Hey there! Are you ready to take control of your financial future? Enrolling in a financial literacy program is an exciting step toward understanding how to manage your money effectively and make informed decisions. Whether you're looking to budget better, save for a big purchase, or invest wisely, this program has something for everyone. Let's dive in and explore how you can empower yourself financiallyâread on to learn more!

Personalization

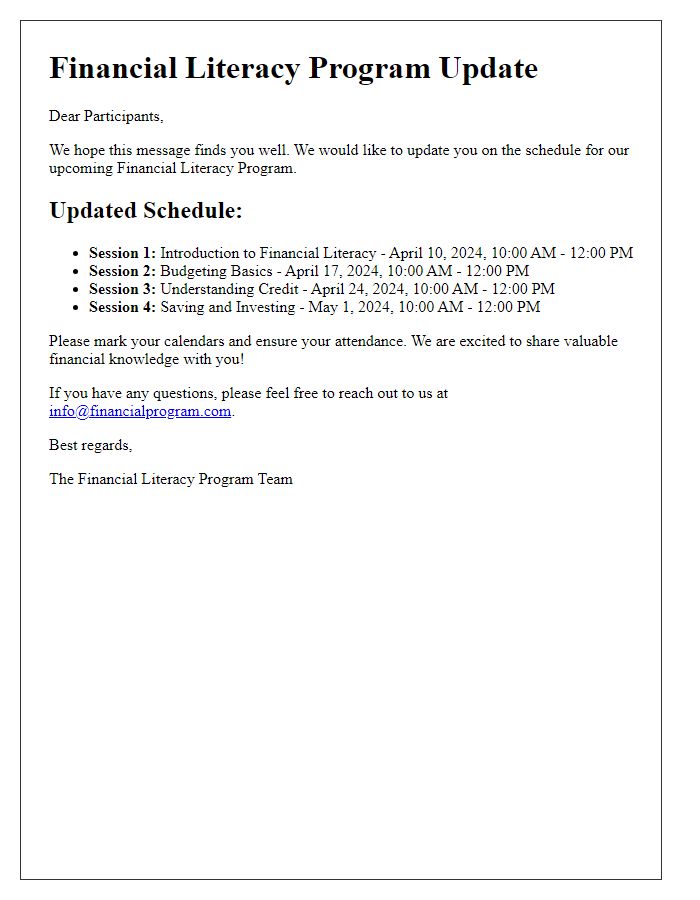

Enrolling in a financial literacy program can significantly enhance individuals' understanding of personal finance, budgeting, and investment strategies. This program, designed specifically for participants of diverse financial backgrounds, often spans 8 to 12 weeks, featuring weekly sessions conducted in community centers like the Plaza Community Center in Los Angeles. Each session includes interactive workshops, expert speakers from financial institutions such as Wells Fargo and Chase, and practical exercises focused on real-world scenarios. Participants can expect to learn essential concepts related to managing debt, improving credit scores (averaging 700 in the U.S.), and creating effective savings plans, aimed at empowering them with the knowledge necessary to make informed financial decisions and achieve long-term financial well-being.

Clear Call-to-Action

Financial literacy programs empower individuals with essential knowledge regarding personal finance management, including budgeting (evaluating income against expenses), investing (allocating resources for future gains), and saving strategies (setting aside funds for emergencies). Programs often target various demographics, such as teenagers preparing for adulthood or working adults aiming for better financial security. Enrollment processes typically utilize online platforms (available 24/7) to facilitate registration and provide resources. Engaging content includes workshops (interactive educational sessions), webinars (virtual seminars), and resource materials (guides, toolkits). Clear calls-to-action encourage participants to take the necessary steps toward financial empowerment, ensuring they can navigate complex financial landscapes effectively.

Program Benefits

The financial literacy program offers essential knowledge and skills to empower individuals in managing personal finances effectively. Participants will learn about budgeting techniques, understanding credit scores, investment strategies, and retirement planning, all crucial for long-term financial health. This program often includes interactive workshops and simulations, providing real-life scenarios that enhance understanding. Participants may also gain access to resources such as financial planning tools and expert consultations, fostering a supportive environment for addressing financial challenges. Overall, enrolling in this program can lead to improved financial decisions, increased confidence in money management, and a clearer path toward financial stability and independence.

Contact Information

Effective financial literacy programs empower individuals with essential skills to manage their finances wisely. Programs like the National Endowment for Financial Education (NEFE) provide resources to improve budgeting techniques and investment strategies. Accessibility to these resources, often available in both online and in-person settings, allows participants of all ages, from high school students to retirees, to enhance their financial understanding. Additionally, incorporating real-life scenarios, such as creating a personal savings plan or understanding credit scores, can significantly improve retention and practical application of financial knowledge. Potential outcomes include increased savings rates and improved credit management, contributing to overall financial well-being in communities.

Enrollment Instructions

Financial literacy programs play a crucial role in enhancing individuals' understanding of money management, budgeting, investing, and credit. Participants, typically ranging from high school students to adults, can expect to engage in interactive sessions that cover essential topics like debt management, savings strategies, and retirement planning. Enrollment procedures often include filling out a registration form, which may request personal information such as name, age, and contact details, as well as financial background. Many programs, often held in community centers or universities, may require a registration fee, which can vary between $10 and $50, depending on the program's duration and resources. It is essential for potential participants to check session schedules, typically offered multiple times a year, to ensure they can commit to the full course duration, commonly spanning six weeks with weekly two-hour sessions.

Letter Template For Financial Literacy Program Enrollment Samples

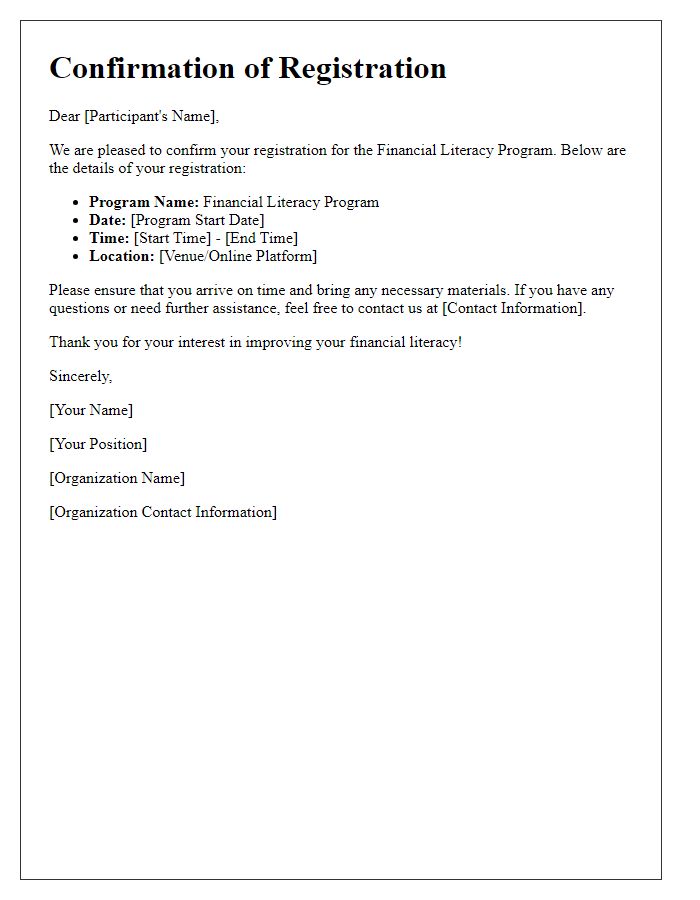

Letter template of confirmation for financial literacy program registration

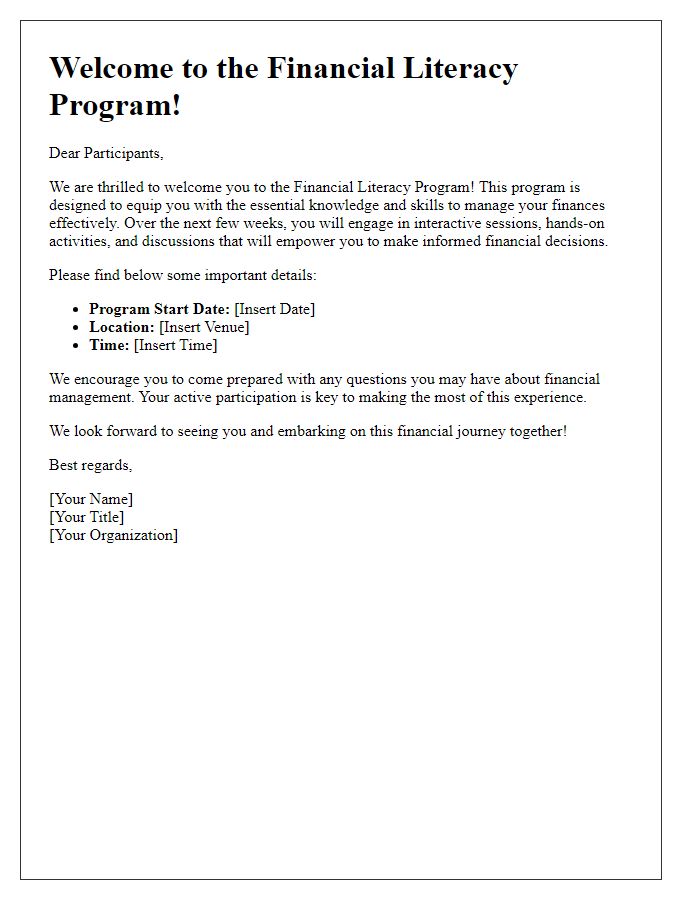

Letter template of welcome to participants of the financial literacy program

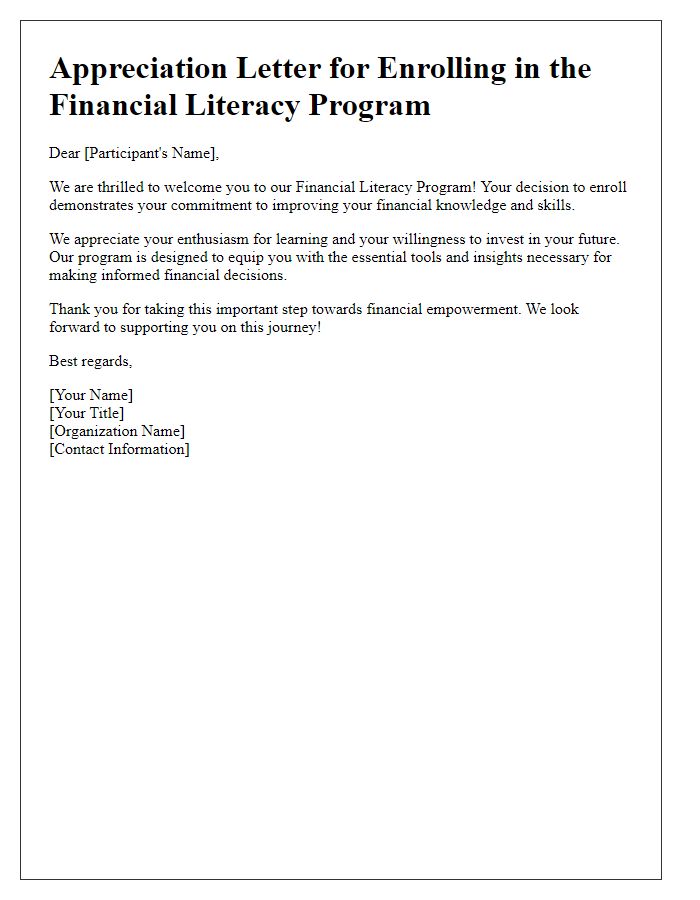

Letter template of appreciation for enrolling in the financial literacy program

Letter template of follow-up for feedback on the financial literacy program

Letter template of completion certificate for the financial literacy program

Letter template of scholarship application for financial literacy program

Comments