Are you considering opening a joint account with a partner or family member? Navigating the world of joint accounts can be quite the adventure, especially when it comes to authorization and account management. Whether it's for shared expenses, saving for a goal, or simply enjoying the convenience of a collaborative financial arrangement, understanding the necessary steps is crucial. Let's dive deeper into the specifics of joint account holder authorization and guide you through the process.

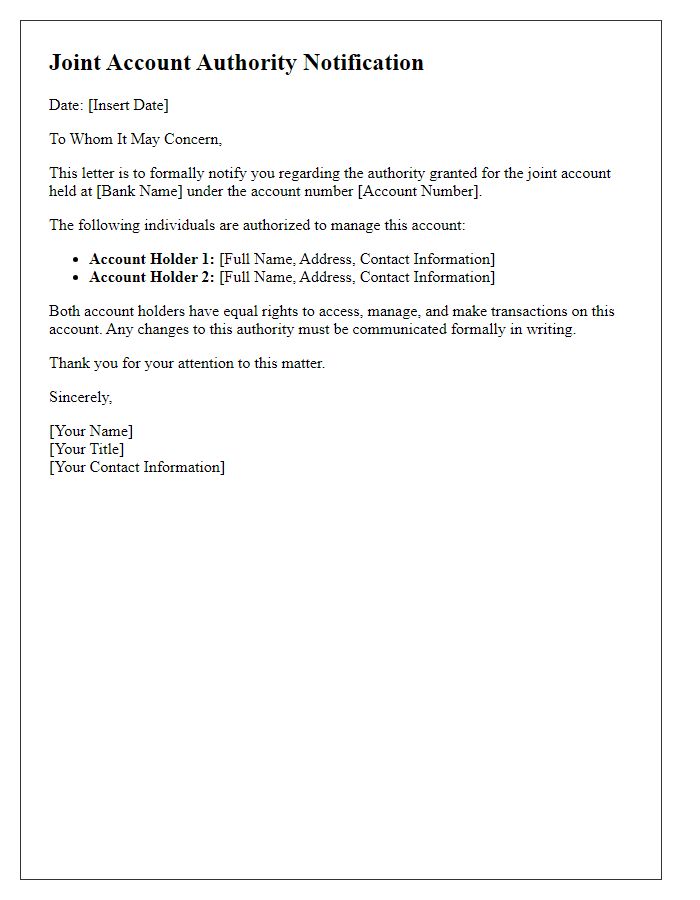

Account holder information

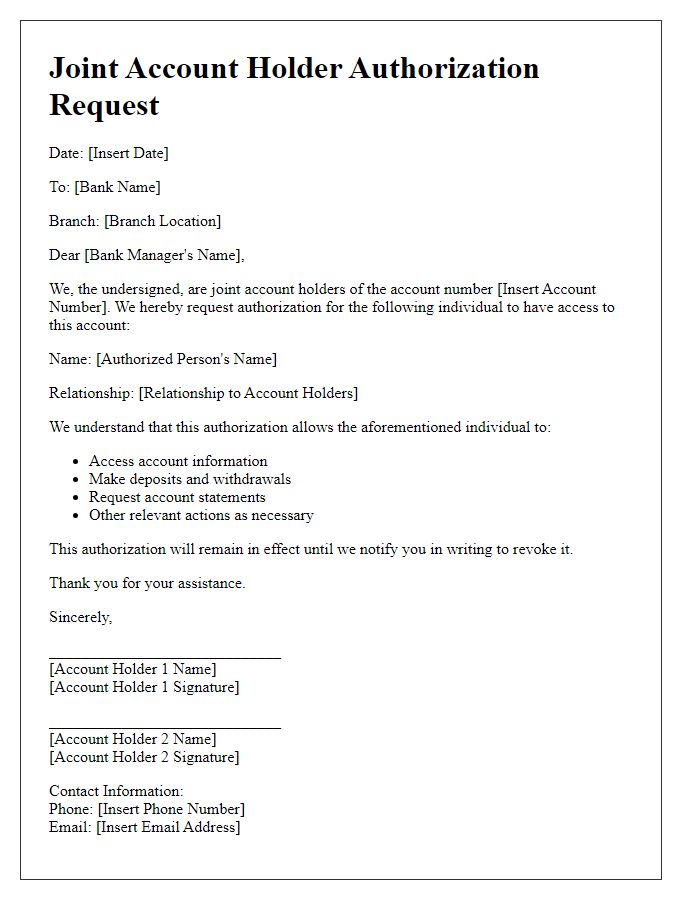

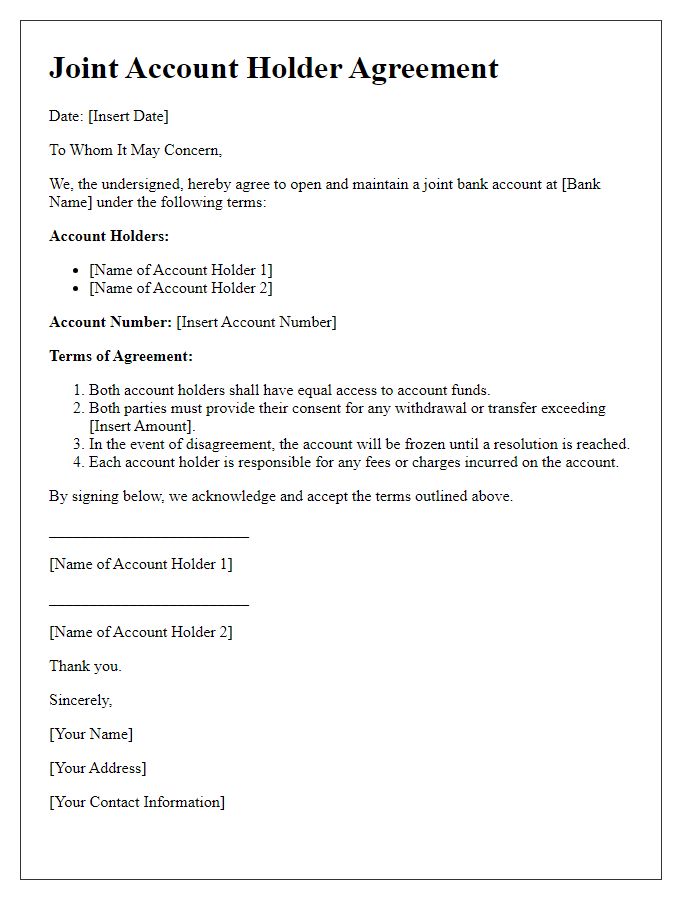

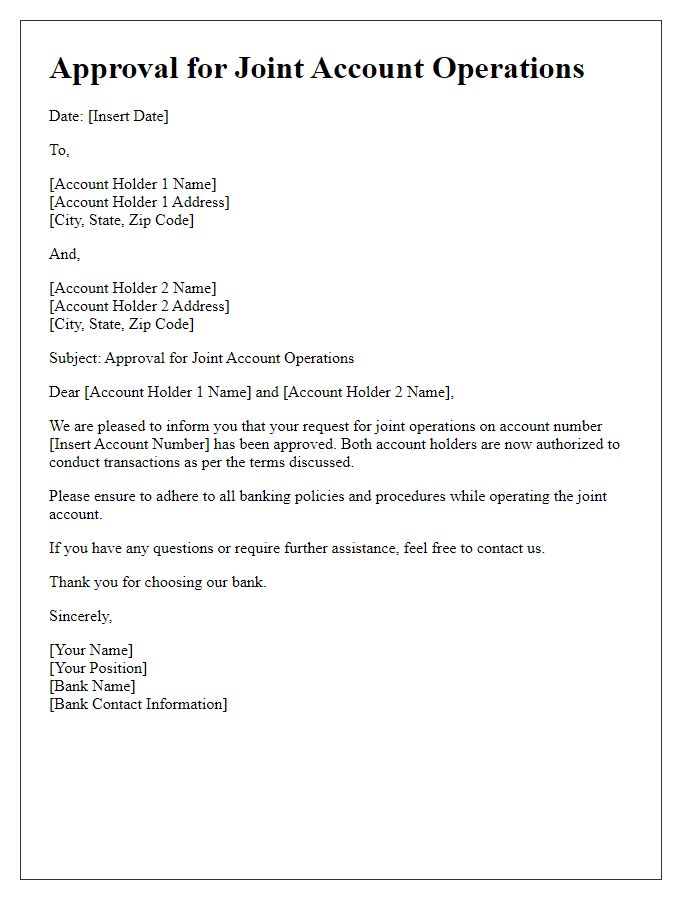

A joint account holder authorization involves a formal request for permission regarding shared banking operations. This authorization typically includes essential account holder information, such as full names, contact details, and Social Security numbers. For example, the primary account holder may be John Smith, residing at 123 Elm Street, Springfield, with a Social Security number of 123-45-6789. The secondary account holder might be Jane Doe, living at 456 Maple Avenue, Springfield, with a Social Security number of 987-65-4321. The authorization might specify powers such as account withdrawals, deposits, and access to statements. It is vital to outline any restrictions or conditions related to the usage of the account, ensuring clarity on each holder's rights and responsibilities.

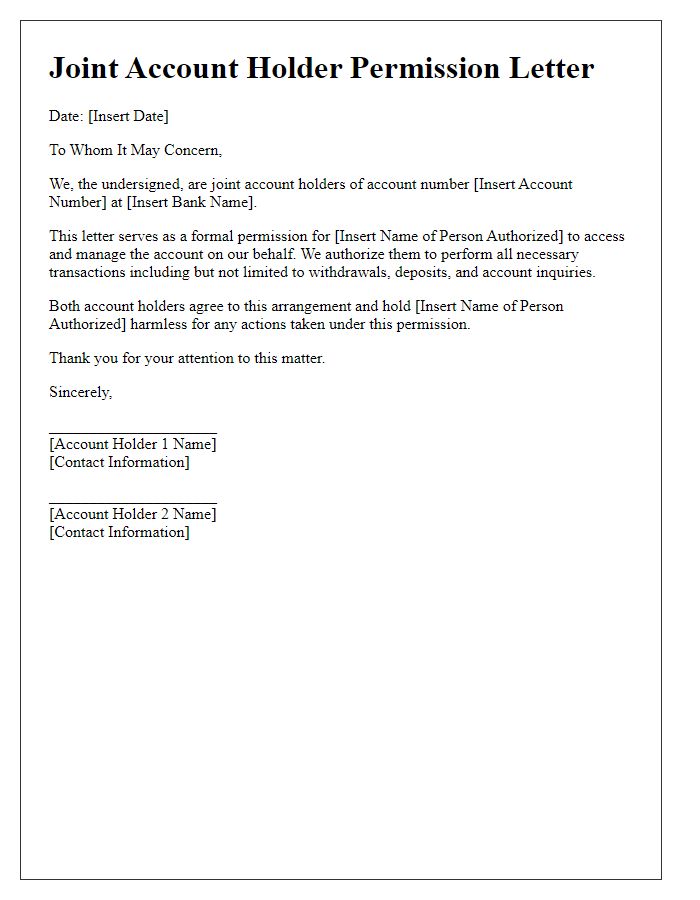

Authorization purpose

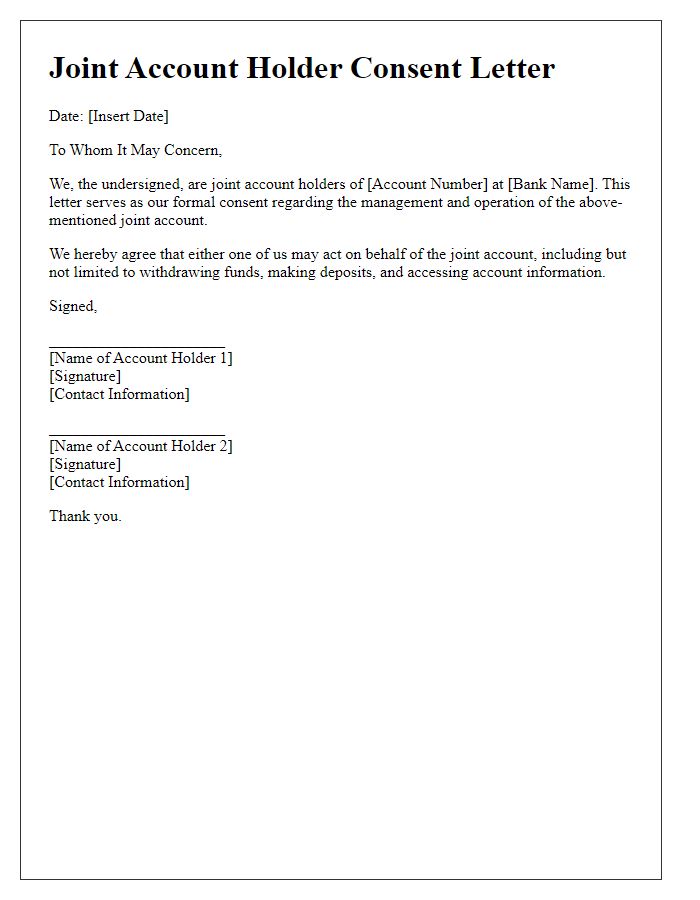

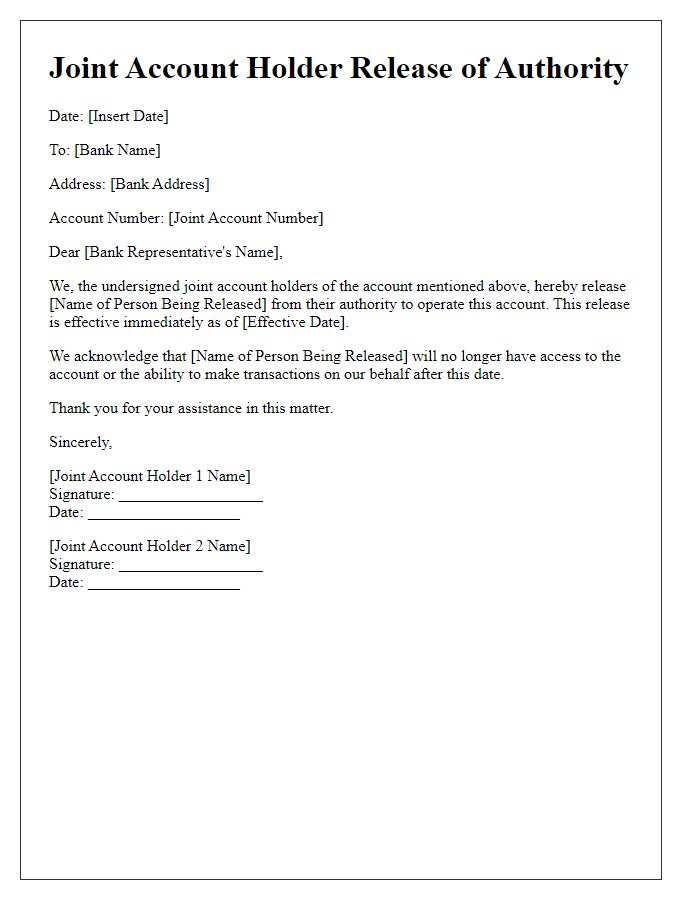

Authorization for joint account holders is crucial in managing shared financial resources. Such authorization can facilitate transactions, account management, and critical decisions regarding funds. For instance, a joint account holder, typically a spouse or business partner, may need to access account details or execute financial decisions on behalf of the other holder. The necessary documentation often includes account numbers (unique identifiers for each joint account), personal identification information, and a clearly stated purpose--ensuring transparency and accountability in financial dealings. Organizations like banks generally request formal letters outlining the authorization scope to safeguard against unauthorized transactions, fostering trust in the management of shared assets.

Authorized person details

An authorized person on a joint account, typically designated for overseeing financial transactions, may include specific details such as their full name, residential address, occupation, and valid identification number (such as a Social Security number or Passport number). Additionally, the relationship to the primary account holder is crucial, whether it be spouse, sibling, or business partner. This information is necessary for banks or financial institutions to ensure the legitimacy of authorized activities and maintain security protocols. Official documents may be required to verify the identity and authorization of the person listed, protecting both parties involved in the joint account arrangement.

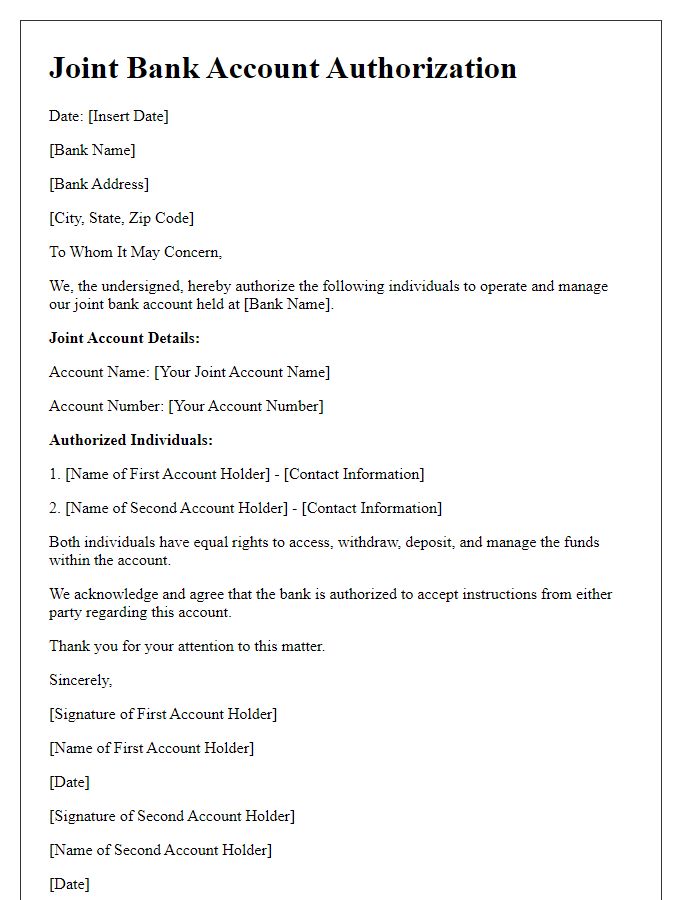

Duration of authorization

In financial institutions, joint account holder authorization often delineates a specified timeframe for which one account holder, referred to as the authorized party, has permission to manage and operate the shared account. This authorization may typically last for a defined duration, such as six months or one year, depending on the bank's policies and the mutual agreement between holders. For example, Bank of America provides options for either short-term or long-term authorizations based on the request form submitted. This directive serves to ensure that both parties exercise control and that proper monitoring of transactions occurs, providing security and accountability in managing shared resources.

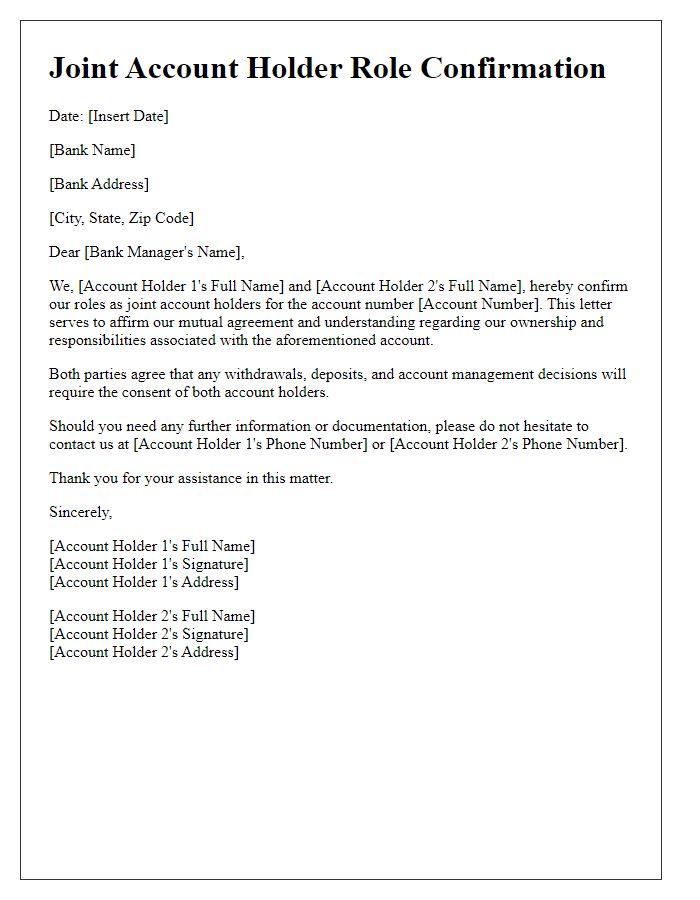

Signature and date

Joint account holders must provide formal authorization when making changes or transactions related to shared accounts. Both parties should sign and date the authorization document to validate their consent. A complete record ensures that financial institutions, such as banks or credit unions, acknowledge the legitimacy of requests or alterations, preventing potential disputes. Proper documentation includes full names, account numbers, and specific instructions regarding the requested action. Clarity in communication fosters trust and accountability in joint financial management.

Comments