Are you tired of sifting through endless statements to find your account activity? We've got you covered with a comprehensive letter template that simplifies the process and highlights your key transactions. Whether you're managing personal finances or tracking business expenses, this summary will make things clearer than ever. Stick around to dive deeper into how our template can streamline your financial overview!

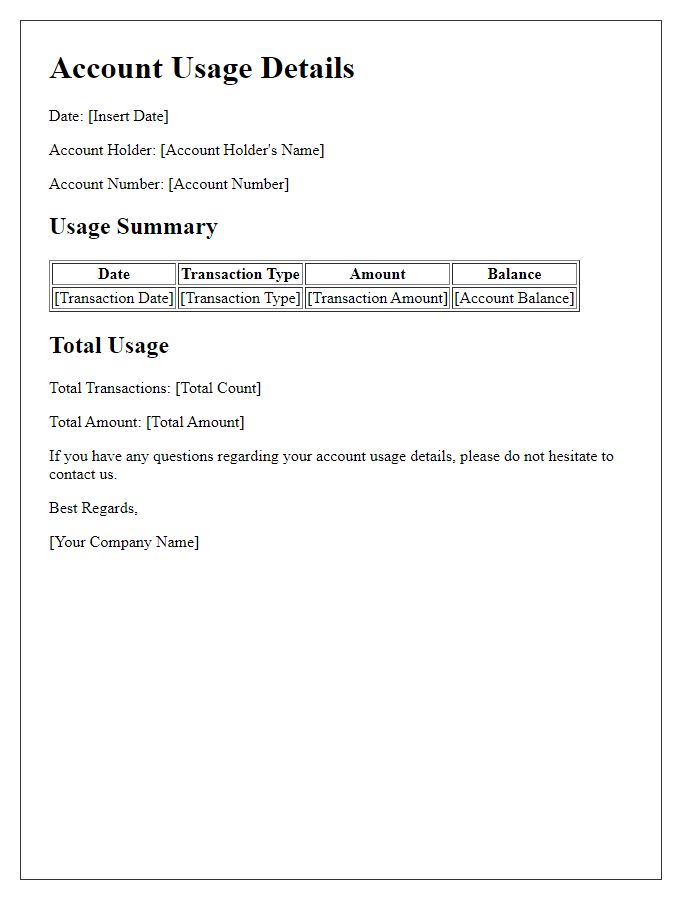

Customized Header

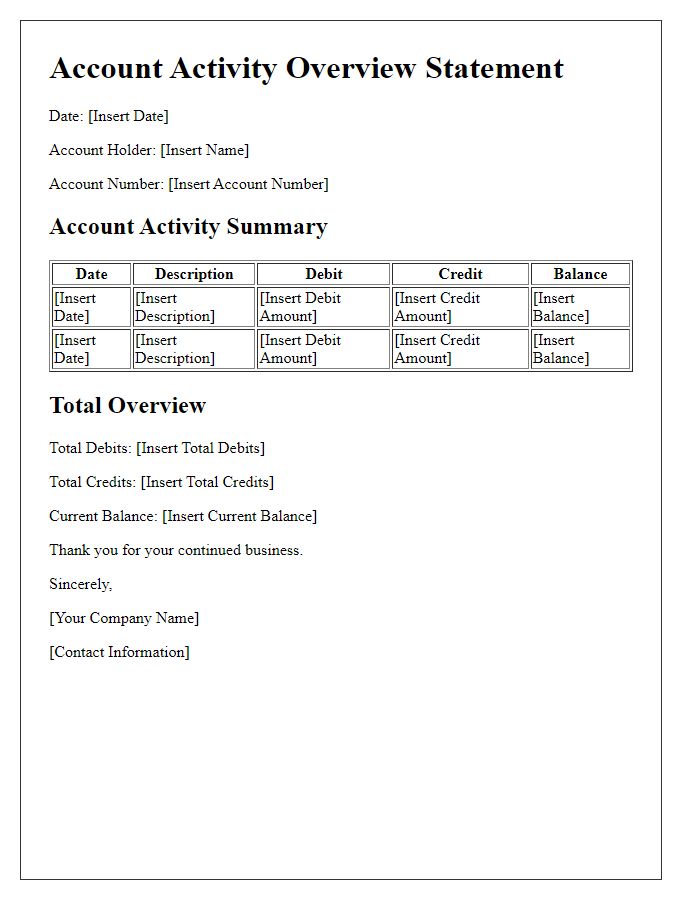

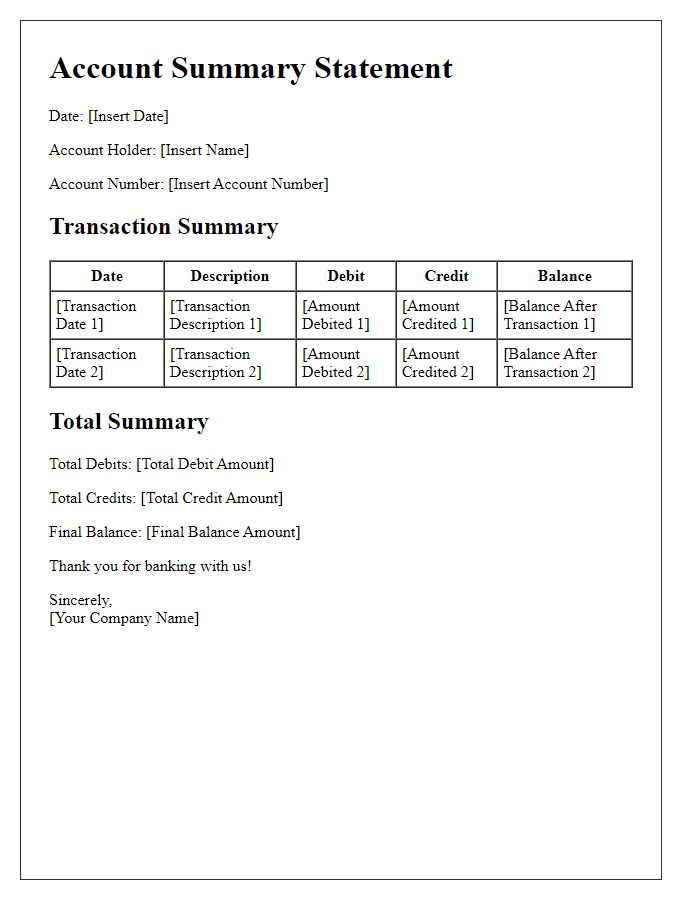

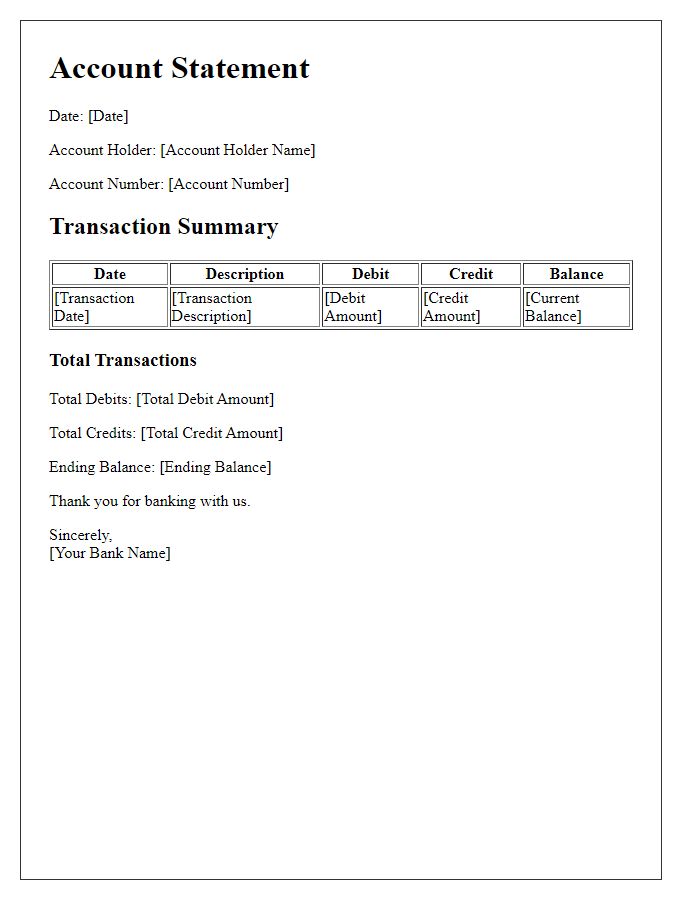

A customized account activity summary statement provides an overview of transactions for account holders. It includes essential data such as account number (typically a 10-12 digit identifier), statement period (for example, January 1 to January 31, 2023), and total account balance at the end of the month (this may vary based on transactions). Transaction details may list dates (format: MM/DD/YYYY), amounts (in currency, often USD or EUR), and descriptions of each transaction, providing clarity on spending patterns. Categories for transactions, such as deposits, withdrawals, and fees, help clients understand their financial activity better, contributing to effective personal budgeting. A clear, concise layout improves readability and assists users in tracking their financial status easily.

Account Information

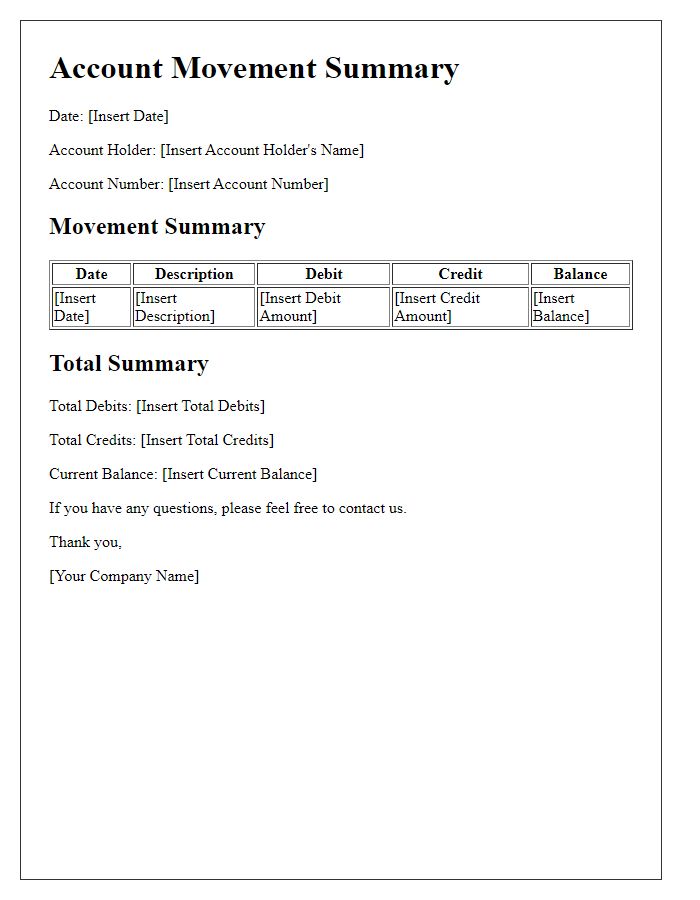

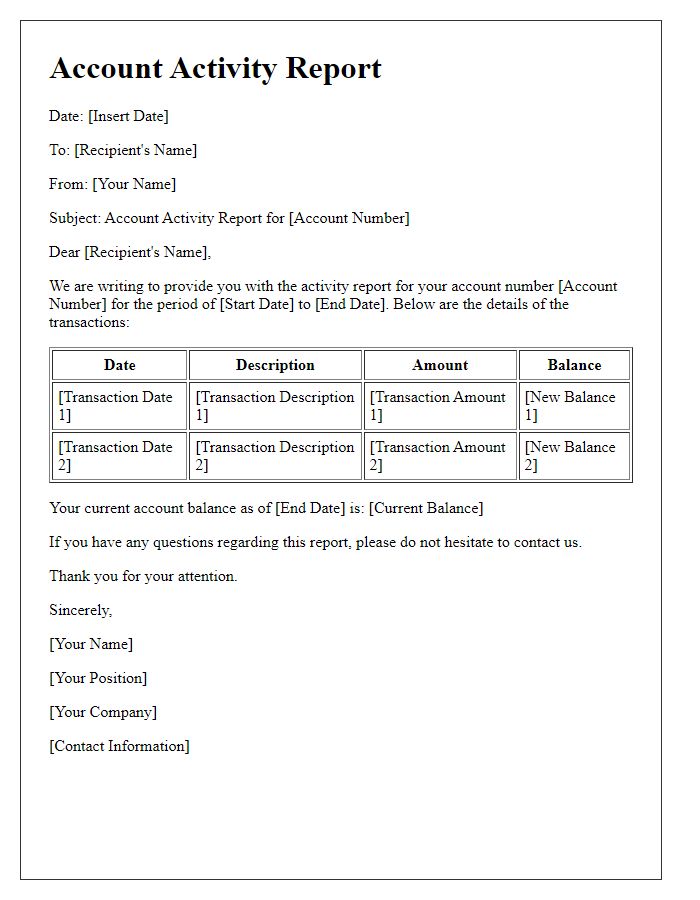

Account activity summaries provide a comprehensive overview of financial transactions within a specified period. These summaries typically include key details such as transaction dates, descriptions, amounts, and current balances. Regularly generated statements, often monthly, ensure account holders remain informed of their financial status. For instance, a bank account statement may list deposits, withdrawals, and fees associated with the account, while investment accounts may detail gains, losses, and dividends accrued. Timely access to these summaries aids individuals in managing their finances effectively and making informed decisions about budgeting and spending.

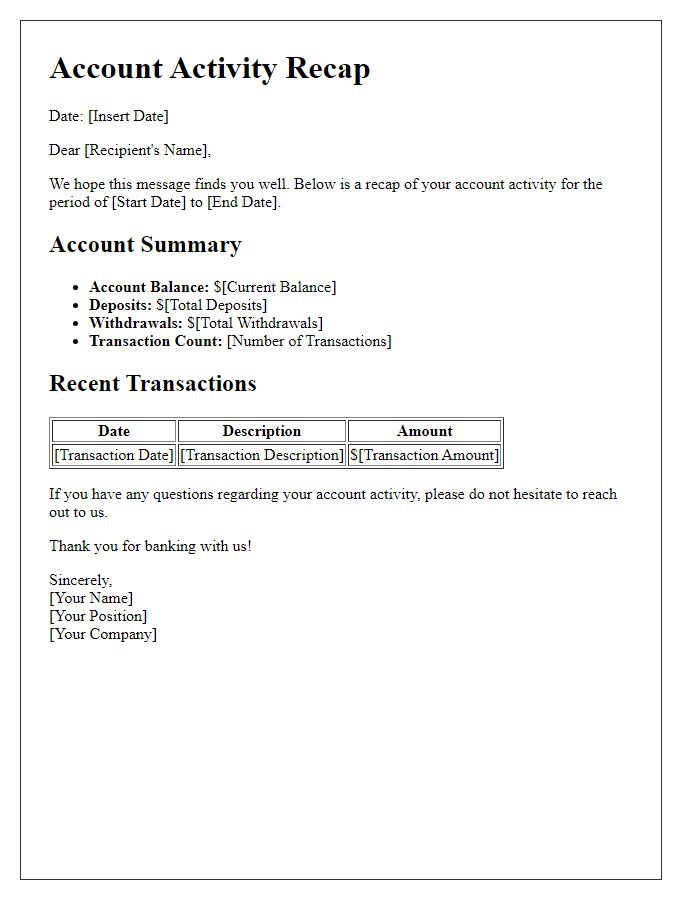

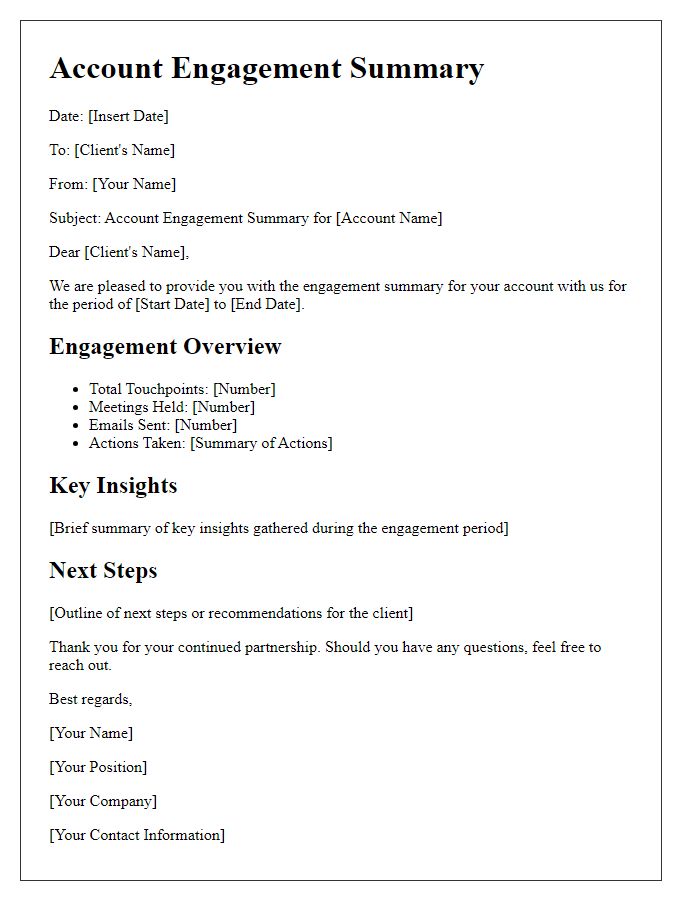

Activity Overview

An account activity summary statement provides a concise overview of financial transactions within a specific period. This statement includes key date ranges, such as monthly or quarterly periods, ensuring clarity on account movements. Notable transactions might encompass deposits, withdrawals, and interest accruals. For example, a deposit of $5,000 on January 15, 2023, from a direct transfer can affect the total account balance significantly. Additionally, recurring payments like a $150 utility bill due on the first of each month contribute to regular expenses. Highlighting the final balance at the end of the statement period, such as the total for March 31, 2023, enables account holders to assess overall financial health effectively.

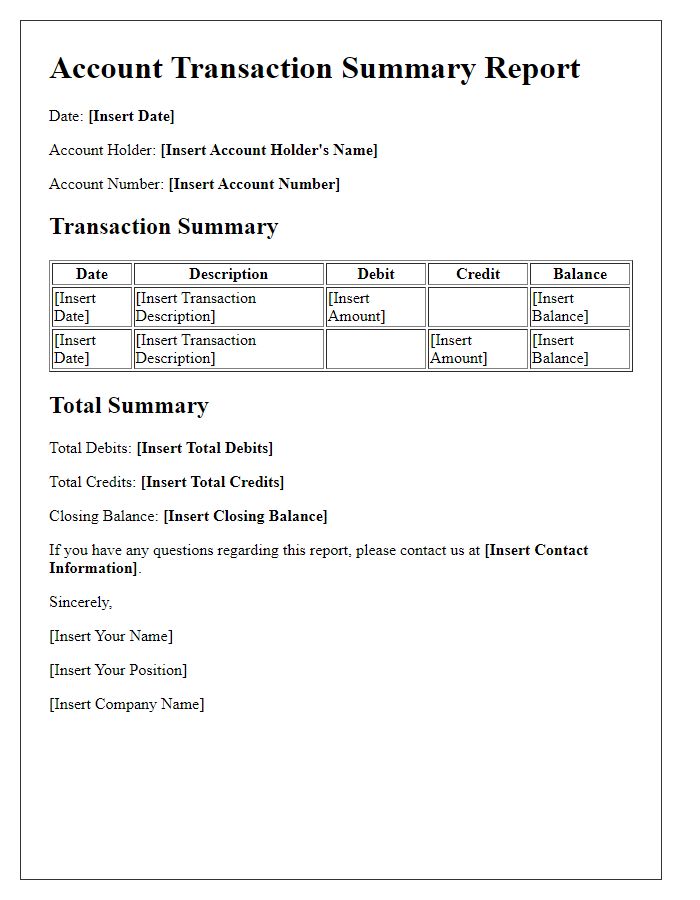

Highlighted Transactions

The account activity summary statement provides a clear overview of significant transactions within the given period. These highlighted transactions include deposits, withdrawals, and payment remittances, offering insights into financial behavior. For example, a substantial deposit of $5,000 on January 15th, 2023, indicates an increase in income sources, while an ATM withdrawal of $300 on February 2nd, 2023, may reflect personal spending habits. Payment remittances, such as a $1,200 transfer on March 10th, 2023, to a utility company can signal recurring expenses. This summary allows for better budgeting decisions and financial planning moving forward.

Contact Information

An account activity summary statement must include essential contact information for clear communication and organization. Include the account holder's full name clearly at the top, ensuring accuracy for identification. Display the account number prominently, allowing for immediate association with specific transactions. List the current address, including street name, city, state, and zip code, which facilitates correspondence and any necessary verifications. Also provide a daytime phone number, ensuring accessibility for inquiries or clarifications. Lastly, include an email address, offering an additional, often faster, channel for communication and information exchange related to account activities.

Comments