Are you ready to dive into the exciting world of currency trading? Opening a currency trading account can be a game-changer for your financial journey, allowing you to tap into global markets and enhance your investment portfolio. With the right guidance and tools at your disposal, you can master the art of forex trading and unlock new opportunities for growth. Curious to learn more about how to get started? Let's explore the essentials together!

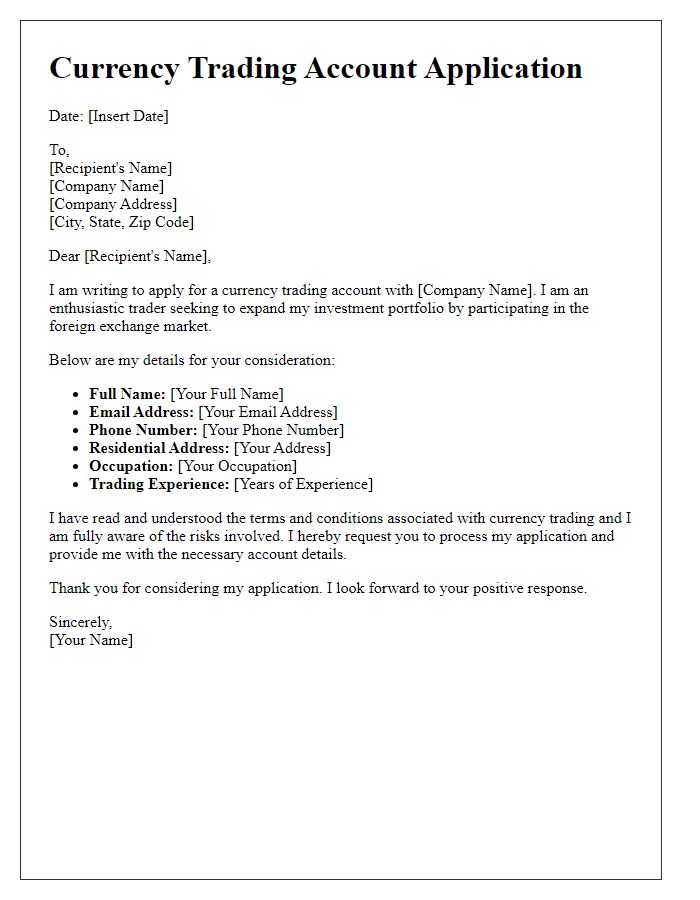

Personal Identification Details

Establishing a currency trading account requires comprehensive personal identification details. Necessary documents include a government-issued photo ID, such as a passport or driver's license, ensuring verification of identity where names, birthdates, and photos are crucial. Additionally, proof of address documentation, like utility bills or bank statements, dated within the last three months, is essential for confirming residence. Financial information, including employment details, annual income, and investment experience, provides brokers insights into trading knowledge and risk tolerance. Finally, tax identification numbers, like Social Security Numbers in the United States or National Insurance Numbers in the United Kingdom, facilitate regulatory compliance and taxation assessments.

Financial Background and Experience

Establishing a currency trading account requires understanding market dynamics and personal financial objectives. A solid financial background encompasses knowledge of various trading strategies, risk management principles, and economic indicators, such as GDP, inflation rates, and unemployment figures that influence currency value fluctuations. Relevant experience in trading platforms like MetaTrader 4 or 5 facilitates navigating foreign exchange markets effectively. Additionally, familiarity with trading instruments, including Forex pairs (e.g., USD/EUR), and derivatives aids in making informed decisions. Building financial acumen through continuous education, market analysis, and practice is essential for successful trading. Networking with seasoned traders and participating in forums can also provide invaluable insights.

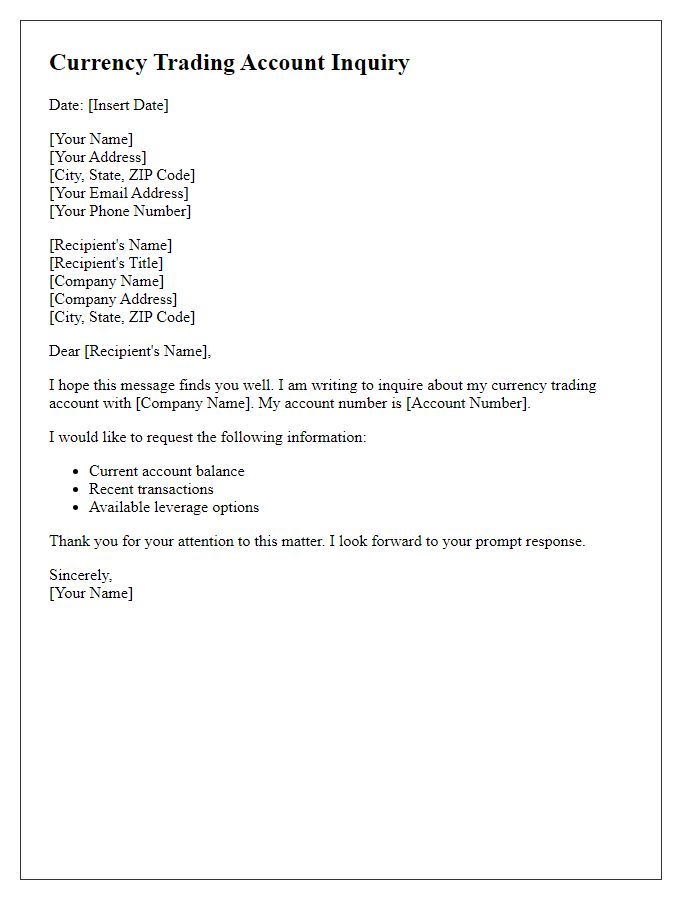

Trading Objectives and Goals

Currency trading accounts, often referred to as Forex accounts, are essential for individuals aiming to participate actively in the foreign exchange market. With an estimated daily trading volume exceeding $6 trillion, traders engage in currency pairs, speculating on price movements. Objectives for these accounts may include capital appreciation through tactical trading strategies, risk management to protect investments, and diversification of portfolio assets. Traders often aim for specific goals, such as achieving a yearly return percentage, minimizing drawdowns, or maximizing return on investment (ROI). Additionally, understanding economic indicators, geopolitical events, and market trends can significantly influence trading success, impacting decision-making and profitability in this dynamic market.

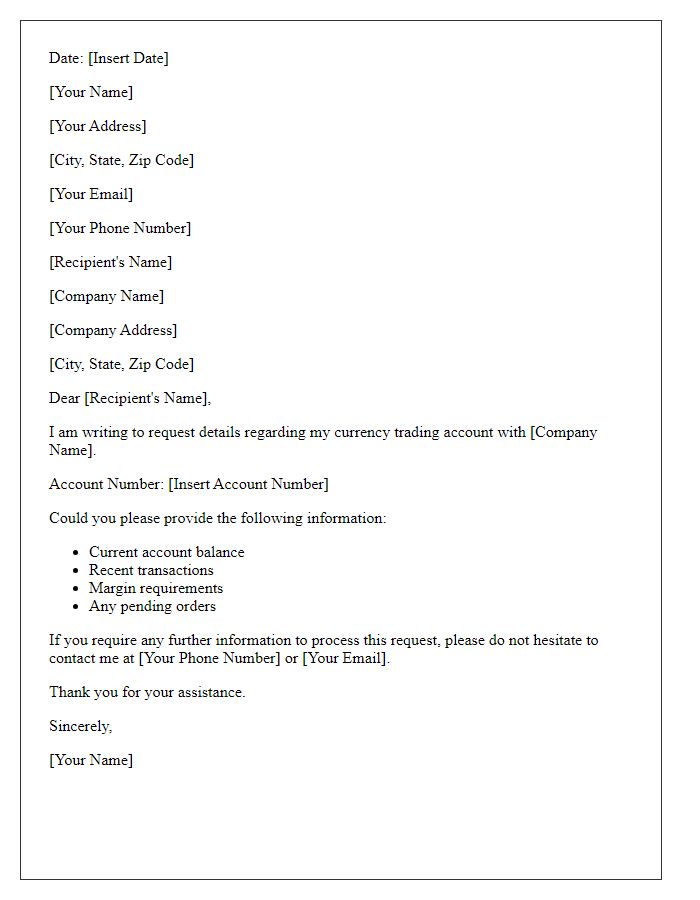

Risk Management Preferences

In currency trading, understanding and implementing risk management preferences is crucial for safeguarding investments. Traders typically utilize strategies like stop-loss orders, which automatically close trades at predetermined levels, minimizing potential losses. A common recommended risk tolerance level is 1% of total account equity per trade, helping to protect significant portions of capital during volatile market conditions. Diversification into various currency pairs, such as EUR/USD and GBP/JPY, can also mitigate risk exposure. Furthermore, traders may analyze the Economic Calendar, which outlines upcoming financial events and indicators, allowing for informed decision-making regarding market volatility and potential price movements.

Regulatory Compliance and Acknowledgments

Establishing a currency trading account requires adherence to various regulatory standards aimed at ensuring market integrity and protecting investors. Financial authorities, such as the U.S. Commodity Futures Trading Commission (CFTC) and the Financial Conduct Authority (FCA) in the UK, impose regulations that mandate comprehensive documentation and verification processes, including Know Your Customer (KYC) procedures. Acknowledgment of risks associated with trading highly volatile currencies is crucial; significant fluctuations can result in substantial gains or losses. Furthermore, understanding margin requirements and leverage ratios is essential for effective risk management. Compliance is not only a legal obligation but also a commitment to ethical trading practices within the dynamic landscape of foreign exchange markets.

Comments