Are you considering a secured loan but feeling a bit overwhelmed by the details? Understanding the ins and outs of secured loans can be crucial to making the right financial decision for your needs. From interest rates to collateral requirements, there's a lot to think about, but don't worry, we've got you covered! Stick around as we delve deeper into the specifics of secured loan packages and what you need to know before committing.

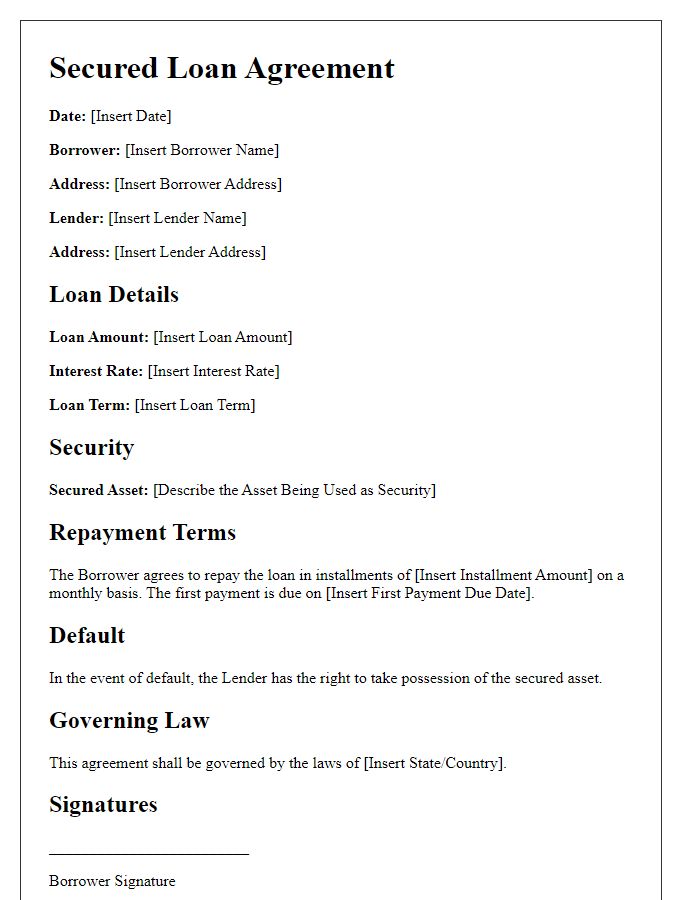

Loan terms and conditions

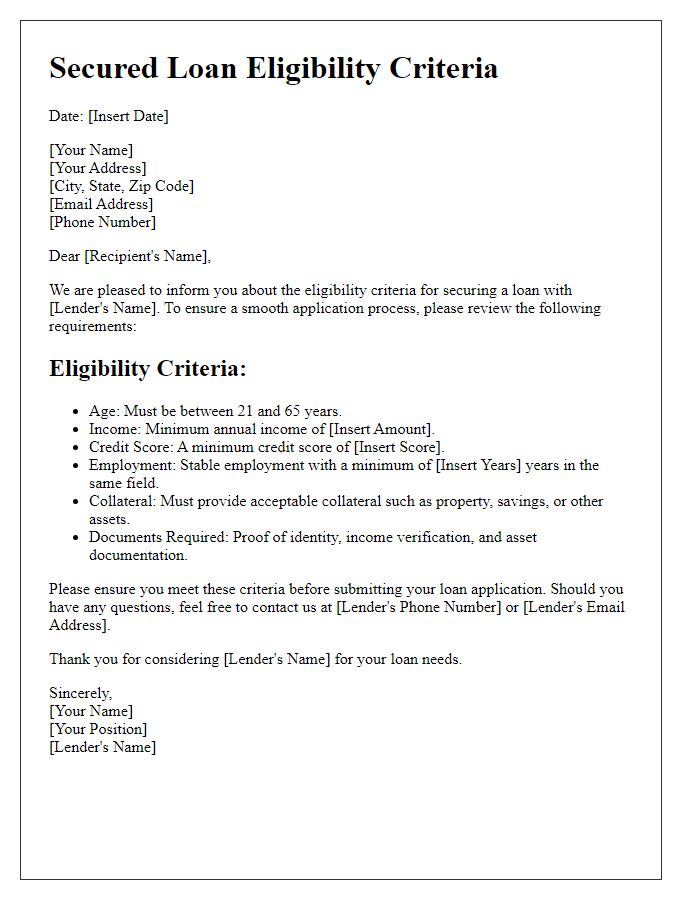

Secured loans, often backed by assets such as property or vehicles, come with specific terms and conditions that borrowers must understand. Loan amounts typically range from $5,000 to $500,000, with interest rates varying based on credit score, generally between 3% to 12%. The lending period usually spans one to thirty years, depending on the loan type and asset value. Borrowers must provide collateral, which can be seized by lenders in case of default, ensuring lower risk for the lender. Monthly payments are structured with fixed or variable rates, and fees may include origination fees, appraisal fees, and late payment charges. Default consequences may involve lawsuits or foreclosure actions, stressing the importance of diligent repayment.

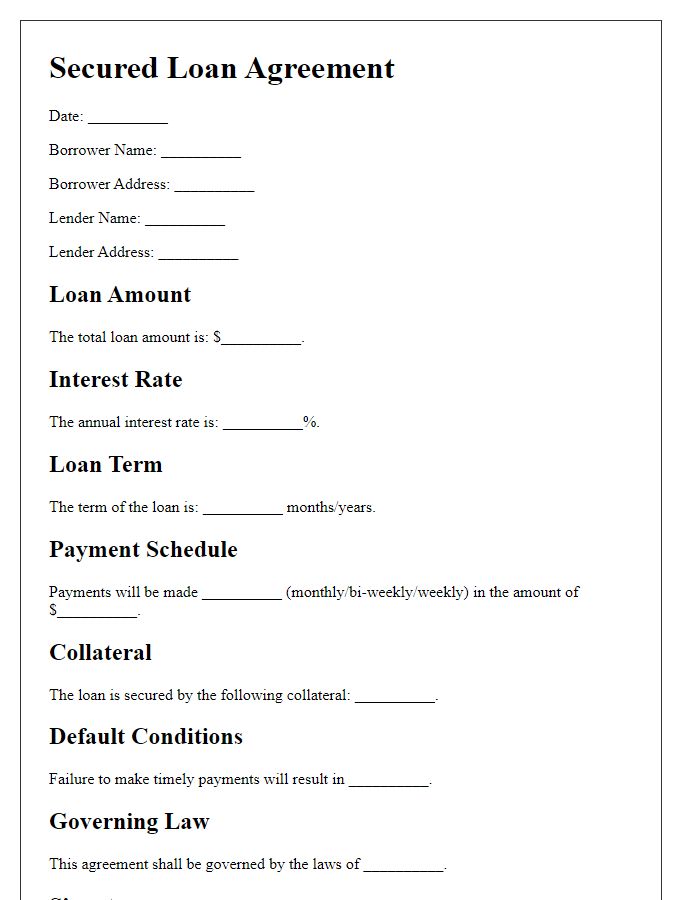

Collateral requirements

Secured loans typically require specific collateral, such as real estate, vehicles, or financial assets, to mitigate lender risk. Real estate properties must possess significant market value, often exceeding the loan amount, and should be verified through appraisal processes. For automobiles, lenders may require documentation proving ownership and current market valuation, adhering to guidelines established by organizations like the National Automobile Dealers Association (NADA). Additionally, financial assets like stocks or bonds may be used, necessitating a margin requirement that typically ranges from 40% to 60%, depending on market volatility. Clear ownership titles and comprehensive insurance coverage are vital in establishing the loan's security, providing lenders with assurance in the event of default.

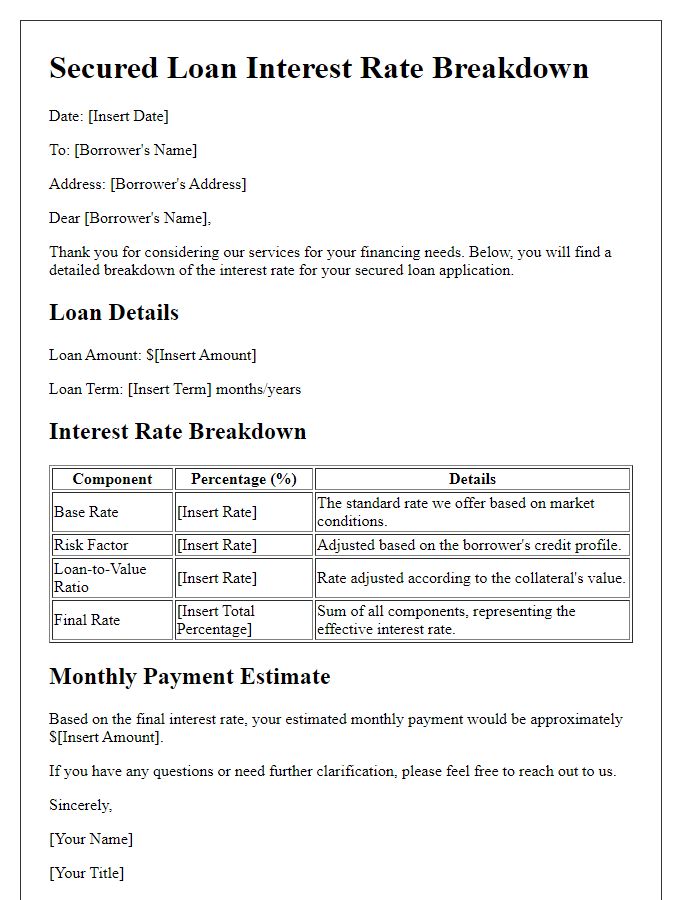

Interest rate and payment schedule

Secured loans typically feature lower interest rates compared to unsecured loans, with rates often ranging between 3% to 7%, depending on creditworthiness and market conditions. The payment schedule for these loans generally follows a monthly structure, with terms spanning from 5 to 30 years. Borrowers may find fixed-rate options appealing, as they provide stability against fluctuations in interest rates. Alternatively, variable-rate loans may start with lower initial payments but can increase over time, impacting long-term financial planning. Applicants should consider the implications of collateral requirements, as assets like real estate or vehicles often secure these loans, which can affect potential risks and consequences of loan default.

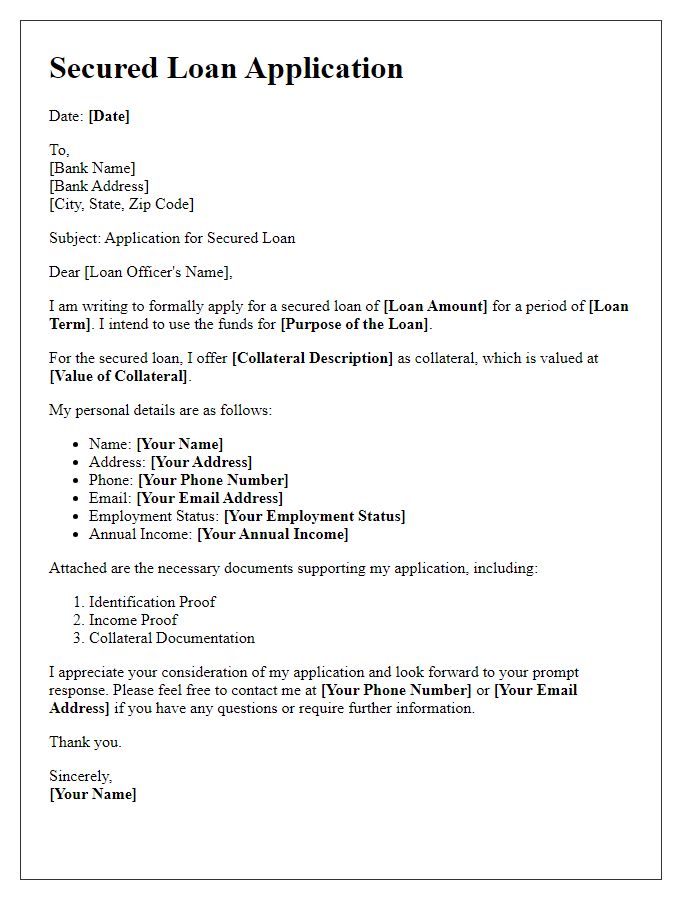

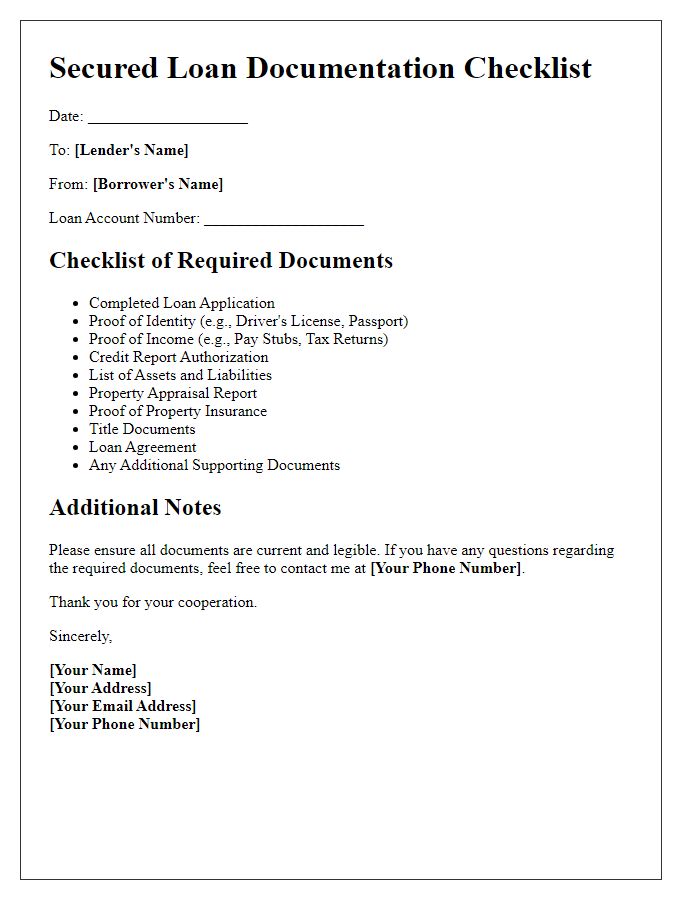

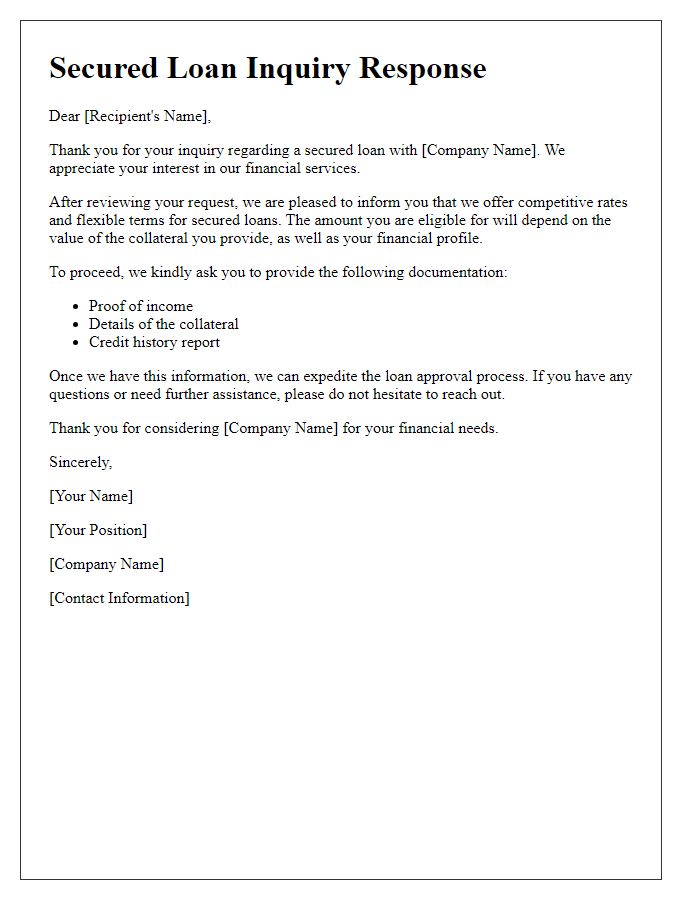

Application process and documentation

Secured loans, commonly used for acquiring properties or consolidating debt, involve a detailed application process and specific documentation requirements. Loan applicants typically need to provide personal identification, such as a driver's license or passport, along with proof of income, like recent pay stubs or tax returns for the last two years, to establish financial stability. Additionally, evidence of collateral, such as real estate or automobiles, must be documented, supported by an appraisal report detailing the asset's market value. Financial institutions may require a complete credit history report to assess creditworthiness. The application process often involves completing a detailed form with personal, employment, and financial information. Background checks and property evaluations may also be necessary steps before finalizing the secured loan agreement.

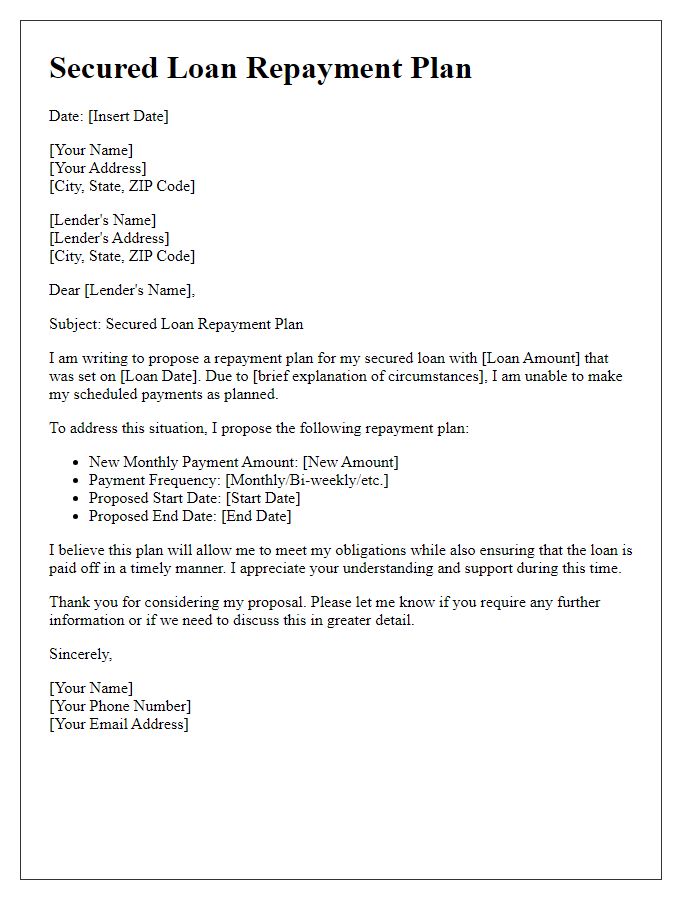

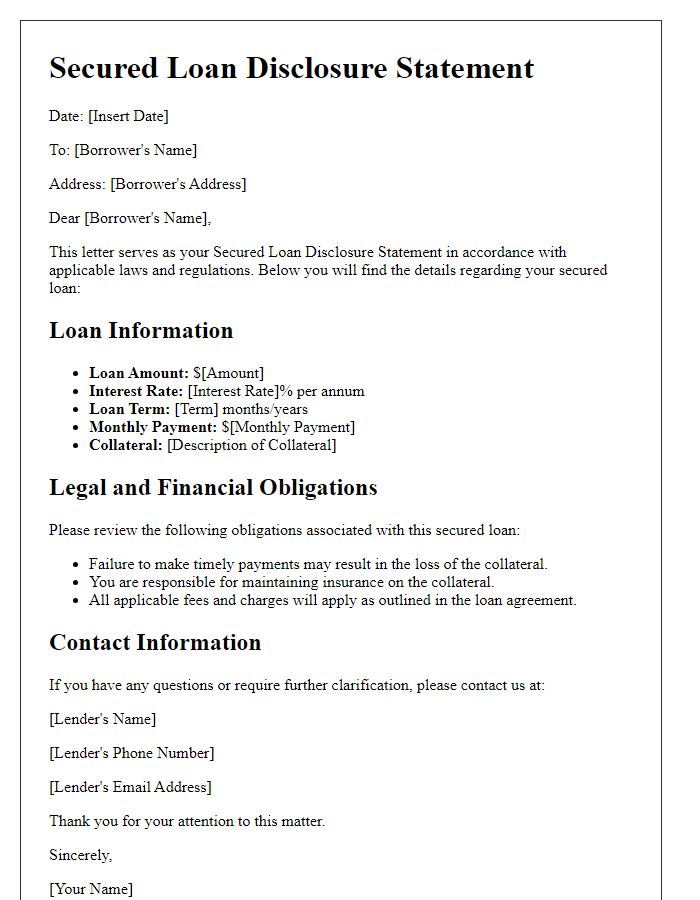

Contact information for queries

Secured loans require comprehensive documentation to process effectively. Key components of a secured loan package include details such as the borrower's credit history, income verification documents (including recent pay stubs or tax returns), and collateral information (like property deeds for real estate or vehicle titles for auto loans). Additionally, lenders often request a detailed loan application form and proof of identity (e.g., government-issued ID). Contact information for queries should include a direct phone number and email address of the loan officer or department, ensuring clarity and prompt assistance for any questions or concerns regarding the secured loan process.

Comments