Are you considering switching your mortgage but feeling a bit overwhelmed by the options? You're not aloneâmany homeowners find the process daunting, but it doesn't have to be! In this article, we'll break down the benefits of mortgage switching, explore various options available, and provide tips on how to choose the best path for your financial future. So, grab a cup of coffee and read on to discover how you can make the most of your mortgage situation!

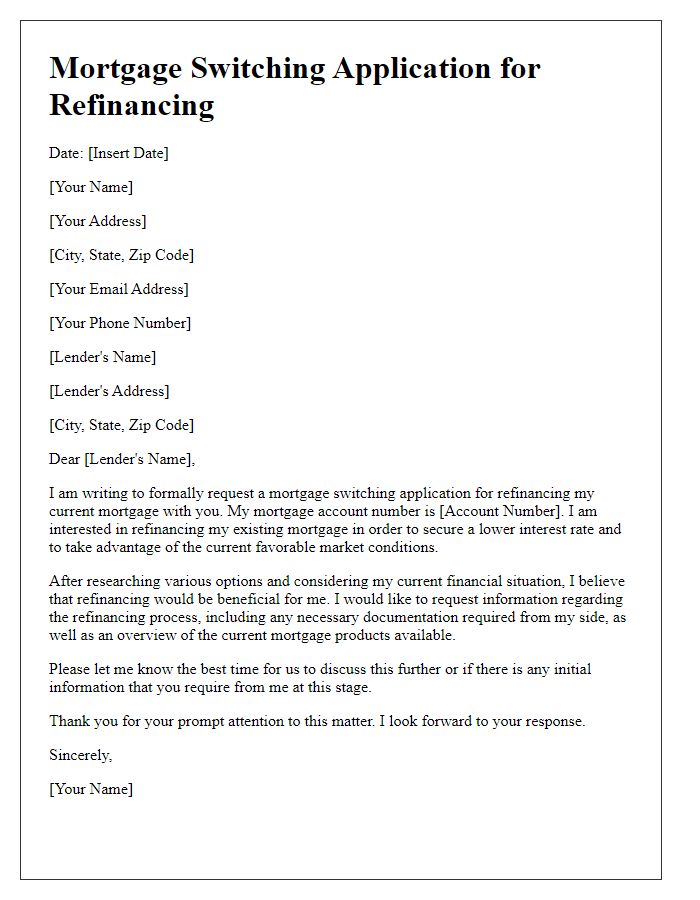

Borrower and Lender Information

Switching mortgage options can provide borrowers with significant savings and enhanced financial flexibility. The borrower, typically an individual or couple seeking to refinance their existing mortgage, must consider factors such as current interest rates, which can fluctuate daily; potential savings over the loan term, often expressed as thousands of dollars; and the lender, which might include established banks like JPMorgan Chase or mortgage companies like Quicken Loans. Loan terms may include 15 or 30-year fixed-rate options, adjustable-rate mortgages (ARMs), or specialized products like FHA loans. It's crucial for borrowers to gather their credit scores and debt-to-income ratios to secure favorable terms. Calculating monthly payments using online mortgage calculators can aid in comparing offers from various lenders, ensuring informed decisions tailored to their financial goals.

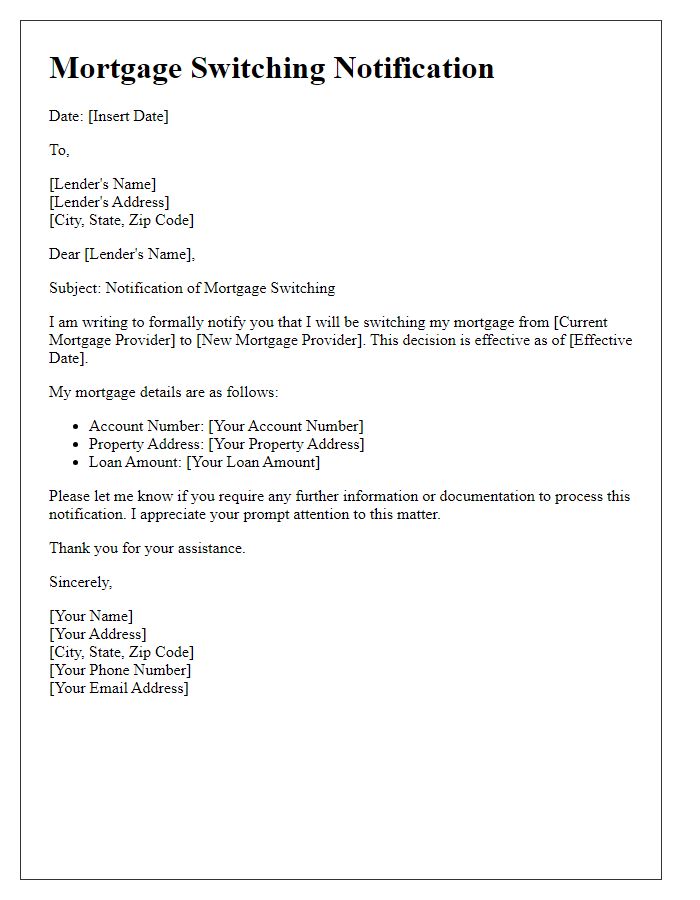

Current Mortgage Details

Mortgage switching options can significantly impact financial stability and long-term savings. The current mortgage details, including the outstanding balance of $250,000, interest rate of 4.5% fixed for 30 years, and terms beginning in January 2010, provide a foundation for evaluating alternatives. Homeowners residing in areas with increasing property values, such as Denver, Colorado, may benefit from refinancing to a lower interest rate to reduce monthly payments or shorten the loan term. Various mortgage products, including adjustable-rate mortgages (ARMs) or cash-out refinancing, can be assessed to capitalize on current market conditions with average rates hovering around 3.2%. Exploring terms offered by different financial institutions, including credit unions and banks, is crucial for making informed decisions that can lead to potential savings of thousands of dollars over the life of the loan.

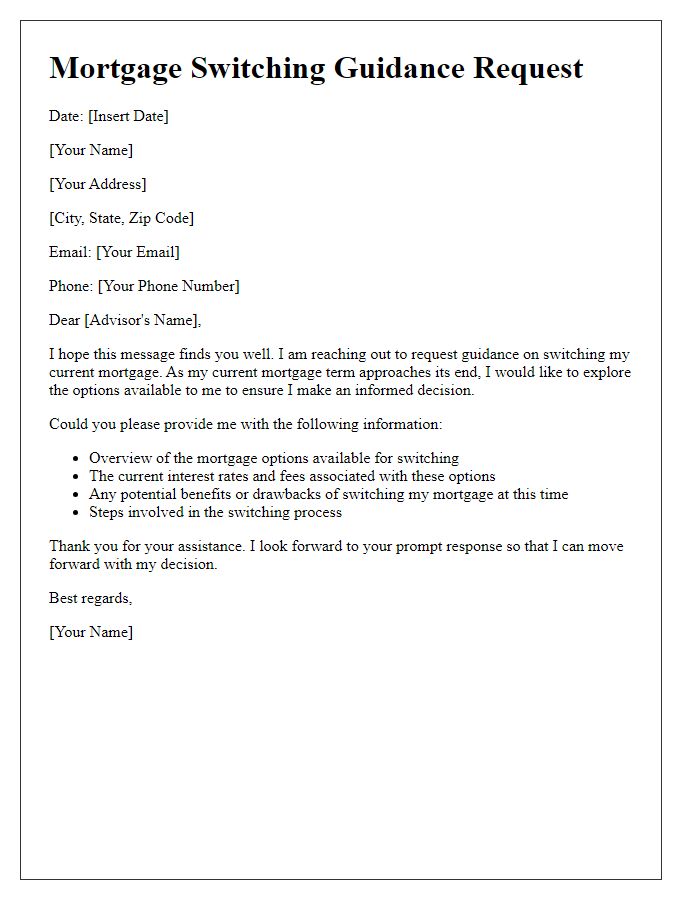

New Mortgage Options and Benefits

Navigating new mortgage options can significantly benefit homeowners seeking to optimize their financial situation. Recently, lenders such as Wells Fargo and Bank of America have introduced competitive interest rates as low as 2.75% for 15-year fixed mortgages, appealing to those looking to refinance. Additionally, programs like the Home Affordable Refinance Program (HARP) may offer valuable opportunities for borrowers with high loan-to-value ratios, while federal initiatives provide limited-time offers that can feature reduced closing costs. Homeowners, especially in areas experiencing rising property values such as Los Angeles and Seattle, stand to gain from these advantageous terms, allowing for enhanced cash flow and increased equity accumulation. Understanding the various products available, including adjustable-rate mortgages (ARMs) and fixed-rate options, empowers individuals to make well-informed decisions tailored to their specific financial situations.

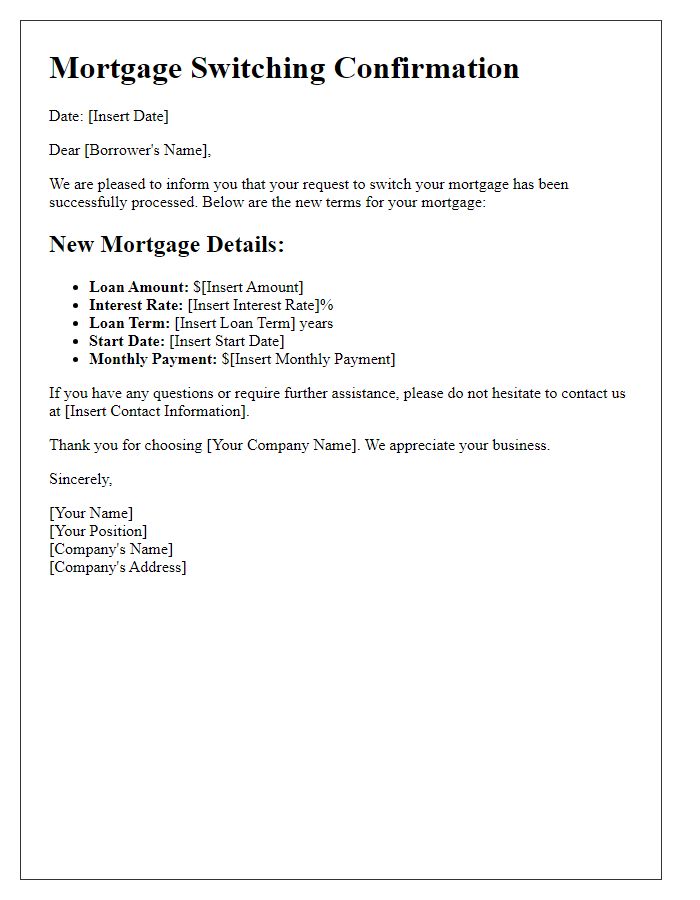

Financial Implications and Comparisons

Mortgage switching offers significant financial implications for homeowners seeking to optimize their loan conditions. Many homeowners assess their current mortgage interest rates, often hovering around 3.5% to 4.5%. Switching to a lower fixed-rate mortgage, potentially as low as 2.5%, can lead to substantial monthly savings, often exceeding $300, depending on loan amount and term length. Additionally, understanding differences in lender fees, such as application charges ($500 to $1,200) and appraisal costs ($300 to $600), is crucial for comprehensive financial analysis. Circumstances like current market trends, which may indicate rising rates due to inflationary pressures, further influence decision-making. Compare various lenders, including national banks and regional credit unions, to identify the best options tailored to unique financial situations. Evaluating potential savings against the costs associated with switching is vital for informed decision-making in managing long-term financial health.

Contact Information for Further Discussion

Mortgage switching options provide potential savings and improved terms for homeowners. Homeowners (those with mortgages) typically seek better interest rates or more flexible agreements. A fixed-rate mortgage offers stability with unchanging monthly payments, while an adjustable-rate mortgage may start lower but could fluctuate over time. Financial institutions, such as banks and credit unions, offer various products, each with distinct benefits and drawbacks, tailored to individual financial situations. Consulting with mortgage brokers or financial advisors can illuminate details on fees, penalties, and potential savings, ensuring informed decisions on the best course of action. Understanding market trends and personal financial goals are essential in this process.

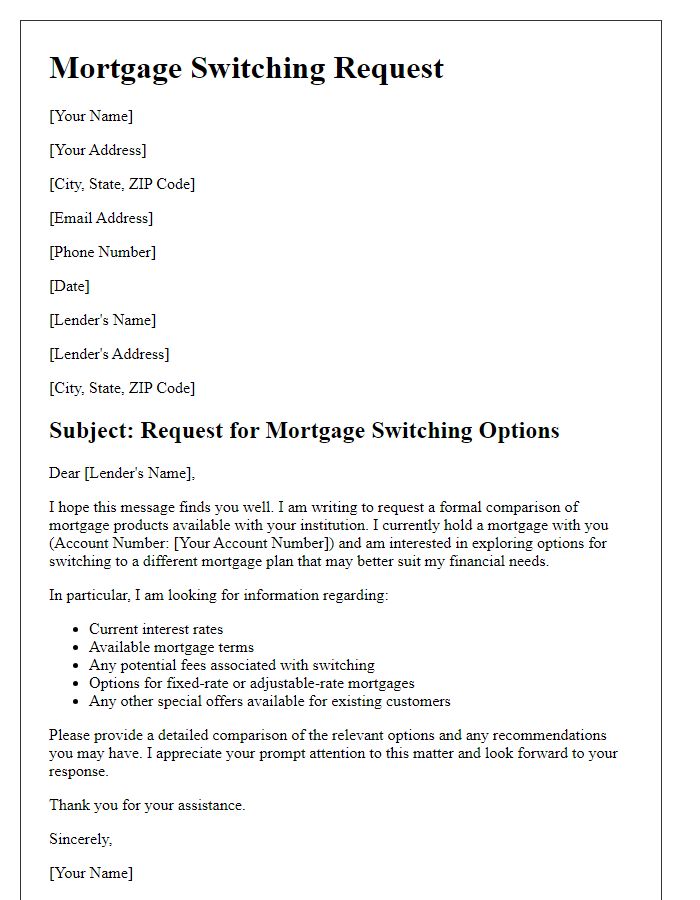

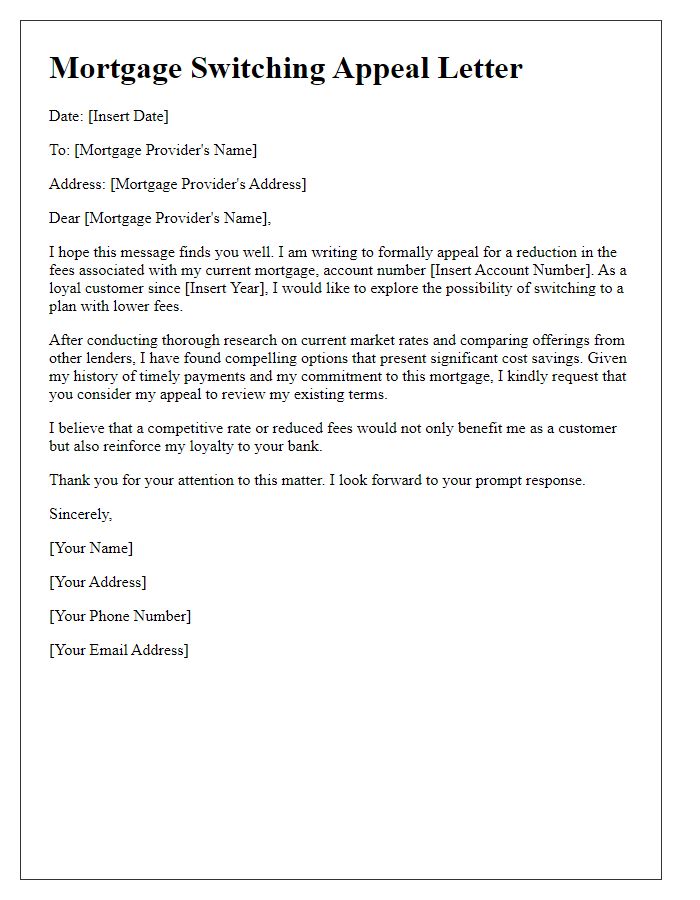

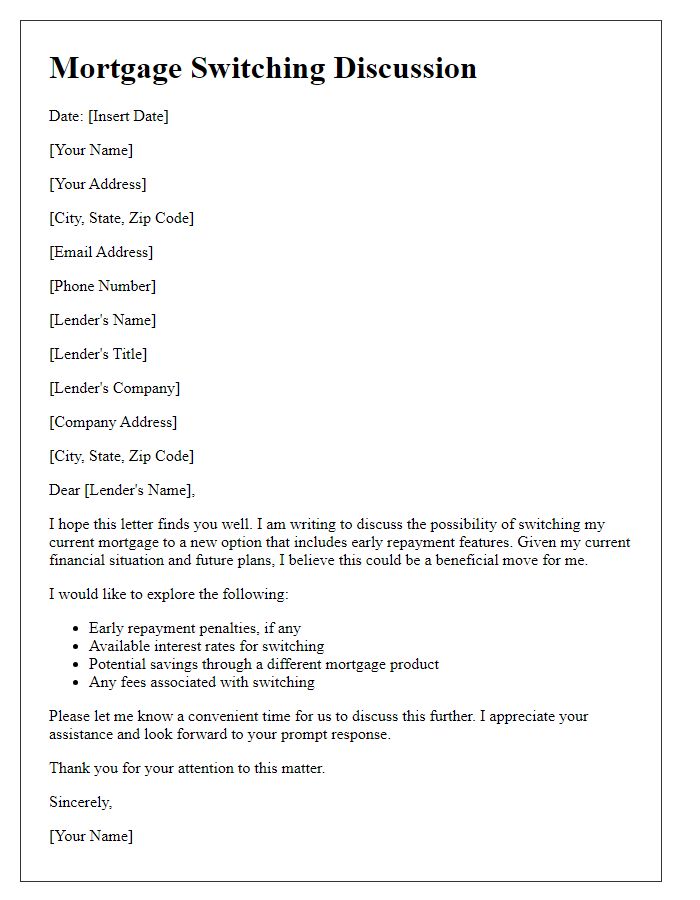

Letter Template For Mortgage Switching Options Samples

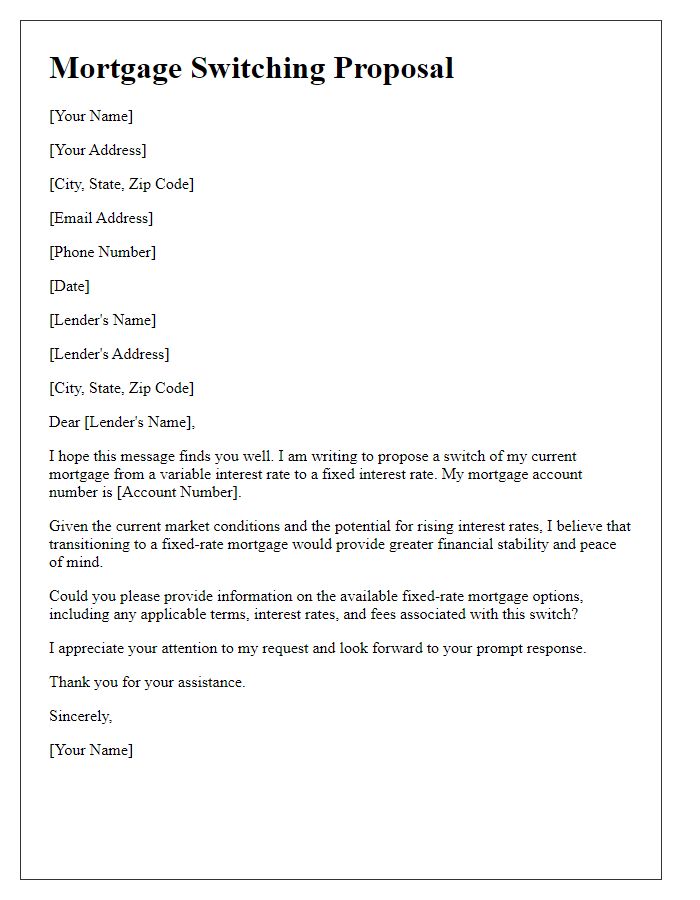

Letter template of mortgage switching proposal for variable to fixed rate

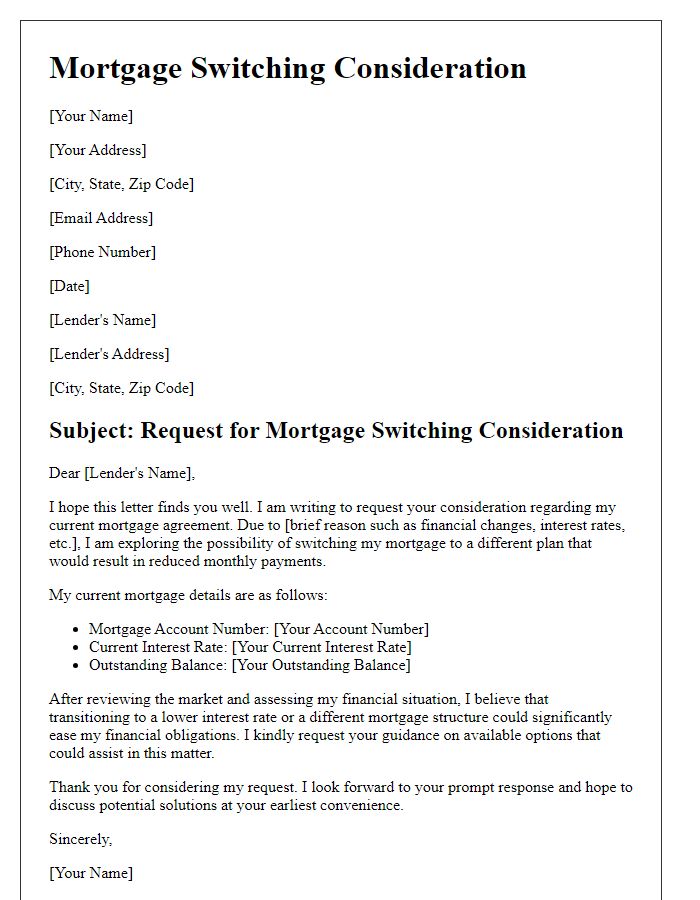

Letter template of mortgage switching consideration for reducing payments

Comments