Are you looking to update your signature mandate but unsure where to begin? Navigating the process doesn't have to be complicated; with a clear template in hand, you can streamline your request effortlessly. In this article, we'll provide you with a step-by-step guide to creating an effective letter for your signature mandate change request. So, grab a cup of coffee and let's dive into the details togetherâread on to find out more!

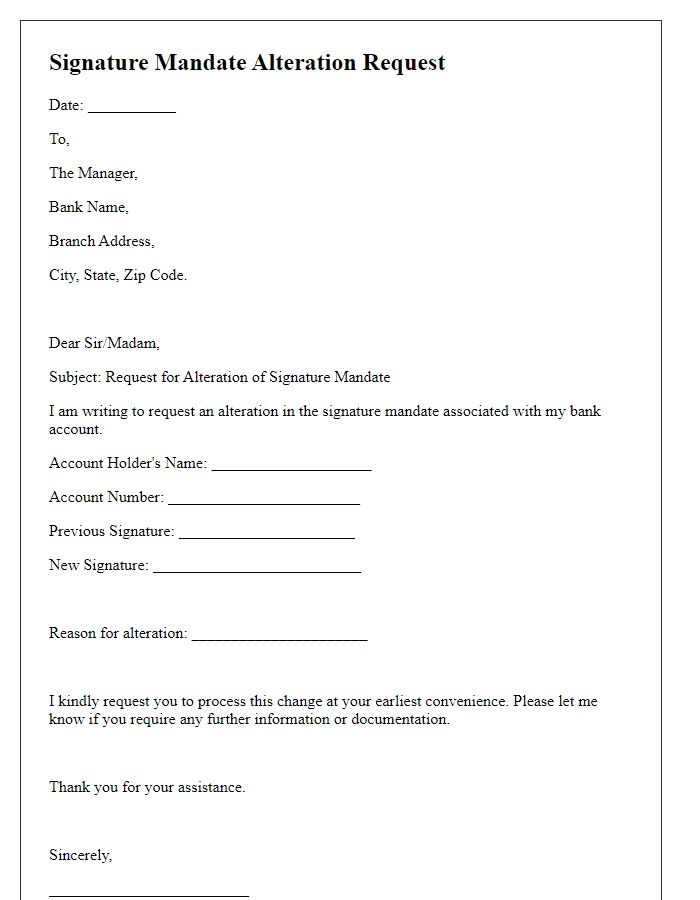

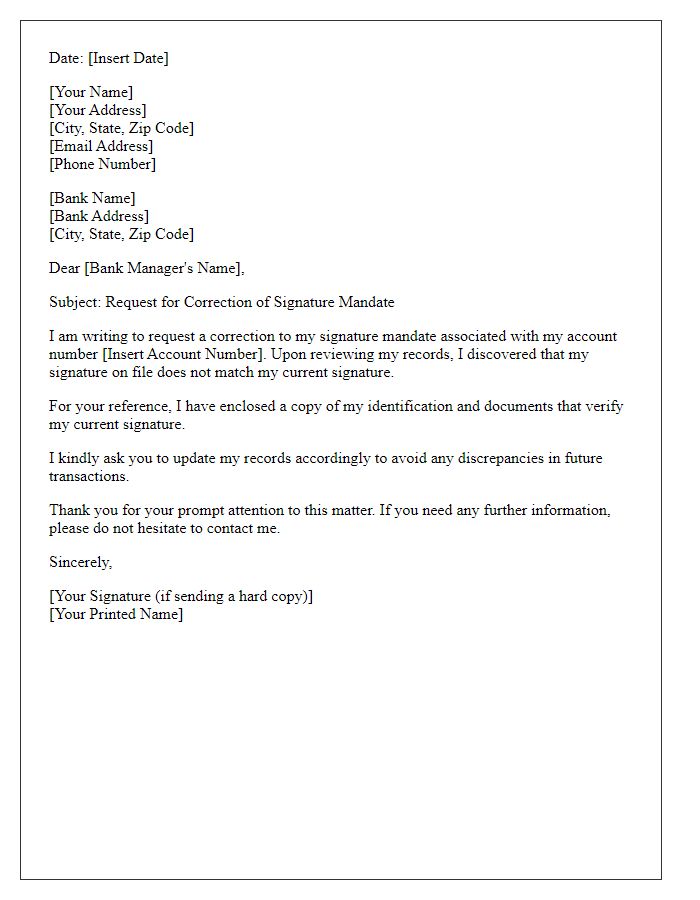

Bank account details

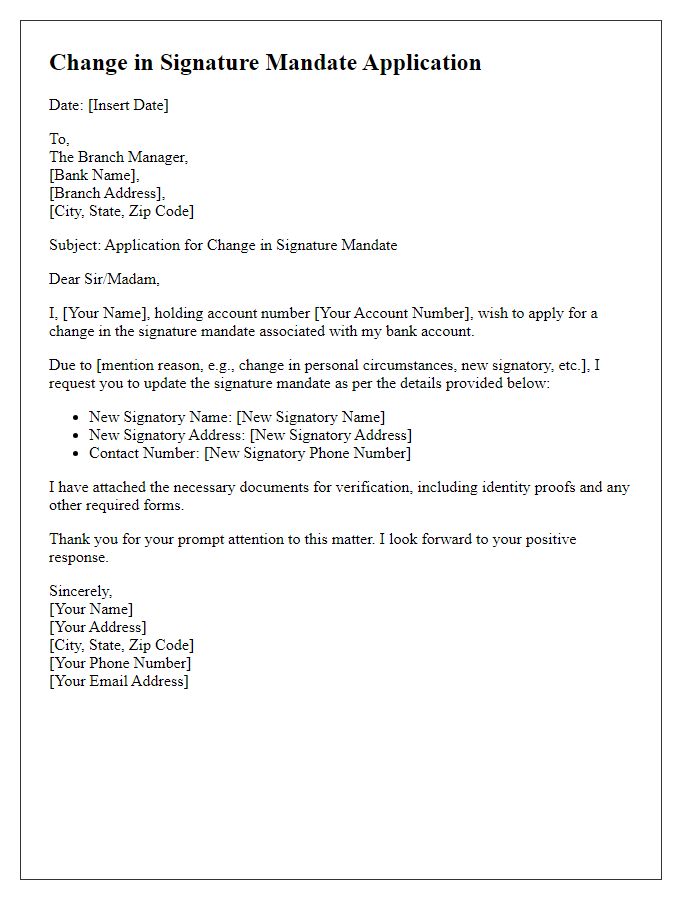

A signature mandate change request for bank account details ensures that institutions have updated authorization for transactions. This process is crucial for maintaining security and preventing unauthorized access. The request typically involves filling out a specific form provided by the bank, such as the XYZ Bank's mandate alteration form, available on their official website. Important information, including the account number, branch code, and the names of authorized signatories, must be clearly indicated. The request should be signed by all current signatories. Submission requires visiting the local bank branch at 123 Main St., or sending the documents to the bank's processing center via registered mail (tracking option recommended). Timely updates secure assets and facilitate smooth banking operations.

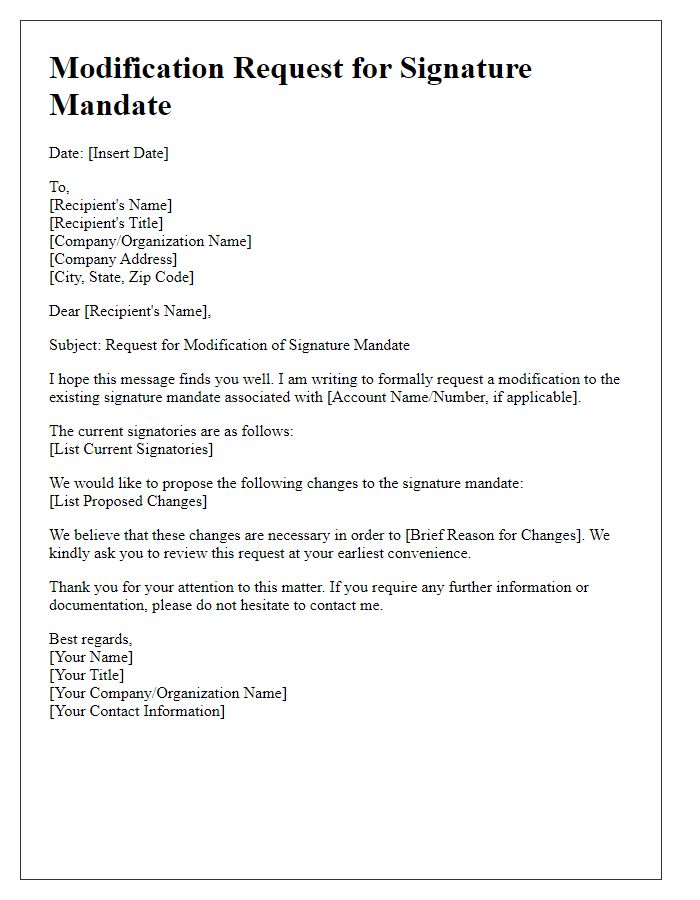

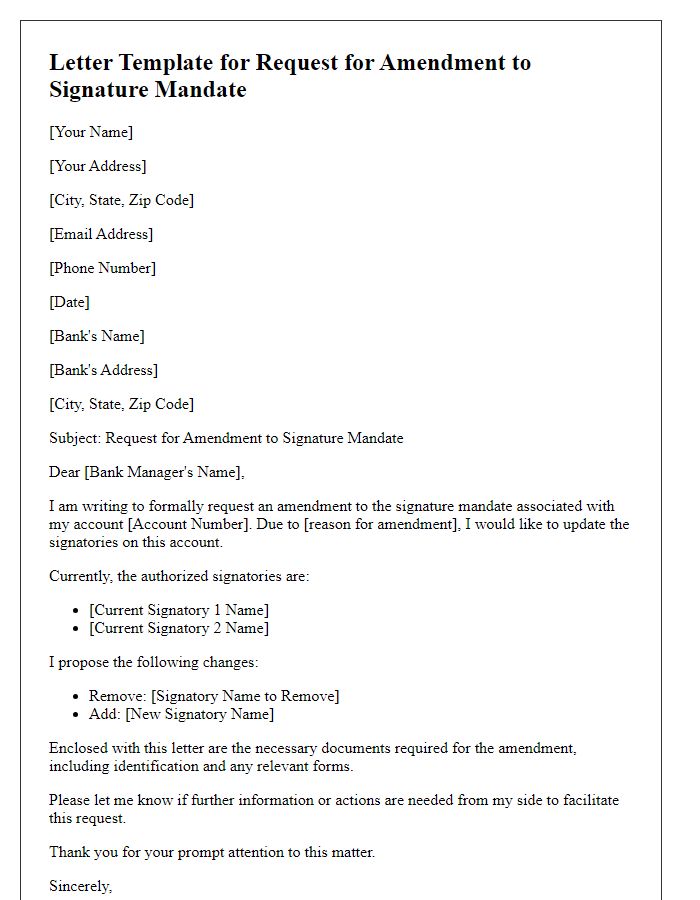

Current authorized signatories

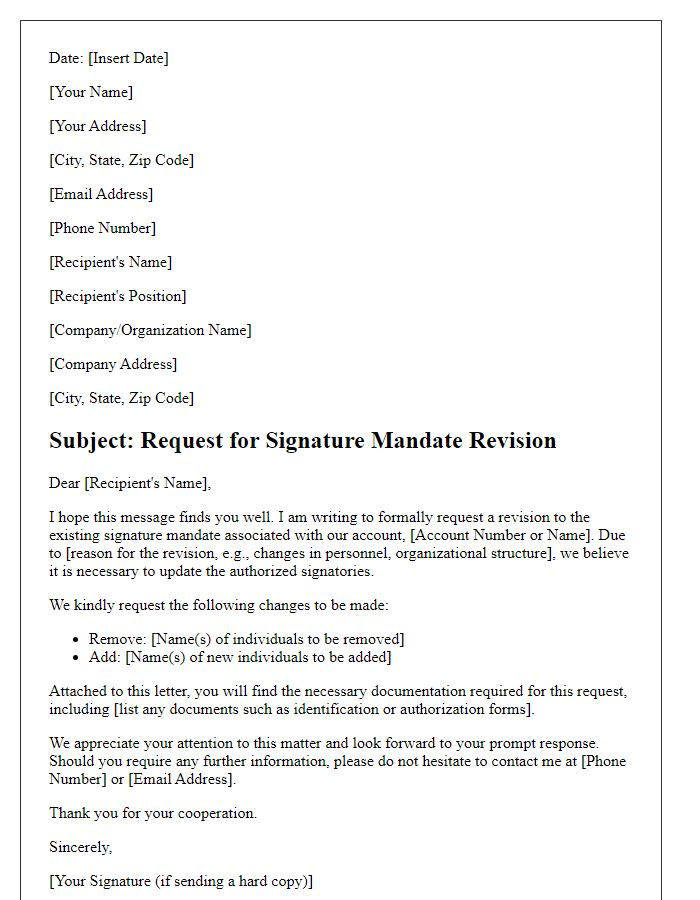

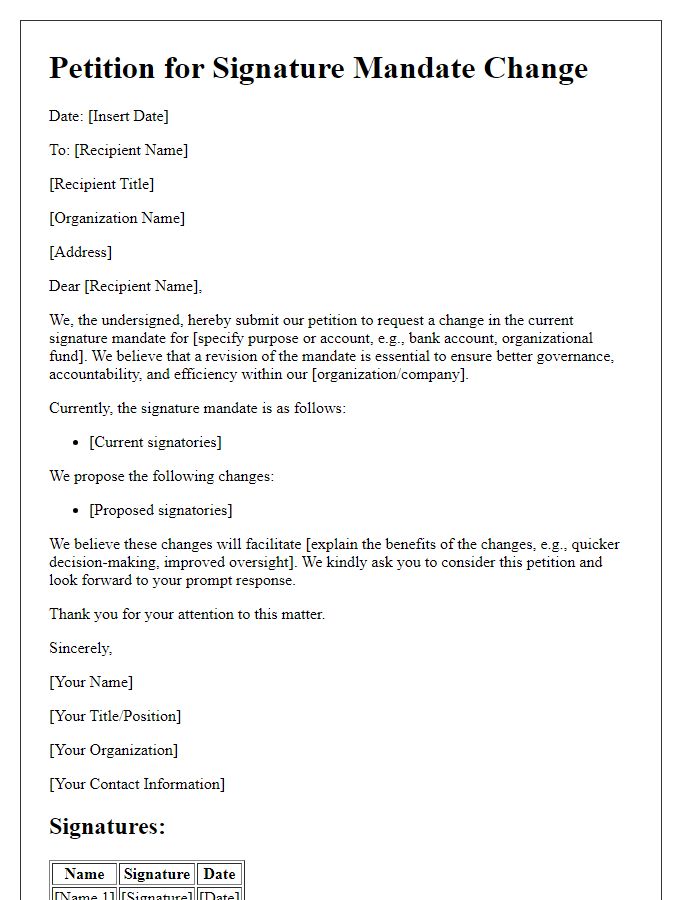

A signature mandate change request is an important document for businesses and organizations, especially in financial institutions. This request typically outlines the current authorized signatories (individuals or representatives) on a bank account, investment account, or other financial instrument. These signatories hold the authority to conduct transactions, such as withdrawals and deposits, representing the organization in financial matters. Organizations can include details such as business registration numbers and account numbers to ensure accuracy. The change request must clearly specify which signatories are being removed or added, ensuring all stakeholders are informed of the updated authorization. Additionally, it often requires signatures from existing authorized parties to verify the legitimacy of the request. Timely submission of this document can help prevent unauthorized transactions and maintain the organization's financial integrity.

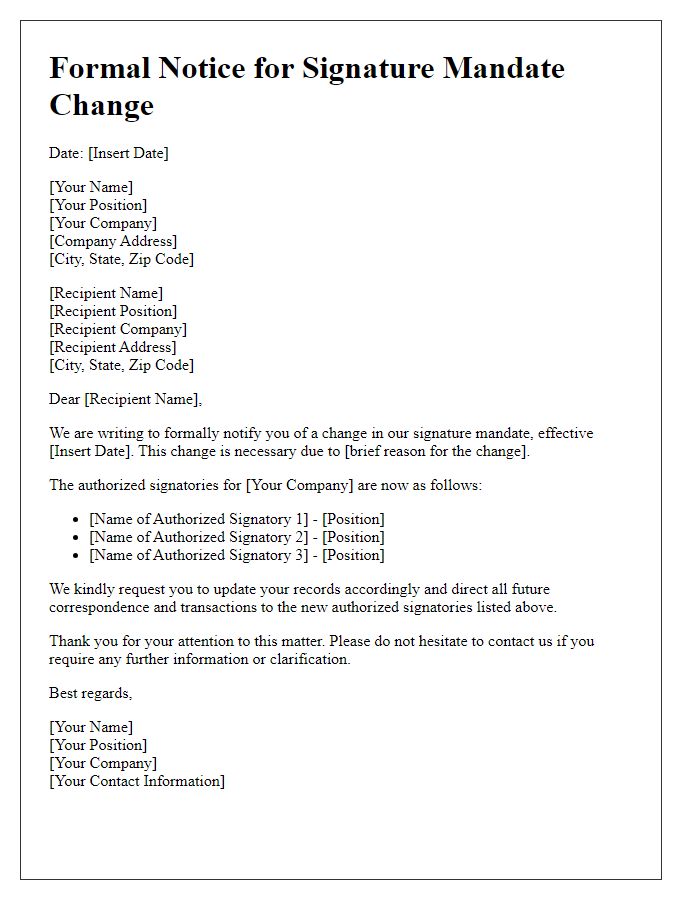

New authorized signatories

Changing authorized signatories on a corporate banking account involves notifying the bank with a formal request. The new authorized signatories should be listed with their respective names, positions, and identification details, such as passport numbers or employee IDs, to avoid any confusion. The request must also include the company's name, registration number, and a resolution from the board of directors, if applicable, verifying the change. This process ensures that the new signatories are recognized and that past signatories' access is revoked, safeguarding the company's financial security. All documentation should be submitted in accordance with the bank's requirements to prevent delays.

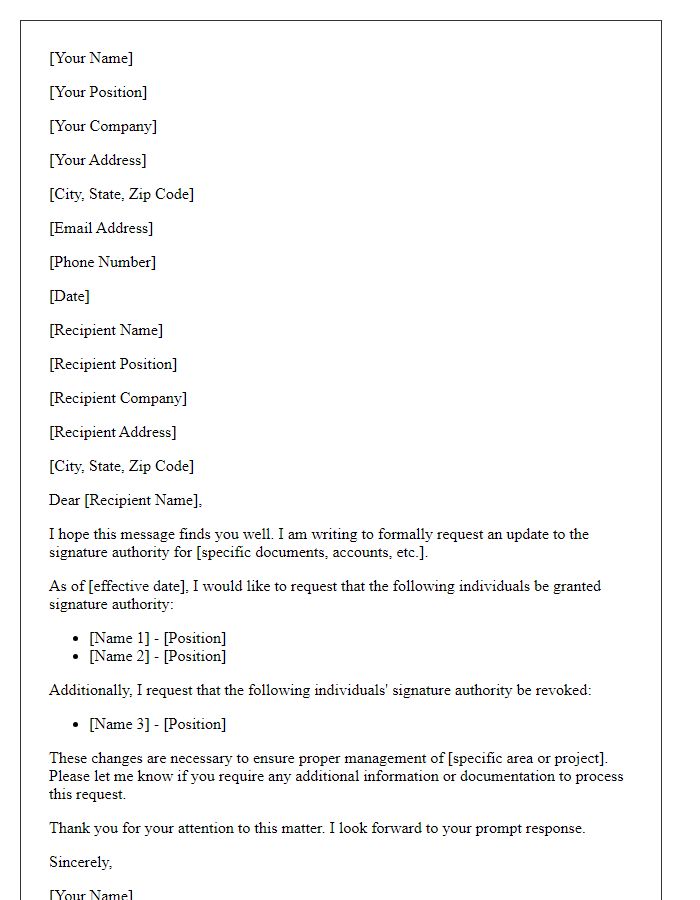

Effective date of change

A signature mandate change request is essential for updating authorized signatories on bank accounts, corporate documents, or financial transactions. This document usually specifies the effective date of the change, often aligned with corporate meetings or board resolutions. For example, a company might submit a request to the bank on January 20th, indicating that the change of signatories will take effect from February 1st. This allows the bank time to process the request and ensure compliance with internal policies. Ensuring accurate and timely submission is crucial to avoid any disruptions in financial operations.

Contact information for confirmation

To initiate a signature mandate change request, ensure to include specific contact information for confirmation. Full name (ensure accurate identification), account number (for verification purposes), phone number (direct line for follow-up), and email address (for electronic confirmation). Provide details of the changes being requested, specifying old and new signatories, and include any reference numbers associated with the current mandate. Clear communication of this information facilitates prompt processing by the financial institution, ensuring compliance with internal policies and procedures.

Comments