Creating an estate account can seem daunting, but it's an essential step in managing your loved one's financial affairs. Whether you're acting as an executor or a trustee, understanding the process is crucial for ensuring everything runs smoothly. You'll need specific documents and information to complete the account setup, but don't worryâit's not as complicated as it sounds! Dive in with us as we break down the estate account creation process and provide helpful tips along the wayâread more to get started!

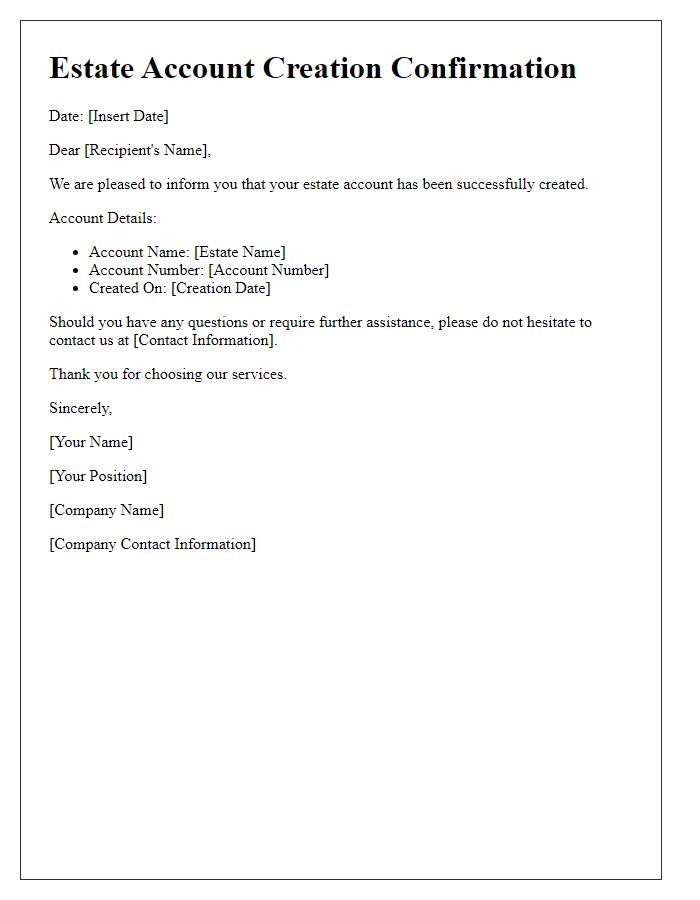

Account Holder Information

Estate account creation requires comprehensive documentation to ensure a smooth process. The account holder, typically the estate representative, must provide essential personal details such as full name, Social Security number, and date of birth. Additionally, the legal documentation, including the death certificate of the deceased and a last will, must be submitted to verify authority. Financial institutions may also require identification documents, such as a driver's license or passport, to establish the account holder's identity. Furthermore, information regarding beneficiaries, along with their contact details and relationship to the deceased, is crucial for the distribution of assets. Understanding the required forms and procedures can significantly expedite the estate account setup.

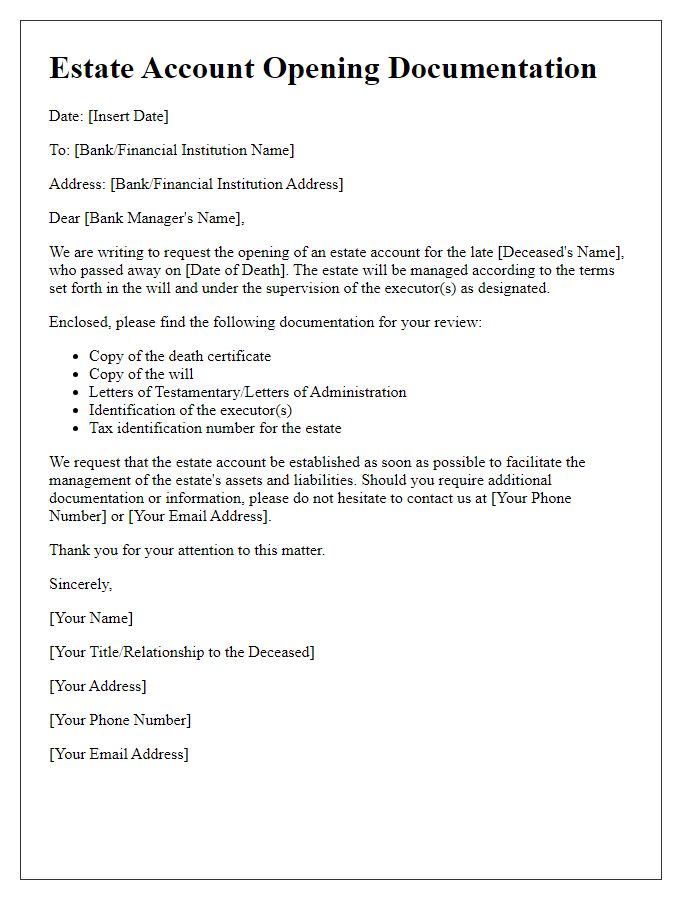

Legal Documentation Requirements

The process of creating an estate account typically involves several legal documentation requirements to ensure compliance with state laws and regulations surrounding estate management. Essential documents often include a certified copy of the death certificate, which verifies the individual's passing and serves as a critical piece of evidence in probate proceedings. A copy of the Last Will and Testament (if applicable) provides the legally binding instructions that outline the distribution of the deceased's assets, alongside an executor appointment document that names the individual responsible for managing the estate. Additionally, identification documents such as a government-issued photo ID of the executor are required to confirm their identity. In some jurisdictions, court-issued Letters Testamentary may also be necessary, granting the executor authority to act on behalf of the estate. Financial institutions may ask for the estate tax identification number (EIN) obtained from the IRS, which is essential for tax reporting purposes. Various forms may be prescribed by banks and estates must comply with local probate procedures to finalize the account setup effectively.

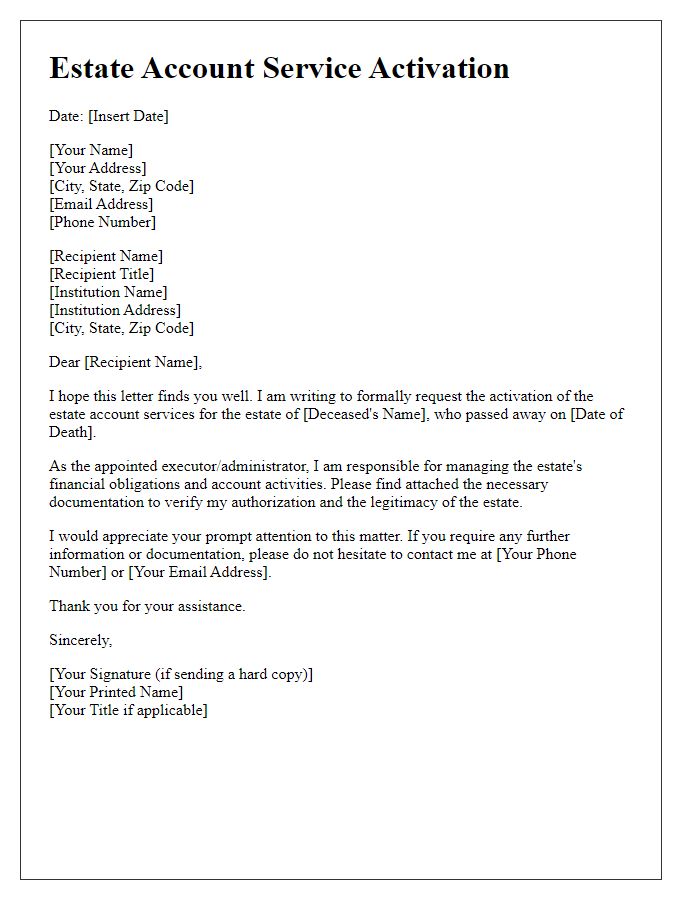

Authorization and Signatories

Estate account creation requires clear authorization and identification of signatories involved in managing the estate's financial matters. Documentation must include a notarized will (in many jurisdictions, must be a legally binding document specifying estate distribution), death certificate (official record confirming the passing of the deceased), and identification (government-issued IDs of all signatories). Bank requirements typically include a trust account application (formal request to open a trust fund), signatures of all authorized individuals, and possibly a resolution or agreement outlining the responsibilities and powers of each signatory. Adhering to these procedural necessities ensures compliance with banking regulations and effective management of the estate's assets. Importance of detailed records cannot be overstated, as they streamline account management and provide transparency among beneficiaries.

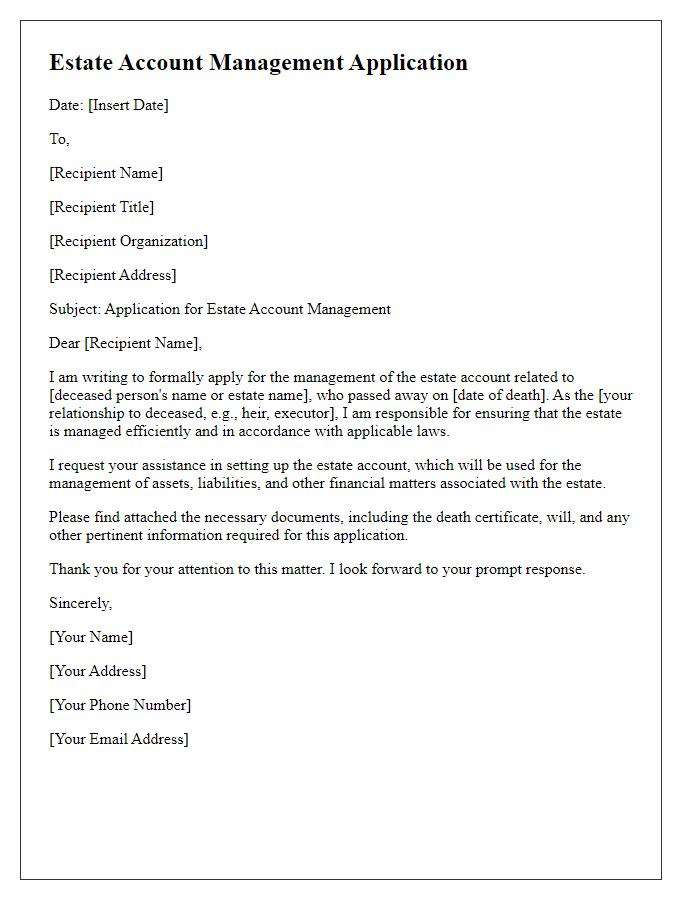

Account Type and Features

Creating an estate account involves selecting the appropriate account type that offers features tailored for managing estate funds efficiently. Common account types include Trust Accounts and Estate Settlement Accounts. Trust Accounts typically provide tax advantages and asset protection for beneficiaries, allowing for a smoother transfer of wealth. Estate Settlement Accounts help manage the financial aspects of an estate, providing access to funds for settling debts, paying taxes, and distributing assets according to the last will and testament. Both account types may require specific documentation like the death certificate, will, and identification of the executor or administrator to ensure proper account setup. Financial institutions may also offer unique features such as online management, detailed transaction records, and dedicated customer support for estate inquiries, enhancing overall management effectiveness.

Compliance and Security Measures

The process of creating an estate account requires strict compliance with regulatory standards, ensuring the secure management of sensitive information regarding assets and beneficiaries. Identification documents such as a government-issued ID (passport or driver's license), Social Security number, and proof of address (utility bill or lease agreement) are essential to verify the identity of the estate representative. Compliance with the 2016 Uniform Trust Code, as well as state-specific estate laws, must be followed diligently. Security measures include encryption protocols for online forms, two-factor authentication during account setup, and secure data storage to protect against unauthorized access. Regular audits and monitoring are implemented to ensure adherence to compliance regulations and to maintain the integrity of the account.

Comments