Are you feeling overwhelmed by your financial decisions and unsure where to turn for guidance? You're not aloneâmany people find themselves searching for reliable financial advisory services to help navigate the complexities of investing, retirement planning, and wealth management. This article will break down what to look for in a financial advisor and how to ensure you choose the right one for your unique needs. So, whether you're just starting your financial journey or seeking to enhance your current strategy, keep reading to discover valuable insights!

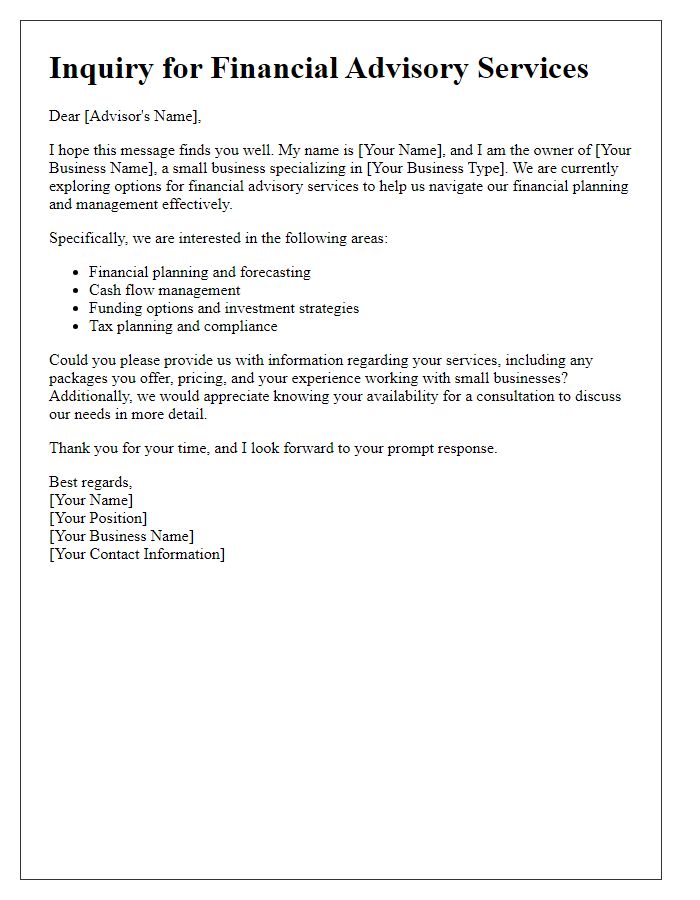

Professional Tone and Clarity

High-net-worth individuals often seek financial advisory services to manage investment portfolios, tax strategies, and retirement planning. Comprehensive financial planning includes analyzing asset allocations, which affects returns and risk management over time. Service providers typically offer personalized consultations, often with certified financial planners who possess expertise in various investment vehicles such as stocks, bonds, and mutual funds. Clients may inquire about specific performance metrics, fee structures, and fiduciary responsibilities to ensure their interests are prioritized. Moreover, understanding market trends and economic indicators is essential for making informed decisions, particularly in volatile economic climates, which can impact investment outcomes significantly.

Specific Financial Needs and Interests

Seeking financial advisory services can be pivotal for individuals aiming to enhance their financial health. Financial needs often encompass areas such as investment strategies, retirement planning, debt management, and wealth preservation. Interests may include asset allocation, risk assessment, and tax optimization. Combining these factors enables a tailored approach, allowing advisors to develop comprehensive financial plans that align with specific life stages or goals, whether it be purchasing a home, funding education, or maximizing retirement savings. Engaging with experienced financial advisors can provide critical insights into market trends, emerging investment opportunities, and personalized strategies that foster long-term financial success.

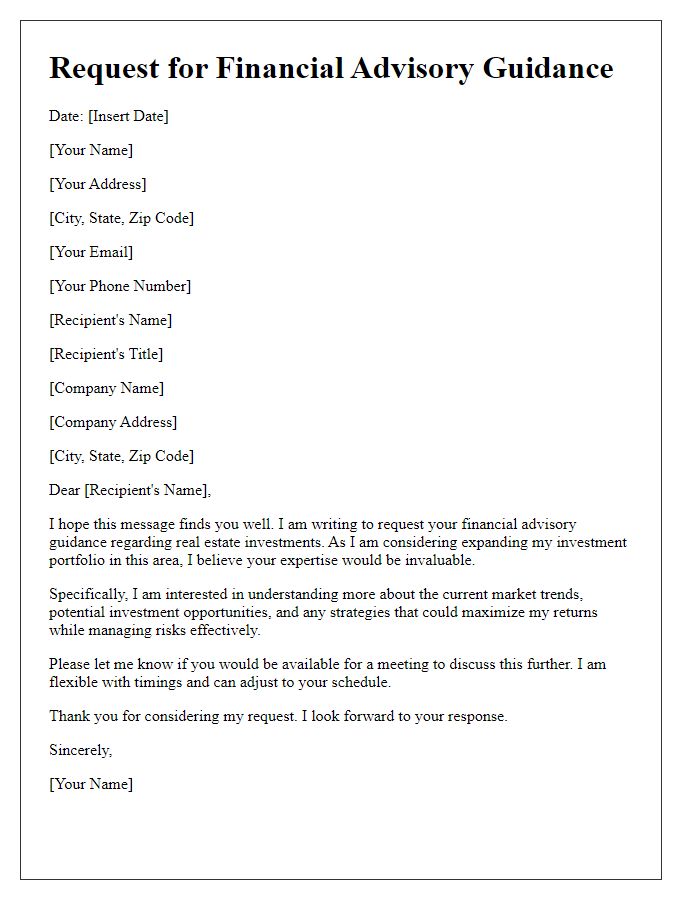

Contact Information and Availability

Inquiries regarding financial advisory services often emphasize the importance of clear communication. Potential clients should provide contact details, including their full name, phone number, and email address, ensuring accessibility for prompt responses. Availability, particularly time zones and preferred times for consultation, plays a crucial role in scheduling discussions, allowing for efficient planning. Specifying any urgent deadlines or specific dates for a meeting enhances the likelihood of timely arrangements. Understanding the client's financial goals, whether retirement planning, investment strategy, or debt management, contributes significantly to tailoring advisory services to their unique needs.

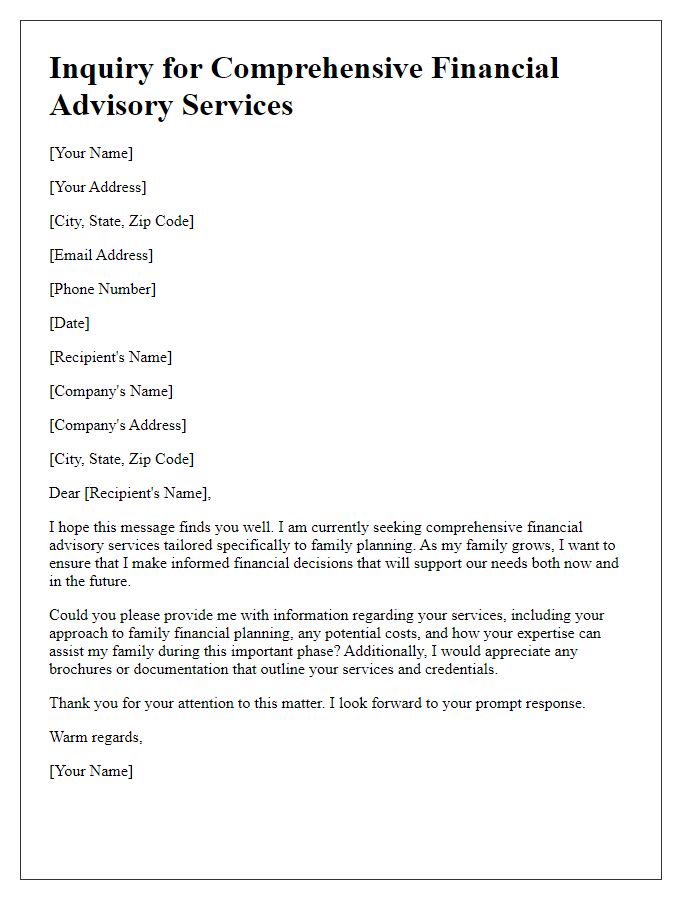

Request for Information and Services Offered

The inquiry into financial advisory services often stems from a need for expert guidance on investment strategies, retirement planning, and wealth management. Individuals or organizations typically seek comprehensive information regarding available services, which may include asset allocation analysis, tax optimization strategies, and estate planning. Notable firms in the financial sector often align with fiduciary standards, ensuring their clients' best interests guide their recommendations. The request for detailed brochures or consultations reflects a growing interest in personalized financial solutions tailored to specific goals, risk tolerance, and market conditions. Ultimately, individuals are looking for qualified advisors who can navigate the complexities of financial landscapes and deliver actionable insights.

Call to Action and Follow-up Request

The financial advisory market offers crucial guidance for individuals and businesses seeking to make informed decisions regarding investments and savings. Experts recommend that clients carefully evaluate their options, considering variables like risk tolerance, financial goals, and market trends. A well-structured financial plan can lead to significant long-term growth, with a potential increase of 7-10% annually depending on investment choices. The importance of following up with trusted financial advisers, particularly after major life events such as marriage, having children, or retirement, is paramount. Such significant changes often necessitate a reassessment of financial strategies to ensure alignment with evolving personal circumstances and economic conditions.

Letter Template For Financial Advisory Service Inquiry Samples

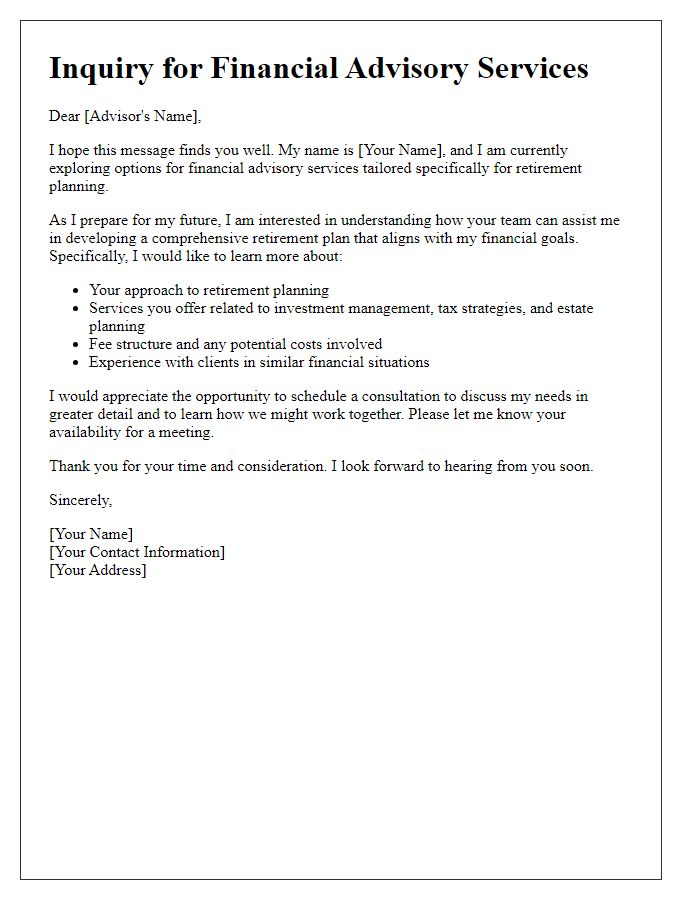

Letter template of inquiry for financial advisory services tailored for retirement planning.

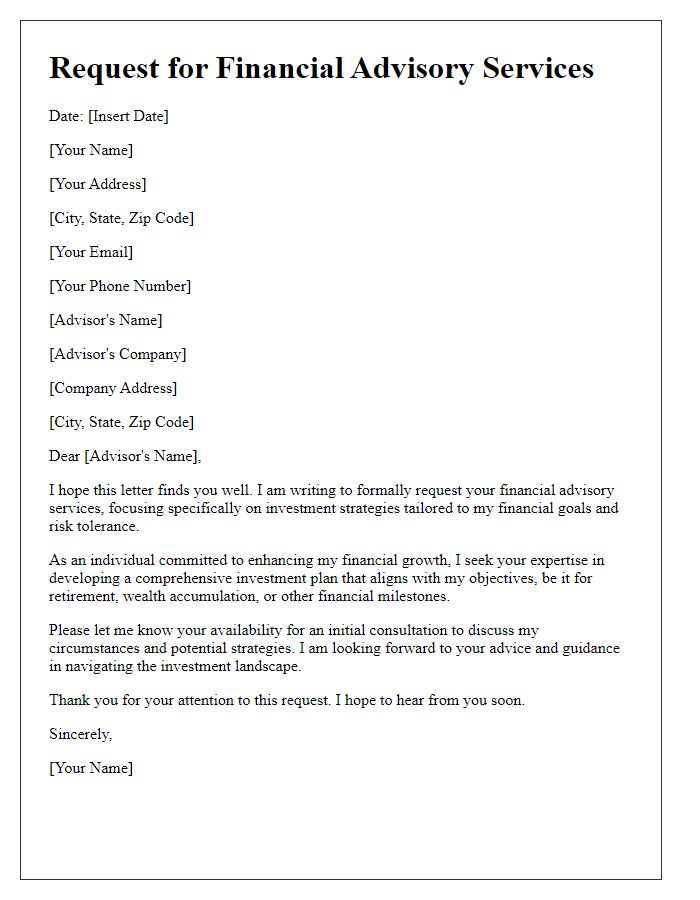

Letter template of request for financial advisory services focused on investment strategies.

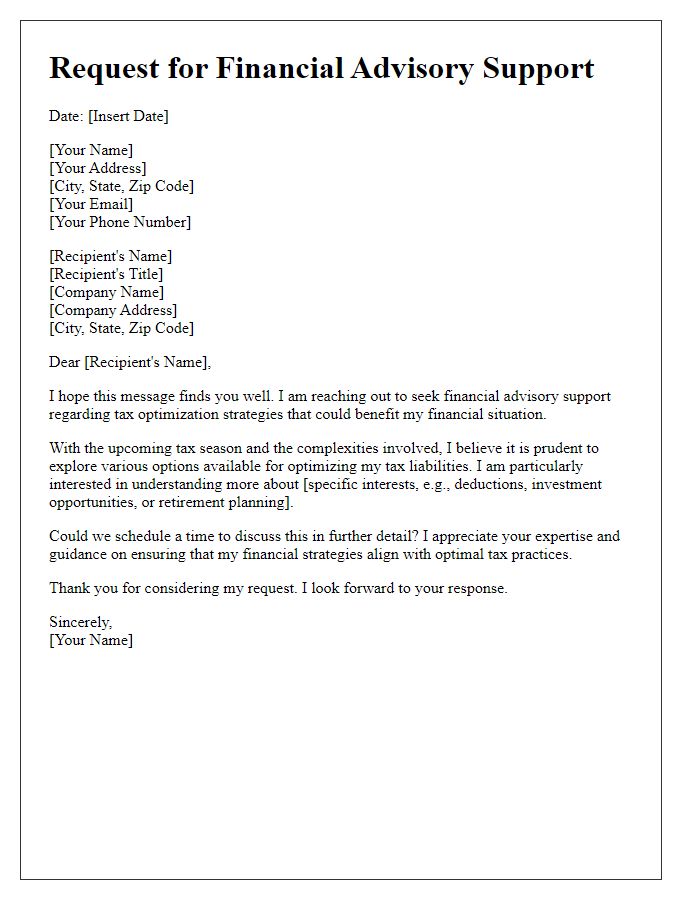

Letter template of communication seeking financial advisory support for tax optimization.

Letter template of inquiry regarding financial advisory services for estate planning.

Letter template of request for personalized financial advisory services for debt management.

Letter template of inquiry for financial advisory assistance in budgeting and savings.

Letter template of request for financial advisory services aimed at wealth management.

Letter template of inquiry for financial advisory services related to small business finance.

Letter template of request for financial advisory guidance on real estate investments.

Comments