Are you looking to streamline your funds transfer process while ensuring security and compliance? Writing a clear and precise endorsement letter can make all the difference in protecting your transactions. This template will guide you through the essential elements to include, making it easy to convey your intentions and secure your funds effectively. Read on to discover our expert tips and get started on crafting your letter today!

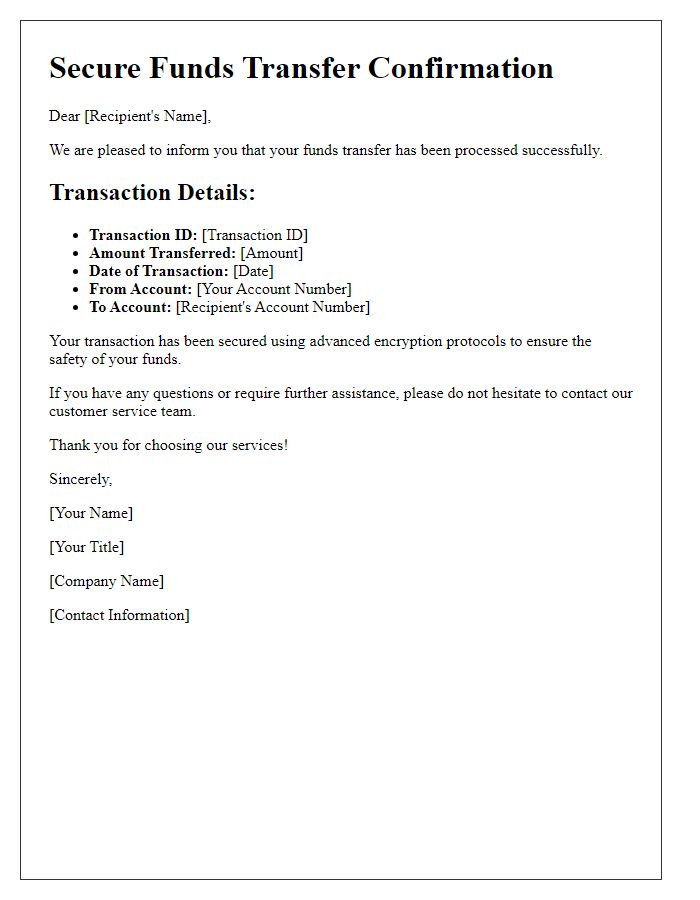

Clear identification of parties involved.

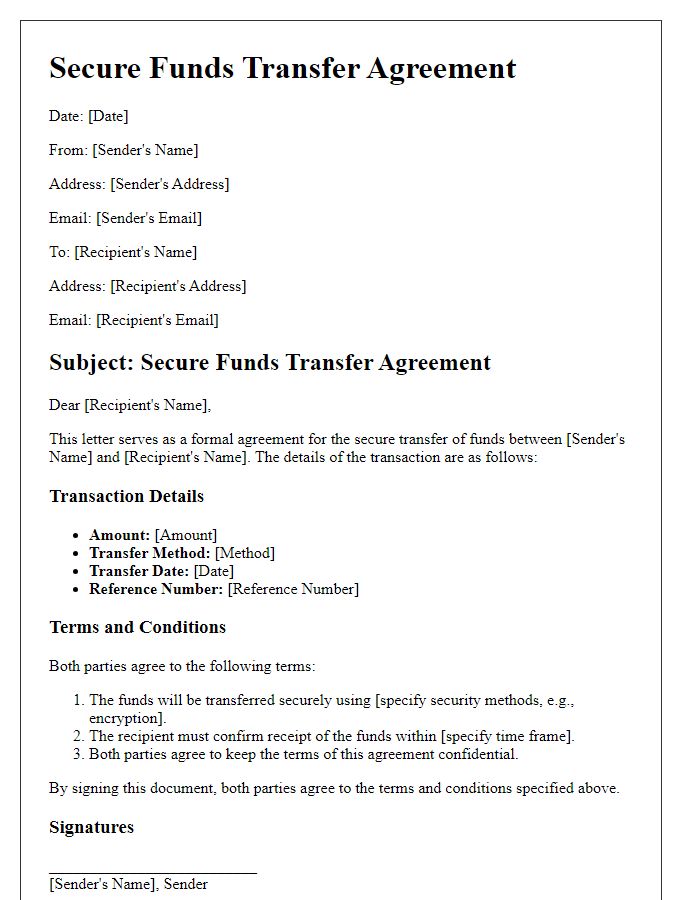

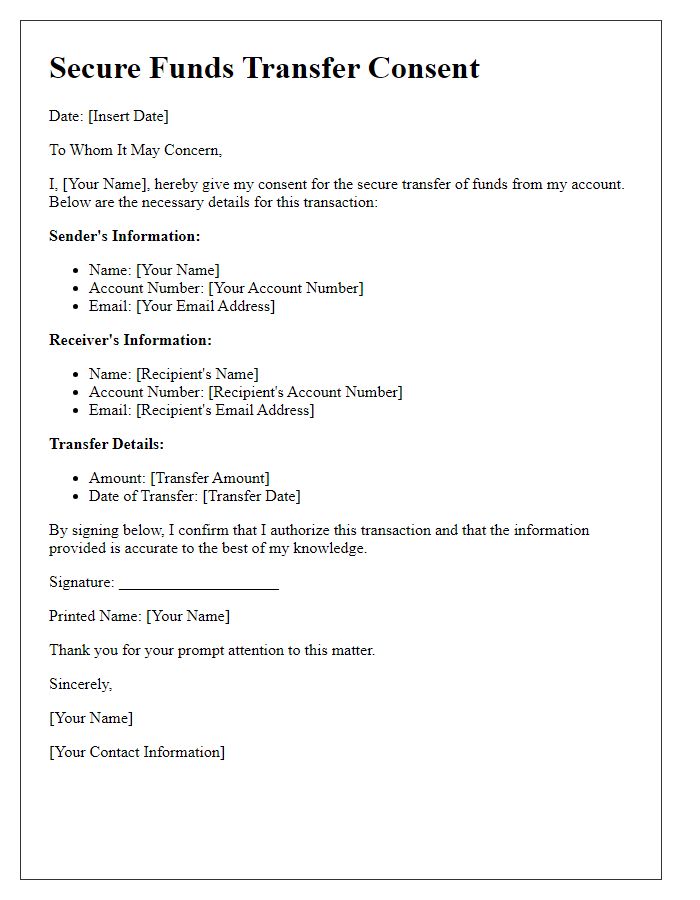

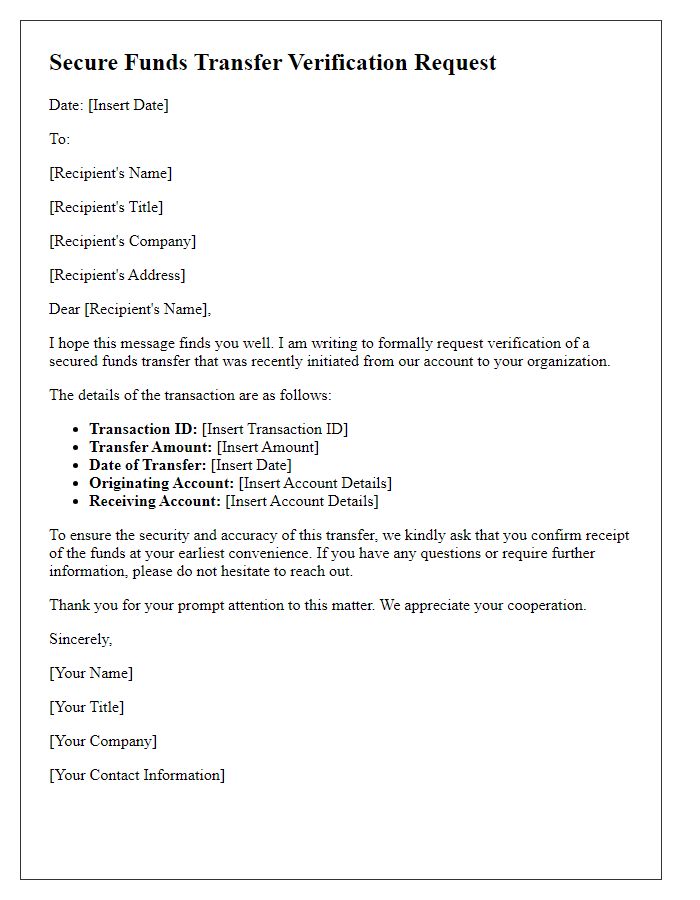

A secure funds transfer endorsement requires clear identification of all parties involved in the transaction. The sender (individual or organization making the transfer, often providing a full name and account details) must be distinctly identified, alongside the recipient (individual or organization receiving the funds, with relevant identification and bank account information). Diagrammatic representation of transaction flow, such as arrows indicating direction of funds from sender to recipient, can enhance clarity. Moreover, including unique identifiers such as transaction reference numbers or codes will aid verification. Details of the financial institution, including name and branch, should also be documented to validate the transfer process. Security measures, such as encryption methods used during the transfer, and dates of the transaction, further establish the authenticity and integrity of the funds transfer endorsement.

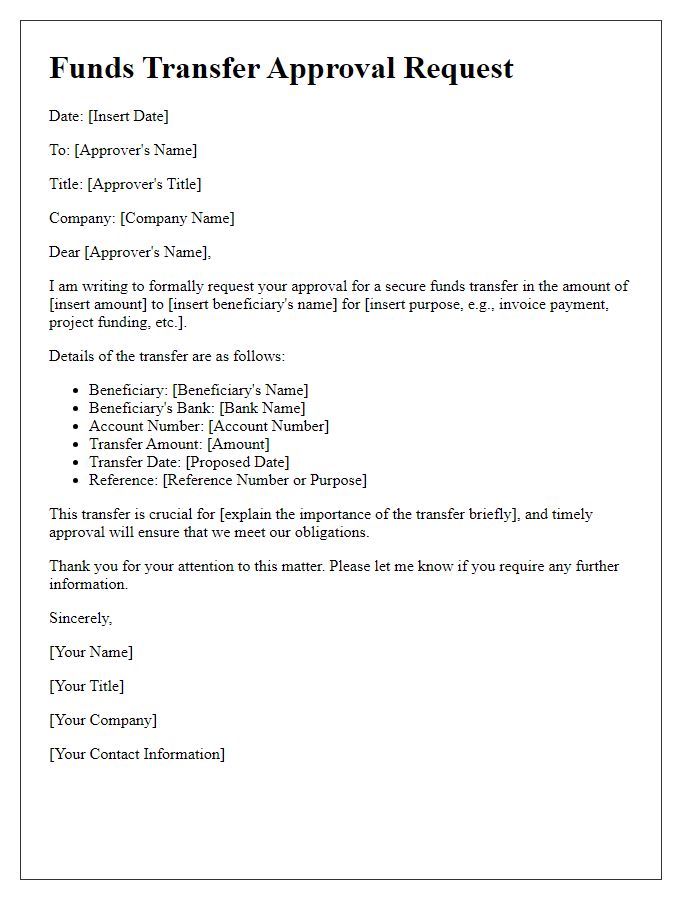

Detailed transaction description.

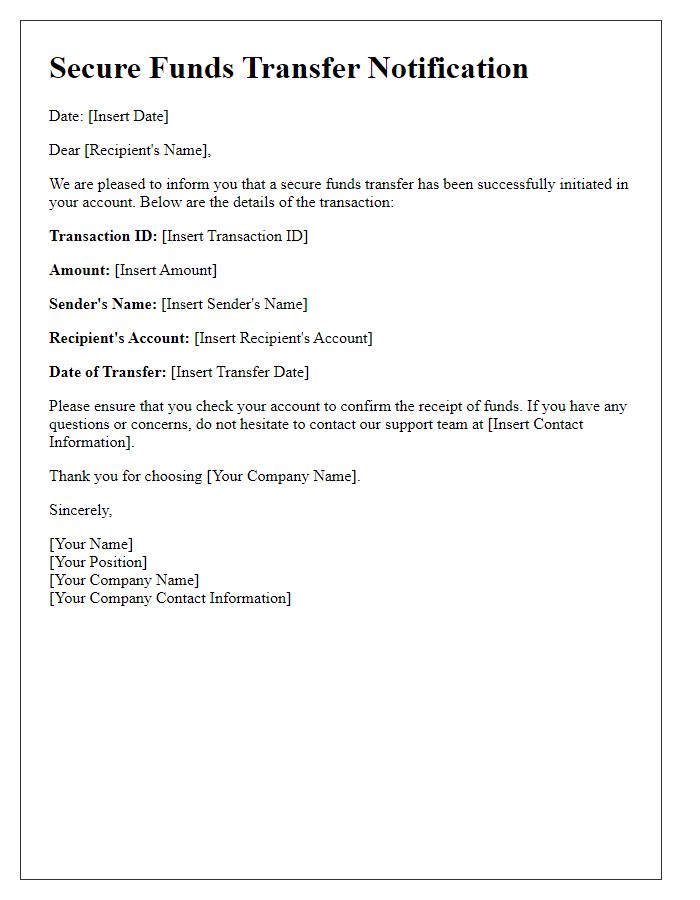

In the process of securely transferring funds, a detailed transaction description is crucial for transparency and traceability. The transaction involves an electronic fund transfer (EFT) executed on January 15, 2023, amounting to $10,000 from Bank A, located in New York, to Bank B, situated in San Francisco. The transaction reference number, 123456789, ensures easy tracking. The purpose of this transfer is to settle invoice #98765 from Company X, a technology firm in Los Angeles, for consulting services rendered over a two-month period. Both banks utilize the SWIFT network (Society for Worldwide Interbank Financial Telecommunication) to ensure secure communications. Funds are to be credited to Company X's account number 54321-67890 within two business days, adhering to the protocols set forth for cross-state transfers.

Specific amount and currency.

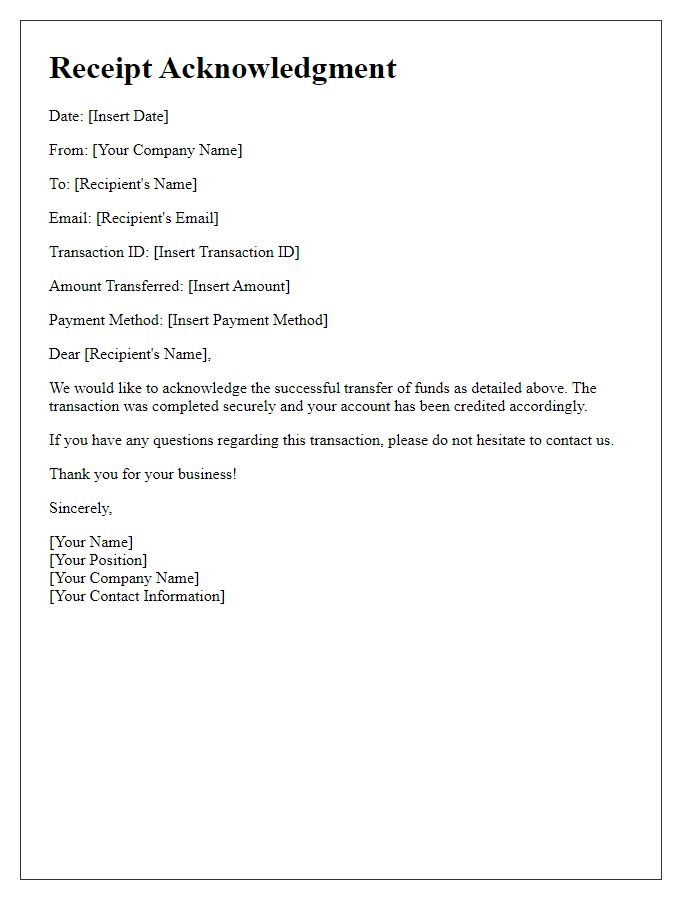

A secure funds transfer endorsement often requires clear communication of critical details to ensure a smooth transaction process. The specific amount, such as $5,000 US Dollars, must be indicated to eliminate ambiguity and confirm the intended transfer. The currency type also plays a crucial role, as it can greatly affect conversion rates and transaction fees, particularly for foreign exchanges. Additionally, essential information such as the bank name (e.g., Chase Bank), account number, or IBAN and SWIFT code (for international wire transfers), ensures precise routing of funds to intended beneficiaries. Proper documentation protects both parties and instills confidence in the transfer's security, crucial in financial transactions.

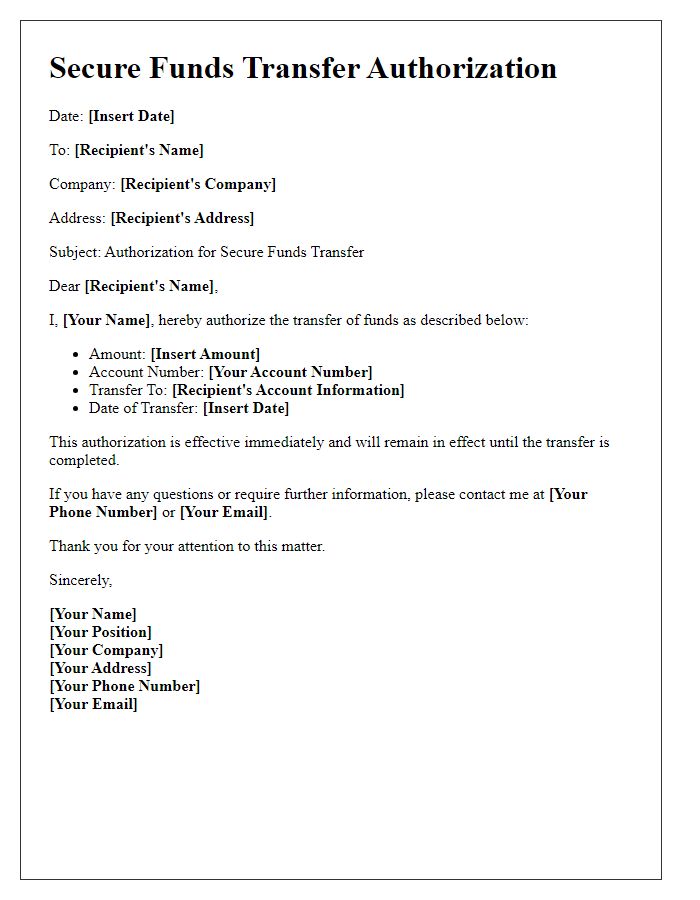

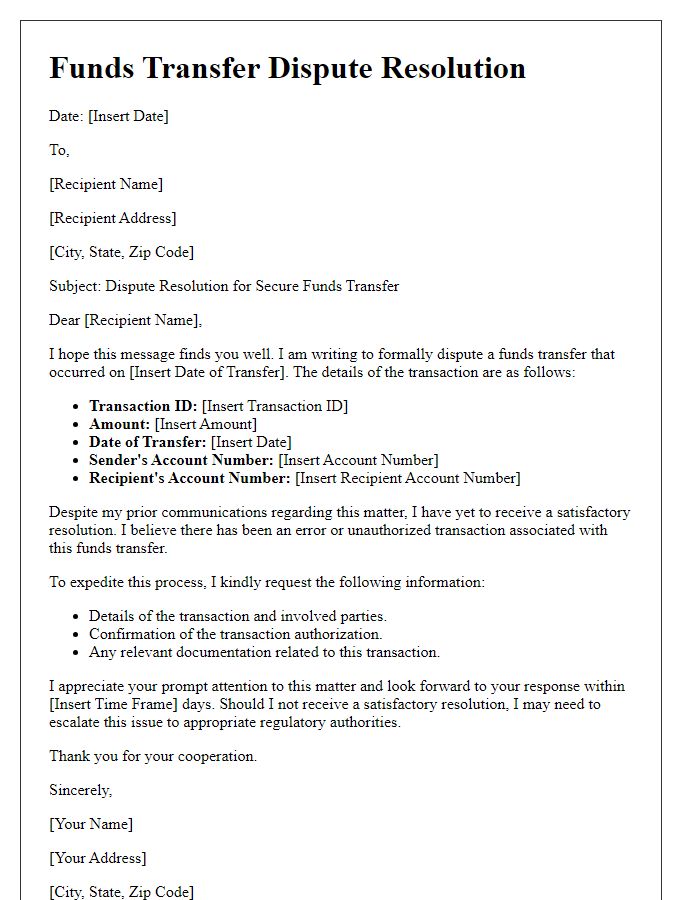

Authorization and consent statement.

Secure funds transfer endorsement requires comprehensive authorization and consent to ensure compliance and protection for all parties involved. The endorsement statement typically includes sender and receiver details, transaction amounts, and specific conditions. Sender verification should involve unique identifiers, such as government-issued ID numbers or bank account details, ensuring authenticity. Consent is pivotal, encompassing acknowledgment of terms related to transaction fees and potential delays, particularly for cross-border transfers involving regulatory protocols. Secure methods, such as encrypted online forms or verified digital signatures, facilitate this process, establishing trust and safeguarding sensitive information throughout the funds transfer operation.

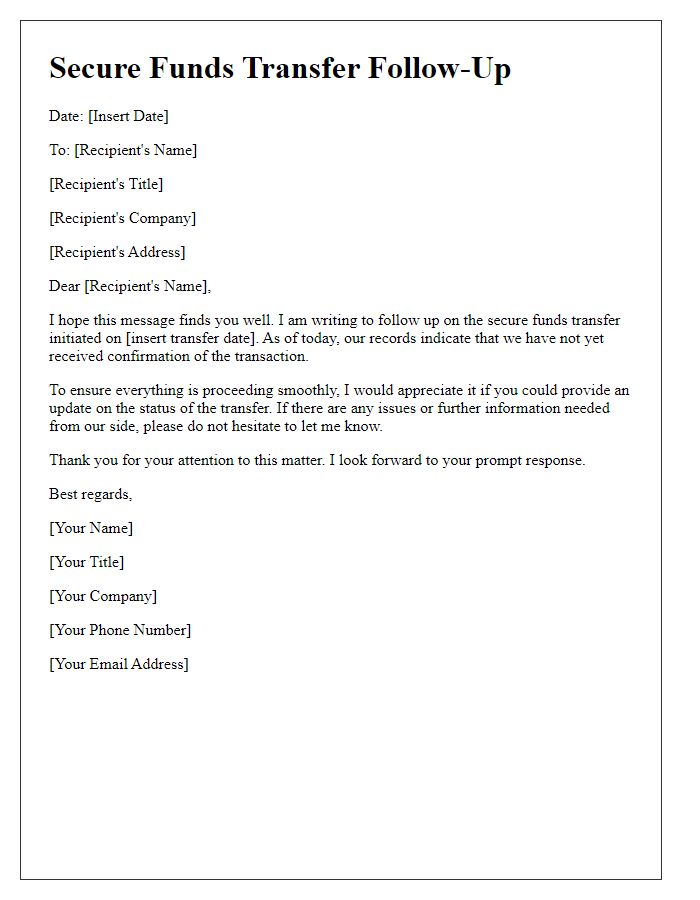

Contact information for queries.

For secure funds transfer endorsements, maintain accurate records of contact information. Include pertinent entities such as financial institutions, transaction coordinators, and compliance officers for queries. Utilize official channels such as customer service lines, email addresses, and secure messaging platforms. Note the hours of operation to ensure timely responses. Precise details, including names, titles, and direct phone numbers, enhance communication efficacy and expedite resolution of inquiries related to fund transfers. Additionally, maintain up-to-date security protocols to safeguard personal information during the transaction process.

Comments