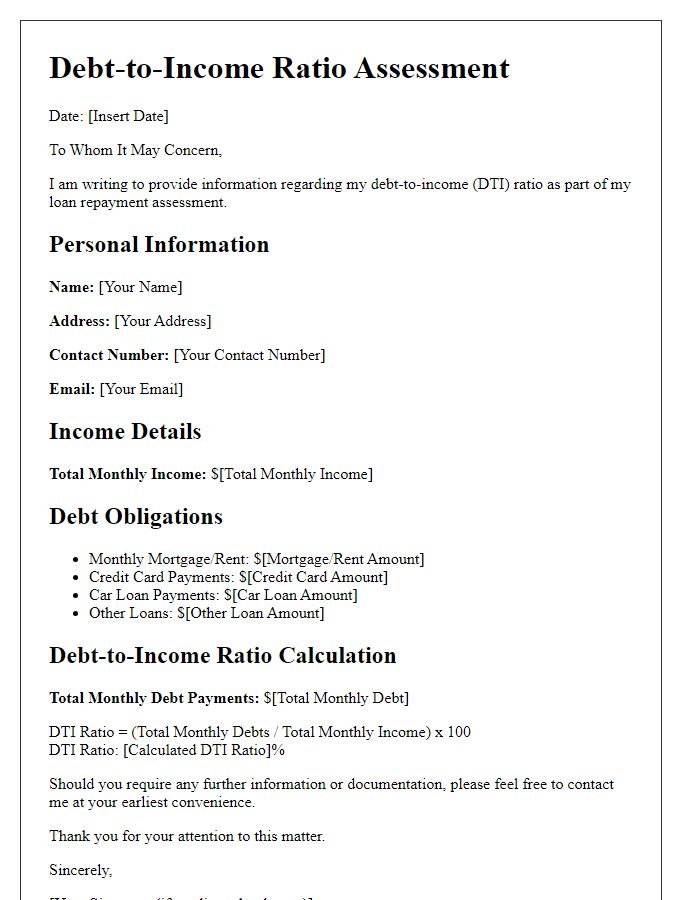

Future financial projections and stability indicators

Future financial projections highlight significant growth for individuals or businesses anticipating a steady increase in income over the next five years. For instance, revenue growth rates projected at 10% annually, coupled with a detailed budget plan showcasing careful expense management, create a clear picture of financial stability. Indicators such as a debt-to-income ratio of less than 36% signal responsible borrowing practices, while an emergency fund covering six months of expenses ensures preparedness for unforeseen circumstances. The presence of diverse income streams, including investments or secondary income sources, mitigates risks, showcasing resilience. This comprehensive approach illustrates a commitment to maintaining an excellent credit score, characterized by consistent on-time payments and low credit utilization.

Comments