Navigating the complexities of beneficiary designations can be challenging, especially when circumstances change. Whether it's due to a marriage, divorce, or the birth of a child, keeping your beneficiary information current is essential for ensuring your wishes are honored. In this article, we'll explore the step-by-step process for updating your beneficiaries and the important considerations to keep in mind. So, if you're ready to simplify your financial planning, let's dive in and discover how to make these important changes seamlessly!

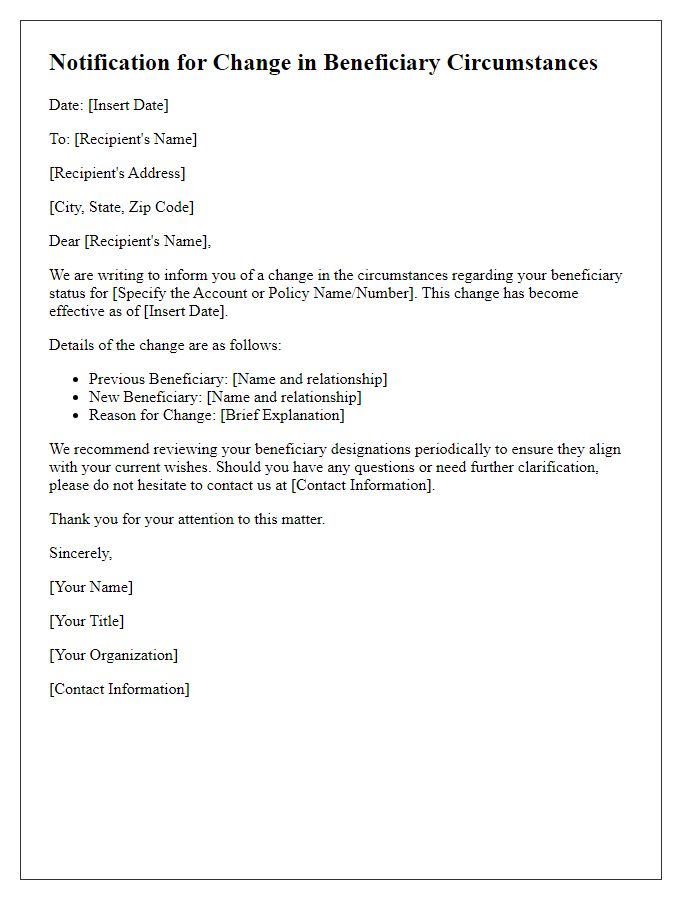

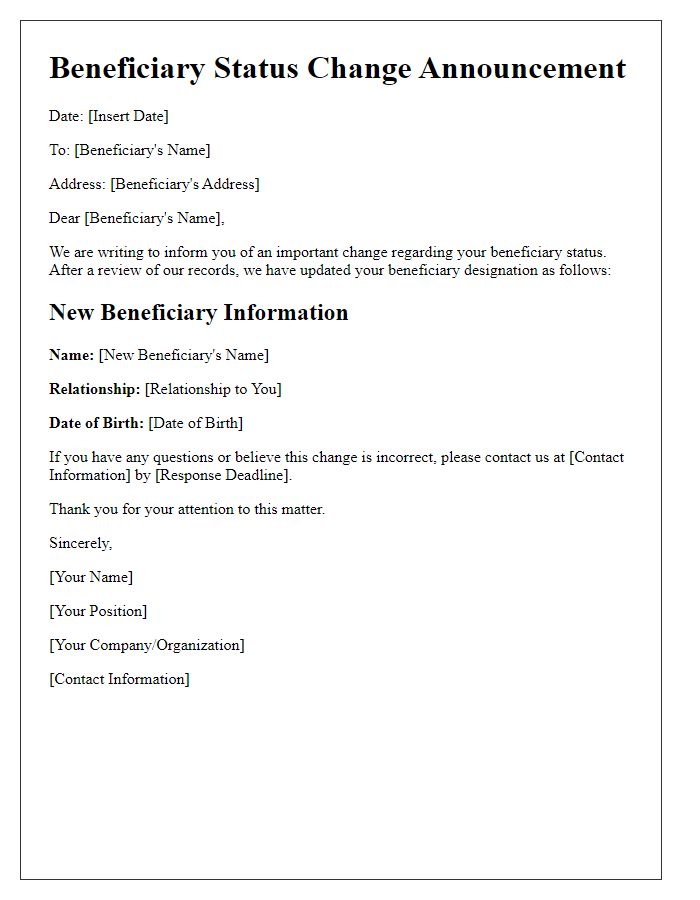

Clear identification of existing beneficiary details.

Current beneficiary details such as full name, date of birth, and Social Security number are crucial for accurate identification. For example, if Jane Doe, born on April 12, 1980, has a Social Security number of 123-45-6789 listed as a beneficiary, this information must be clearly stated. Changes in circumstances can include events like marriage, divorce, death, or relocation, which may impact the status or preference of the beneficiary. Providing updated information regarding the new beneficiary, including their full name, date of birth, and Social Security number, ensures compliance with legal requirements and clarity in records. This process is essential for organizations like insurance companies or retirement plans to maintain accurate beneficiary designations.

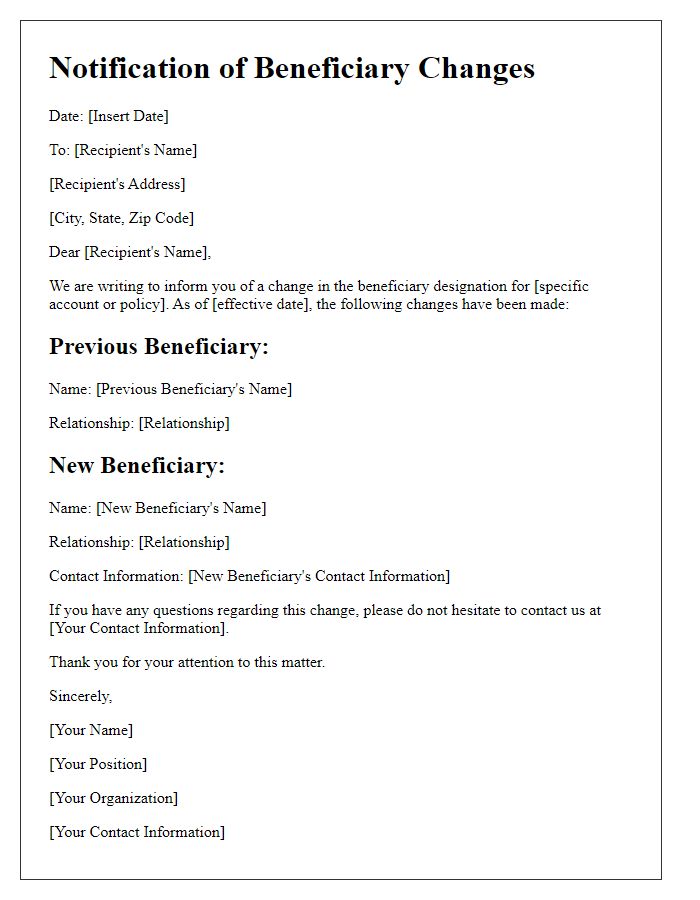

Specific description of change in circumstances.

A change in circumstances can significantly impact a beneficiary's eligibility or benefits. For instance, a change in income level, such as an increase or decrease in salary due to a new job or job loss, can alter the financial situation a beneficiary faces. Other factors include changes in family dynamics, such as marriage, divorce, or the birth of a child, which may require updating beneficiary designations to align with current legal responsibilities. Additionally, moving to a different state or country can affect taxation and legal regulations, necessitating a review of benefits and any relevant documentation. Situations involving health status changes, such as a diagnosis of a critical illness, can lead to increased financial needs, requiring a reassessment of beneficiary arrangements.

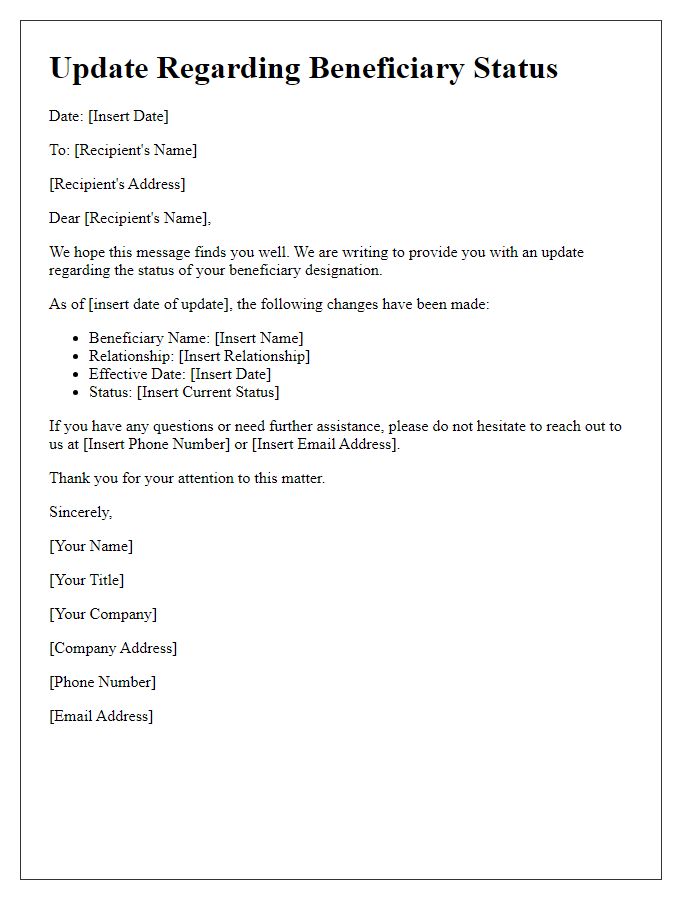

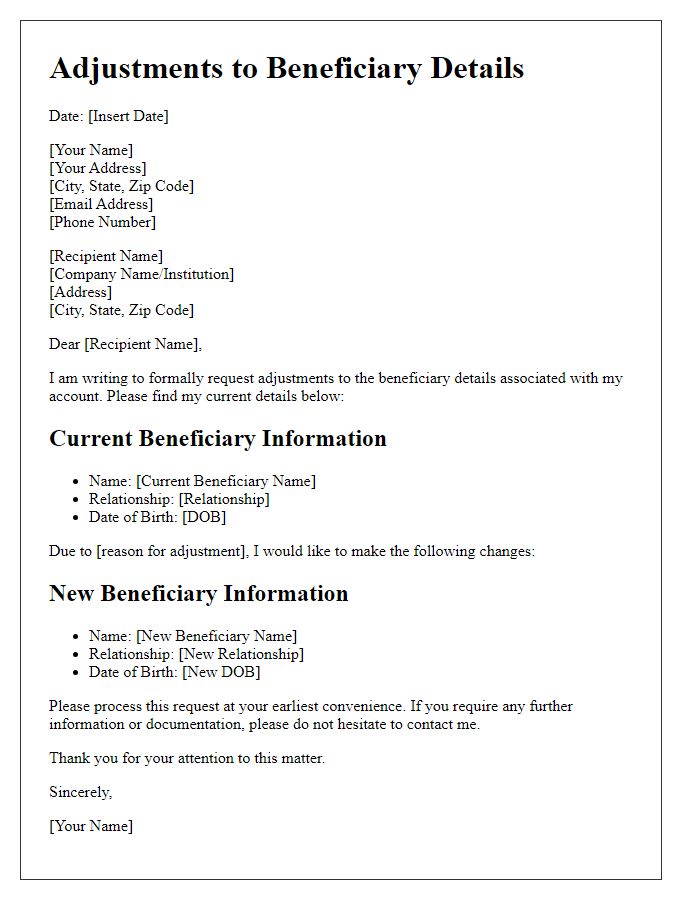

Accurate beneficiary contact information.

Accurate beneficiary contact information is crucial for financial institutions and insurance companies managing policies and accounts. Updated details, such as current phone numbers (including area codes), email addresses, and physical addresses, ensure timely communication regarding benefits or claims. Specific events, like the death of a primary beneficiary or a change in marital status, necessitate prompt updates to prevent delays in distribution. Failure to maintain accurate records may result in missed notifications or legal complications. Regularly reviewing and confirming beneficiary information is essential for financial planning and security, particularly following significant life events or policy changes.

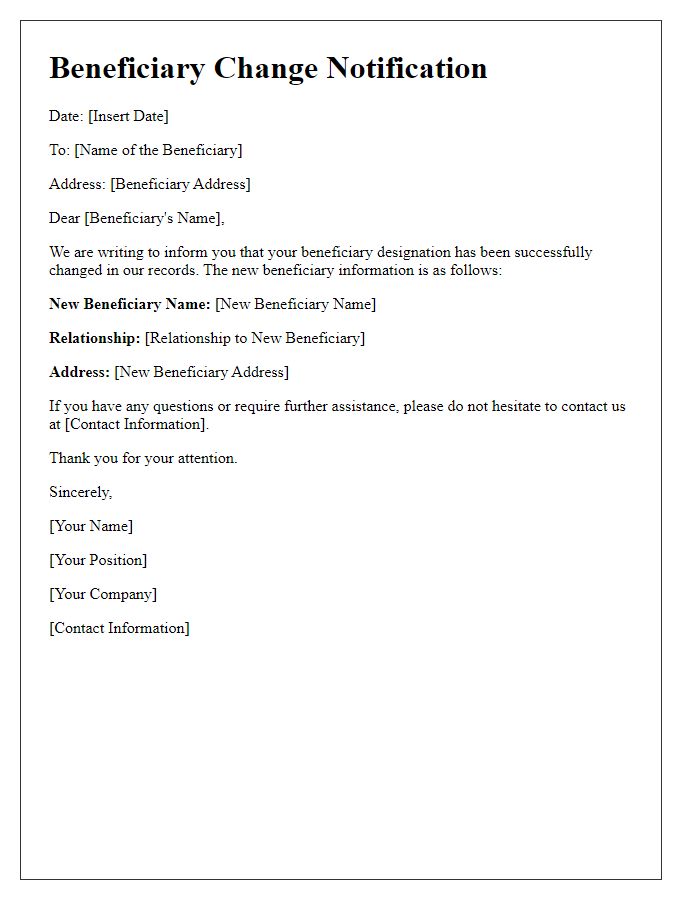

Legal or supporting documentation as needed.

Beneficiary change of circumstances requires careful documentation to ensure compliance with legal standards. Relevant legal documents include forms like Change of Beneficiary, executed wills, or updated trust agreements. Supporting documentation could encompass marriage certificates, divorce decrees, or proof of death for deceased beneficiaries. Proper submission often requires notarization, depending on jurisdiction, ensuring authenticity. Accurate record-keeping of previous beneficiary details is essential for clarity in financial institutions or insurance policies. Adhering to specific guidelines set by the governing entity, such as the Internal Revenue Service (IRS) or specific insurance companies, underpins successful changes.

Request for confirmation of the change.

Beneficiary changes, particularly regarding financial accounts or insurance policies, require careful documentation to ensure accurate updates. Notification to the responsible institution is essential, providing clear details about the change, such as the individual's full name, Social Security Number for identification, and the specific changes being requested. Institutions often need confirmation of such requests to maintain compliance with regulations and to prevent potential fraud. It is advisable to include a request for written confirmation of the update, which serves as proof of the alteration for future reference and provides assurance that the necessary steps have been taken.

Comments