Are you feeling overwhelmed by unexpected overdraft penalties on your bank account? It's a common issue that can leave anyone scratching their head, especially when fees pile up without clear warning. In this article, we'll break down what these penalties mean, how they occur, and ways to avoid them in the future. So, stick around to learn how to take control of your finances and dodge those pesky fees!

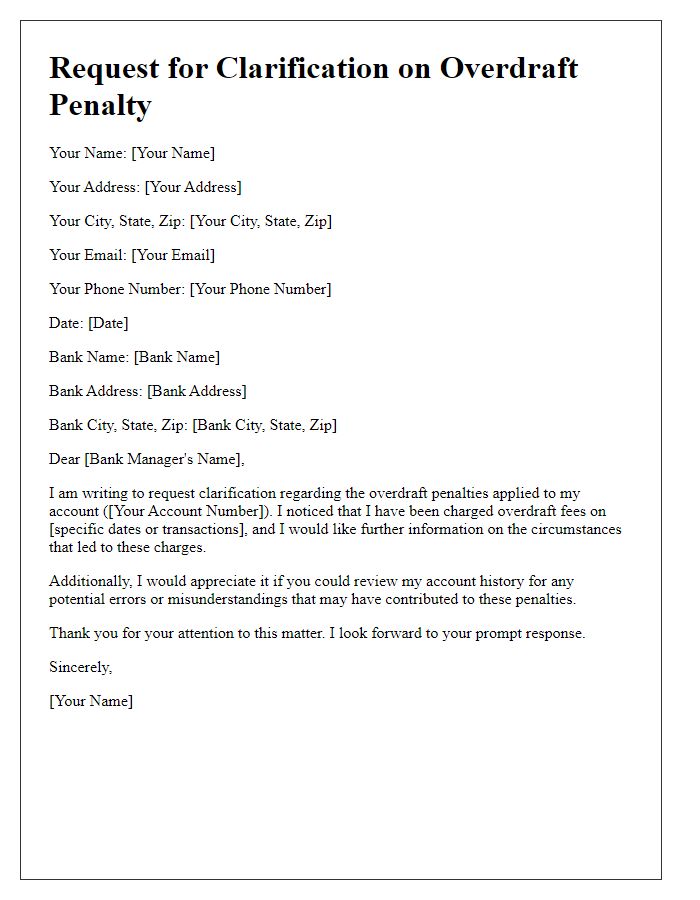

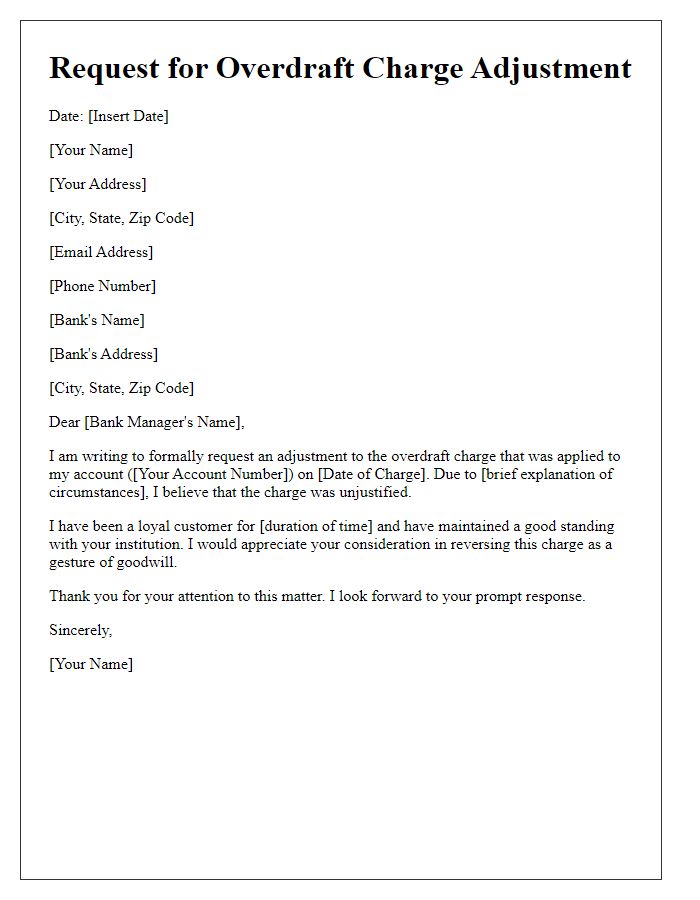

Account Details and Identification

The overdraft penalty can significantly impact personal finances, especially for bank account holders with checking accounts. The penalty fee, often ranging from $30 to $35 per transaction, can accumulate quickly when multiple overdrafts occur within a month. Account details, including the account number (unique identifier for transaction tracking), account holder name (individual or business registered with the bank), and bank name (financial institution managing the account), are critical for resolving discrepancies. Identification methods, such as Social Security Number (for individuals) or Employer Identification Number (for businesses), may also be required to verify the account owner during inquiries or disputes regarding overdraft penalties. Understanding these components can help account holders navigate potential fees more effectively.

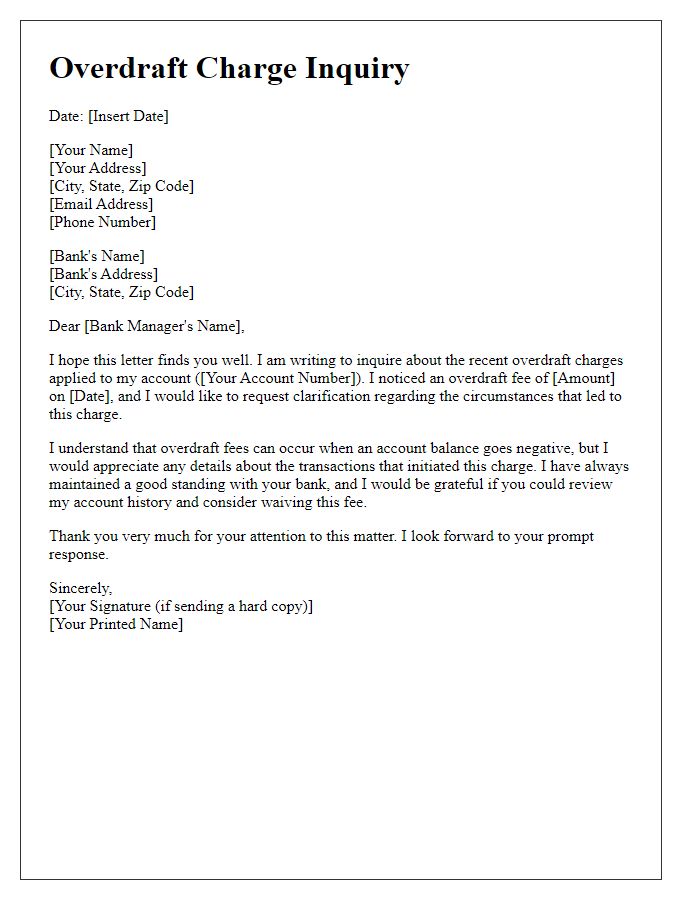

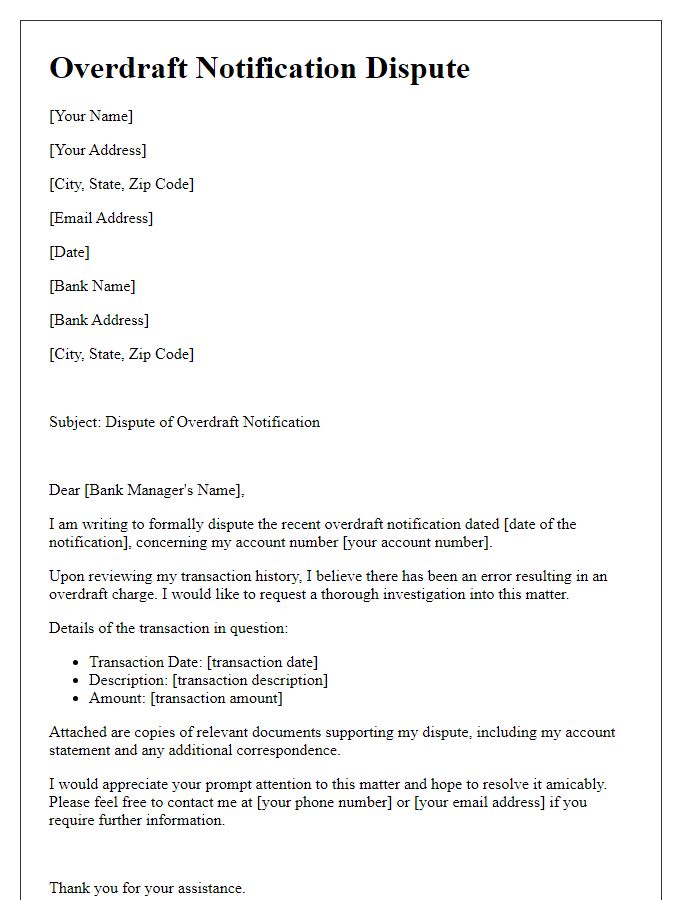

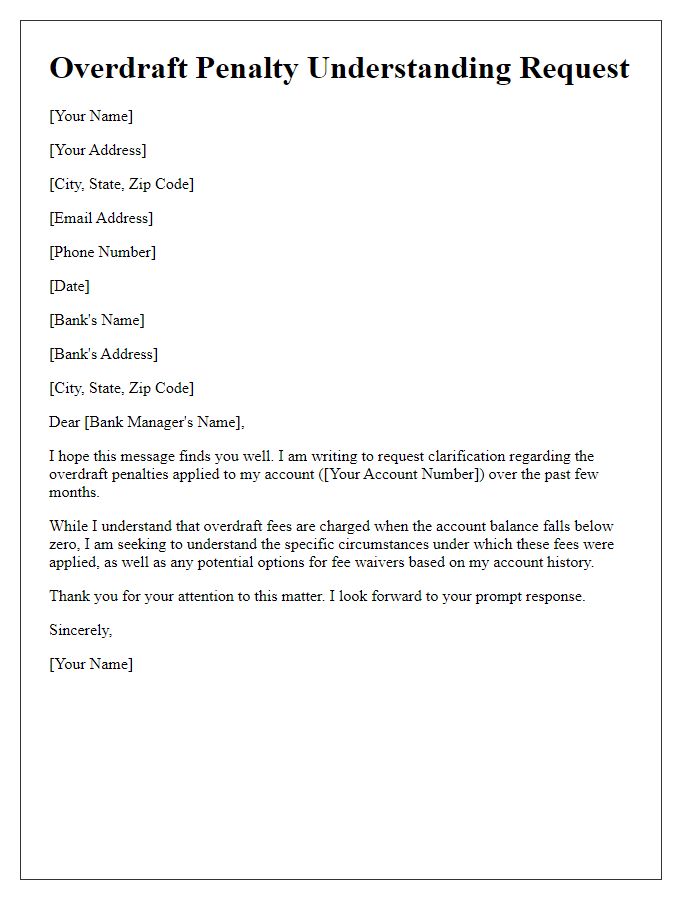

Clear Explanation of Overdraft Occurrence

Overdraft penalties arise when a bank account balance falls below zero, typically due to insufficient funds exceeding the available account balance. Financial institutions, like Wells Fargo or Chase, charge overdraft fees, often ranging from $30 to $50 per occurrence. For instance, a customer with a $100 balance might incur an overdraft penalty after they write a check for $150. The transaction triggers an automatic overdraft, resulting in the account reflecting a negative balance of $50. Frequent overdrafts can lead to significant cumulative fees and potential account restrictions, impacting credit scores and future banking relationships due to perceived financial instability. Understanding each bank's specific overdraft policy is crucial for effective financial management and avoiding unexpected charges.

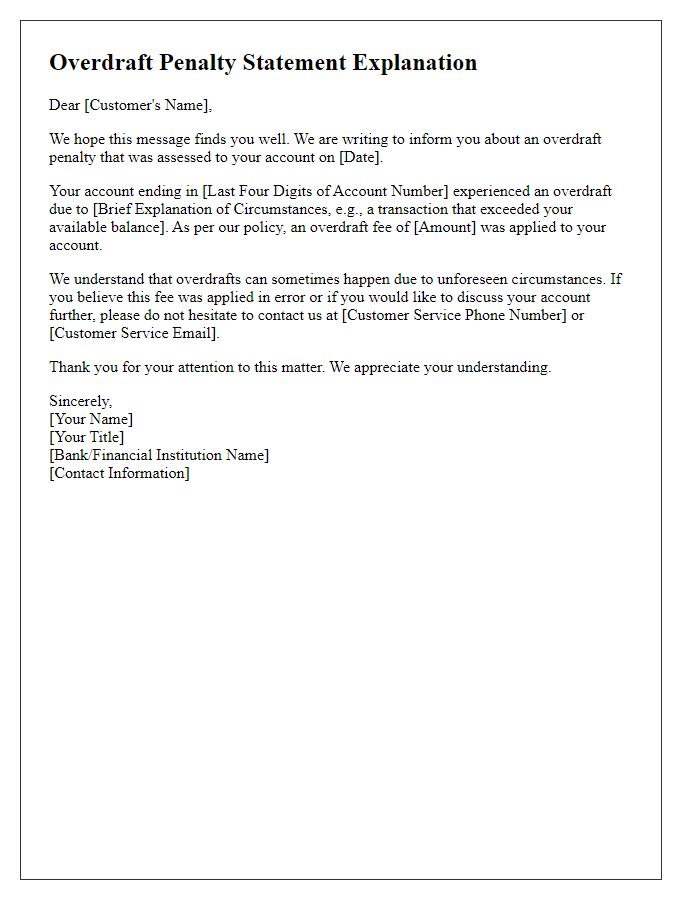

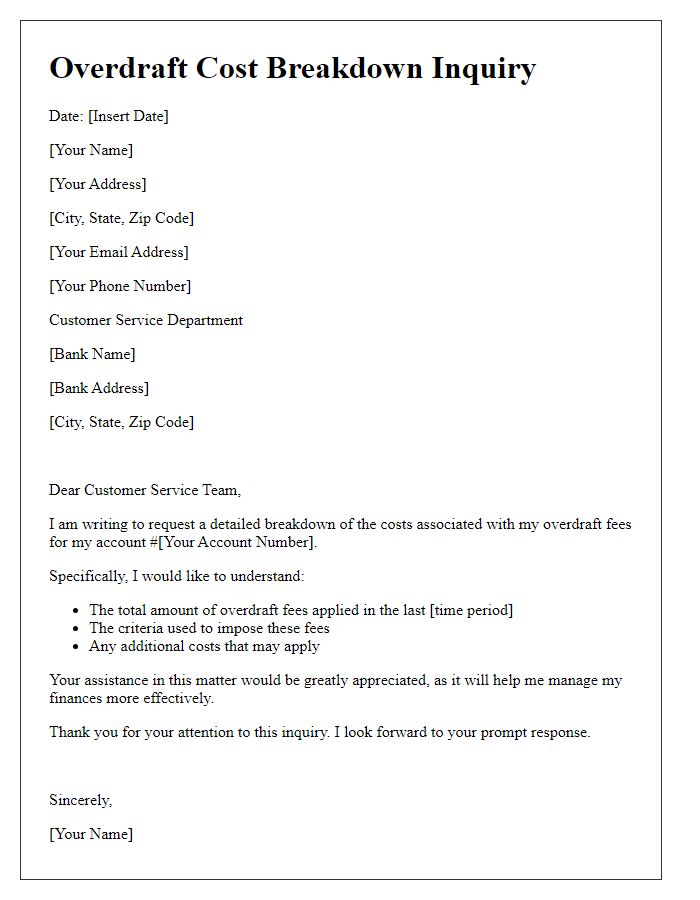

Penalty Fees and Charges

Overdraft penalties are fees applied when a bank customer exceeds their account's available balance. These charges typically occur when transactions such as checks, debit purchases, or automatic bill payments occur without sufficient funds in the account. Financial institutions like JPMorgan Chase or Bank of America may impose overdraft fees ranging from $25 to $35 for each insufficient transaction. Continued use of overdraft protection can lead to compounded charges if multiple overdrafts occur within a short time frame. Understanding account terms is crucial; some banks may offer grace periods, whereas others might automatically enroll customers in overdraft coverage, leading to unexpected expenses.

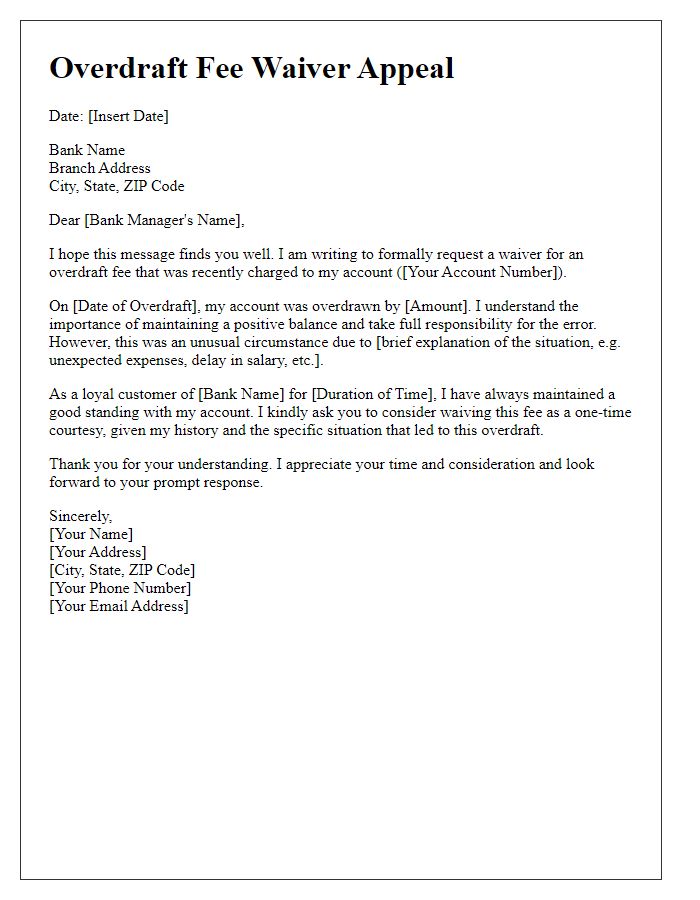

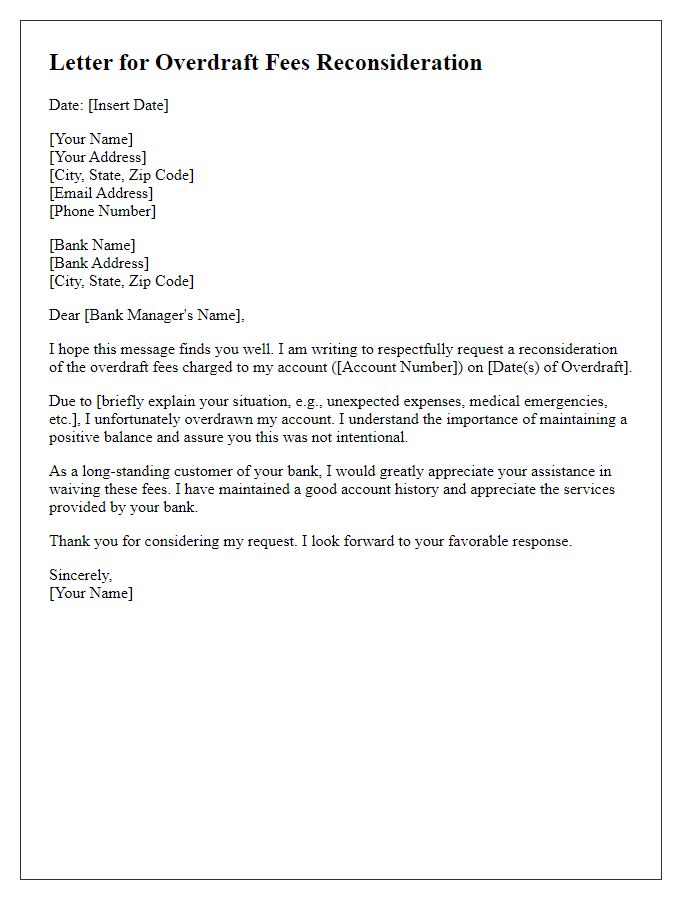

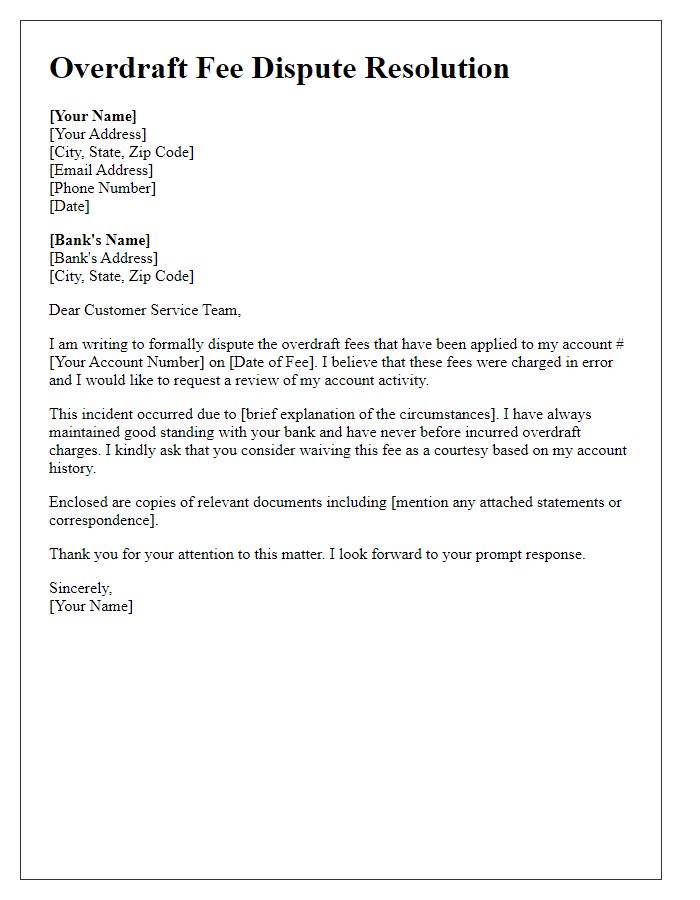

Available Options for Resolution

Overdraft penalties can impose significant financial strain on account holders, particularly when unexpected charges arise. Banks typically charge a standard fee ranging from $30 to $40 for each transaction that exceeds the account balance. Awareness of the specific terms outlined in the account agreement is crucial for avoiding these fees. Furthermore, financial institutions may offer various options for resolution, such as overdraft protection plans, which link savings accounts or lines of credit to cover shortfalls. Additionally, customers can request waivers for the first occurrence of an overdraft fee if contacted within a certain period, commonly 30 days. Engaging with customer service representatives can lead to personalized solutions, including payment arrangements or financial counseling programs that promote better money management practices.

Contact Information for Assistance

Overdraft penalties arise when bank account balances fall below zero, incurring fees that typically range from $30 to $35 per transaction at financial institutions, like Wells Fargo or Chase. Accounts may face multiple penalties if several transactions are processed, further amplifying the total cost. These fees can significantly affect personal finances, potentially leading to negative account balances and increased debt. Awareness of account terms, daily limits, and potential overdraft protection programs can help prevent these fees. For assistance, contact customer service departments available through bank websites or nationwide hotlines, where representatives can provide detailed explanations and solutions.

Comments