When it comes to handling the affairs of a loved one's estate, navigating the process can often feel overwhelming. One crucial step in this journey is requesting an inventory of the estate, which provides a detailed account of all assets and liabilities. In this article, we'll guide you through a simple letter template to make this request, ensuring you have all the necessary information at your fingertips. So, let's dive in and simplify this important task togetherâread on to discover how to craft the perfect letter!

Clear Identification of the Requesting Party

A beneficiary estate inventory request must clearly identify the requesting party to avoid any confusion during the estate administration process. Essential details include the full name, address, and contact information of the beneficiary (such as phone number and email) to facilitate effective communication. Additionally, any relevant identification numbers, like Social Security Number or tax identification, should be included to confirm the beneficiary's identity. The relationship to the deceased individual, such as daughter, son, or spouse, is crucial for establishing standing in the request. This comprehensive identification aids in ensuring that the estate executor or administrator can efficiently address the request while adhering to legal protocols surrounding estate distributions.

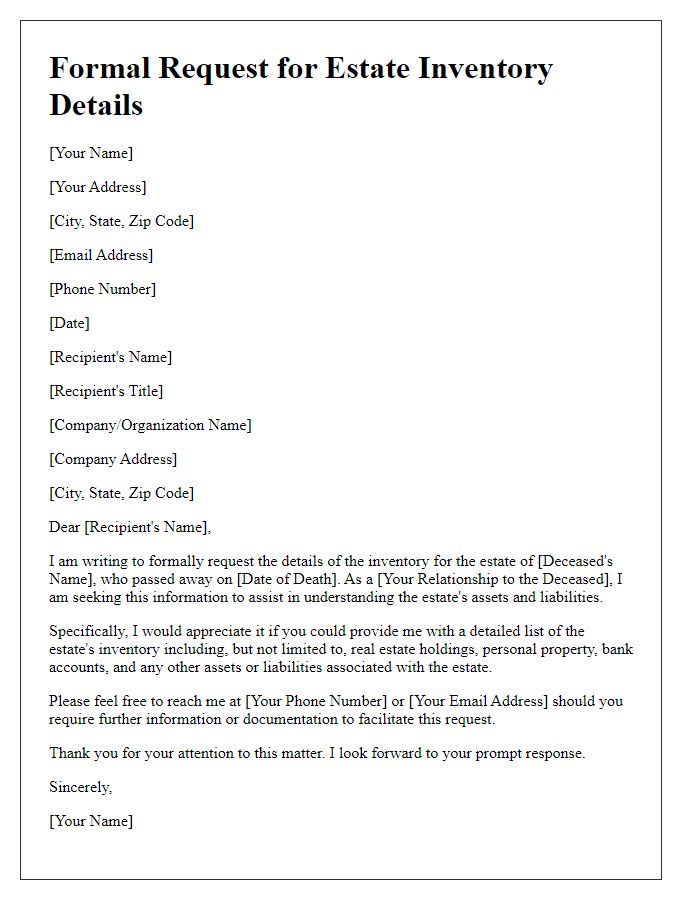

Precise Description of the Estate and Deceased

The estate of the late Johnathan Smith, who passed away on March 15, 2023, includes a residential property located at 123 Elm Street, Springfield, valued at approximately $300,000. Personal assets consist of a vintage 1965 Ford Mustang, valued at $25,000, and various collectibles, including a baseball card collection worth around $10,000. Financial assets include a savings account with Chase Bank, holding a balance of $50,000, and an investment portfolio with Vanguard, estimated to be worth $150,000. The inventory of the estate is crucial for the accurate distribution of assets among beneficiaries, including his spouse, Emily Smith, and his two children, Sarah Smith and Daniel Smith, as outlined in his will dated January 10, 2020.

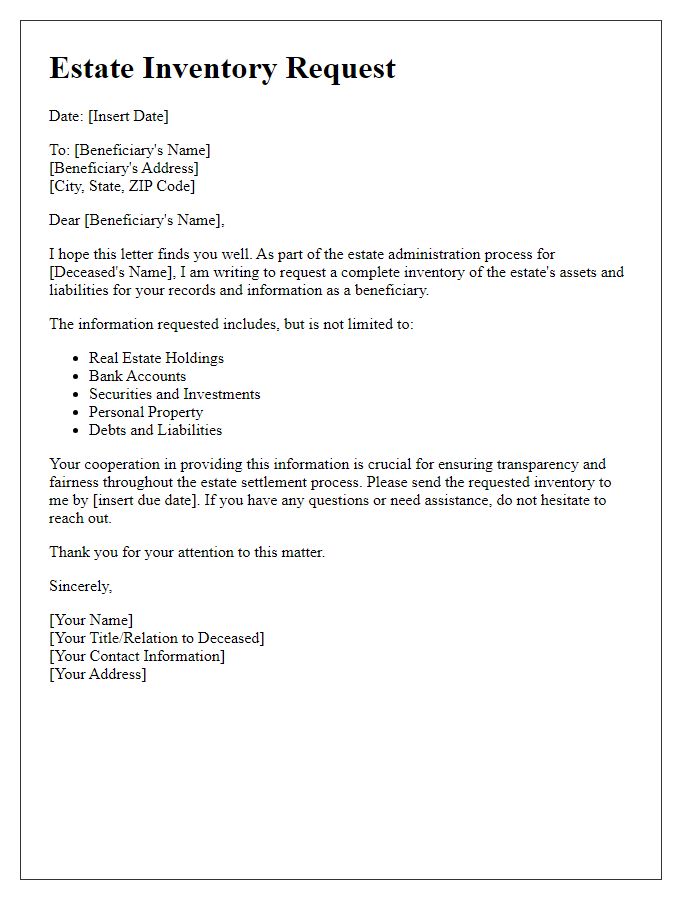

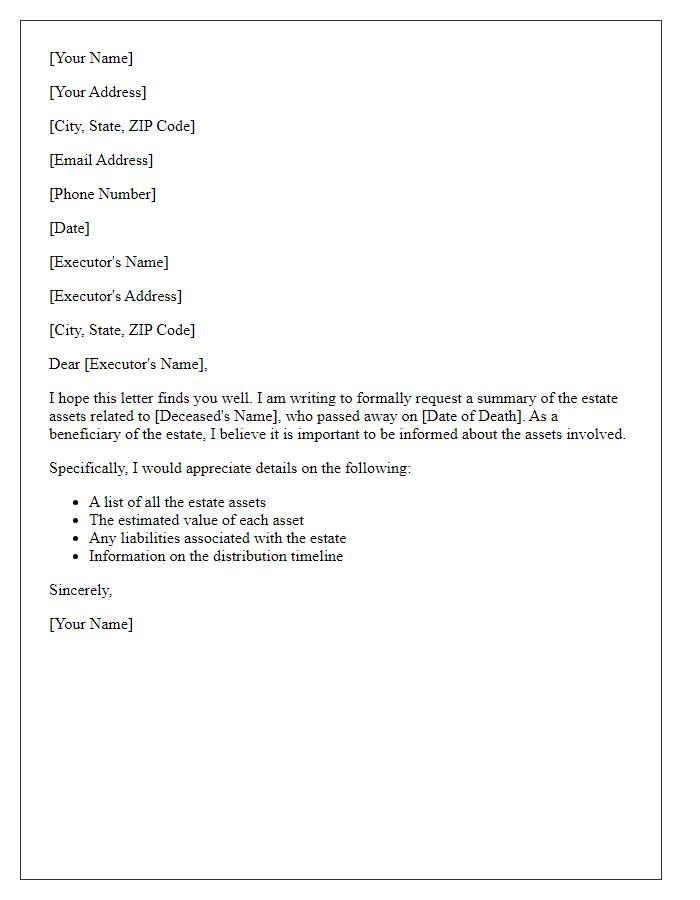

Detailed List of Requested Documents/Items

Beneficiaries of an estate may require a comprehensive estate inventory to understand the assets involved in estate settlement. This inventory typically includes physical assets such as real estate properties (e.g., residential homes, commercial properties valued at market prices), financial accounts (bank statements, investment accounts from institutions like Fidelity or Vanguard), personal belongings (high-value items such as jewelry, artwork, collectible antiques), and liabilities (mortgages, credit card debts outstanding). Additionally, legal documents (wills, trusts) should be provided to clarify the distribution plan, while tax-related items (previous tax returns, estate tax documents) must be considered for assessing potential tax obligations. Each document plays a vital role in ensuring transparency and safeguarding the rights of all parties involved in the estate settlement process.

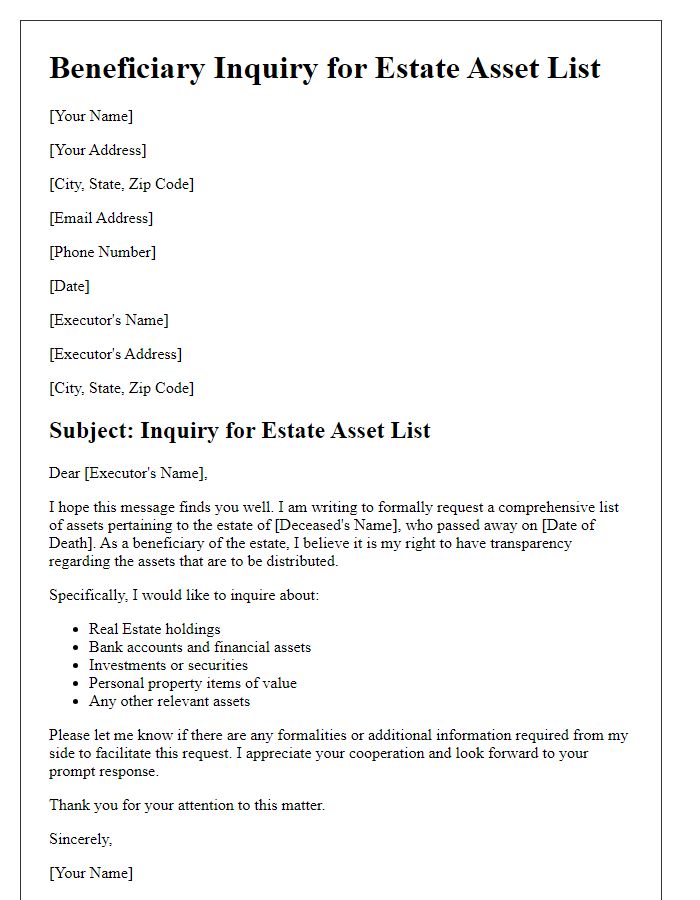

Stated Purpose for the Inventory Request

Beneficiary estate inventory requests serve a critical role in estate management after someone's passing. This process involves creating a detailed list of all assets and liabilities belonging to the deceased individual. Key components typically included in the inventory are real estate properties (such as residential homes, rental properties, or commercial buildings), financial accounts (like bank accounts or investment portfolios), personal belongings (including jewelry, vehicles, or artwork), and outstanding debts (like mortgages or loans). The purpose of this inventory request is to ensure transparency and facilitate a fair distribution of the estate among beneficiaries, following legal requirements stipulated by estate laws in the relevant jurisdiction. Accurate documentation of the estate's value helps in tax assessments and can aid in resolving potential disputes among heirs.

Contact Information for Follow-Up and Queries

A thorough estate inventory request must include accurate contact information for beneficiaries. This ensures efficient follow-up and resolution of any queries regarding the estate. Key details to collect include the full name of the beneficiary, specific relationship to the deceased, and current residential address. Additionally, an active phone number is essential for direct communication. Email addresses can facilitate quick correspondence, especially for sharing documents. Confirming the best times for contact can further enhance responsiveness. All collected information should be stored securely, considering privacy and confidentiality to protect the interests of the beneficiaries during the estate settlement process.

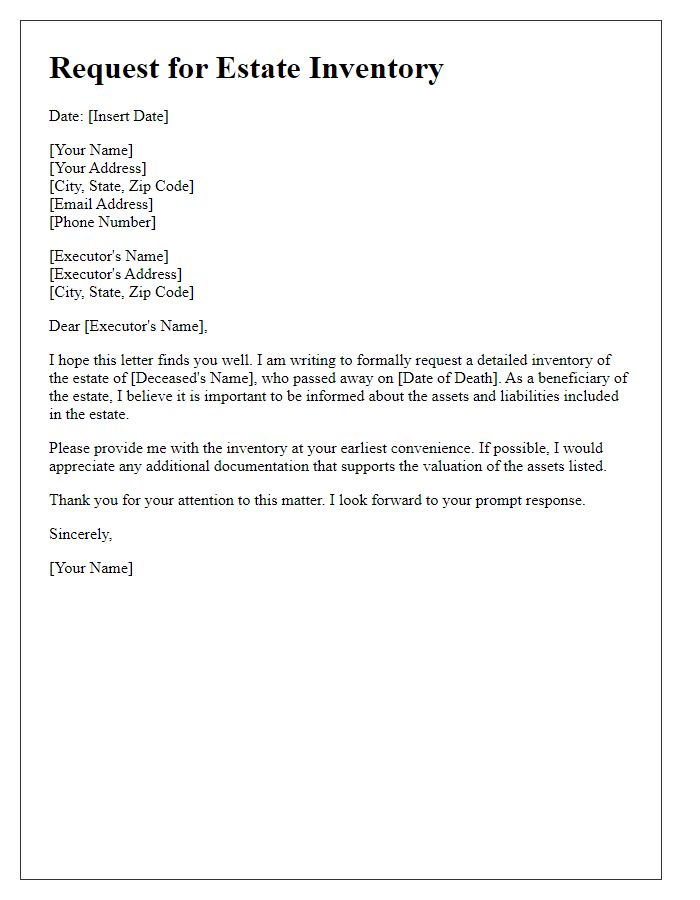

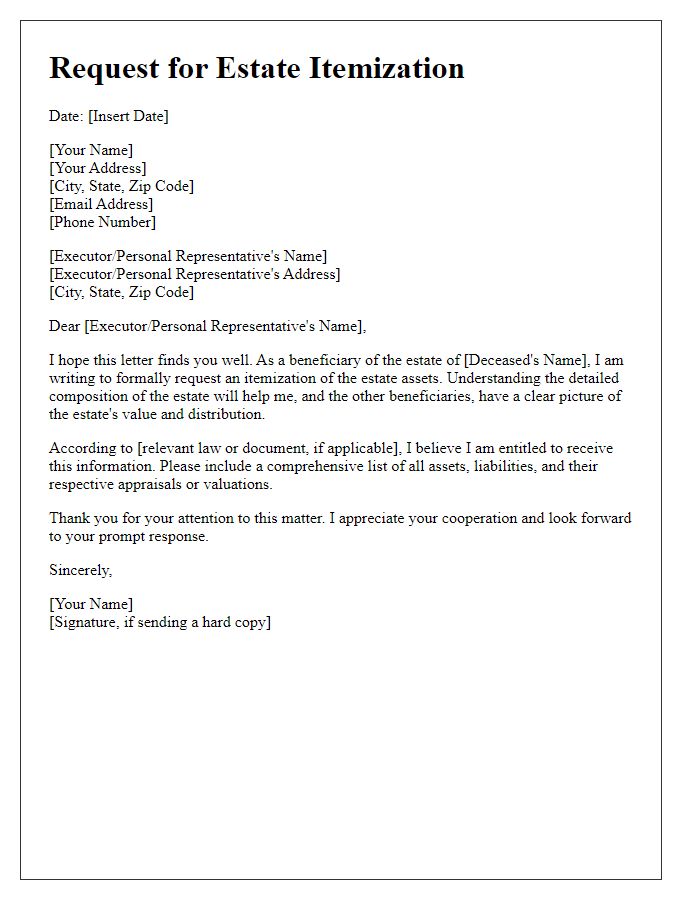

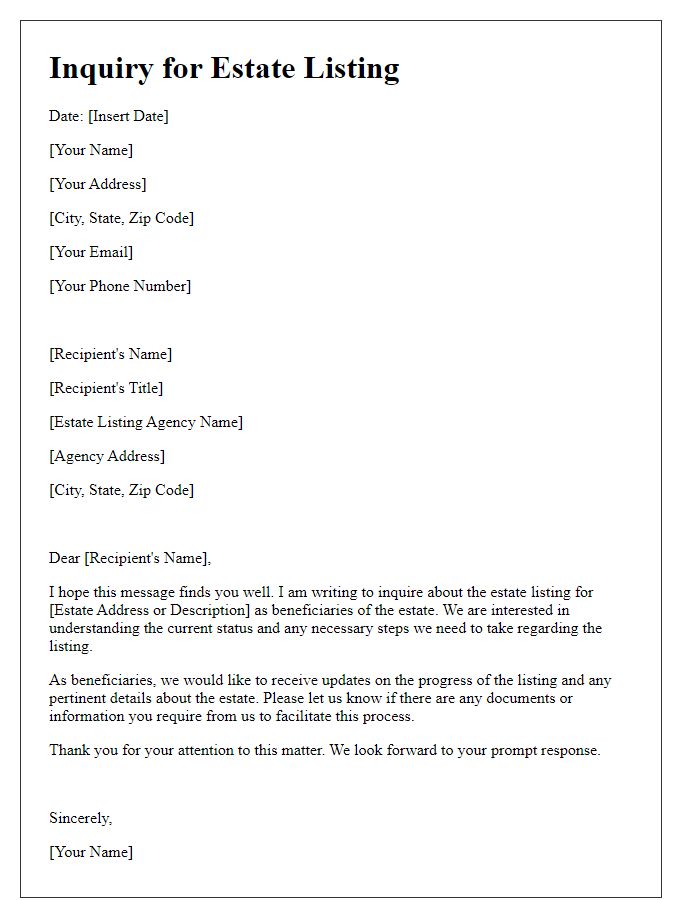

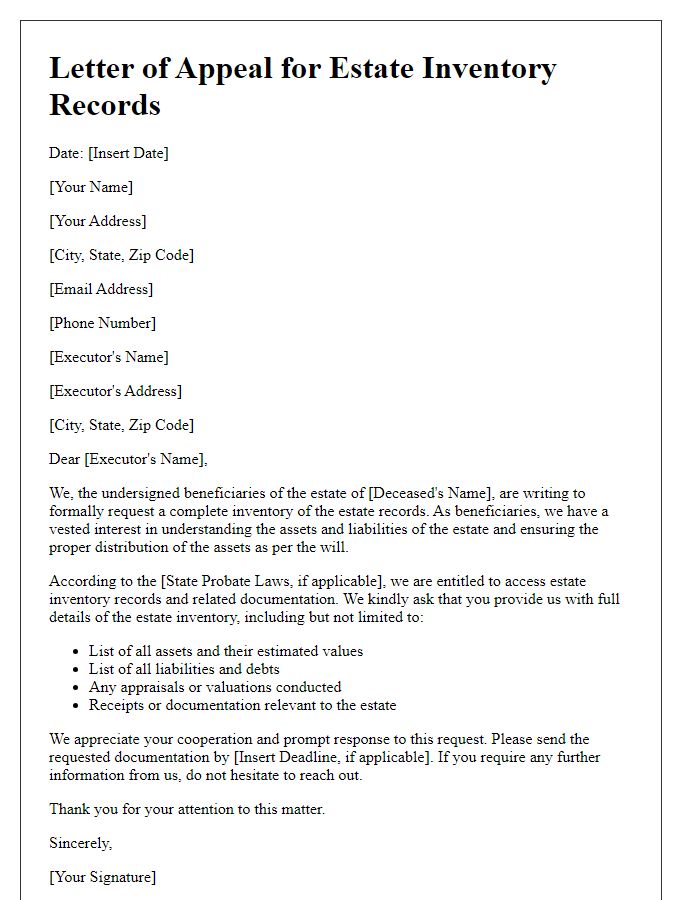

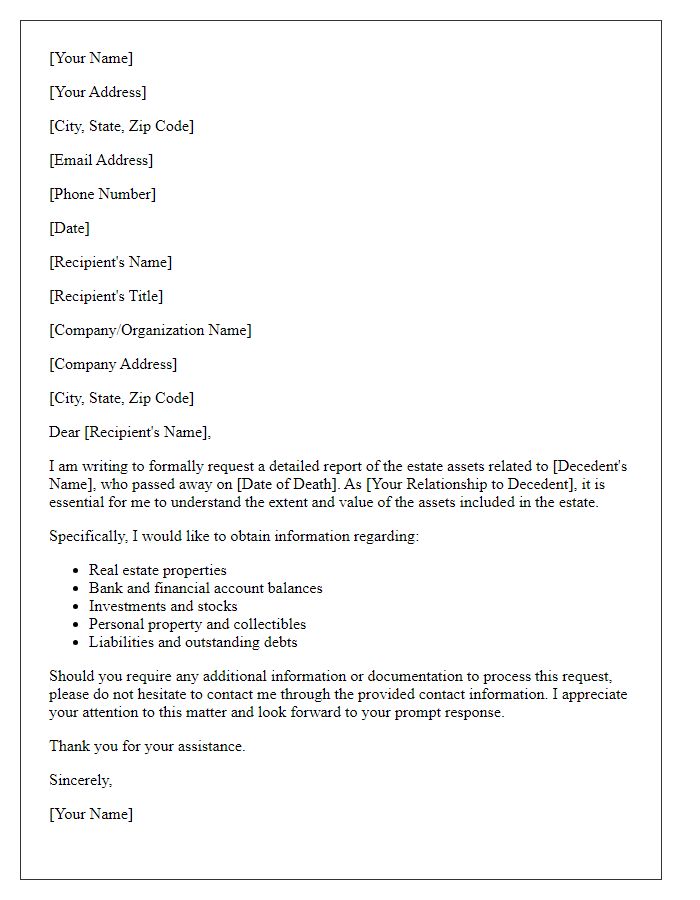

Letter Template For Beneficiary Estate Inventory Request Samples

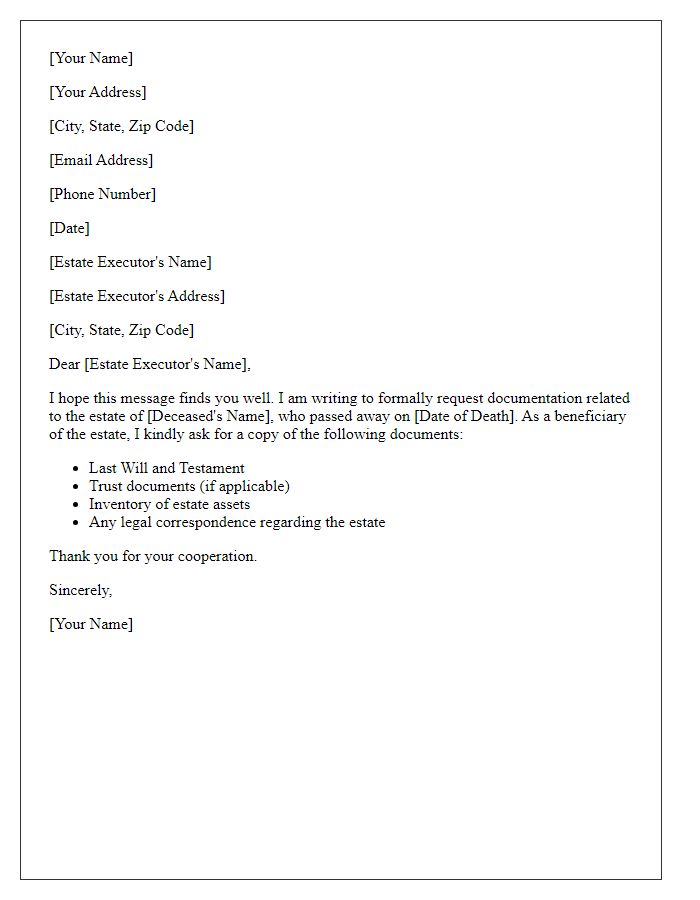

Letter template of formal request for estate documentation from beneficiaries

Comments