Are you feeling overwhelmed by your current loan repayment terms? You're not aloneâmany people find themselves in situations where the original terms no longer fit their financial circumstances. In this article, we'll explore how you can effectively request a modification of your loan repayment terms to better align them with your needs. So, stick around to find out the essential steps to navigate this process successfully!

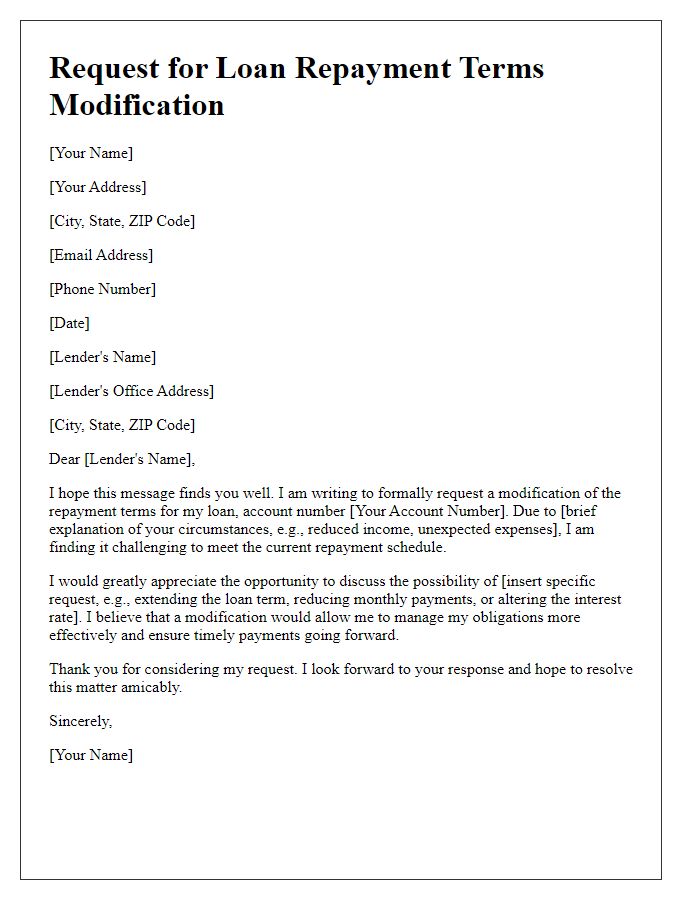

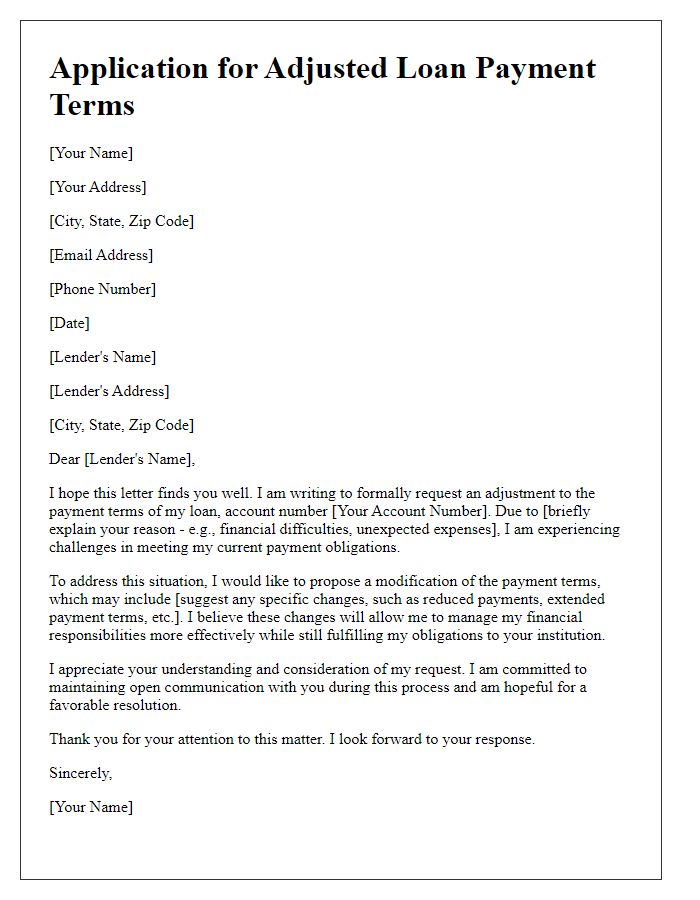

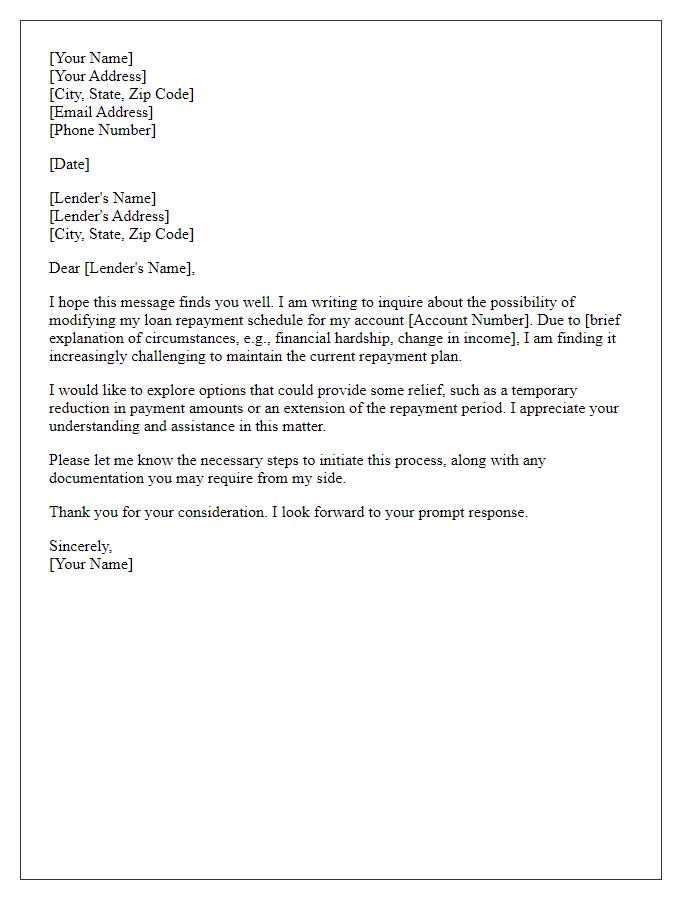

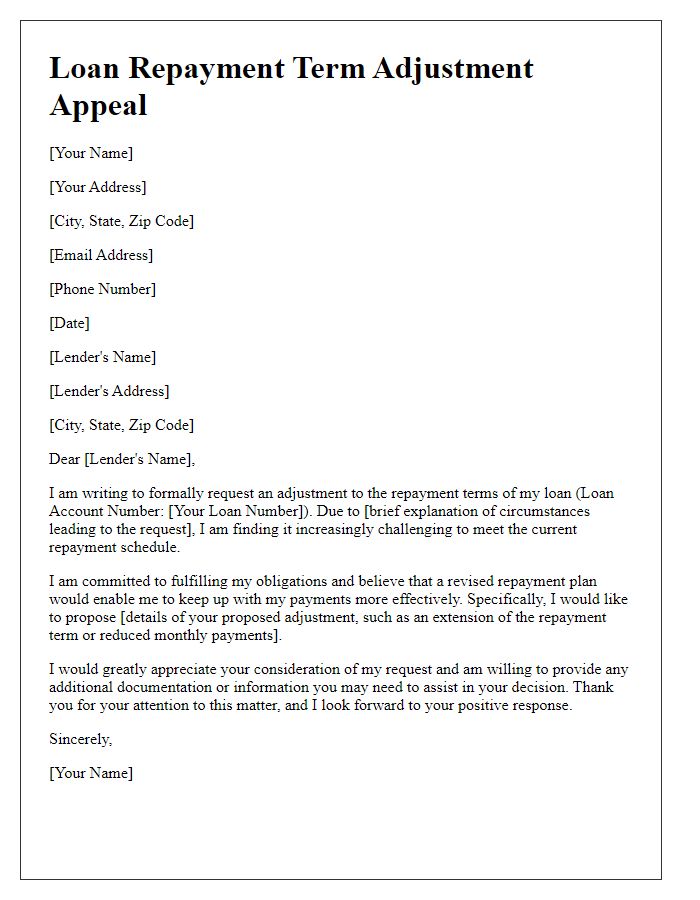

Borrower Information

Borrower information includes vital details essential for identifying the borrower and their loan specifics, such as the borrower's full name (e.g., John Doe), contact information (e.g., phone number, email address), address (e.g., 123 Main St, Anytown, USA), and loan account number (e.g., #123456789). Additionally, it is important to include details regarding the current loan type (e.g., personal loan, mortgage), original loan amount (e.g., $20,000), remaining balance (e.g., $15,000), interest rate (e.g., 4.5%), and repayment schedule (e.g., original term of 5 years). Affected financial circumstances should also be outlined, such as job loss, medical expenses, or other factors impacting the borrower's ability to meet existing payment obligations.

Loan Account Details

Loan Account Details are critical when discussing repayment terms modifications. The loan account number (typically consisting of 10-15 numeric digits) identifies the specific loan under consideration. The original loan amount, which refers to the initial principal typically ranging from $1,000 to $500,000, provides context regarding the size of the financial obligation. Interest rates, often expressed as an annual percentage rate (APR) between 3% and 12%, dictate the cost of borrowing. The remaining balance, the current amount owed after any payments have been made, is crucial for negotiating new terms. Moreover, understanding the original loan term (commonly spanning 15 to 30 years) allows for assessing how changes may affect the repayment schedule. Payment history, including any missed or late payments (recorded in days), can impact eligibility for modifications. All these elements contribute to a comprehensive understanding of the loan account in discussions with lenders.

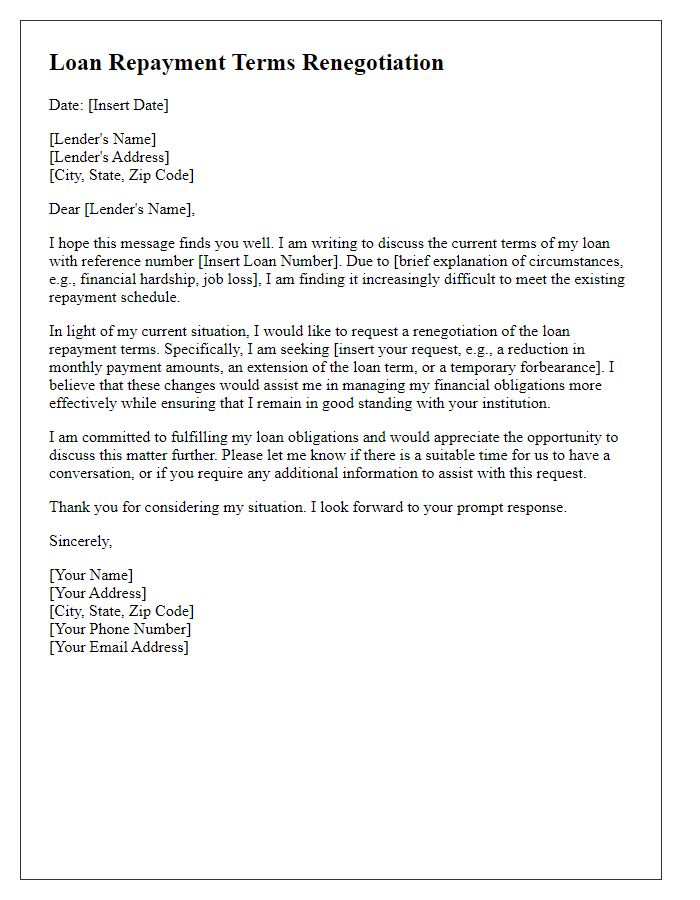

Reason for Modification Request

A loan repayment terms modification request often arises due to significant life changes or financial disruptions. Events such as job loss, unexpected medical expenses, or major home repairs can lead borrowers to seek adjustments. For instance, a borrower facing a job displacement may find their income reduced by up to 50%, directly impacting their ability to meet monthly payments. Financial institutions, like banks or credit unions, often assess such requests to accommodate the borrower's new circumstances while minimizing risk. It's vital to include accurate personal details, current repayment amounts, and proposed adjustments, such as extended payment terms or reduced interest rates, to provide a comprehensive overview of the request.

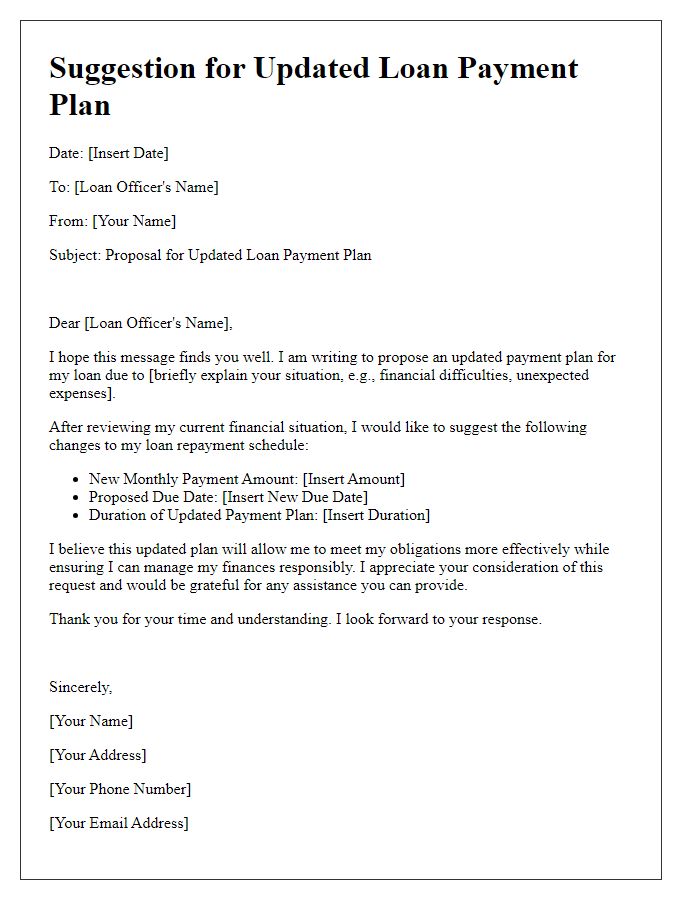

Proposed New Terms

Loan repayment terms modification can significantly impact borrowers and lenders. Understanding the new proposed terms is essential. For instance, adjusting the monthly payment amount from $500 to $350 can ease financial pressure. Extending the loan term from 5 years to 7 years may reduce the monthly obligations but increase the overall interest paid. A lowered interest rate from 6% to 4% can provide substantial savings over the life of the loan, making repayment more manageable. Clear communication about these terms is critical to ensure both parties understand the modifications and their implications on financial planning and obligations.

Contact Information for Follow-Up

A loan repayment terms modification can significantly impact financial obligations for both parties involved. Clear communication is crucial during this process to ensure understanding and agreement on new terms. Homeowners (such as those in loan agreements with banks like Chase or Wells Fargo) might need to provide updated contact information (phone numbers, emails) for effective follow-up. Essential to this process are documents like financial statements (showing current income levels) and proof of hardship (such as job loss or medical expenses). Timely responses to modification requests can lead to more favorable terms and prevent potential defaults on loans (which can negatively affect credit scores, such as FICO scores).

Comments