Are you concerned about potential fraudulent activity affecting your finances or personal information? You're not alone, as many individuals find themselves in similar situations and often feel overwhelmed. In this article, we'll guide you through the essential steps to investigate fraudulent claims and protect yourself effectively. So, grab a cup of coffee, get comfortable, and let's dive into the details to empower you against fraud!

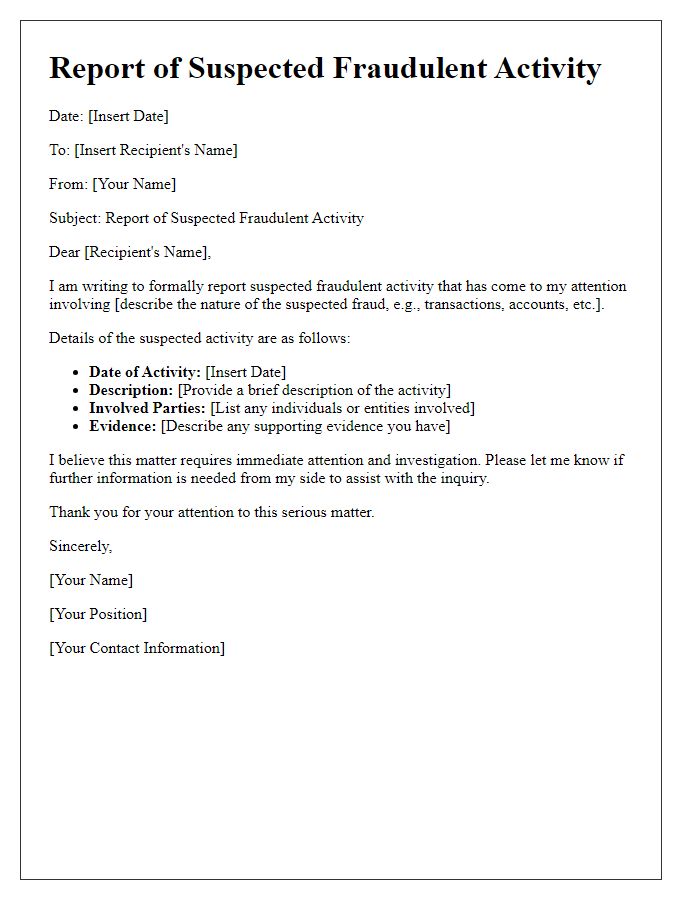

Subject line clarity

Subject lines in fraudulent activity investigations should be clear and concise to convey urgency and the nature of the issue. For instance, "Urgent: Investigation of Fraudulent Transactions on Account #123456" emphasizes the criticality and specifies the account involved. A subject line like "Notification of Suspicious Activity Detected on Your Credit Card" flags the matter to the recipient promptly. Including the term "Fraud Alert" can also indicate the matter's seriousness, while specific identifiers like transaction dates or locations can provide context. Such clarity helps ensure quick recognition and response from stakeholders involved in the investigation.

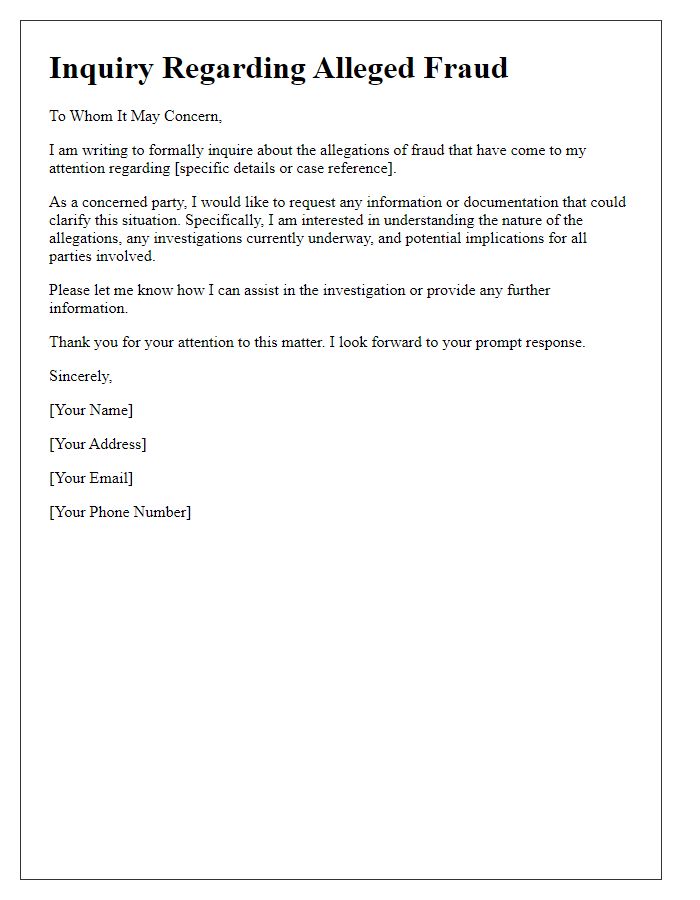

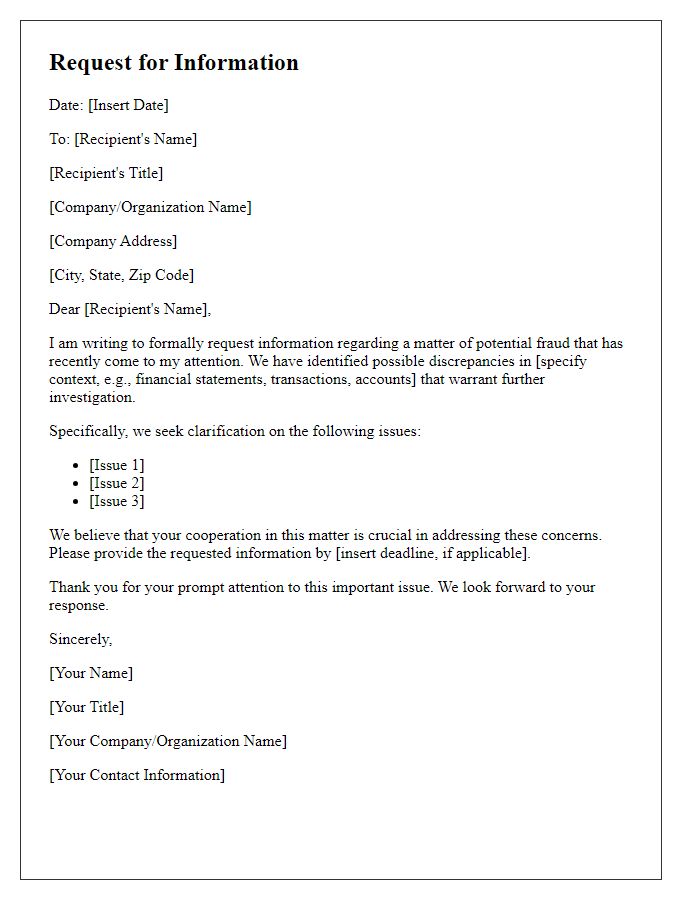

Recipient information

Recipient information in a fraudulent activity investigation often includes personal identifying details crucial for verification. This may comprise full name, typically formatted as "John Doe", mailing address (including street, city, state, and zip code, such as "123 Elm Street, Springfield, IL 62701"), phone number (e.g., "(555) 123-4567"), and email address (like "johndoe@example.com"). Additionally, account numbers related to the alleged fraudulent activity, such as bank account or credit card numbers, are essential for tracking the case efficiently. Ensuring accuracy in this data helps facilitate the investigation process conducted by financial institutions or law enforcement agencies.

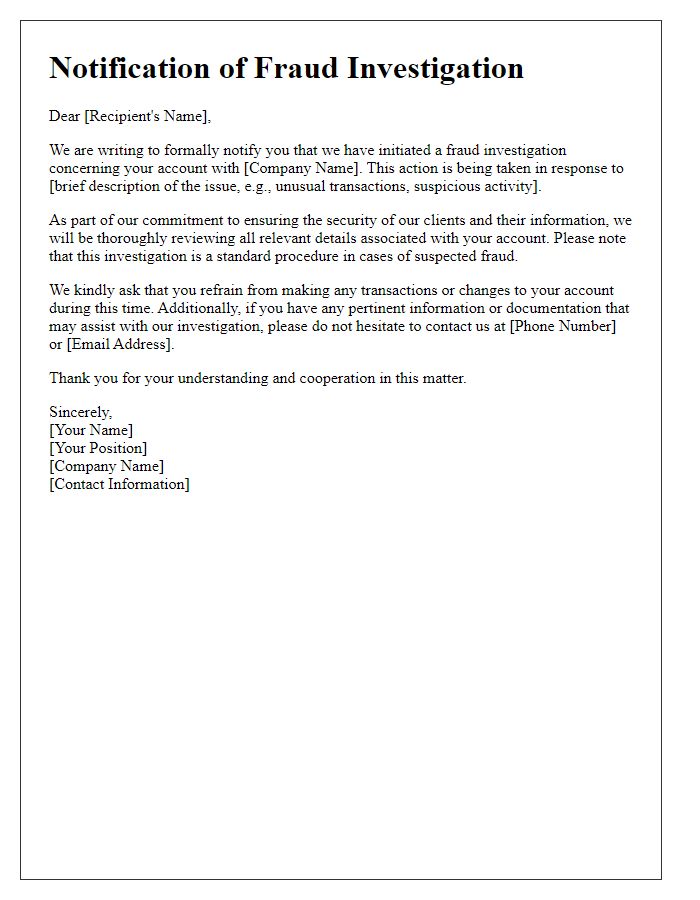

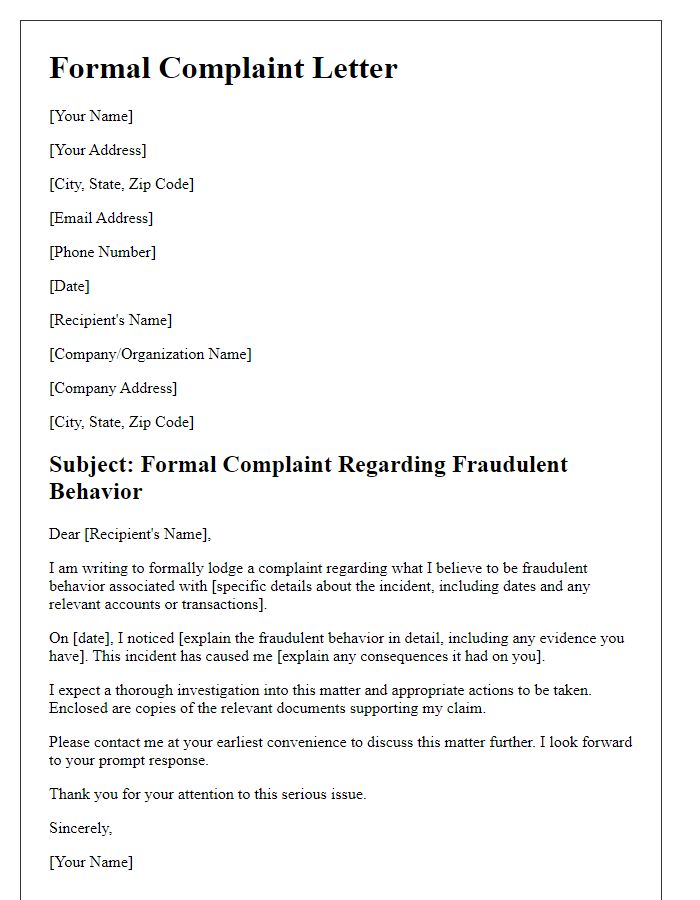

Investigation purpose

Fraudulent activity investigations aim to uncover deceptive practices within financial transactions or business operations, ultimately protecting economic integrity. Agencies such as the Federal Bureau of Investigation (FBI) and local law enforcement departments often conduct these inquiries to identify offenders and prevent further violations. Typical cases involve credit card fraud, identity theft, and insurance fraud, impacting millions of individuals and businesses annually. The investigation process includes collecting evidence, interviewing witnesses, and analyzing financial records to ascertain patterns of illicit behavior. By employing advanced forensic techniques and technology, investigators trace dubious transactions across various platforms, collaborating with financial institutions to halt ongoing fraudulent activities. Ultimately, these rigorous investigations seek to uphold trust within economic systems and safeguard consumers and businesses alike.

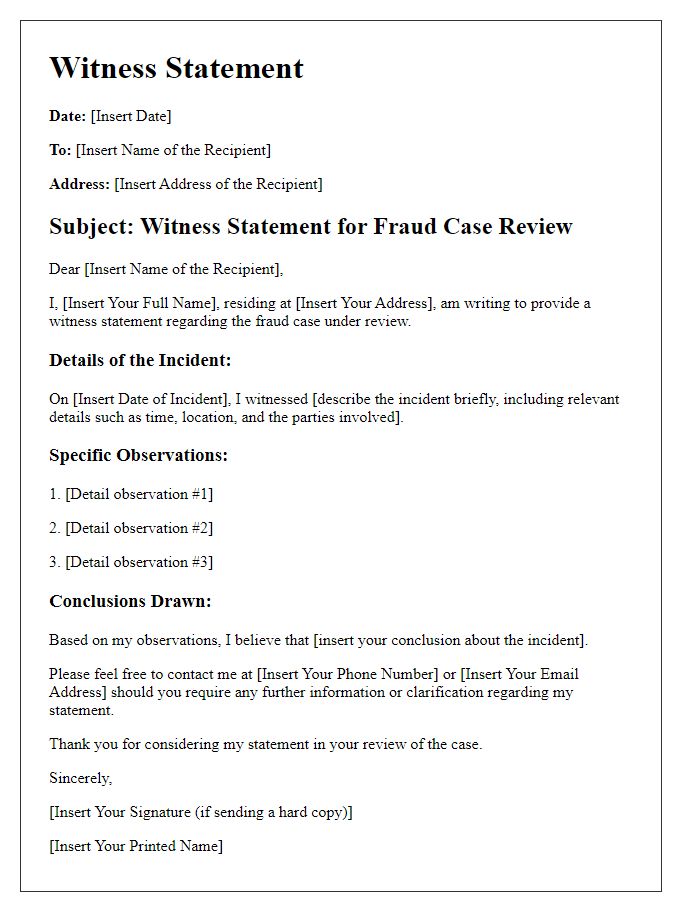

Evidence details

Fraudulent activity investigations often rely on detailed evidence to build a case. Key documents include transaction records from financial institutions like bank statements and credit card receipts, which can show unauthorized charges. Surveillance footage from places of business can provide visual proof of individuals involved. Email correspondence can reveal communication patterns between parties, while signed contracts or agreements can demonstrate discrepancies. Witness statements from employees or customers can add credible testimonies, and digital footprints such as IP address logs or social media activity can trace the actions of suspected individuals. Collecting and organizing this evidence is crucial for a comprehensive investigation.

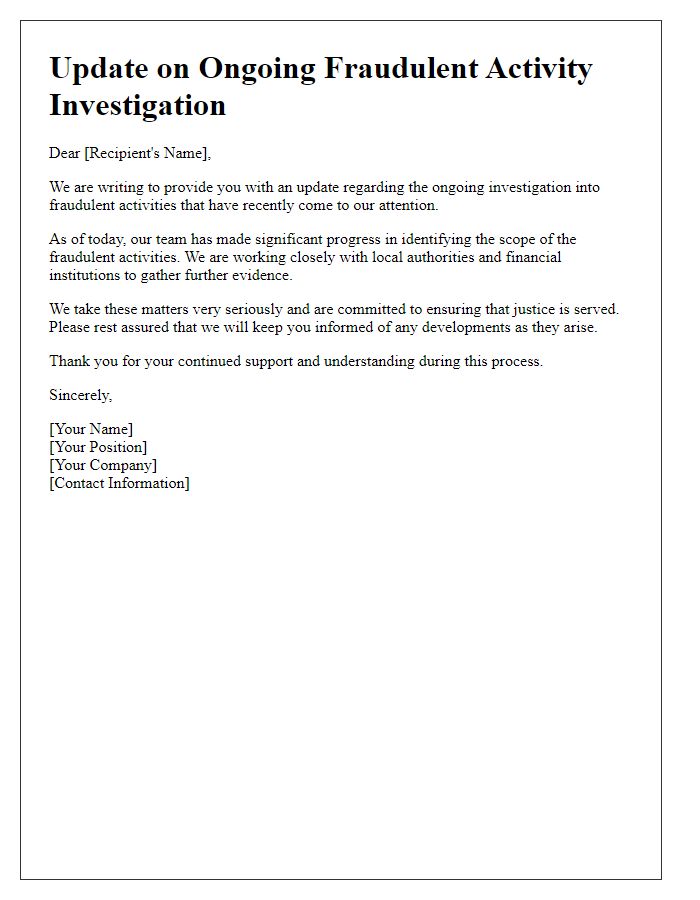

Response timeline

Fraudulent activity investigations require meticulous attention to detail and a structured response timeline. Typically, the investigation begins immediately upon receiving a report of suspected fraudulent behavior. Within the first 48 hours, key actions include gathering preliminary evidence, interviewing witnesses (such as affected individuals and employees), and securing relevant documentation (such as transaction records). By day five, investigators compile findings to identify patterns or irregularities, such as repeated transactions exceeding certain financial thresholds (e.g., $1,000) or unusual account activity. A comprehensive review of financial accounts may involve analyzing patterns, looking for discrepancies in transaction records over the past three months. Following initial analysis, a detailed report is drafted by day ten, summarizing findings and proposed actions. Communication with law enforcement agencies may occur by week two, especially if clear evidence of fraud is discovered. The investigation process emphasizes thorough documentation and collaboration, ensuring all parties involved maintain transparency throughout the timeline.

Comments