Are you feeling overwhelmed by the looming threat of foreclosure? If so, you're not aloneâmany individuals face this daunting challenge every day. Understanding the foreclosure process can empower you to take control of your situation and explore your options. Join us as we delve into the key steps in the foreclosure process and provide practical tips to help you navigate this tricky terrain.

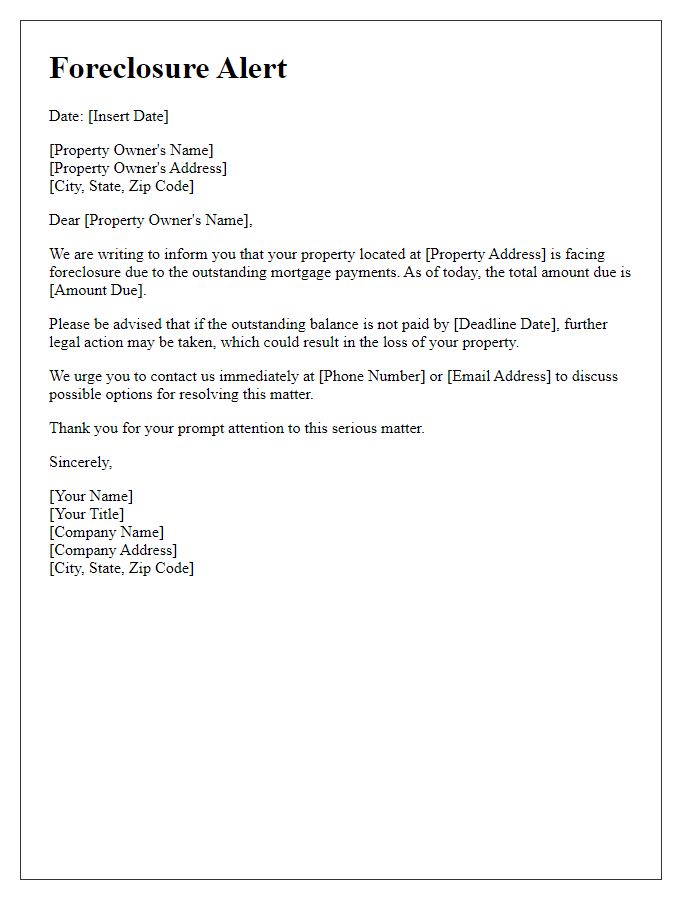

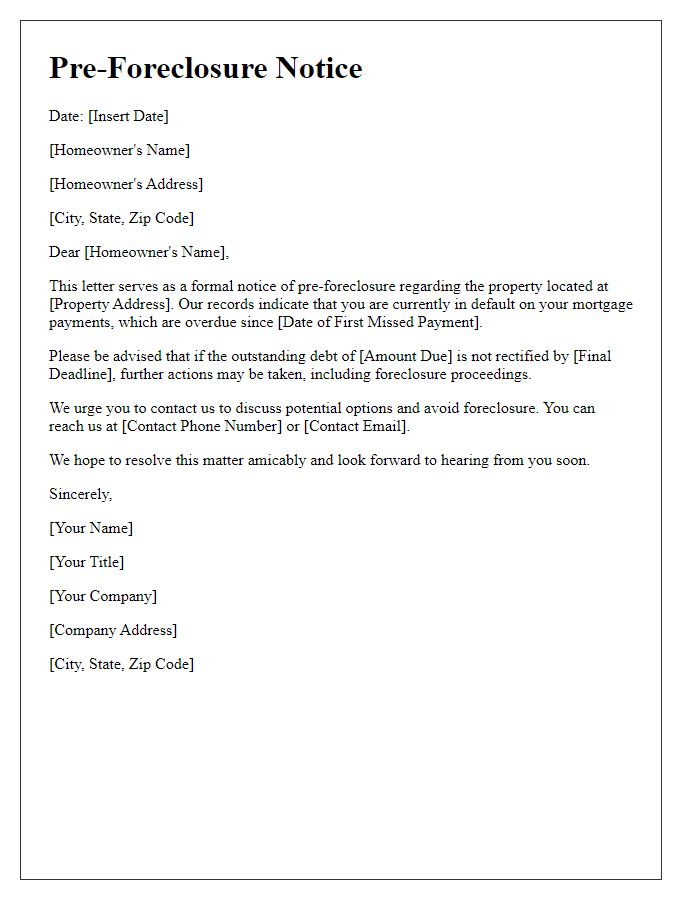

Property address and owner details

The initiation of a foreclosure process signifies a significant legal action involving real estate, often linked to non-payment of mortgage obligations. Foreclosure typically occurs when homeowners fail to maintain monthly payments, leading to default notices issued by lenders. Properties, like residential homes located at 1423 Maple Street, Springfield, must undergo legal procedures as defined by state regulations. Lender entities, such as Bank of America, maintain a vested interest in recovering losses. Homeowners, like John Doe, must be informed of their rights and potential repercussions associated with foreclosure, including credit score deterioration and possible eviction. The timeline leading to this situation is critical, often spanning several months, with opportunities for loan modification or repayment plans prior to the final foreclosure judgment. The legal framework enables lenders to reclaim the property, often for auction, aiming to recoup financial losses. Understanding state-specific statutes is essential for both parties involved in the foreclosure process.

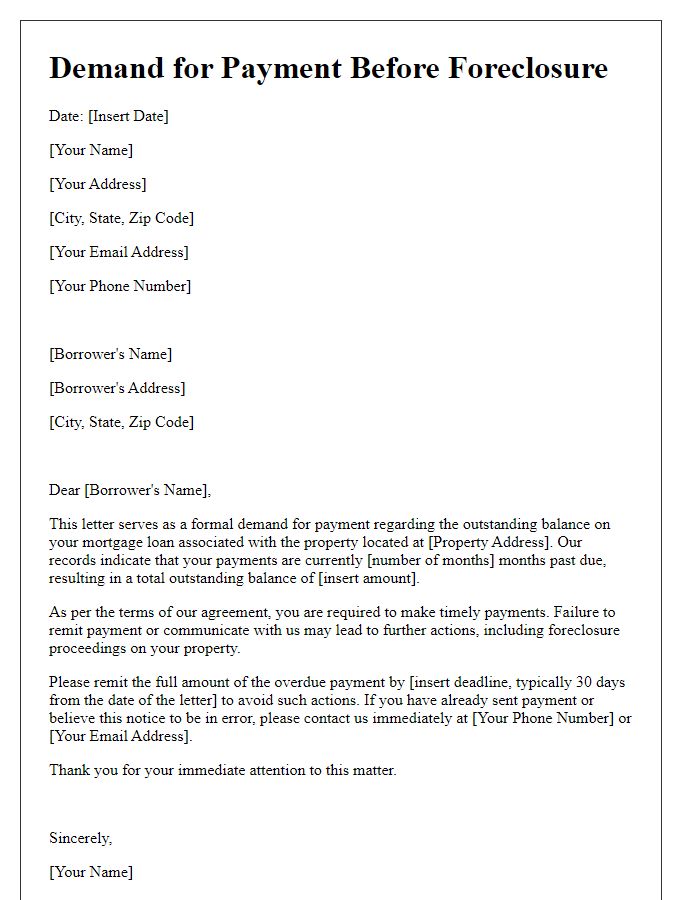

Default amount and payment history

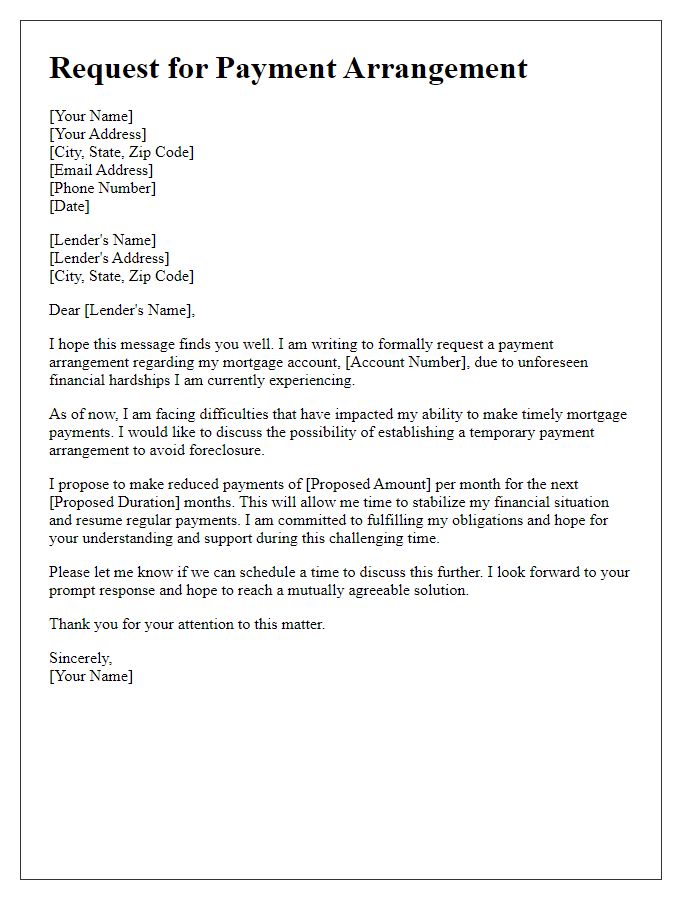

In the process of foreclosure, mortgage default reflects a borrower's inability to meet repayment obligations, typically after three consecutive missed payments, which amounts to a default of at least 90 days. Payment history records, detailing instances of delinquency, reveal crucial insights into the borrower's financial behavior, showing missed payments (or late payments) and accrued amounts. Additionally, foreclosure notifications are often initiated through formal letters sent to the borrower, outlining outstanding amounts (often escalating due to penalties and interest), the total loan amount initially borrowed (frequently thousands or even millions of dollars), and terms of the loan agreement, in accordance with state laws, such as specific timelines for responses. Local foreclosure laws dictate processes and timelines, creating a complex framework surrounding rights, obligations, and potential resolutions for both lenders and borrowers involved.

Legal rights and obligations

Foreclosure proceedings involve complex legal rights and obligations for both lenders and borrowers. When a borrower defaults on a mortgage payment, typically after 90 days of non-payment, lenders may initiate foreclosure in jurisdictions like California, where specific statutory procedures apply. The initial step often includes sending a Notice of Default (NOD), which informs the borrower of their default status. Borrowers have a grace period, usually 90 days, to rectify the missed payments or face further legal action. During this period, alternative options such as loan modifications or short sales may be available, encouraging communication between both parties. It's essential for borrowers to understand their rights, such as the ability to contest the foreclosure, and the legal obligations of lenders, including providing proper notice and following state regulations throughout the process. Understanding these dynamics helps navigate the foreclosure landscape effectively.

Deadline for payment or response

Foreclosure proceedings are initiated when homeowners, such as those in the United States, fail to make mortgage payments for an extended period, generally over 90 days. A formal notice, often referred to as a Notice of Default, is sent by the lender, detailing the specific amount owed and the deadline for payment or response, which typically ranges from 30 to 90 days. Failure to respond by the specified deadline can lead to further legal actions, including the possibility of a public auction of the property, as mandated by state laws. Even after notice, homeowners may have options to negotiate a loan modification or seek assistance from foreclosure prevention programs, which are available through various organizations, including government agencies like HUD (U.S. Department of Housing and Urban Development).

Contact information for inquiries

The foreclosure process initiation involves several critical steps and official communication that must be clearly articulated for all parties. Homeowners facing foreclosure should be aware that they typically receive a notice of default or a similar document detailing the initiation of this serious legal proceeding, which can affect their property located in specific jurisdictions. Important contact information for inquiries is usually specified in the notice, including phone numbers for legal representatives representing the lender or mortgage servicer, email addresses, and physical mailing addresses to ensure homeowners can seek clarity about their situation promptly. It is crucial to note that understanding the foreclosure timeline, which may vary by state and can range from a few months to over a year, as well as the relevant laws and rights of the homeowner during this process, can significantly impact the outcome of any foreclosure case. Legal counsel is often recommended to navigate the complexity of the foreclosure laws, preventing potential loss of property.

Comments