Hello there! Are you looking to strengthen your relationship with your clients while enhancing your business connections? In today's competitive landscape, having a dedicated relationship manager can truly make a difference in building trust and fostering loyalty. Join me as we explore the essential qualities and strategies of effective relationship managers that can take your professional interactions to the next level!

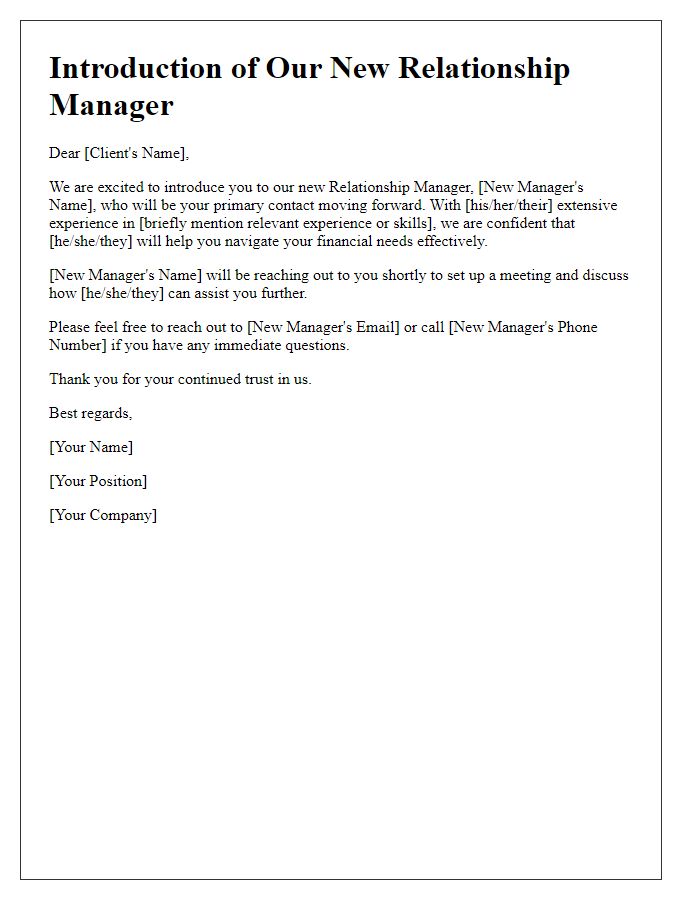

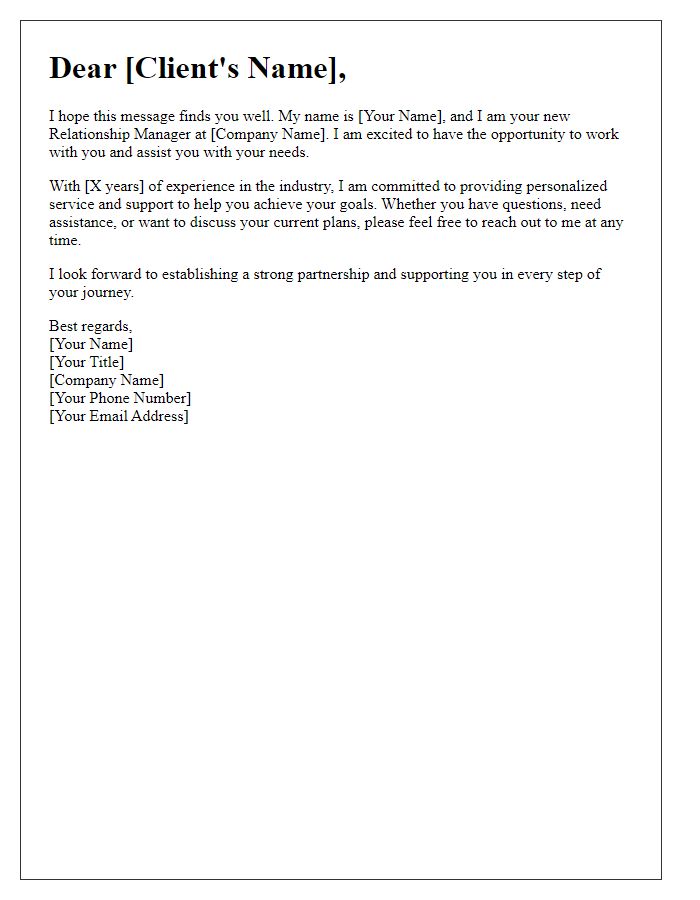

Personalization and Salutation

Effective relationship management in financial services relies on personalized communication. A relationship manager's introduction typically begins with a warm greeting that addresses the client by name, enhancing the personal touch. Following this, the manager should succinctly state their role within the organization, such as a dedicated advisor at XYZ Bank, emphasizing their commitment to providing tailored solutions. Including specific details about the client's financial goals or previous interactions can strengthen this introduction. Personalization fosters trust and demonstrates a proactive approach to understanding and addressing the client's unique needs in investment strategies or financial planning.

Clear Introduction and Role Explanation

A relationship manager plays a crucial role in building and maintaining client relationships within various industries, particularly in finance and customer service sectors. This professional acts as the primary point of contact for clients, addressing their needs and concerns while providing tailored solutions. Responsibilities include regular communication, conducting needs assessments, and overseeing account management. Additionally, relationship managers analyze data to enhance client satisfaction and retention, ensuring the firm's services align with clients' evolving objectives. Their expertise in fostering strong interpersonal connections contributes significantly to client loyalty and long-term business success.

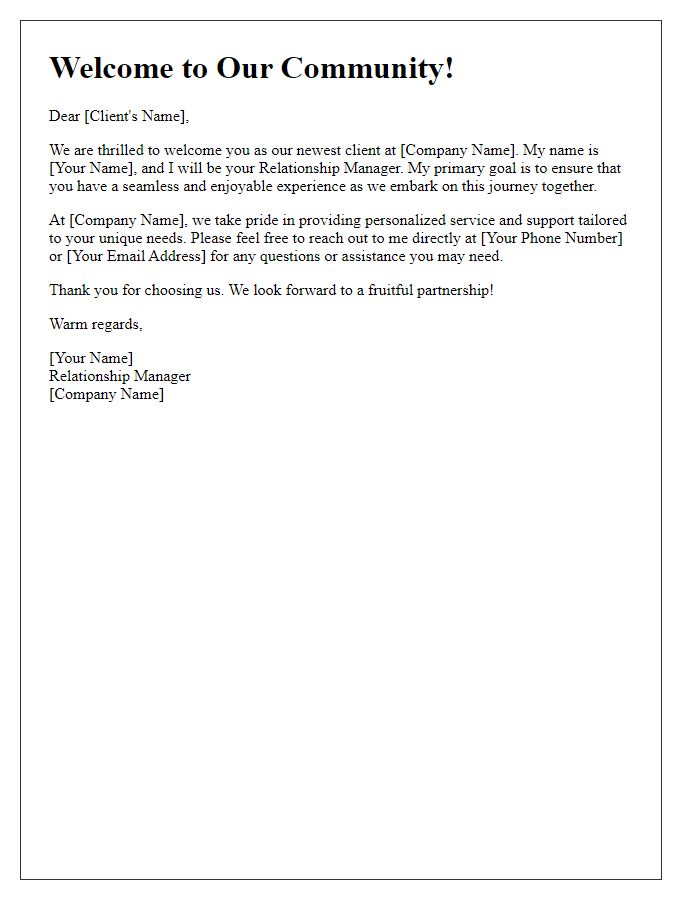

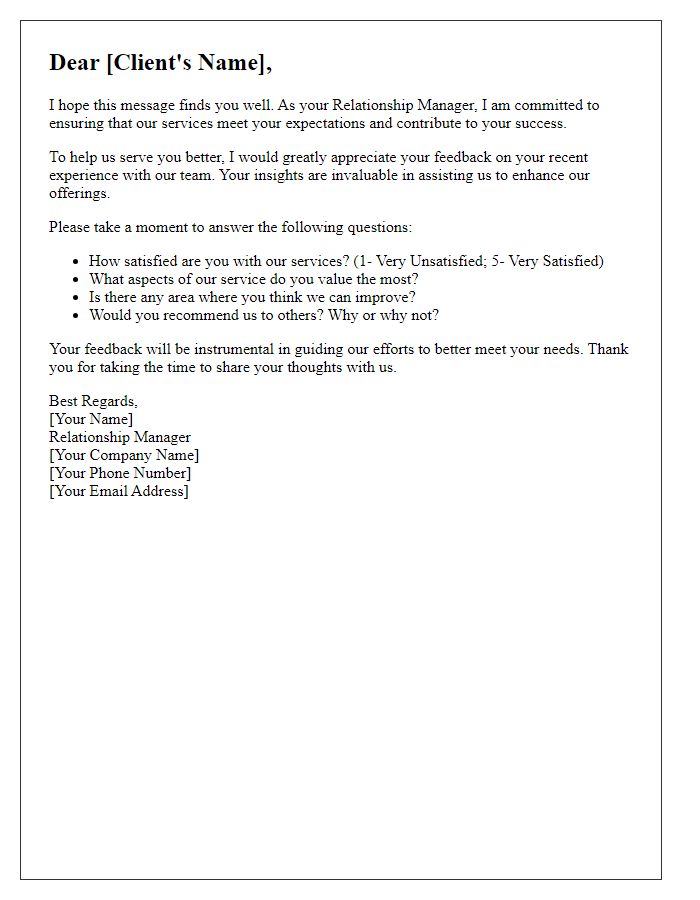

Value Proposition and Benefits

A relationship manager plays a critical role in maintaining and enhancing client connections, particularly in financial institutions or service-oriented businesses. They provide personalized support (tailored assistance based on individual client needs) to clients, ensuring that their financial goals (such as saving for retirement or purchasing a home) align with the services provided. Effective communication skills (the ability to convey information clearly and empathically) are essential for understanding client requirements and addressing any concerns. Relationship managers also analyze market trends (shifts in investment opportunities or consumer behavior), helping clients make informed decisions based on real-time data. The benefits include increased client satisfaction (the likelihood of clients feeling valued and understood), loyalty (continuing business relationships), and potential referrals (recommendations to new clients). This strategic role ultimately aims to foster long-term partnerships that drive growth for both the client and the organization, enhancing portfolio performance and overall client experience.

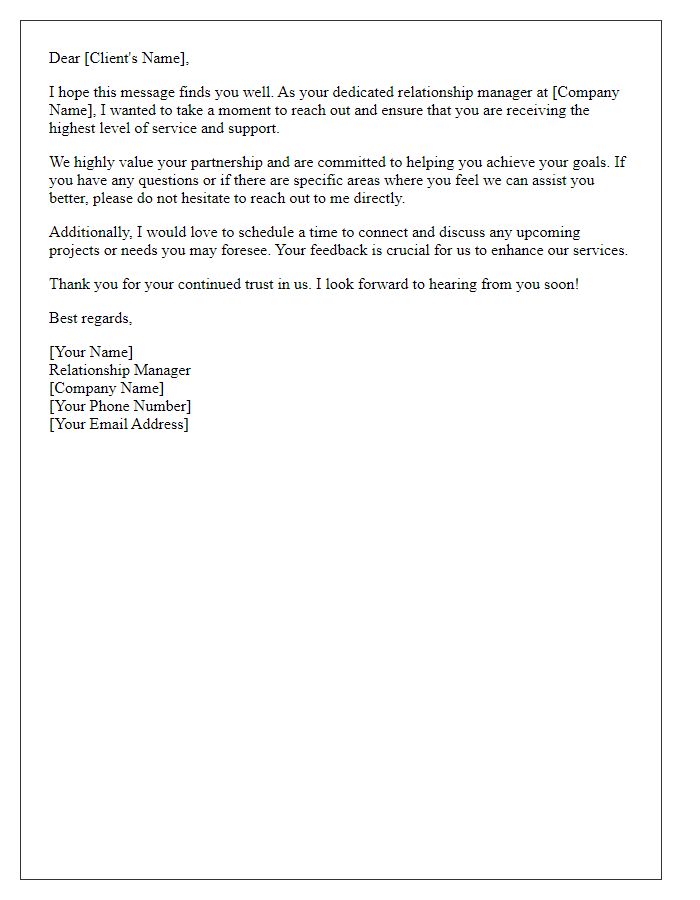

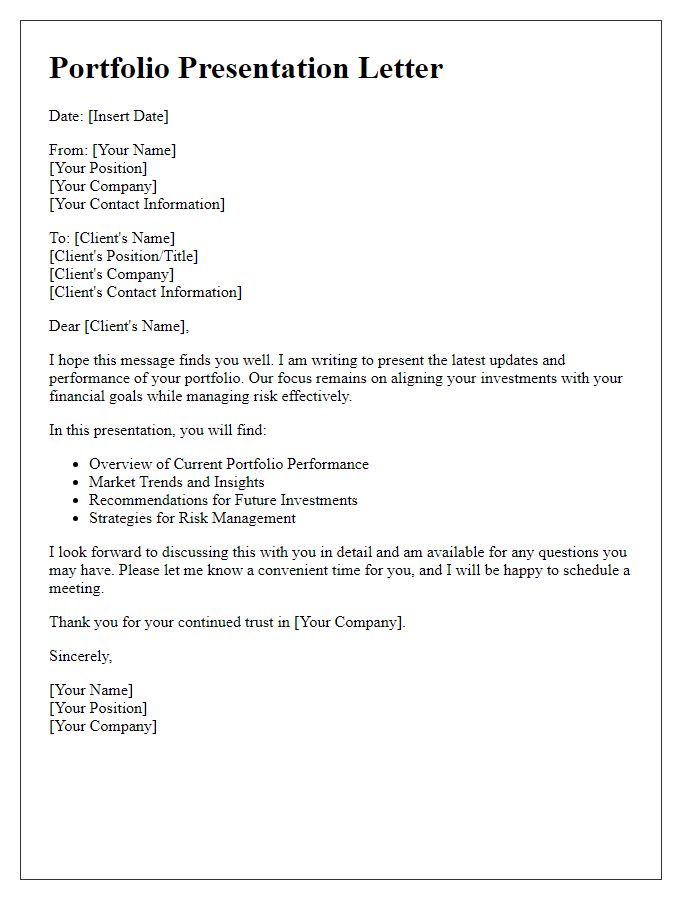

Call to Action and Engagement Invitation

In the ever-evolving landscape of personal finance, a relationship manager serves as a crucial guide for navigating investment opportunities and financial strategies. This key professional provides personalized advice tailored to individual goals, highlighting relevant market trends. For instance, understanding investment frameworks such as stocks, bonds, or mutual funds allows better decision-making. Engaging with a relationship manager also means gaining insights on wealth management strategies, particularly in high-value areas like retirement planning (examples include IRAs, 401(k)s). To initiate a meaningful dialogue, individuals are encouraged to schedule an introductory meeting, ensuring that financial objectives align with a well-crafted plan for future success.

Professional Sign-off and Contact Information

A relationship manager acts as a key liaison for clients in financial services, ensuring their needs are met effectively and efficiently. The relationship manager specializes in understanding client portfolios, which can include various assets such as stocks, bonds, and real estate. Their role encompasses providing personalized service, addressing inquiries promptly, and facilitating communication between clients and other departments. Key performance indicators may include client satisfaction rates, retention rates, and revenue growth from existing clients. In their communication, they often include professional sign-offs such as "Best regards" or "Sincerely," accompanied by detailed contact information outlining direct phone numbers, email addresses, and sometimes social media handles to enhance accessibility and connection.

Comments