Are you navigating the often complex world of pension payment adjustments? You're not alone! Many beneficiaries find themselves in need of clarification and support when it comes to these important financial matters. In this article, we'll break down the essential steps you need to take for a smooth adjustment processâso stick around and read more!

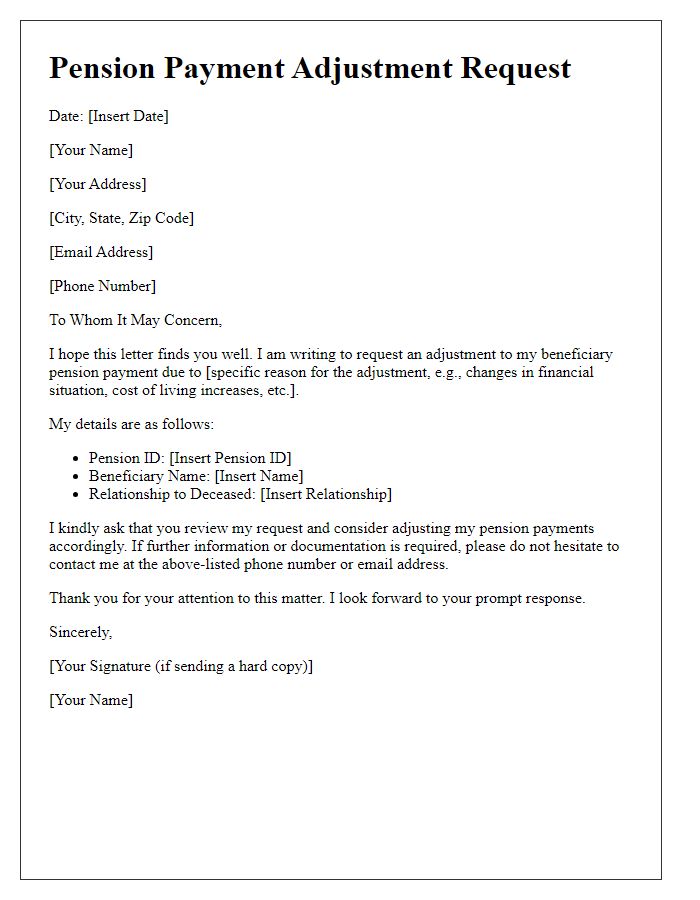

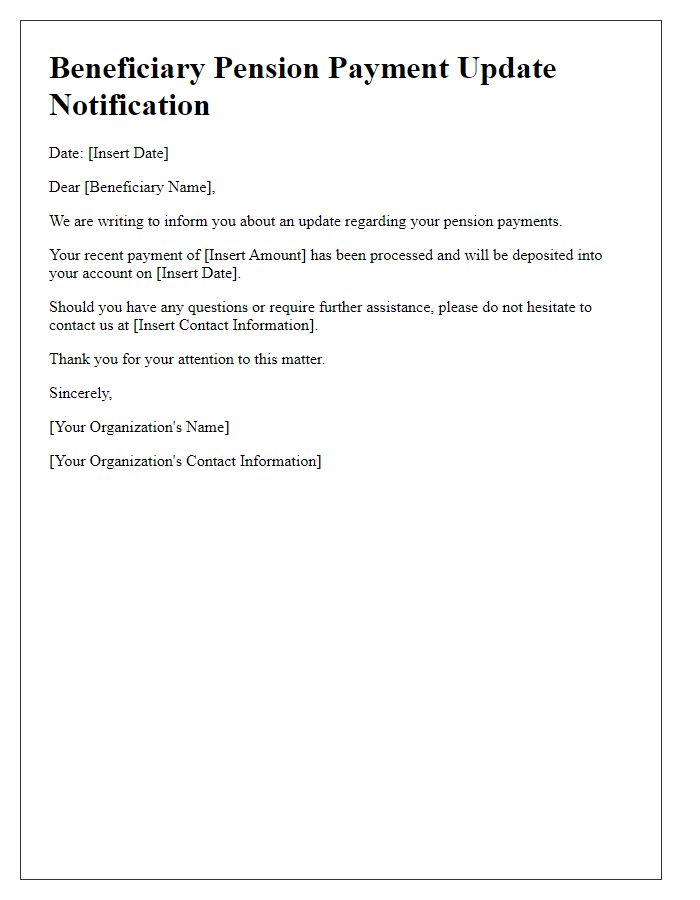

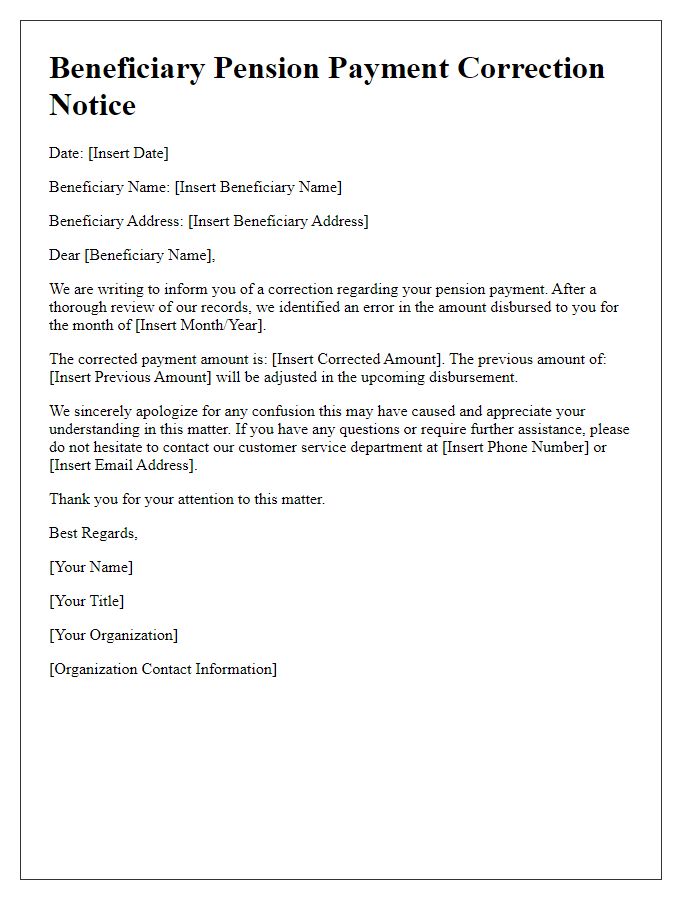

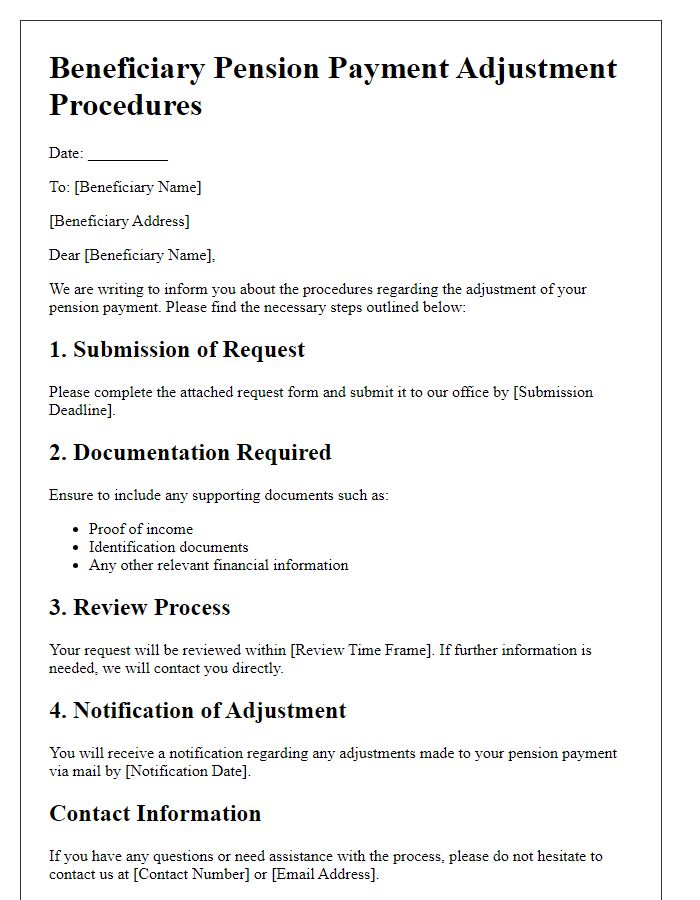

Header: Sender's contact information and logo

The pension payment adjustment process for beneficiaries often requires precise communication detailing the necessary modifications. Beneficiaries, individuals designated to receive retirement funds typically established under legal frameworks (e.g., Social Security in the United States), may experience changes in situational income or eligibility criteria. Adjustments may involve recalculating monthly disbursements based on factors such as lifespan changes, income fluctuations, or economic conditions impacting the fund's status (like the Consumer Price Index). Clear and concise notification regarding these adjustments is crucial for financial stability, ensuring that beneficiaries understand their payment timelines and any required documentation (such as Tax Forms or Identification Verification) needed for seamless processing.

Recipient's contact information

Beneficiary pension payment adjustments can significantly impact financial stability. Recipients, often seniors or individuals with disabilities, may rely on regular deposits from pension funds like Social Security or private retirement accounts. Accurate contact information, including current address and telephone number, is crucial for timely notifications about changes in pension amounts. Errors in contact details can lead to delays in adjustment notices, creating confusion and potential financial hardship. Financial institutions must prioritize maintaining updated records to ensure beneficiaries receive essential information without interruption.

Subject line: Clear and concise

The adjustment of beneficiary pension payments can significantly impact the financial stability of individuals relying on these funds. Accurate calculations are crucial, as mistakes may lead to overpayments, risking repayment demands from organizations like Social Security Administration (SSA) or private pension funds. Regular reviews of income sources and changes in life circumstances, such as employment or marital status, must be documented thoroughly to ensure compliance with regulations effective from January 2024. Inaccuracies can cause delays in payment processing, affecting the timely receipt of funds that support living expenses. Communication with the financial institution managing the pension, including necessary forms about the adjustment requests, is essential to maintain transparency and consistency in payments.

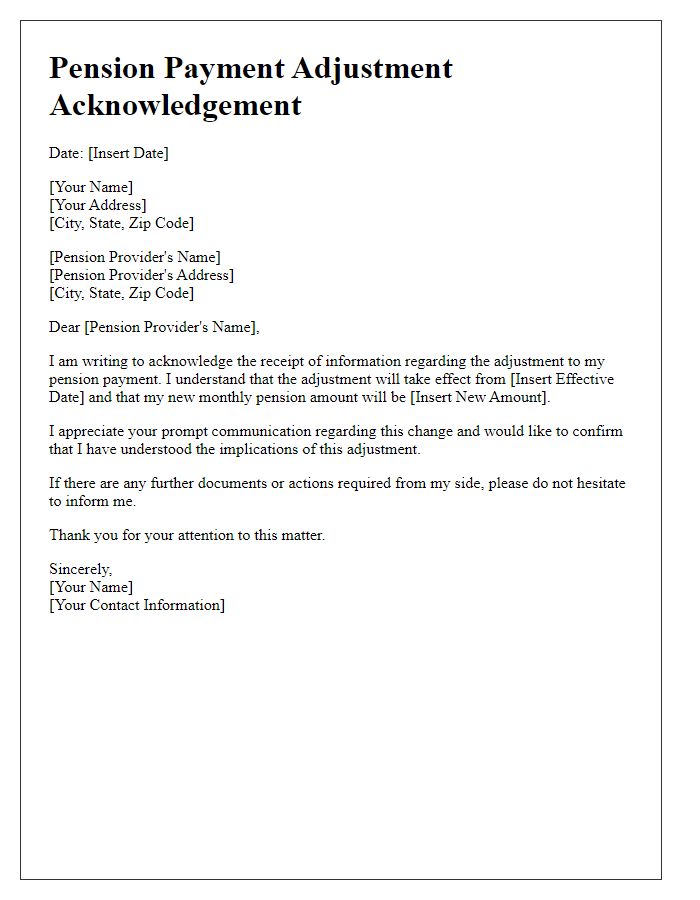

Opening salutation

In the context of notifying an individual about a pension payment adjustment, the opening salutation should be respectful and professional. A common format includes addressing the recipient by their title and last name, followed by a polite greeting. For example: "Dear Mr. Smith," This establishes a formal tone and shows consideration for the recipient's position.

Body: Explanation of adjustment and new payment details

Adjustment of beneficiary pension payments reflects changes in financial circumstances affecting eligibility. As of October 2023, adjustments have been made to account for cost-of-living increases affecting monthly disbursements. The new payment amount, set at $1,200 per month, represents a 5% increase based on the Consumer Price Index (CPI) adjustments reported by the Bureau of Labor Statistics. Effective November 1, 2023, revised payments will ensure continued support for beneficiaries in meeting essential needs. Detailed breakdowns of adjustments will be provided in the upcoming statements for clarity.

Closing statement and contact information for inquiries

Beneficiary pension payment adjustments can be complex, requiring clarity in communication. Important information should include the recipient's name, pension identification number, and specific adjustment details such as effective dates and payment amounts. It is critical to highlight upcoming changes in pension policies or tax regulations that may influence the beneficiary's payments. For further inquiries, reliable contact options should be provided, including a dedicated phone number or email address for customer service representatives, ensuring prompt assistance with any concerns related to the pension adjustments.

Closing salutation

In the context of pension payment adjustments, a closing salutation might include a formal expression of gratitude for the recipient's attention to the matter, accompanied by a wish for their well-being. For instance: "Sincerely appreciate your prompt attention to this adjustment; wishing you continued success and well-being.

Signature block (digital or handwritten)

Pension payment adjustments can significantly impact beneficiaries' financial stability. Detailed documentation usually accompanies these adjustments, including the beneficiary's name, identification number, and specific changes to payment amounts. Accurate record-keeping is vital for compliance with regulations by the Social Security Administration or relevant pension plans. Updates may arise due to factors such as cost-of-living adjustments (COLAs) or changes in eligibility status. Proper communication of alterations through official channels ensures clarity for recipients regarding their entitlements and responsibilities. Signature verification, whether digital or handwritten, serves to authenticate the document, safeguarding against any potential discrepancies.

Attachments or enclosures list

When initiating a pension payment adjustment for beneficiaries, it is essential to include relevant documentation to support the request. Attach relevant attachments such as the pension payment adjustment request form, a copy of the beneficiary's identification (like a driver's license or passport), recent tax documents (such as W-2 forms or 1099 statements), proof of address (such as a utility bill), and any legal documents (including wills or trust documents) that may pertain to the adjustment. Clear labeling of each document ensures efficient processing and reduces potential delays in the adjustment procedure. Make sure each attachment is updated and reflects the current financial status of the beneficiary for accurate evaluation.

Compliance and legal notices

Pension payment adjustments for beneficiaries can have significant implications. Compliance with regulatory standards, such as those outlined in the Employee Retirement Income Security Act (ERISA), is crucial for ensuring that payments meet legal criteria. Beneficiaries need clear communication regarding these adjustments, including specific factors influencing changes like cost-of-living adjustments (COLAs) or alterations in eligibility due to income thresholds. Legal notices must detail the reasons for adjustments, the calculations involved, and the timeline for any changes. Additionally, it's essential to provide contact information for inquiries, ensuring beneficiaries understand their rights under applicable pension laws and have access to necessary resources for further assistance.

Comments