Hey there! If you're looking to update your beneficiary dependent information, you've come to the right place. Keeping your records accurate is crucial for ensuring that your loved ones are protected and benefit from your plans as intended. In this article, we'll guide you through the simple steps to update your information and clarify any potential confusion. So, let's dive in and make sure your details are up-to-date!

Personal identification details

Updating personal identification details for beneficiaries is essential for accurate record-keeping in various financial services, especially in trusts and insurance policies. Specific information such as full name, date of birth, and social security number must be precisely recorded. The address is crucial too, reflecting the current residence to ensure timely communication and updates. Contact information, including phone number and email address, helps maintain open lines of communication for any queries or changes regarding benefits. Additionally, identification documents like government-issued photo ID facilitate verification processes. Regular updates mitigate potential issues during claims or distributions, ensuring beneficiaries can access their entitled resources without delay. Proper documentation reinforces legal compliance in financial operations, safeguarding both the provider and the beneficiary.

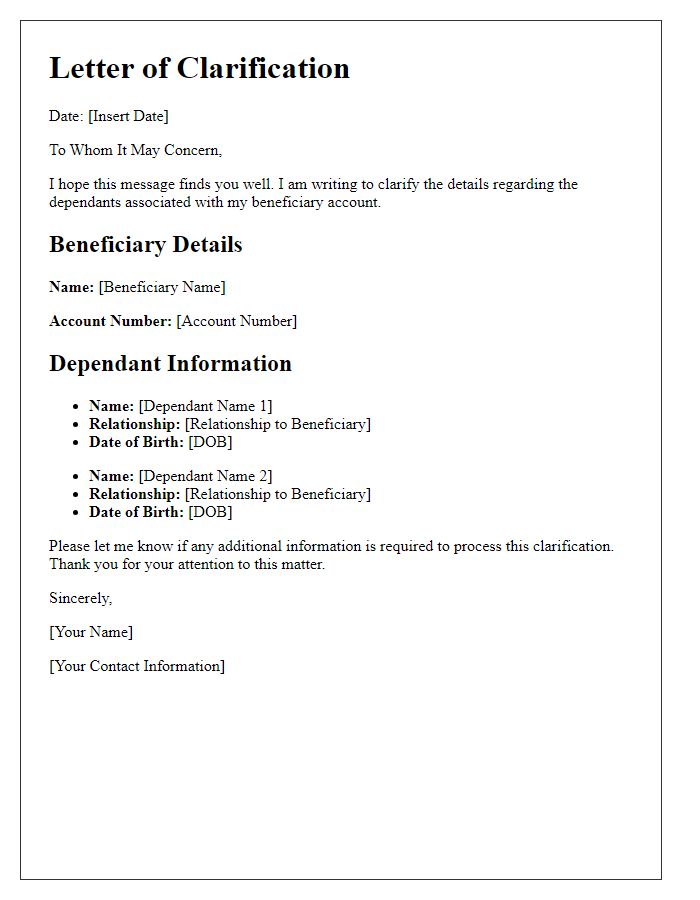

Beneficiary relationship clarification

Beneficiary relationship clarification is essential for accurate estate planning and financial documentation. A dependable relationship, like spouse or child, falls under immediate family, impacting inheritance rights and insurance benefits. Legal guidelines, such as those outlined in the Employee Retirement Income Security Act (ERISA), dictate the necessity of accurate information in maintaining beneficiary designations. Regular updates ensure alignment with current personal circumstances, such as marriage, divorce, or the birth of a child, particularly for policies held by major institutions like banks or insurance companies. Accurate records also minimize disputes and help financial institutions expedite claims processing, ensuring beneficiaries receive entitled assets without unnecessary delays.

Updated contact information

Beneficiaries often need to ensure their contact information is current for various services, such as insurance or financial assistance programs. Updating contact details, including phone numbers and addresses, is essential for timely communication regarding claims or benefits. For instance, a change in residence may necessitate an update to avoid potential lapses in service notifications. Maintaining accurate records also helps organizations keep beneficiaries informed about critical updates or changes in policy. Additionally, prompt reporting of contact updates assists in maintaining compliance with program requirements and minimizes potential delays in service delivery.

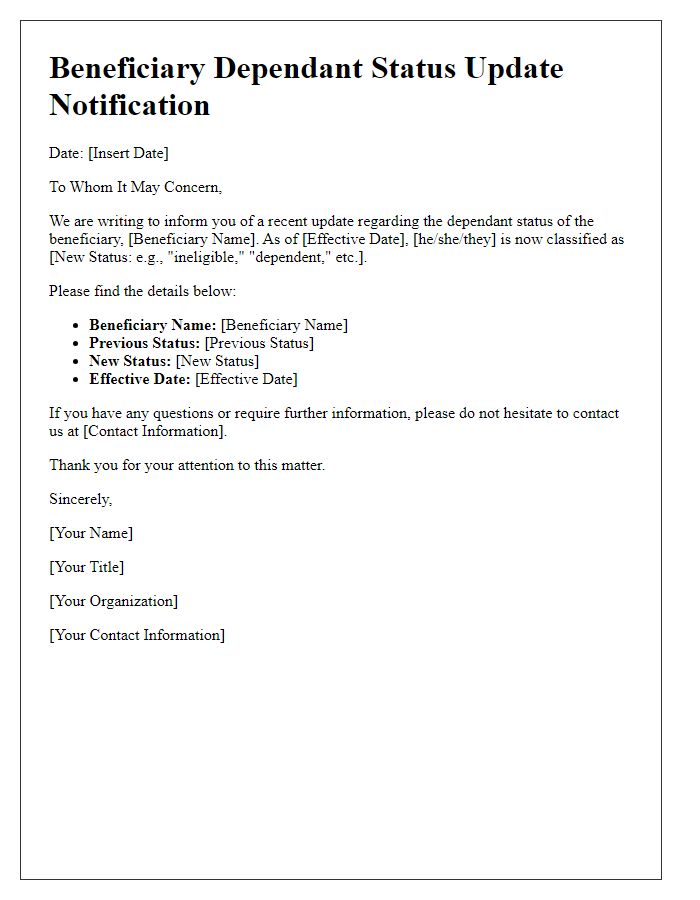

Explanation of changes or updates

Beneficiary updates commonly involve significant life changes such as marriage, divorce, birth of a child, or changes in dependency status. These updates ensure accurate reflection of an individual's current situation within benefits programs. For example, after a marriage, a spouse may become a beneficiary, while a divorce might lead to their removal. Birth events introduce new dependents requiring addition to benefit plans. Additionally, aging out of dependency eligibility, such as when a child reaches the age of 26, necessitates their removal from the plan. Timely updates are crucial to maintain compliance with regulations and ensure correct distribution of benefits.

Signature and date for verification

Beneficiary dependency information updates often require signature verification. The process typically involves collecting essential details about the dependent, such as full name, relationship to the primary beneficiary, and date of birth. To ensure authenticity, a signature from the primary beneficiary is necessary on the official form, along with the date the update is submitted. This verification helps organizations maintain accurate records and ensures that benefits are allocated appropriately, in accordance with regulations. Proper documentation is crucial, particularly for future claims or audits.

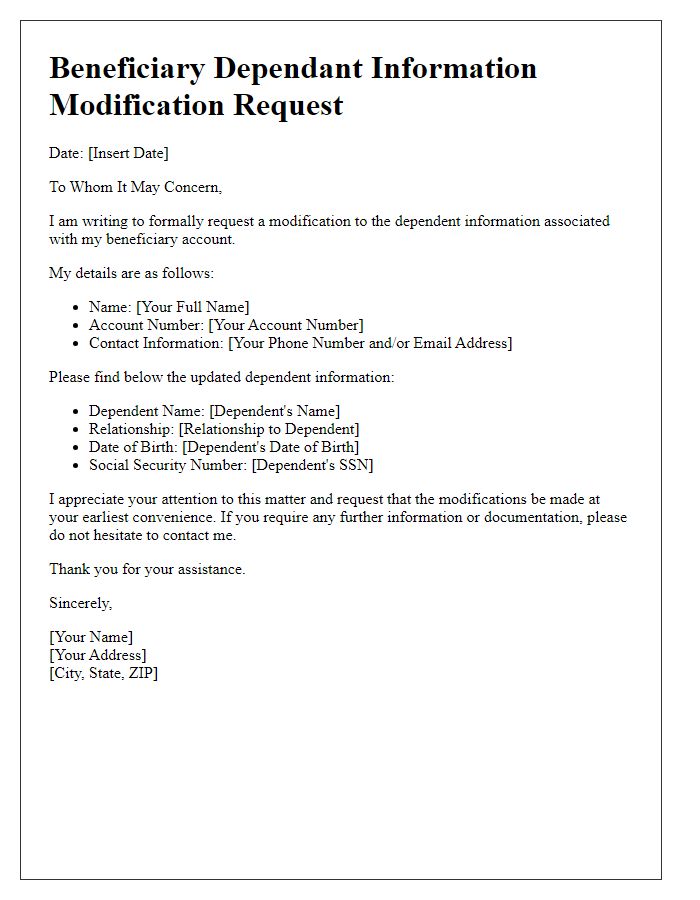

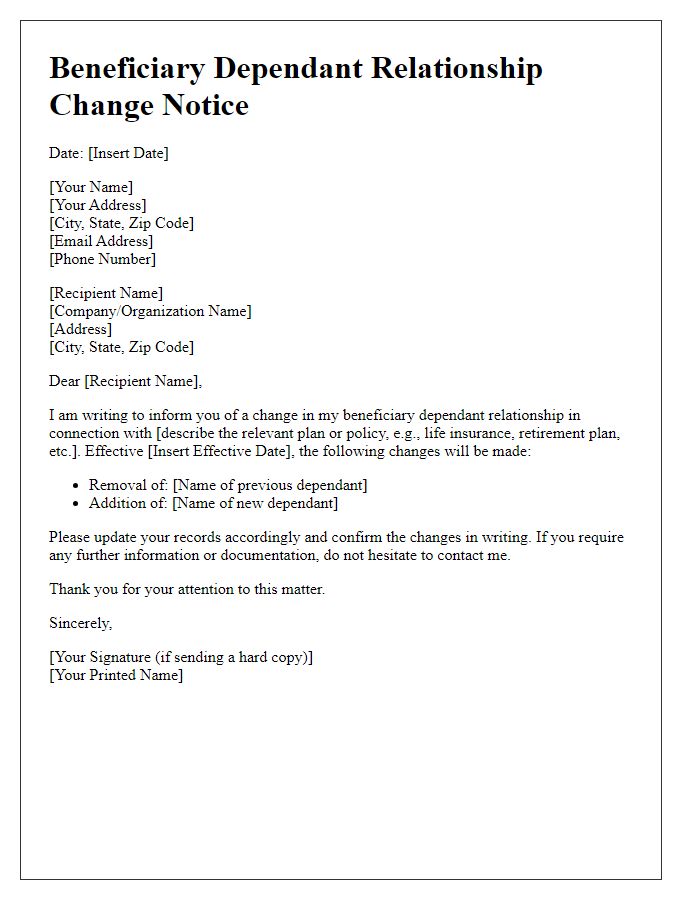

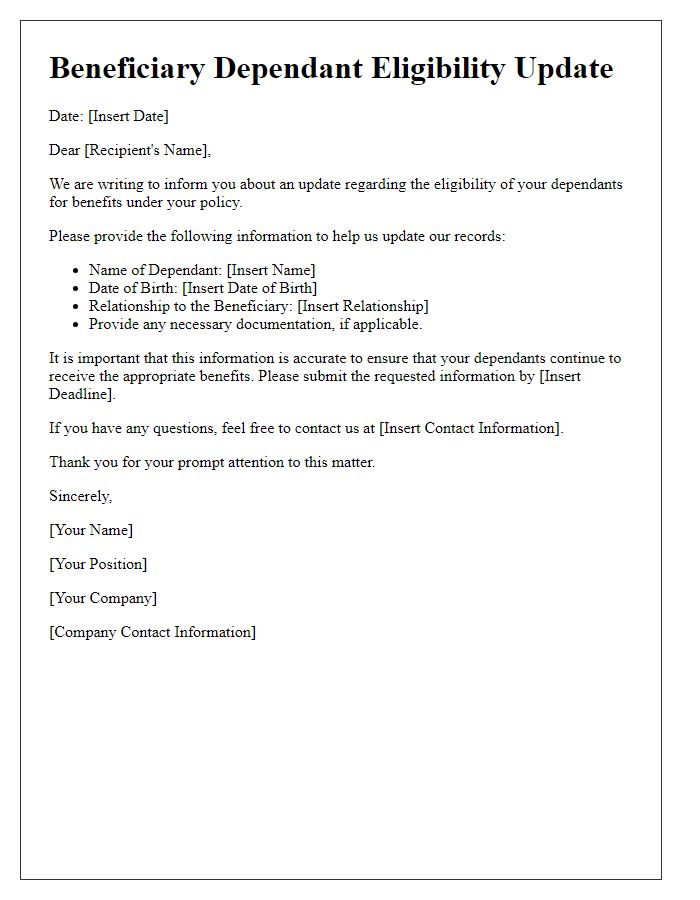

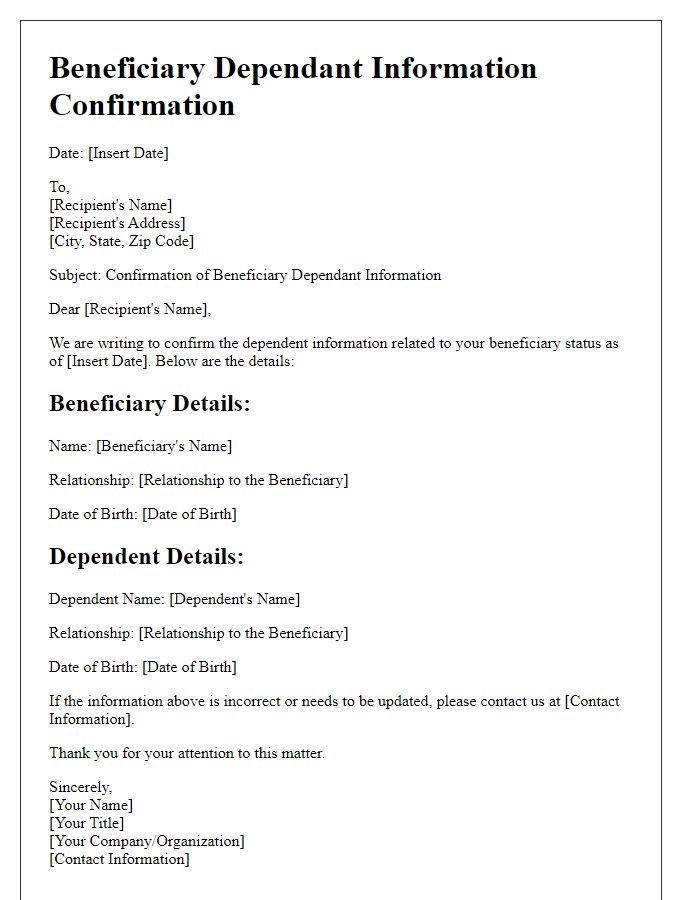

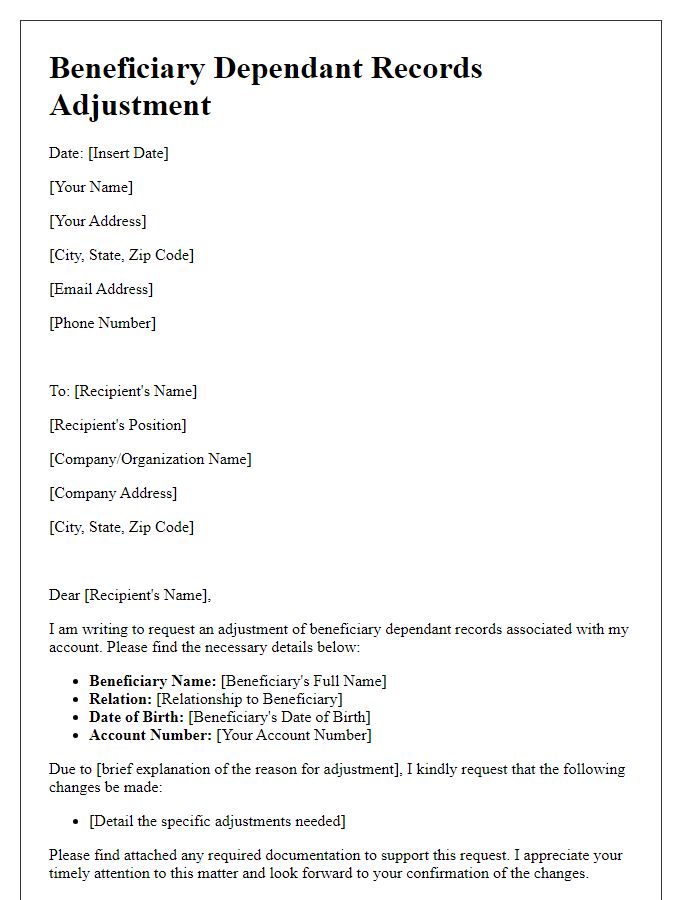

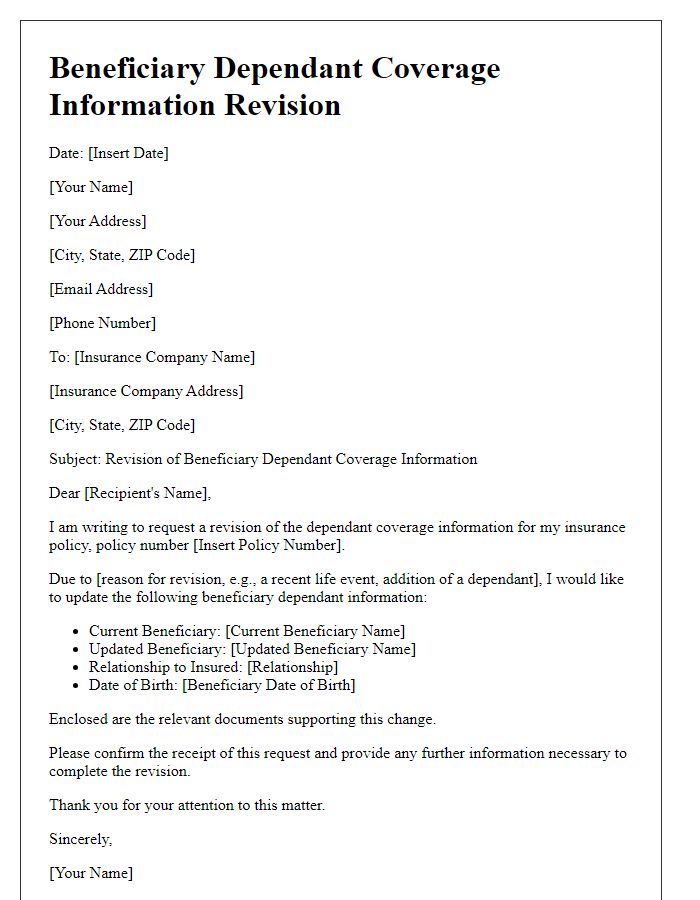

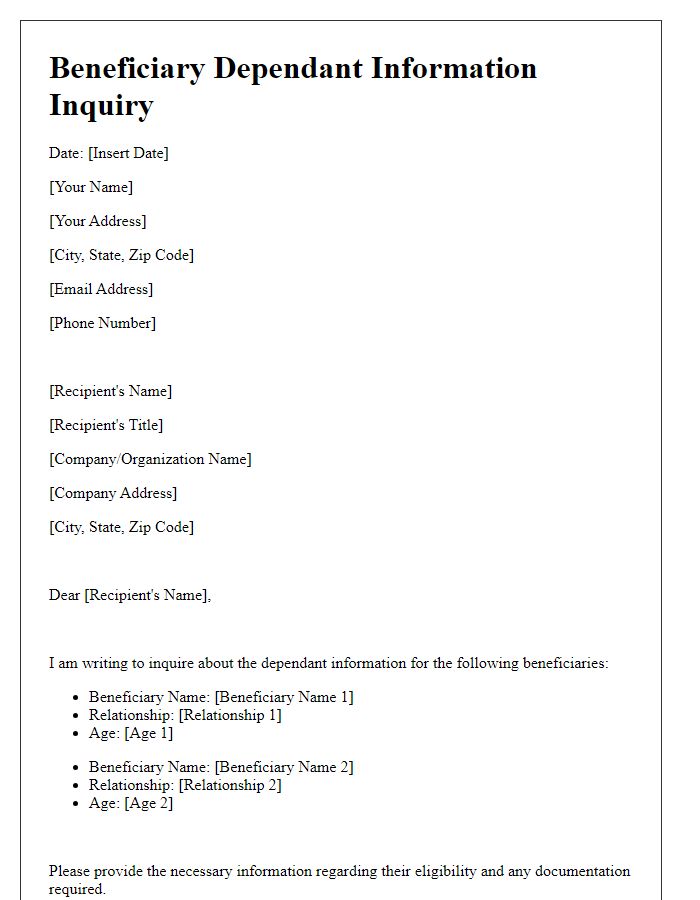

Letter Template For Beneficiary Dependant Information Update Samples

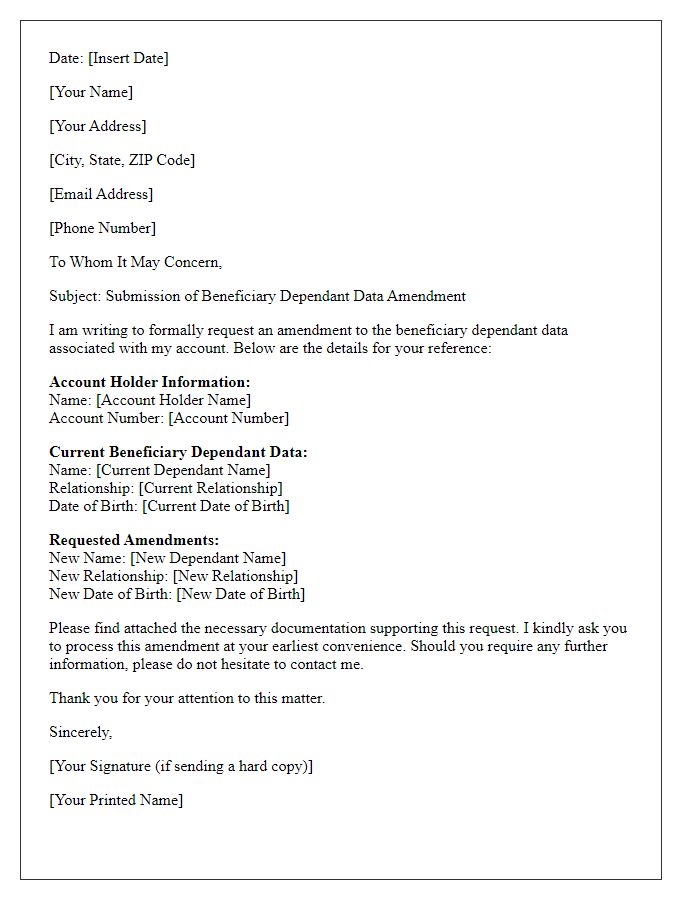

Letter template of beneficiary dependant information modification request

Comments