Are you finding it challenging to keep up with your loan payments? Revising your loan payment schedule can be a practical solution to ease financial stress and better manage your budget. With a few simple steps, you can communicate your needs effectively to your lender and pave the way for a more manageable repayment plan. Read on to discover helpful tips and a sample letter template to get you started!

Borrower's contact information

The borrower's contact information serves as a crucial link in the loan payment schedule revision process. This typically includes details such as the borrower's full name, residential address (which may include street name, city, state, and ZIP code for accurate identification), phone number (for direct communication regarding payment updates), and email address (for digital correspondence). Clear and accurate borrower information ensures efficient processing by financial institutions, like banks or credit unions, while also facilitating any necessary follow-up discussions. Proper documentation of this information can help avoid delays in the reconsideration of the loan terms, especially if circumstances have changed since the original agreement.

Lender's contact information

The lender's contact information serves as a crucial element in facilitating communication regarding loan payment schedule revisions. This typically includes the full name of the lending institution (for example, Bank of America), the mailing address which often specifies street number, area, and zip code (such as 123 Main Street, Charlotte, NC 28202), telephone number for direct inquiries (like 1-800-432-1000), email support contact (e.g., support@bankofamerica.com), and sometimes a dedicated loan officer's name. By including these details, borrowers can ensure timely correspondence with the lender, allowing for smoother negotiations related to potential adjustments in repayment terms or payment dates due to unforeseen circumstances or financial hardship.

Subject line and reference details

A loan payment schedule revision request typically involves specific details and context to ensure clarity and understanding. The subject line should be concise yet informative, while reference details should provide essential information related to the loan. Subject: Request for Loan Payment Schedule Revision Reference Details: - Loan Account Number: [Insert Loan Account Number] - Borrower's Name: [Insert Borrower's Full Name] - Loan Type: [Insert Type of Loan, e.g., Mortgage, Personal Loan] - Original Loan Amount: [Insert Original Amount] - Current Interest Rate: [Insert Current Rate] - Payment Terms: [Insert Original Payment Terms, e.g., Monthly, Quarterly] - Reason for Revision: [Insert Reason, e.g., Financial Hardship, Change in Income] - Requested Revision Date: [Insert Desired Start Date for New Schedule]

Current loan terms and requested changes

Current loan terms typically include a principal amount (e.g., $50,000) with a fixed interest rate (e.g., 5% APR) over a duration of 15 years. Monthly payments are usually set at a predetermined amount (approximately $400) due on a specific date (e.g., the 1st of every month). Requested changes might include extending the loan duration to 20 years, which could lower monthly payments to approximately $350, or adjusting the interest rate to a more favorable 4% APR to reduce overall repayment costs. Other considerations may involve a deferred payment option for a specified period (e.g., six months) due to financial hardship, allowing for extended breathing room. Clear communication regarding these adjustments is essential for both lenders and borrowers to ensure mutual understanding and compliance with revised terms.

Justification for revision request

Borrowers often face unexpected financial challenges necessitating a revision of their loan payment schedule. Key factors influencing this request may include a significant loss of income due to job loss, medical emergencies resulting in unforeseen expenses, or economic downturns affecting overall financial stability. For instance, in the context of the COVID-19 pandemic, many individuals experienced abrupt changes in employment status, leading to reduced income. Additionally, sudden medical bills can strain budgets, compelling borrowers to seek an alternative payment plan. Financial institutions prioritize understanding clientele situations and adjusting payment schedules, ensuring that borrowers can continue fulfilling their obligations while managing their financial realities effectively.

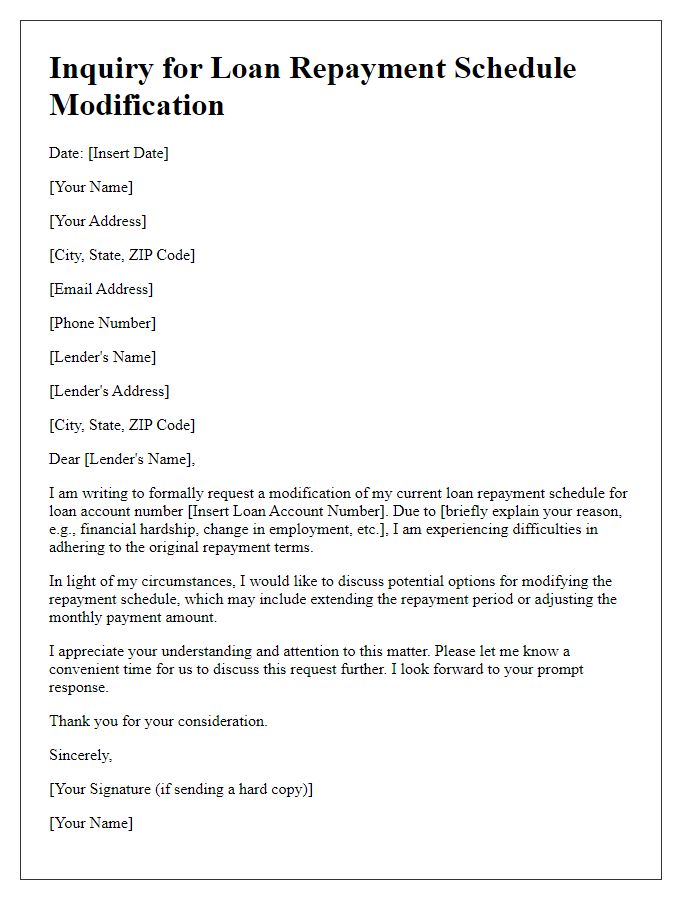

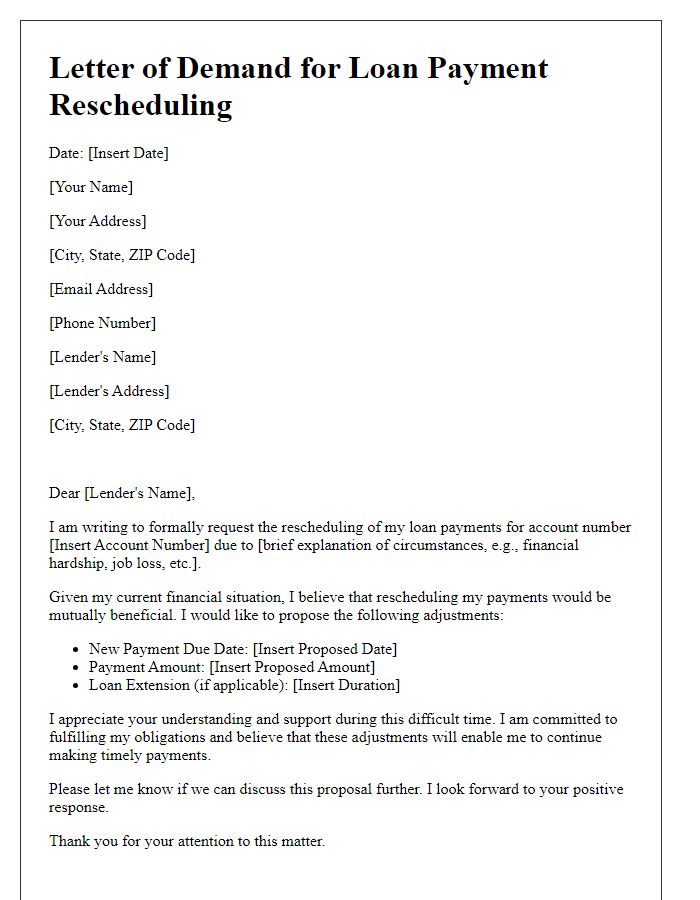

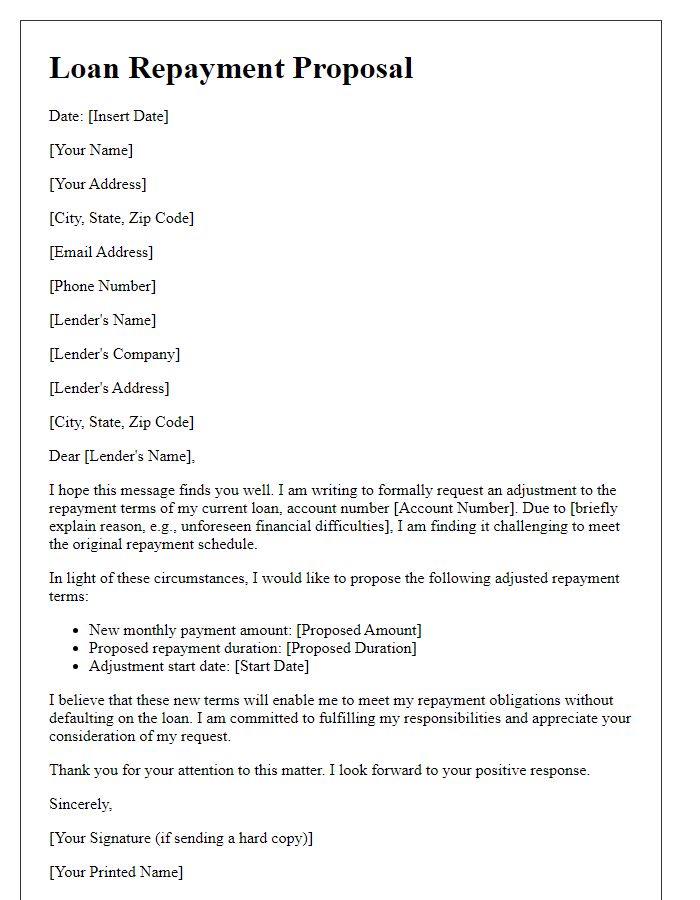

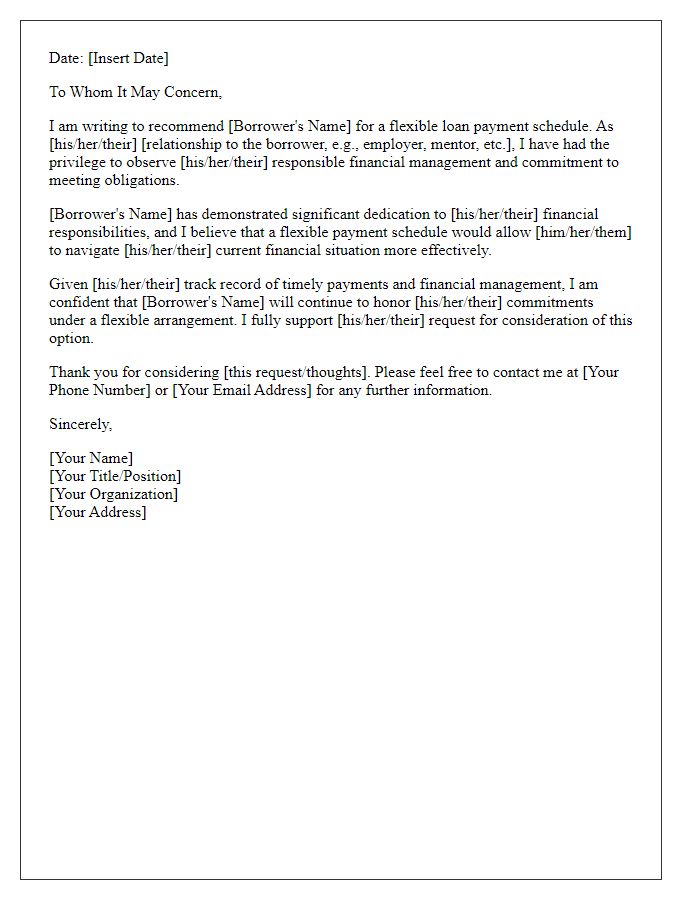

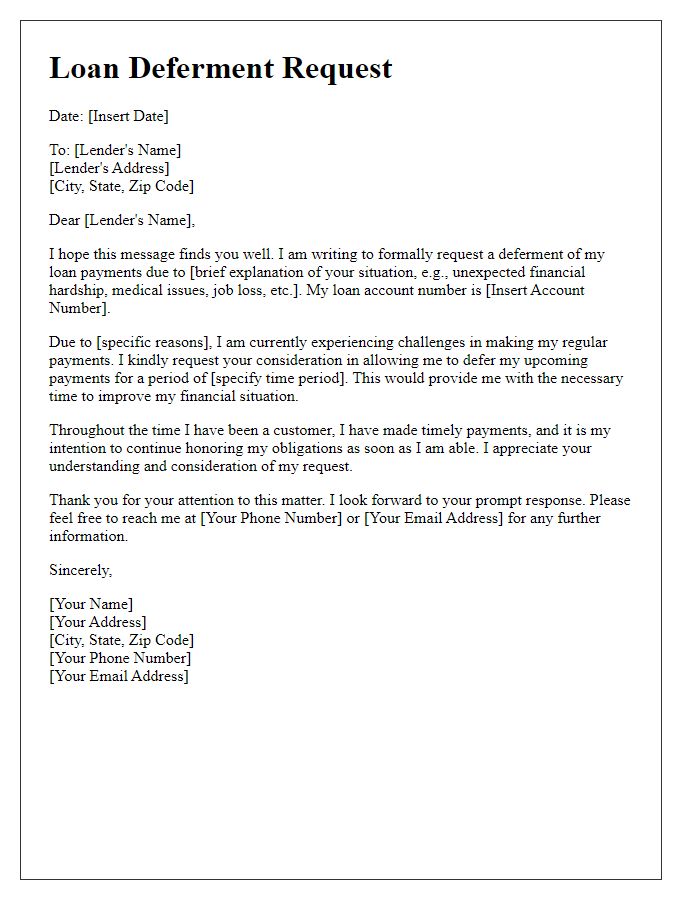

Letter Template For Loan Payment Schedule Revision Samples

Letter template of notification for changes in loan payment arrangements.

Comments