Are you feeling overwhelmed by the responsibilities of being an executor or beneficiary? Navigating the process of request letters can be a daunting task, especially when clarity and professionalism are essential. In this article, we'll break down how to craft the perfect letter template for requesting a beneficiary executor report, ensuring you communicate effectively and respectfully. So, let's dive in and simplify the process together!

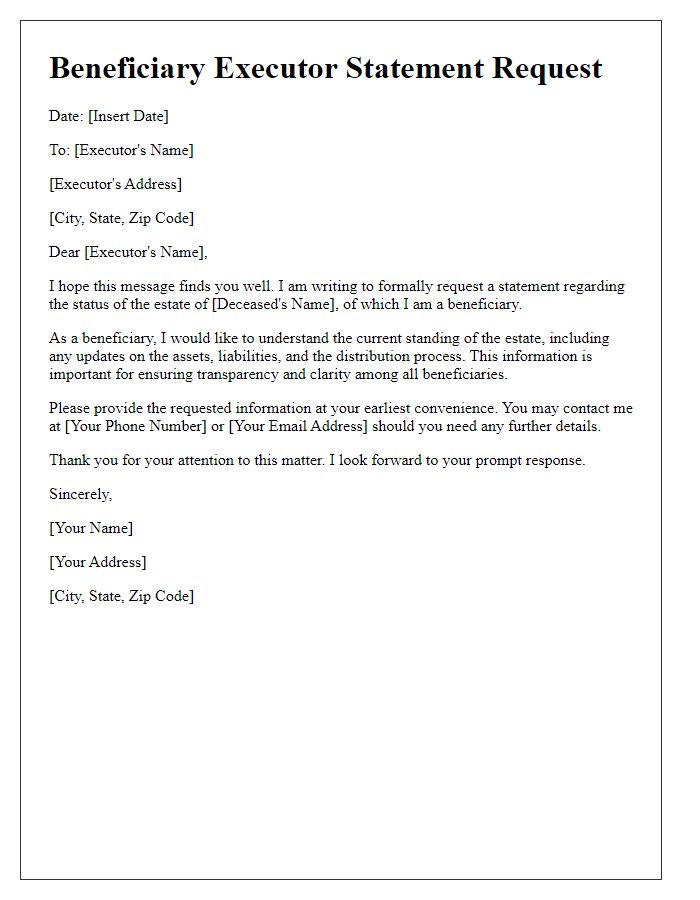

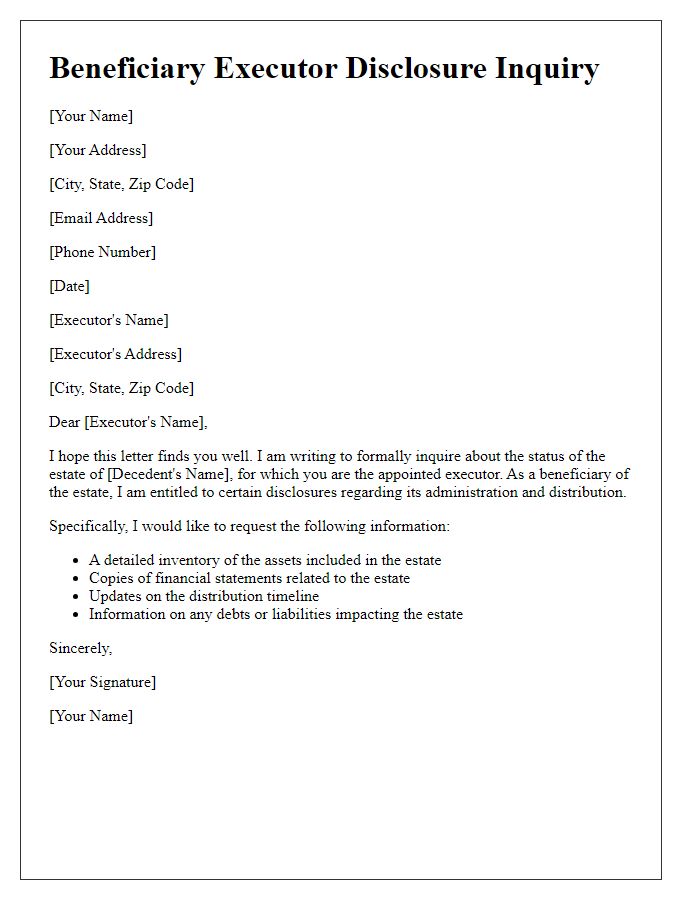

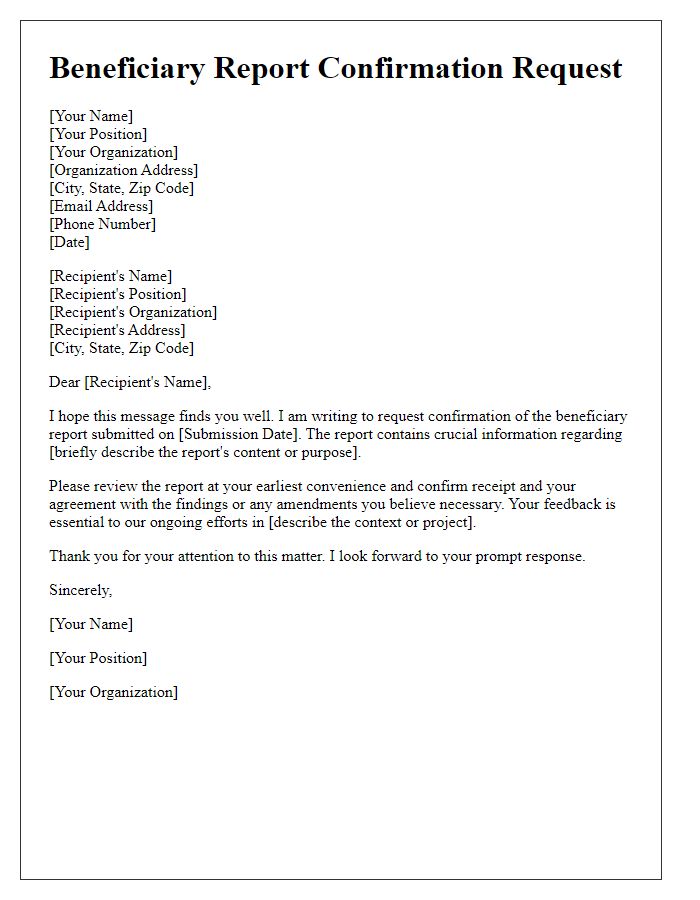

Beneficiary Identification Details

Beneficiary identification details are crucial in the estate settlement process. Essential information includes full name, date of birth, Social Security Number for verification, and current residential address for accurate correspondence. Additional identifiers such as email address and phone number may facilitate effective communication. It's important to gather relationship status to the deceased, which can influence inheritance claims. A detailed background of prior communications regarding estate matters can also prove beneficial. This comprehensive collection of beneficiary identification details can expedite the executor's report request, ensuring that estate assets are distributed in accordance with the deceased's wishes.

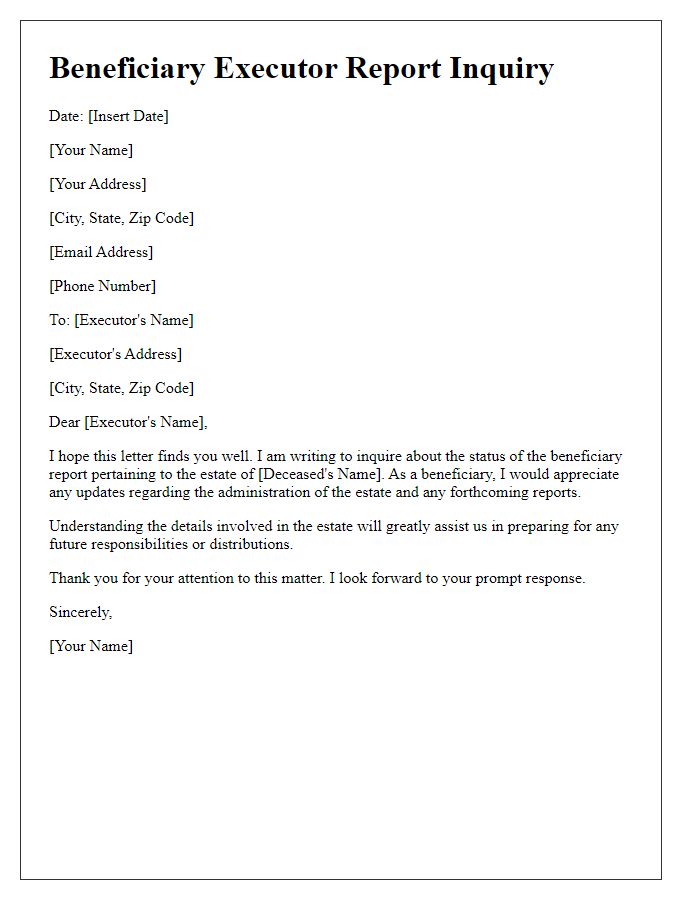

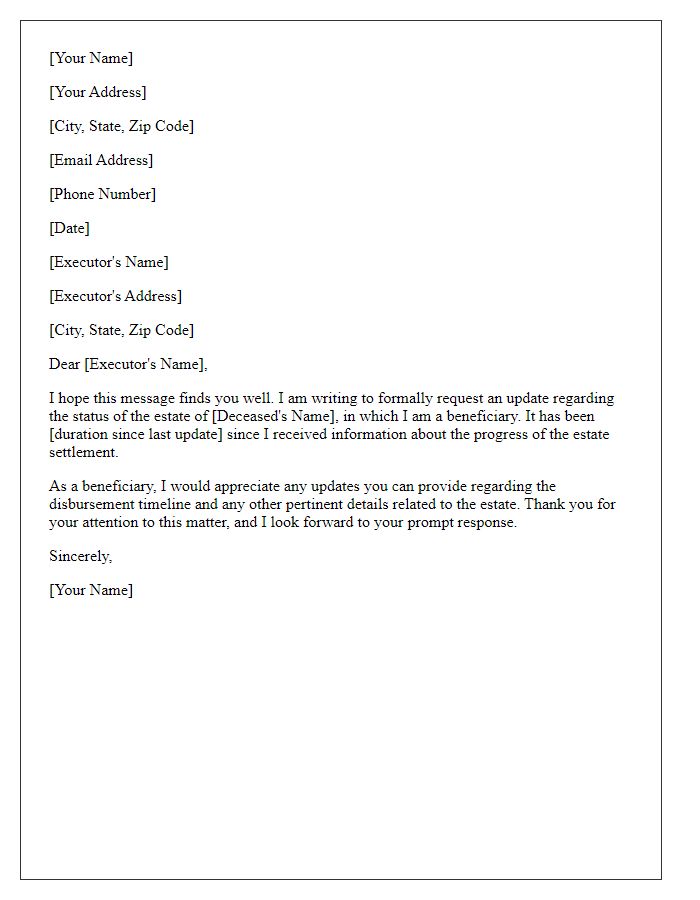

Executor Contact Information

The executor contact information is essential for the execution of a will, such as the name, address, and phone number of the appointed individual, typically a trusted friend or family member, designated in the document following the death of the testator, which can be a complex legal process. This information aids beneficiaries in directly reaching out for updates regarding the administration, which may include handling assets, debts, and taxes associated with the estate. Accurate executor details, such as an email address for efficient communication, are vital for ensuring that receipts, reports, and any required legal documentation regarding inheritance distribution are appropriately shared and addressed in accordance with local probate laws in the jurisdiction where the estate is processed.

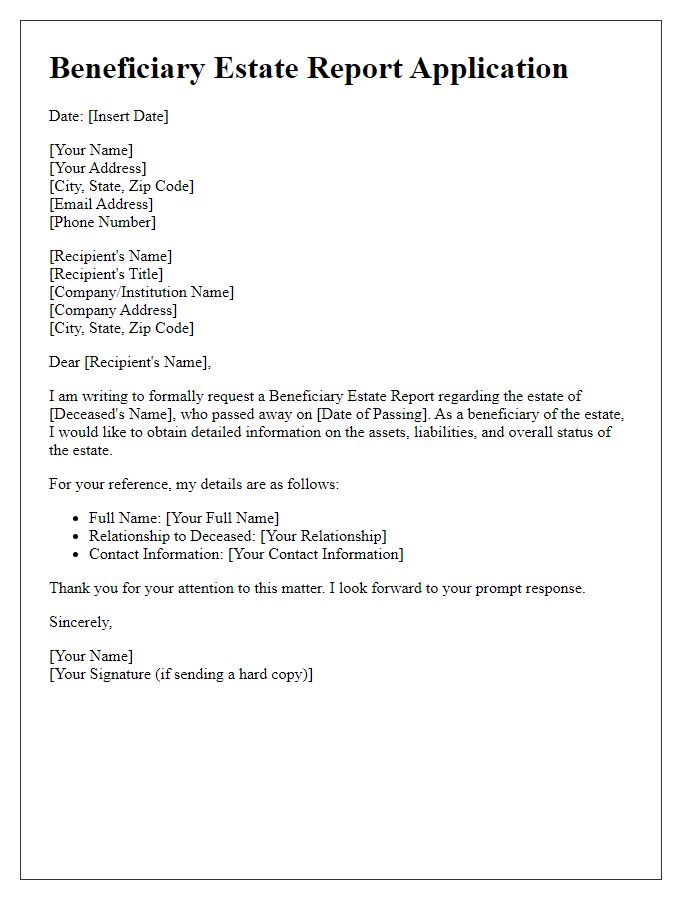

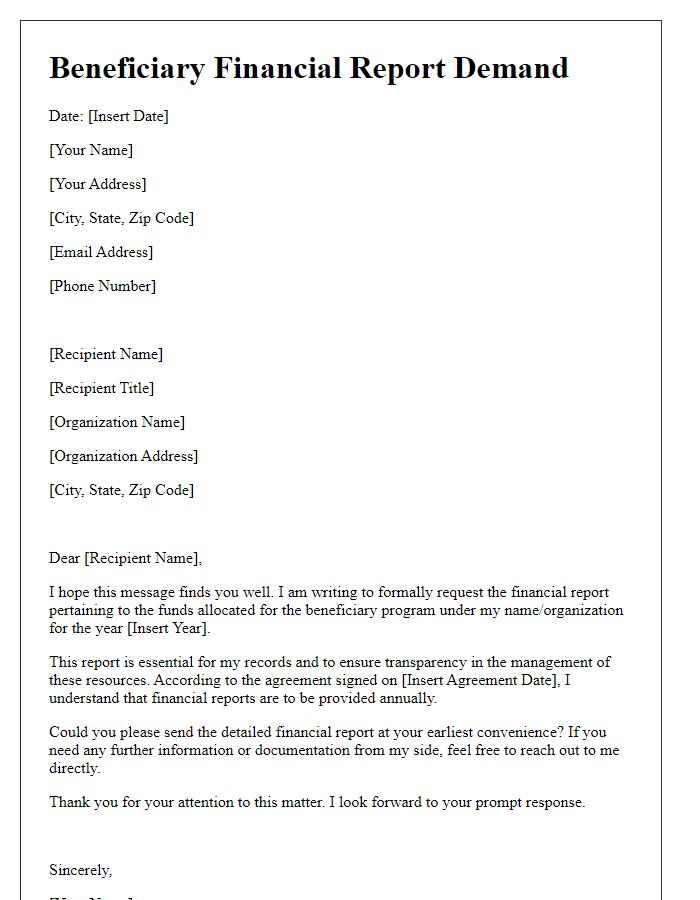

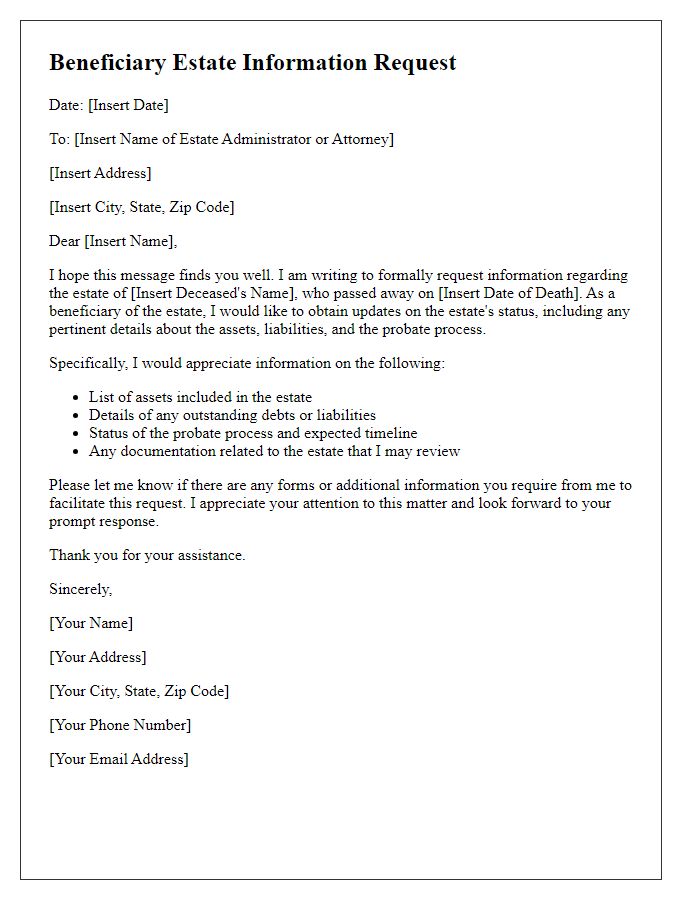

Estate Summary and Status

An estate summary outlines the distribution of assets and liabilities for a deceased individual, providing clarity for beneficiaries. Key components include a detailed asset list, such as real estate properties (including addresses and market values), bank accounts (with account numbers and balances), personal belongings (valued appraisals for items like antiques or vehicles), and investments (including stocks or bonds held). Liabilities should also be listed, detailing outstanding debts such as mortgages, loans, and funeral expenses. Status updates on probate proceedings in specific courts, like the County Court of Los Angeles, along with timelines for asset distribution, are essential. Transparency is critical to maintain beneficiary trust and ensure a smooth administrative process.

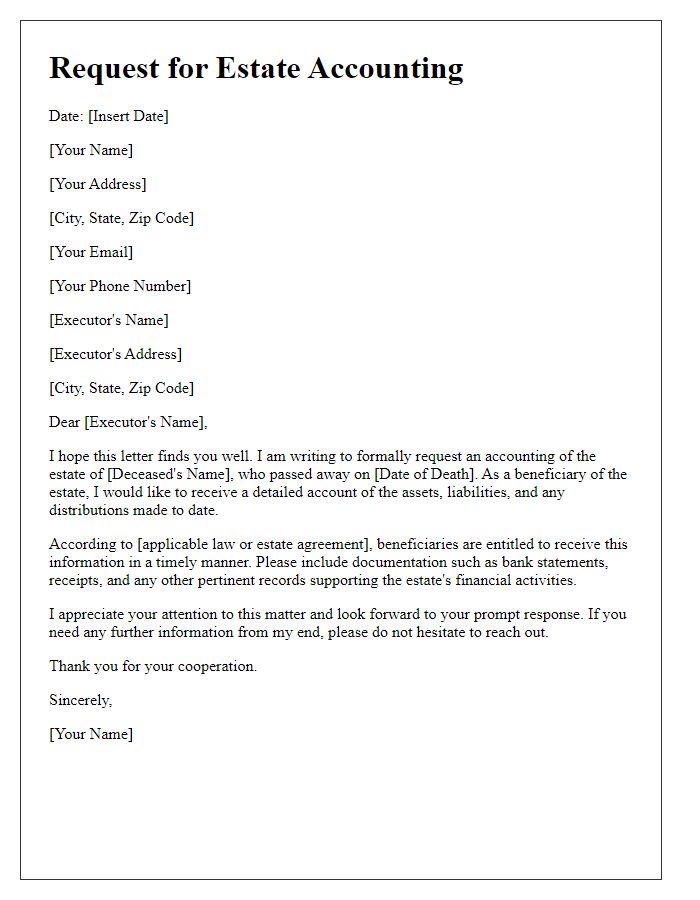

Itemized Inventory of Assets

An itemized inventory of assets provides a comprehensive overview of the wealth and property owned by the deceased individual, essential for legal and financial proceedings. This inventory typically includes real estate properties (such as homes or rental units), personal belongings (like jewelry, collectibles, and vehicles), bank accounts (checking and savings), investment portfolios (stocks, bonds, mutual funds), and any other valuable items (artwork, antiques). Each asset should be documented with specific details, such as location, estimated market value, and photographs, which assist in the fair distribution among beneficiaries. Accurate records enable executors to comply with legal requirements and facilitate the probate process, often extending across multiple jurisdictions, impacting tax obligations and inheritance arrangements significantly.

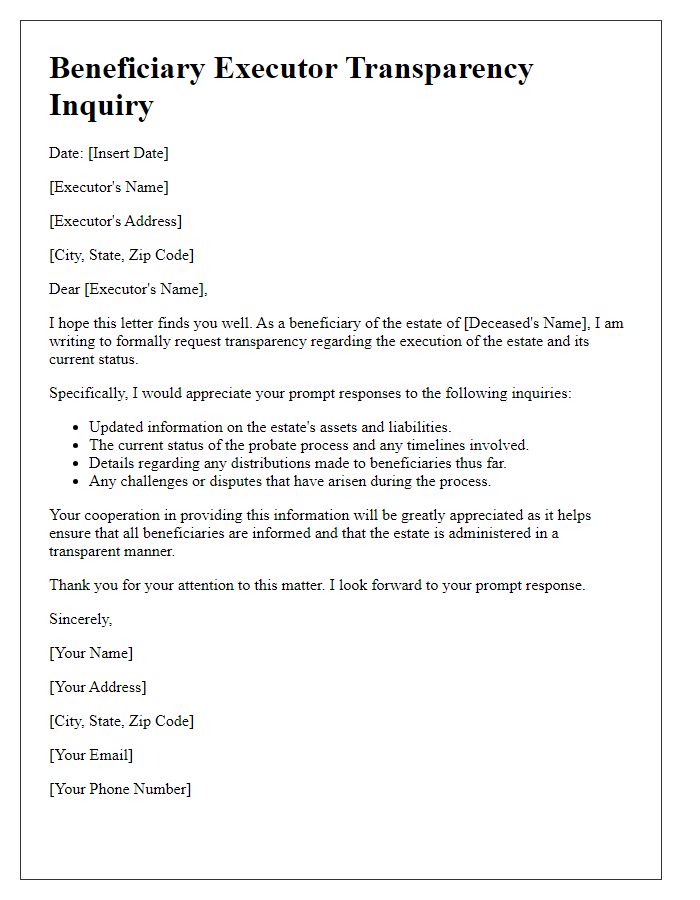

Estimated Timeline for Estate Distribution

The estimated timeline for estate distribution varies by jurisdiction and the complexity of the estate involved. In general, the probate process (legal procedure to settle an estate) can take anywhere from six months to over a year. Factors influencing this timeline include the need for appraisal of assets, resolution of debts and taxes, and potential disputes among beneficiaries. For instance, in California, the probate court often mandates a four-month waiting period for creditors to file claims after the executor submits the will. Additionally, if the estate includes real estate in multiple states, the executor may face additional proceedings, extending the overall timeline significantly. Overall, effective communication with the executor can provide insight into specific expectations based on the unique circumstances surrounding the estate.

Comments