Hey there! Have you ever wondered what happens when your account goes inactive? It might seem daunting, but understanding the process can help you stay in the loop and avoid any surprises. Whether it's for an old social media account or an online subscription, knowing how to reactivate or manage your account is essential. So, grab a cup of coffee and let's dive deeper into the specifics of account inactivity and what steps you can take to keep everything running smoothly!

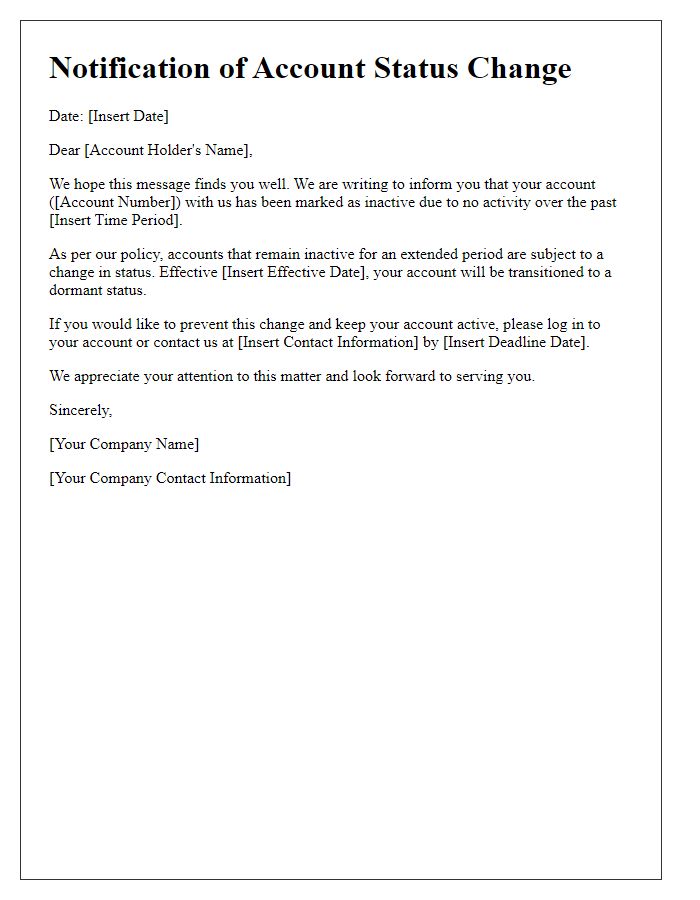

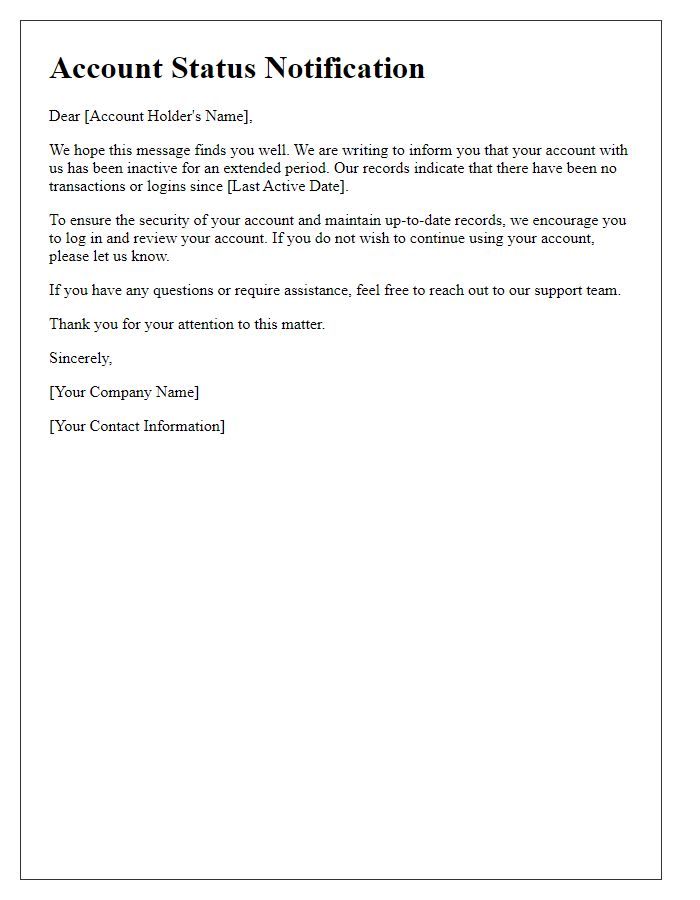

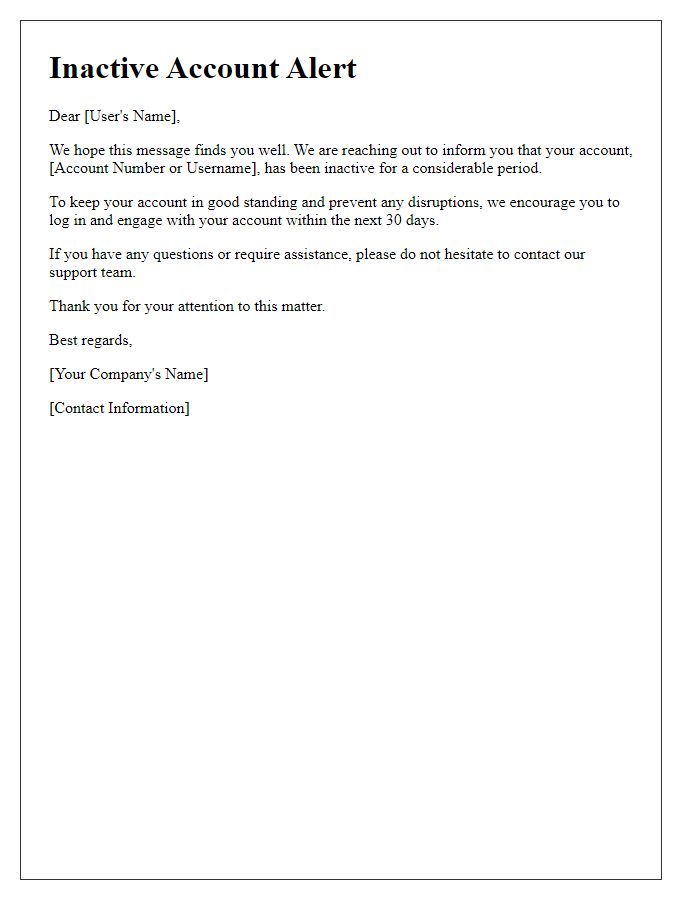

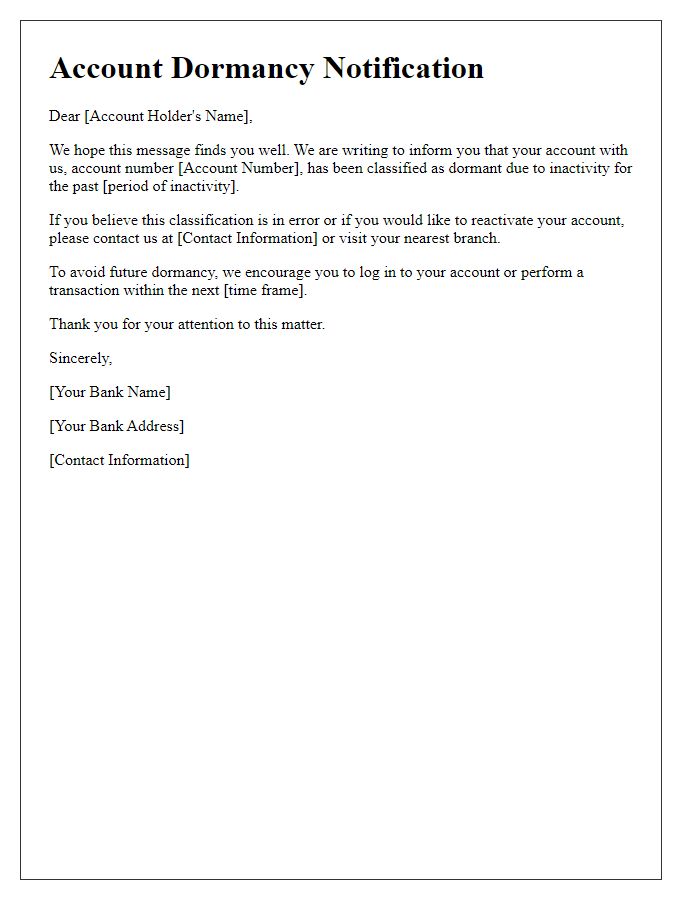

Subject line and greeting.

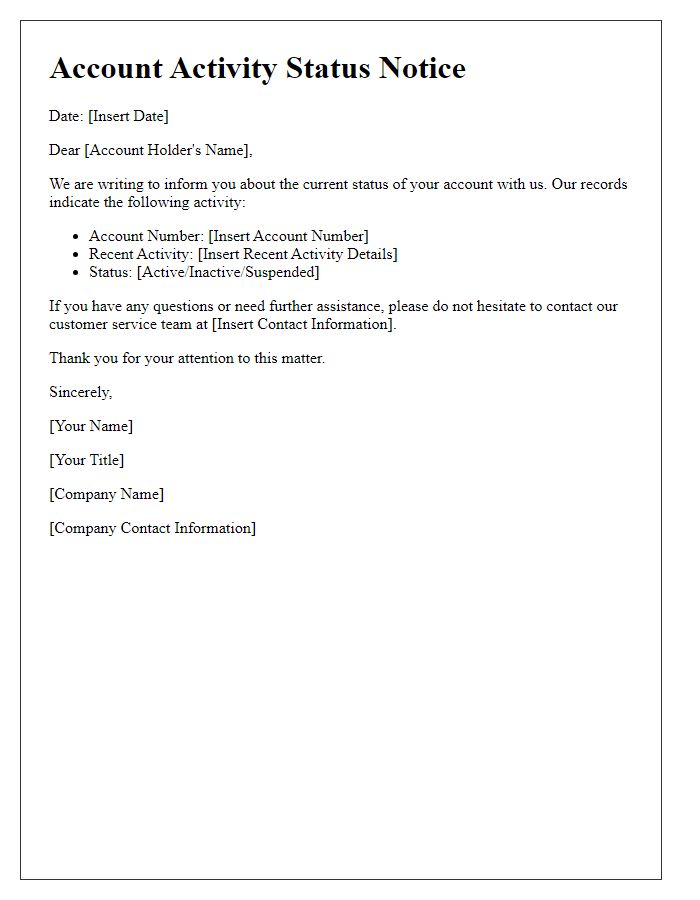

Account inactivity can lead to potential issues such as loss of access to important features and services. Accounts may be marked inactive after 12 months of no login activity, prompting security measures to protect user data. Users in such a situation receive notifications outlining the need to log in within a designated timeframe, typically 30 days, to avoid deactivation. Following the deadline, accounts can be permanently closed, resulting in irreversible data loss. Users are advised to check their email and login periodically to maintain account activity.

Account status details and inactivity reason.

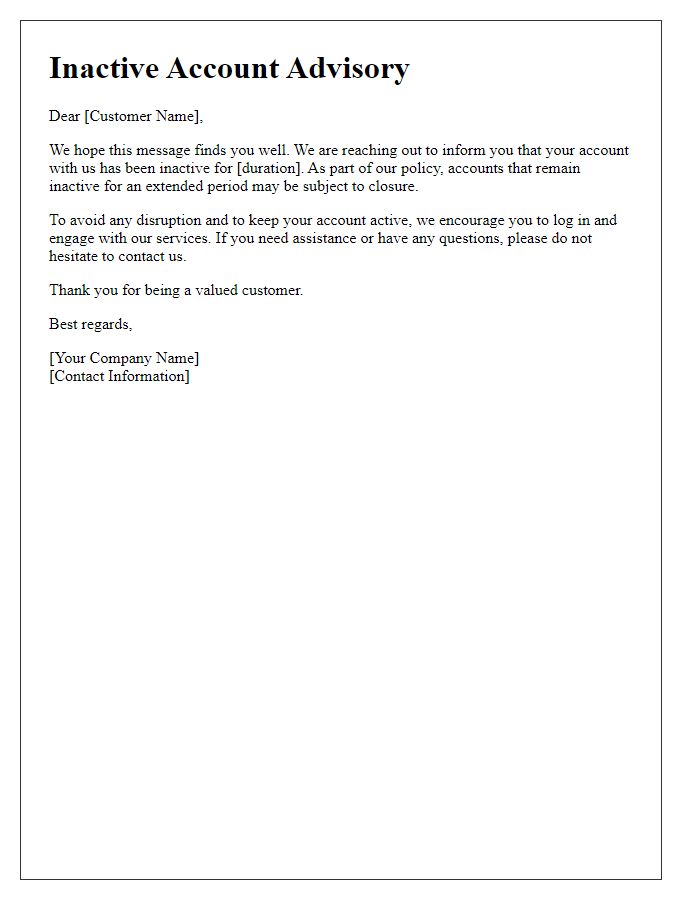

Inactive accounts can lead to potential security risks, making it crucial for account holders to monitor their status regularly. Accounts may become inactive due to prolonged periods of non-use, often exceeding twelve consecutive months without login activity. Common reasons for inactivity include user forgetfulness, loss of access credentials, or lack of interest in services such as online banking, social media, or subscription platforms. Notifications sent to users regarding their account status serve as reminders of the importance of maintaining engagement while also providing options to reactivate accounts. Ensuring proper communication about inactivity helps protect user data and encourages account holders to update their preferences or recover access.

Re-engagement incentives and instructions.

Inactive accounts often result in missed opportunities, particularly in platforms like online banking or subscription services. Users may face account inactivity after 12 months, leading to penalties or loss of services. To encourage re-engagement, companies might offer incentives such as bonuses or discounts, often ranging from 10% to 25% off future purchases. Instructions for reactivating accounts typically include a simple login process, verification steps, and confirmation of personal information, ensuring that users regain access swiftly. Communication via email or direct notification through application alerts can highlight these offers, increasing the likelihood of user action.

Contact information for questions or assistance.

Inactive status of bank accounts can occur due to prolonged inactivity, typically defined as no transactions over a period of 12 months. This status may result in restrictions on account access and potential fees, depending on financial institution policies. Customers experiencing issues due to inactivity should contact the bank's designated customer service hotline, usually found on the website or account statements, for assistance. Representatives can provide guidance on reactivation procedures, necessary documentation, and any implications regarding account balance or fees. It's important to address inactive status promptly to avoid complications related to account management.

Closing remarks and signature block.

Accounts that remain inactive for extended periods, typically defined as twelve months or longer, face potential closure by the financial institution. Inactivity may lead to issues such as account fees or loss of services. Customers receive notifications prior to account closure, providing opportunities to maintain account status by initiating a transaction. Contact information for customer service remains vital for addressing concerns. Closing remarks often emphasize the importance of regular account monitoring and staying informed about institutional policies. The signature block includes the representative's name, title, and organization, ensuring authenticity and providing a point of contact for further inquiries.

Letter Template For Account Inactive Status Notice Samples

Letter template of Notification of Account Status Change due to Inactivity

Comments