Are you ready to take the next step towards your dream home? A loan pre-approval confirmation letter is a crucial step in your home-buying journey, as it helps you understand your financial capabilities and strengthens your credibility as a buyer. In this article, we'll explore what a loan pre-approval confirmation letter entails and why it's important for your mortgage process. Join us as we dive deeper into this essential topic and uncover valuable tips for your home financing journey!

Loan Approval Amount

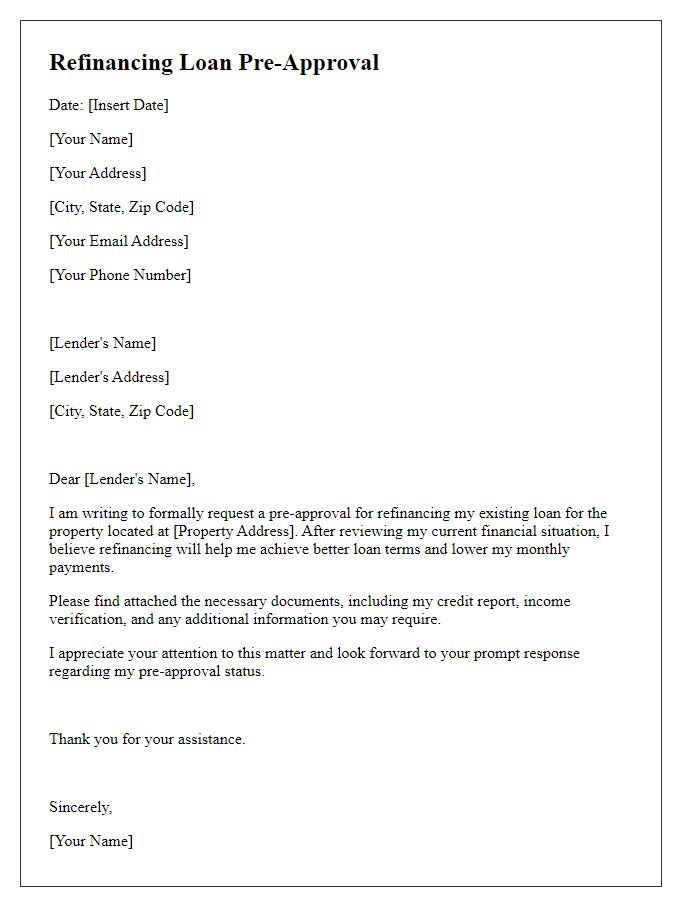

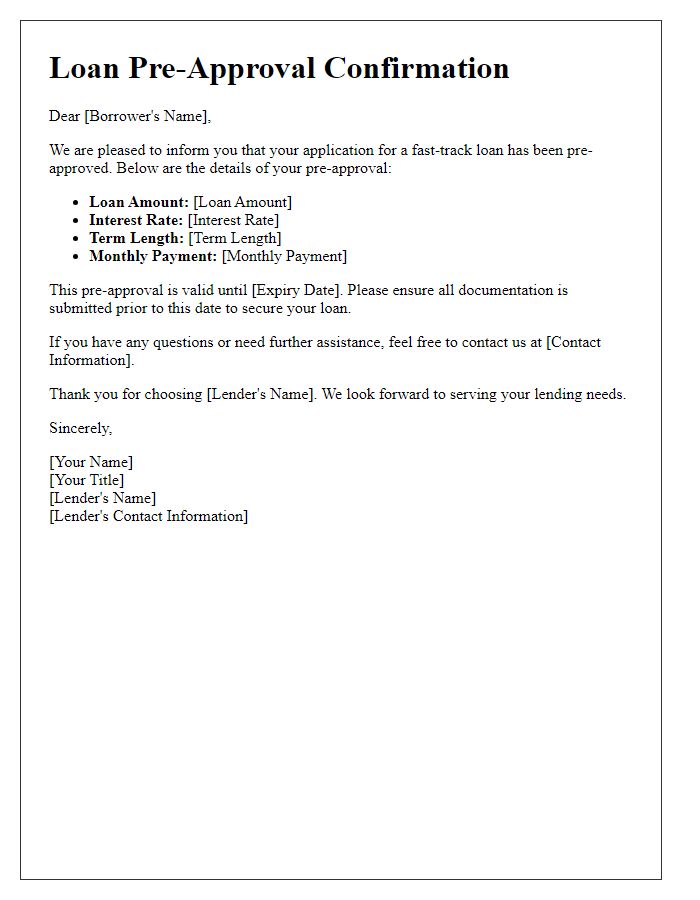

Loan pre-approval confirmation provides borrowers with a clear understanding of their financial capacity. This document outlines the loan approval amount, which is a crucial figure for prospective homebuyers. Typically, lenders base this figure on factors such as credit score, income verification, debt-to-income ratio, and down payment size. For example, a borrower with a stable annual income of $75,000 might receive a pre-approval for up to $300,000, allowing for a potential home purchase in metropolitan areas like San Francisco or New York City, where property values are significantly higher. This confirmation ensures that buyers can confidently engage in the real estate market with a pre-approved budget, streamlining the home buying process.

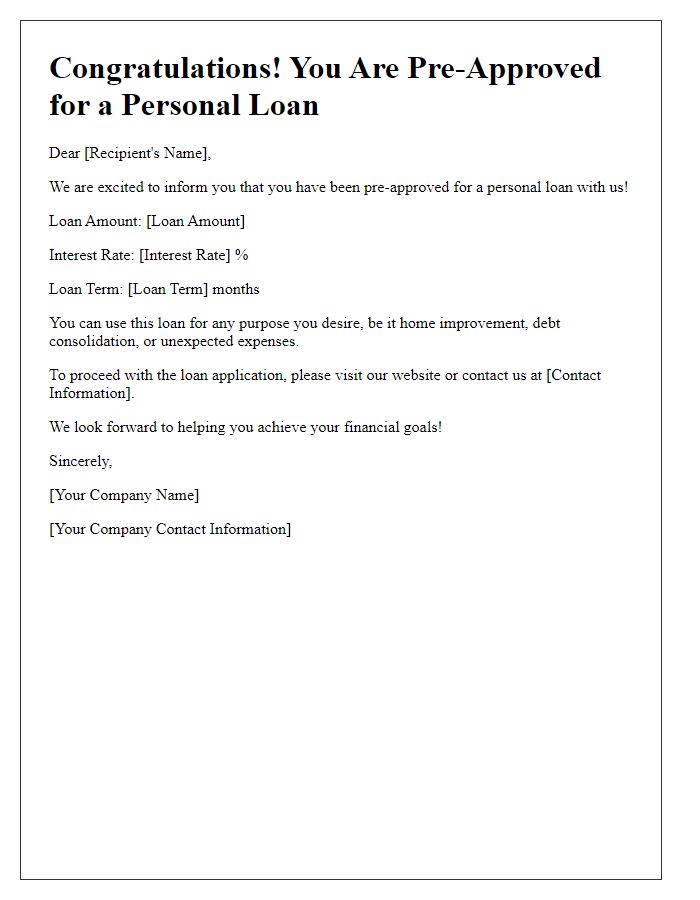

Interest Rate and Terms

Loan pre-approval confirmation signifies a lender's initial assessment of a borrower's eligibility for financing. This process typically involves evaluating the borrower's credit score, income, employment history, and debt-to-income ratio. Interest rates, which can fluctuate based on market conditions, typically range between 3% to 6% for conventional loans, impacting monthly payment amounts significantly. Terms of the loan can vary widely, with common durations being 15 or 30 years, and this affects overall cost and monthly obligations. Understanding these details is crucial for borrowers when planning their financial futures.

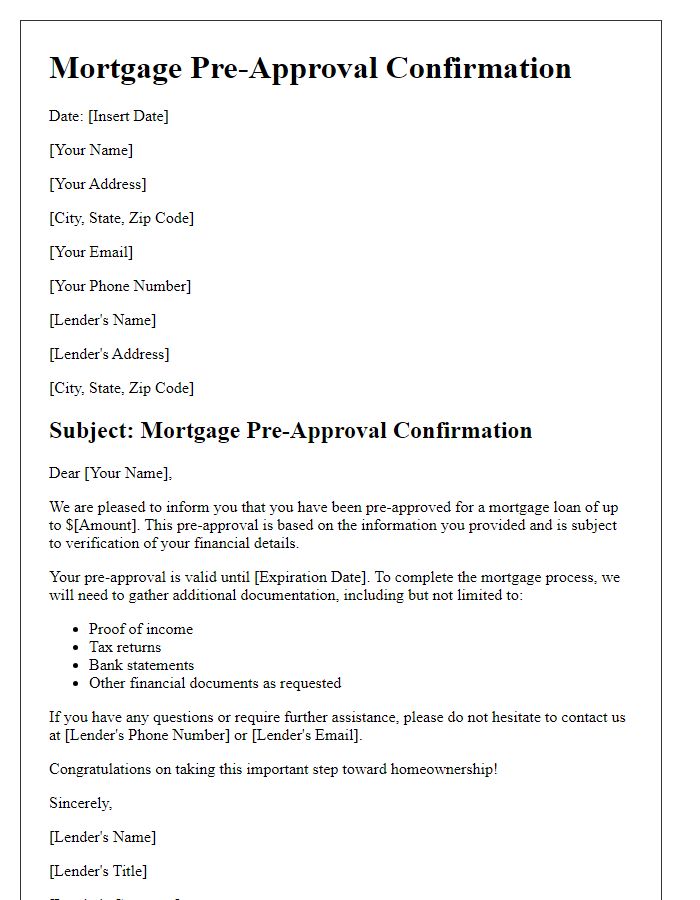

Expiration Date of Pre-Approval

Confirmation of loan pre-approval is an important step for prospective homebuyers. The pre-approval status indicates that a lender, such as a bank or credit union, has evaluated the financial profile, including credit score, income, and debt-to-income ratio, of the borrower. This assessment results in a specific loan amount offered by the lender, allowing buyers to set an appropriate budget for their home search. The expiration date of the pre-approval letter is typically set 60 to 90 days from the date of issuance. This time frame requires borrowers to close the purchase process before the expiration to avoid re-evaluation, which may change loan terms based on any alterations in the borrower's financial situation. Potential borrowers should be aware of this timeframe to ensure timely action in their home buying journey.

Property Address (if applicable)

Loan pre-approval is a critical step in the home-buying process. Successful pre-approval indicates that a lender, such as a bank or credit union, has evaluated an applicant's financial situation. This includes reviewing credit scores, income documentation, and debt-to-income ratios. The property address, if applicable, is often included in the pre-approval letter, providing a specific location of interest, which can enhance the buying process. Typically, pre-approval letters are valid for a limited time, often around 90 days, requiring buyers to act promptly in their home search or risk starting the process anew. Buyers can demonstrate their seriousness to sellers with pre-approval letters, thus increasing competitiveness in a dynamic real estate market.

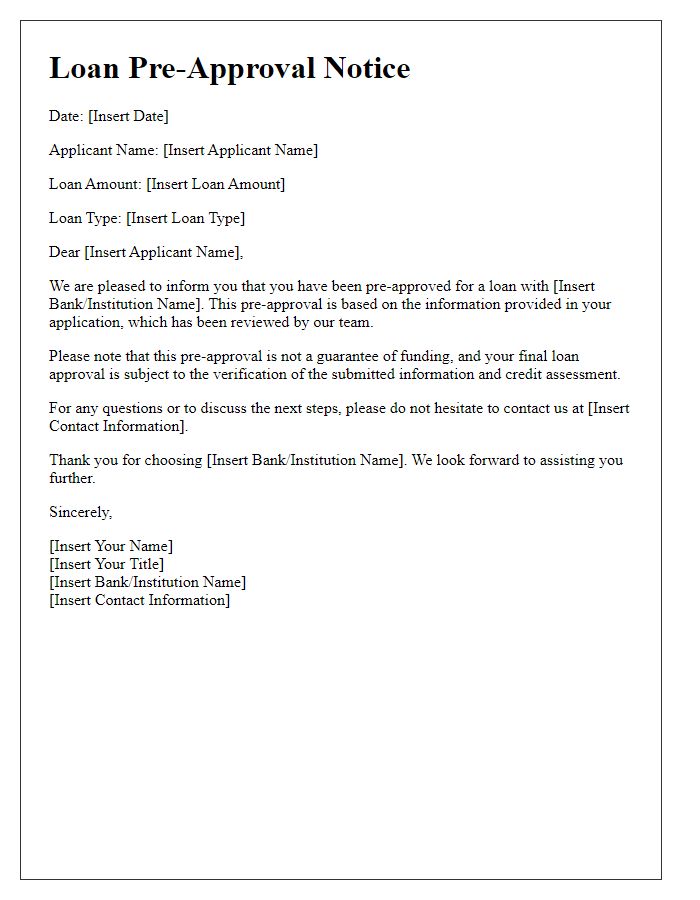

Conditions and Requirements

Loan pre-approval confirmation can be a pivotal step in the borrowing process for prospective homeowners. The bank or financial institution typically outlines specific conditions that must be met to finalize the loan. Essential documentation may include proof of income, such as pay stubs and tax returns, which verify employment status and financial stability. Credit score checks will be conducted to assess borrower risk, usually requiring a minimum score of 620 for conventional loans. Additionally, property appraisal is necessary to confirm the home's market value. Some lenders may mandate a debt-to-income ratio below 43%, ensuring responsible borrowing. Lastly, any changes in financial status during the approval process must be reported immediately to avoid jeopardizing the loan offer.

Comments