Are you looking to confirm a beneficiary decision in a professional yet friendly manner? Crafting the perfect letter can make all the difference in ensuring that your message resonates. It's essential to convey your information clearly while maintaining a conversational tone that puts the reader at ease. Join us as we delve deeper into creating an effective beneficiary decision confirmation letter that strikes just the right balanceâread on to discover helpful tips and templates!

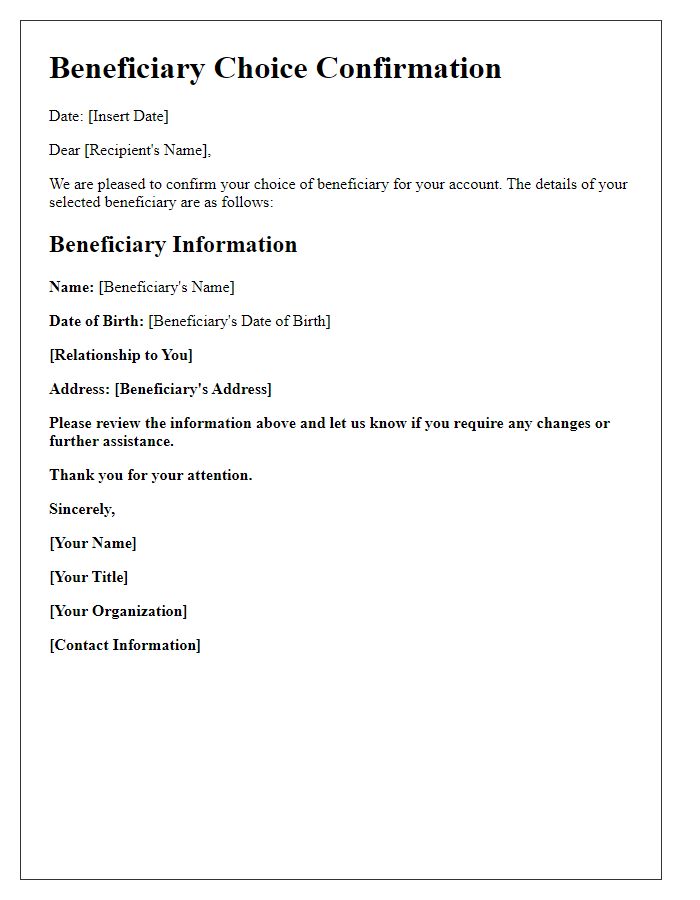

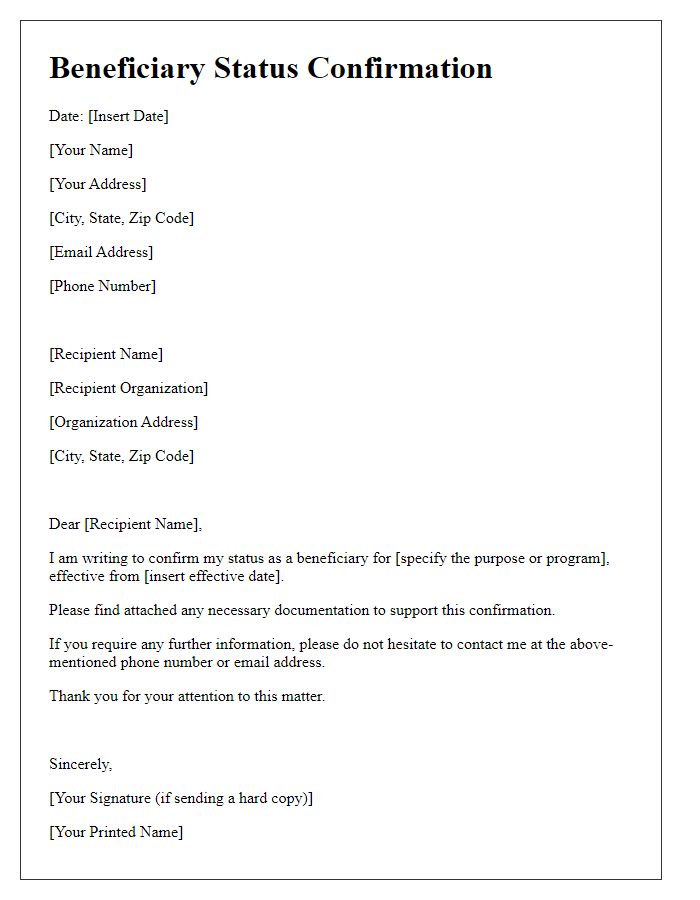

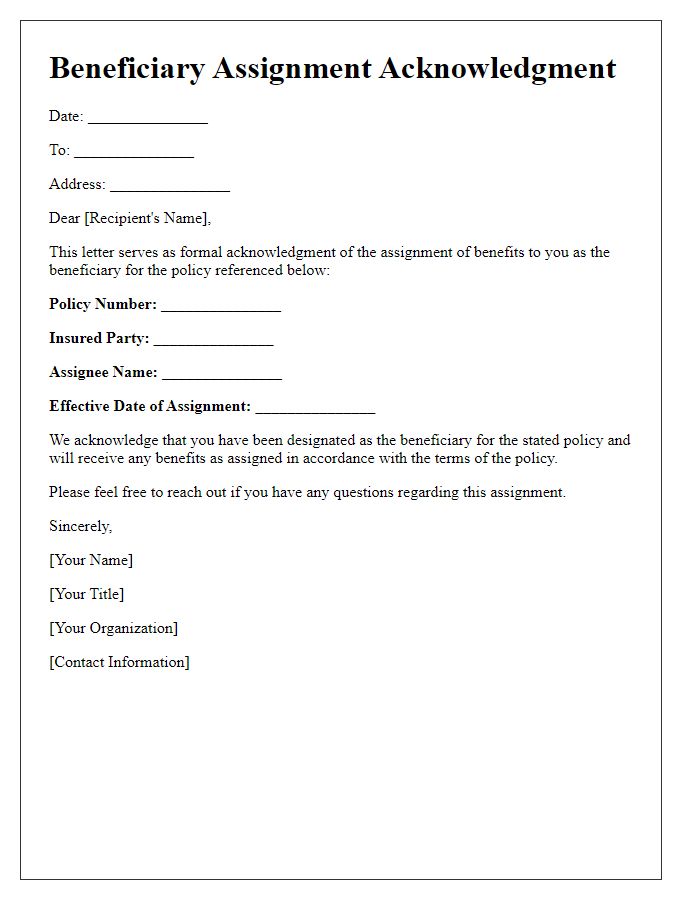

Clear Identification of Beneficiary

The identification of beneficiaries is crucial in various contexts, such as insurance claims, trust distributions, or financial aid programs. Accurate record-keeping includes full names, dates of birth, and personal identification numbers. Incorrect identification can lead to delays or fund misallocation. Beneficiaries must provide supporting documents such as birth certificates or government-issued IDs to streamline the verification process. Furthermore, institutions need to maintain updated records to ensure accurate disbursement of benefits. Establishing a strong relationship between beneficiaries and organizations fosters transparency and trust, thus facilitating smooth transactions.

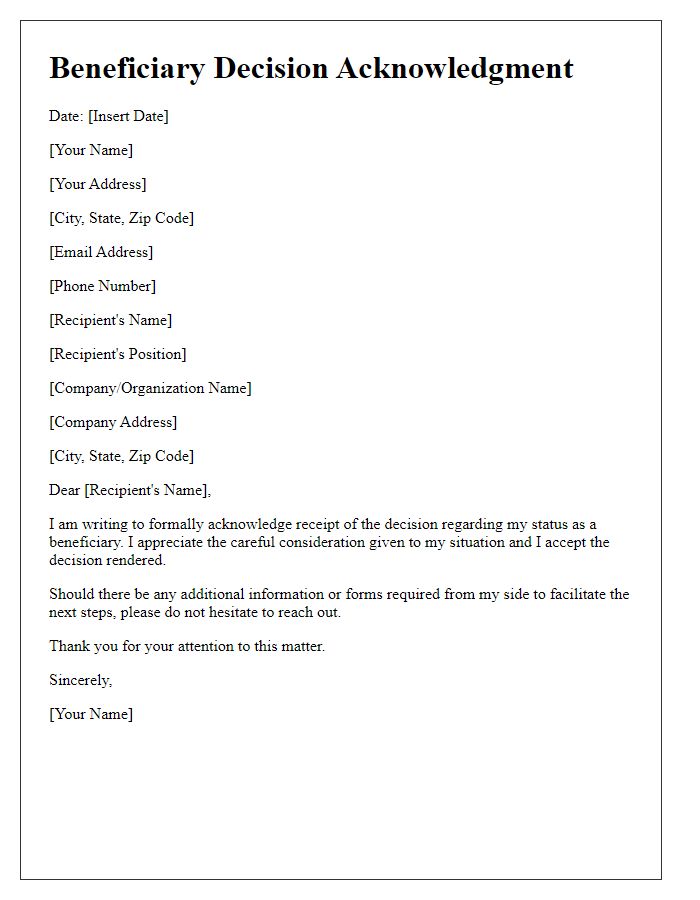

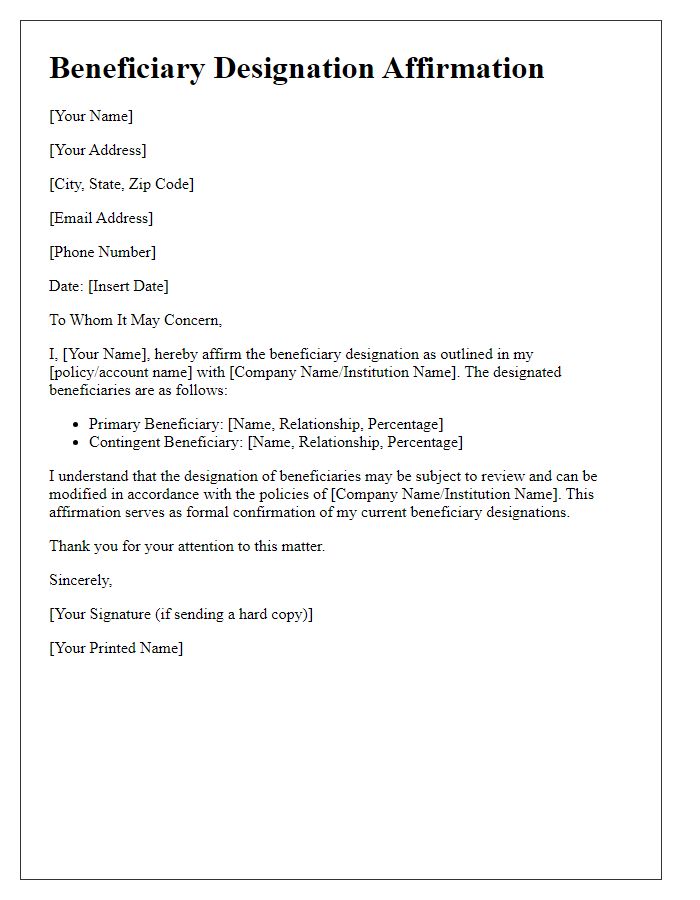

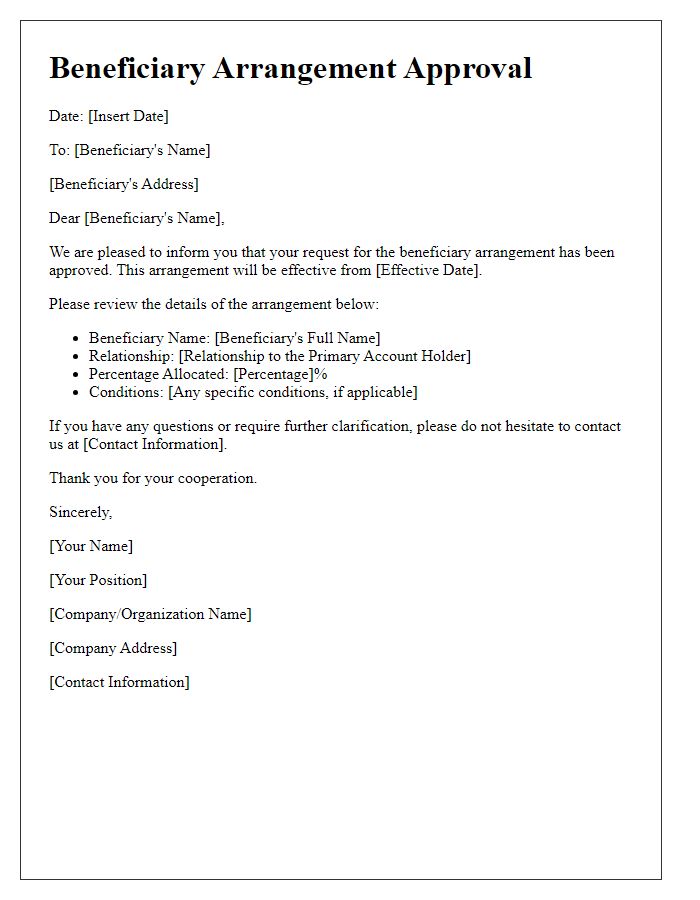

Explicit Confirmation Statement

The explicit confirmation statement regarding the beneficiary's decision serves as a formal acknowledgment of their selection in the context of financial services such as insurance or trust management. This document highlights the beneficiary's full name, along with their identification details, ensuring clarity and legal validity. The statement outlines the specific benefits or entitlements being conferred, including monetary values or percentage distributions, as per the terms established on the policy or agreement. It also stipulates the effective date of this decision, which is crucial for compliance with legal timelines, ensuring that the beneficiary's rights are protected. Such statements often require notarization or signatures from witnesses to enhance their legitimacy.

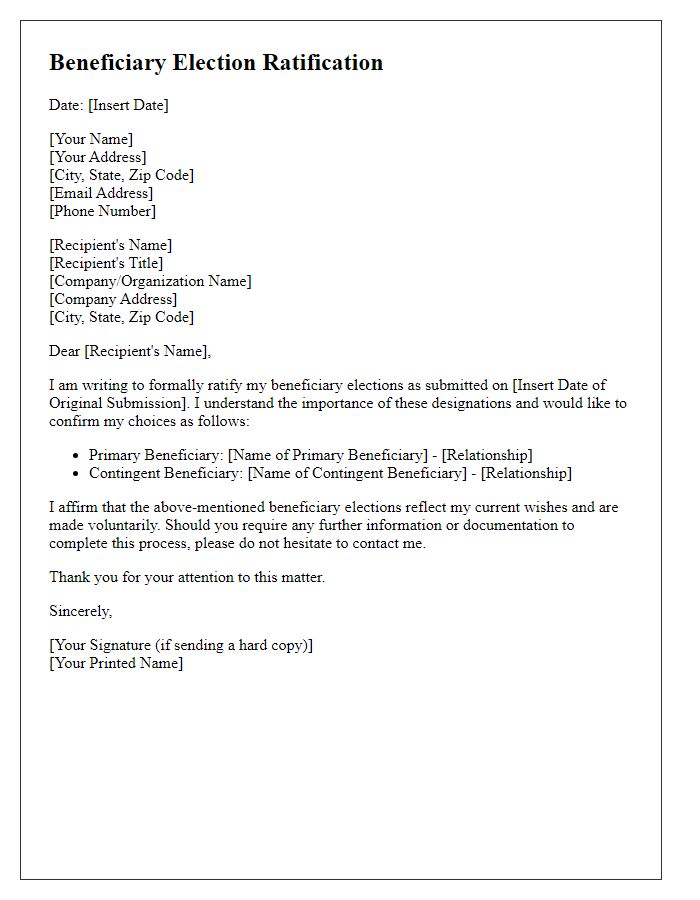

Detailed Benefits Description

The confirmation of beneficiary decisions often involves complex benefits structures, such as pensions, health insurance, or life insurance policies. Each benefit type can vary significantly based on factors like age, employment duration, or specific coverage options. For instance, pension benefits might offer fixed monthly payments upon retirement, based on the employee's salary and years of service, potentially including cost-of-living adjustments. Health insurance programs usually cover medical expenses, with specific terms regarding premiums, deductibles, and out-of-pocket maximums. Life insurance typically provides a lump sum payment to designated beneficiaries, contingent on policyholder eligibility criteria, premiums paid, and the cause of death. Each benefit description must highlight the respective eligibility criteria, payout structures, and any limitations to ensure beneficiaries fully understand their entitlements.

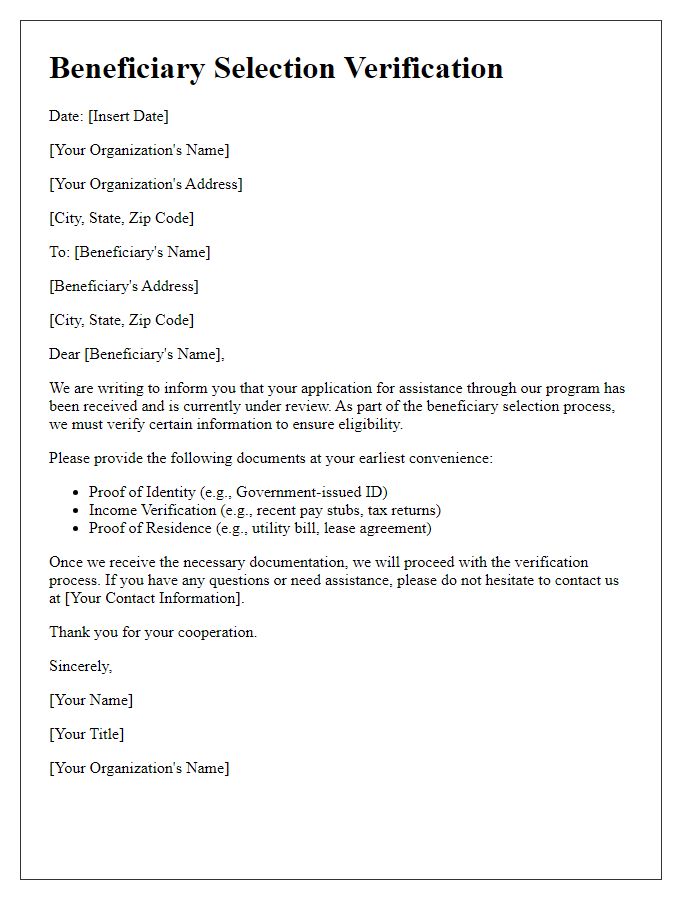

Contact Information for Inquiries

Beneficiaries of the funded program are encouraged to verify their decisions regarding eligibility and support options. Contact details are essential for resolving inquiries effectively. Reach out to the designated support team via the official email address at beneficiariesupport@program.org, available from 9 AM to 5 PM EST, Monday through Friday. Additionally, beneficiaries can call the dedicated hotline at 1-800-555-0199 for immediate assistance. Ensure to have your identification number (assigned upon registration) ready when contacting for a quicker response. All communication will be handled with confidentiality to protect personal information.

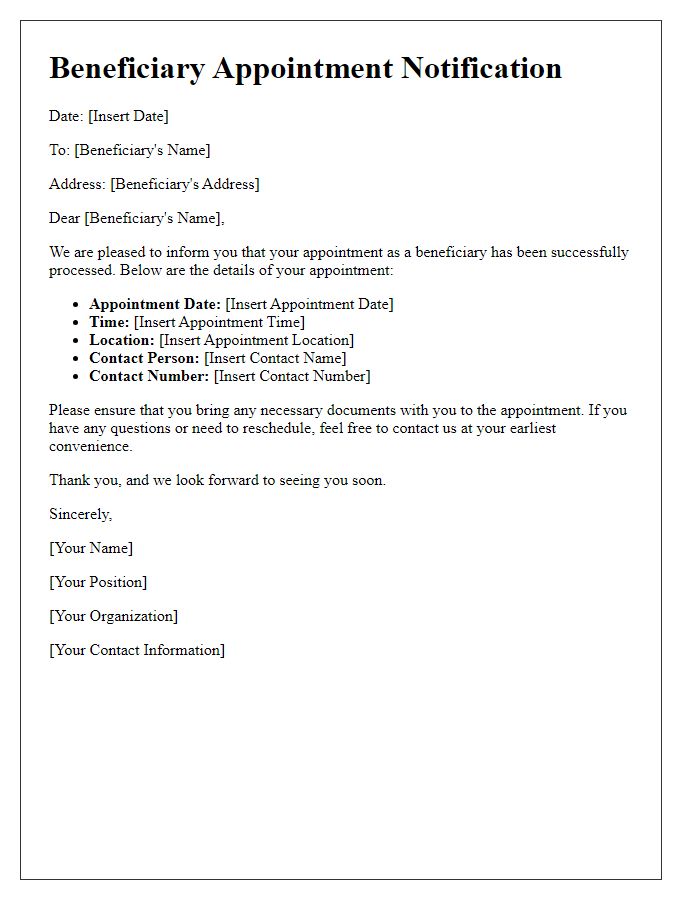

Instructions for Next Steps

Beneficiary decision confirmations require clarity for subsequent actions. After reviewing the assessment, beneficiaries should understand their eligibility status along with benefits provided under the program. This includes monetary assistance amounts, healthcare services access, and educational support details. Next, stakeholders must complete necessary documentation by specific deadlines, ensuring compliance with all legal regulations. Important contact information for local case managers should be included to facilitate questions or clarifications. Educational workshops or informational sessions may be scheduled to guide beneficiaries through the next steps, fostering a supportive environment for their transitions.

Comments