Thinking about refinancing your mortgage can feel overwhelming, but it doesn't have to be! Whether you're looking to reduce your monthly payments, access your home equity, or secure a better interest rate, a well-crafted letter can set the stage for a smoother process. In this article, we'll guide you through the essential components of a mortgage refinance letter, highlighting tips to make your request stand out. So, if you're ready to take the next step towards financial flexibility, keep reading for valuable insights!

Loan Information and Current Terms

Mortgage refinancing involves analyzing key factors such as loan amount, interest rate, term length, and monthly payments to ensure favorable financial outcomes. Current loan information for a typical mortgage might include a principal balance of $250,000, an interest rate of 4.5% fixed over a 30-year term, resulting in a monthly payment of approximately $1,266. Homeowners considering refinancing should evaluate the potential new terms, which may offer a lower interest rate of 3.5% and a reduced term of 15 years, potentially saving thousands in interest payments over the life of the loan. An assessment of closing costs and any remaining equity in the property, located for instance in Los Angeles, can also impact the overall suitability of the refinancing decision.

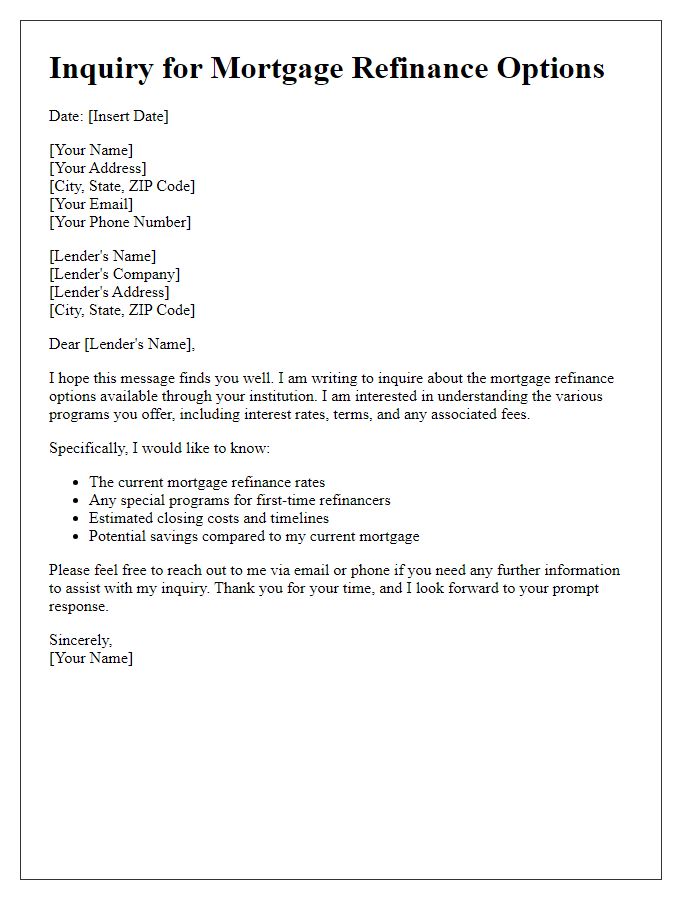

Financial Goals and Objectives

Mortgage refinancing can significantly impact financial goals and objectives, including long-term savings and monthly cash flow management. Lower interest rates (commonly around 3% in recent markets) can reduce monthly payments, increasing disposable income for investments or savings. Additionally, refinancing can consolidate high-interest debt, such as credit cards with APRs exceeding 20%, into a more manageable mortgage payment, often benefiting from tax deductions related to mortgage interest. Furthermore, extending the loan term from 15 years to 30 years can lower monthly payments, although this may increase total interest paid over the life of the loan, reaching figures over $100,000 depending on the principal amount. Careful consideration of current market trends, individual credit scores (for the best rates, a score over 740 is often preferred), and specific financial circumstances is essential in pursuing refinancing as a strategic option for achieving diverse financial goals.

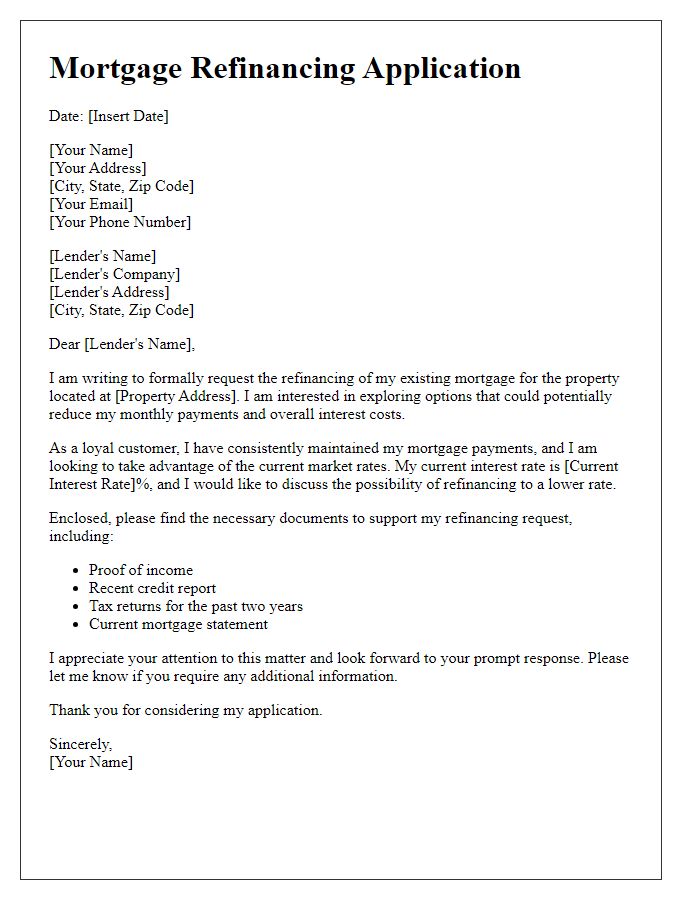

Employment and Income Verification

For mortgage refinance considerations, employment and income verification play crucial roles in determining eligibility and loan amount. Lenders often request documented proof of employment, such as pay stubs from the last 30 days, recent W-2 forms, and possibly tax returns from the past two years, ensuring that borrowers maintain a stable income. Employment verification letters from current employers, detailing job title, duration of employment, and salary can also be essential. Additionally, if borrowers have other sources of income, documents like bank statements or benefit letters should be provided, showcasing a diversified income profile. This thorough verification process helps lenders assess the borrower's financial stability and capacity to meet mortgage obligations.

Property Details and Appraisal Information

When considering mortgage refinance, various property details and appraisal information play a crucial role in the evaluation process. Specific information such as the property address (including city and state), square footage (total living area) which typically ranges from 1,200 to 3,000 square feet for residential homes, and the year built are essential. The appraisal process involves comparing the property to similar homes (comps) in the same neighborhood, often within a 1-mile radius, that have sold within the last six months. Local market trends, including average home sale prices (which may vary significantly between urban and suburban areas), current interest rates (often fluctuating around 3% to 5%), and the overall condition of the property (including any renovations or upgrades, such as kitchen remodels or roof replacements) influence the refinancing decision. A well-documented appraisal report can enhance the borrower's chances of securing favorable refinance terms, potentially resulting in lower monthly payments or shorter loan duration.

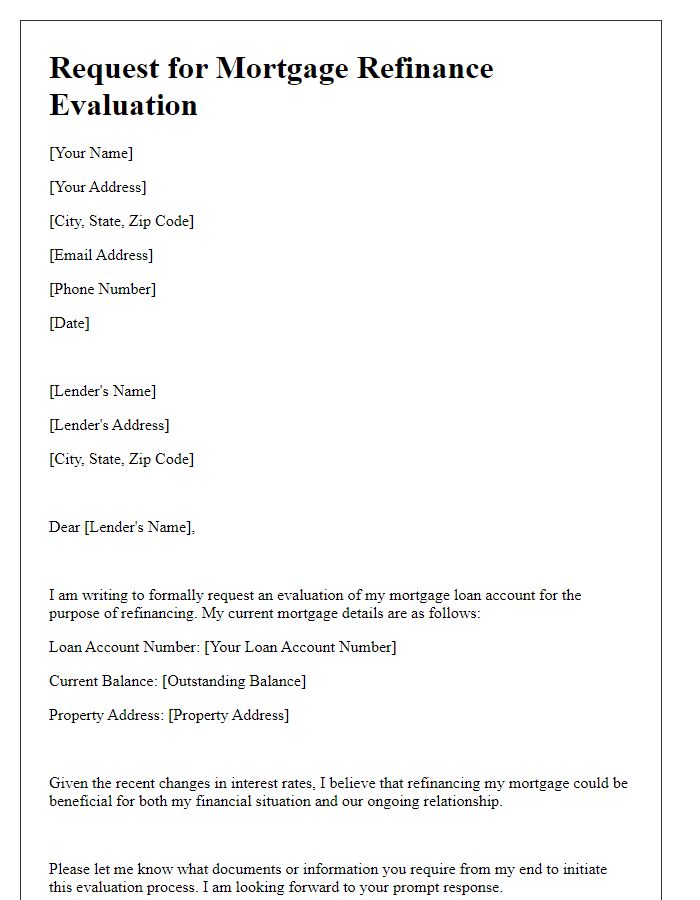

Contact Information and Preferred Communication Method

Mortgage refinancing can significantly impact monthly payments and overall financial health. Contact information, including phone numbers for lenders or brokers, plays a crucial role in facilitating communication. Preferred communication methods, such as email or direct phone calls, ensure efficient discussions regarding loan terms, interest rates, and closing costs. This is particularly important in competitive markets, where timely information can lead to better refinancing opportunities and rates, potentially saving homeowners thousands of dollars over the life of the loan. Staying organized with clear contact details and communication preferences streamlines the refinancing process, enhancing the overall experience for borrowers.

Comments