Are you feeling a bit overwhelmed by your personal loan balances? You're not alone; many people find themselves in this situation and have questions about their remaining dues. Understanding your balance is crucial for managing your finances and planning for the future. Dive into our article to discover tips and templates for crafting a balance inquiry letter that will help you get the information you need!

Account Information

To inquire about the outstanding balance of a personal loan, it is essential to provide detailed account information, including your loan account number (typically a 10- to 15-digit number specific to your loan), the name under which the loan is held, and contact details for verification. The lender may require additional data such as the original loan amount, interest rate (expressed in percentage), and the date of the loan agreement to provide accurate information. The inquiry should also specify whether the request pertains to a recent payment made or a request for a payoff amount, which is the total sum needed to fully satisfy the loan and close the account. Prompt and clear communication can ensure a swift response to the inquiry.

Loan Details

Personal loans often come with specific details that impact repayment plans. Loan amount (e.g., $10,000) reflects the total borrowed, while interest rates (around 5% to 15%) influence monthly payments. Loan duration (commonly 3 to 5 years) determines the full term over which the borrower is responsible for repaying the principal plus interest. Loan servicer contact information plays a crucial role in inquiries regarding remaining balance. In addition, payment history (including late payments or defaults) can also affect current balances and future borrowing eligibility. Borrowers may seek clarity on outstanding balances after making regular payments, as understanding these figures can guide financial planning.

Specific Inquiry Request

Inquiries regarding personal loan balances are crucial for financial planning and management. Individuals often need to assess their current outstanding balance, which includes principal, interest rates, and any applicable fees. Loan accounts, typically managed by financial institutions such as banks or credit unions, maintain detailed records. Loan agreements from the origination date serve as reference points for tracking repayment schedules and remaining obligations. Borrowers may contact customer service departments via phone or secure online portals to request this information. Accurate balance inquiries also facilitate budgetary adjustments, reflecting monthly payment capability.

Contact Information

Inquiries regarding personal loan balances necessitate detailed communication between the borrower and the lending institution. Essential items include the loan account number (a unique identifier assigned to the loan), the interested party's full name (as listed on the loan agreement), and the contact details (address, phone number, email) to facilitate prompt responses. Additionally, the inquiry should specify the type of loan (such as secured or unsecured), the amount originally borrowed (often referred to as principal), and any relevant dates (such as the loan origination date or last payment date) that could assist the lender in processing the request.

Signature and Date

Personal loan balances can vary significantly based on repayment terms and interest rates. Lenders often provide detailed summaries of outstanding amounts, including principal remaining and accrued interest. For instance, a borrower with a personal loan of $10,000 at 5% interest over five years may need to request a balance inquiry at the halfway mark to understand their current liability. Monitoring these balances allows borrowers to make informed decisions about additional payments or refinancing options. Additionally, awareness of the current outstanding balance is crucial for financial planning and budgeting.

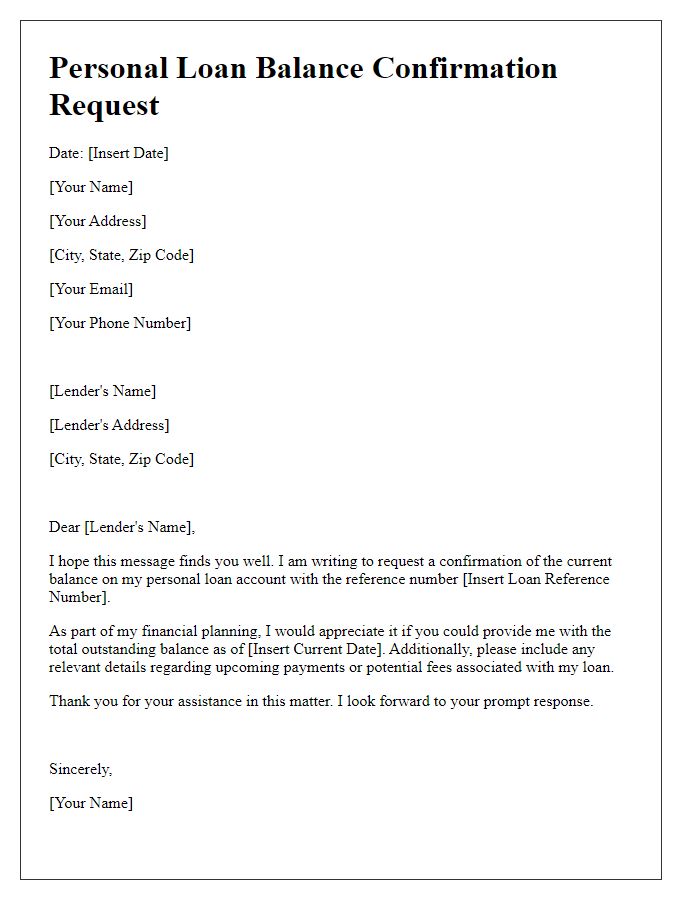

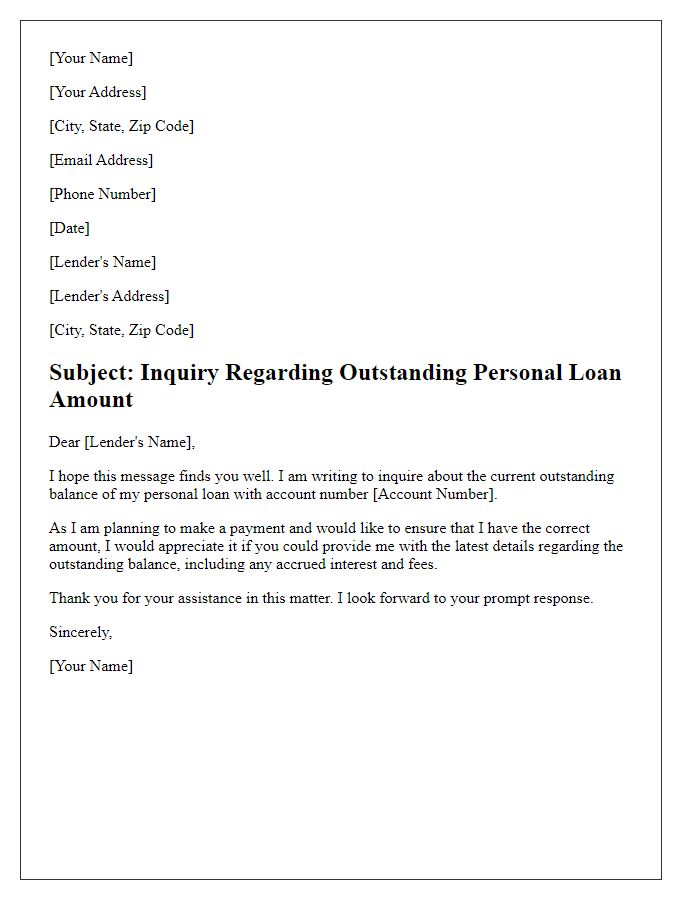

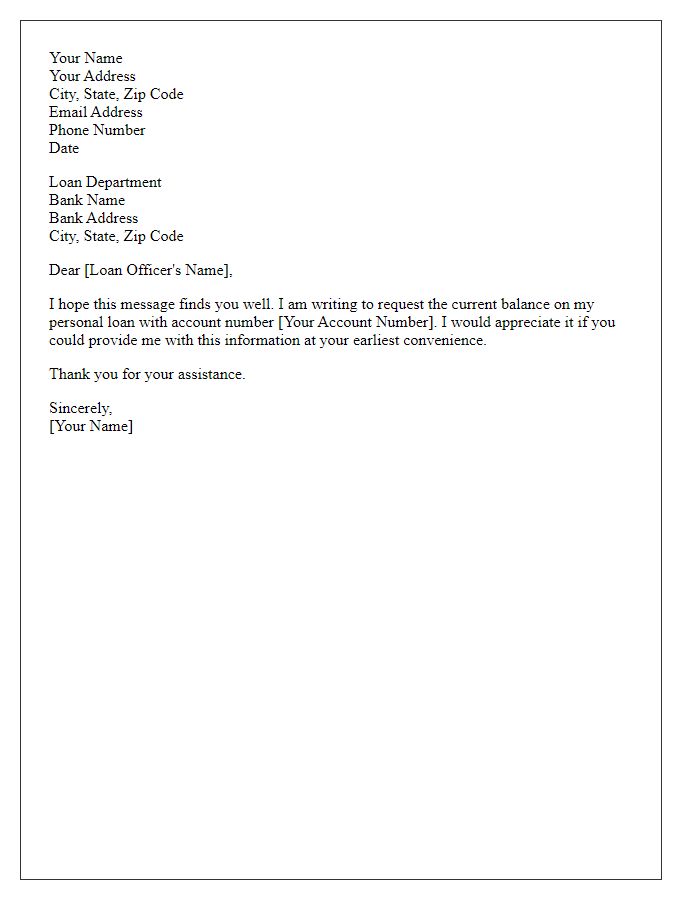

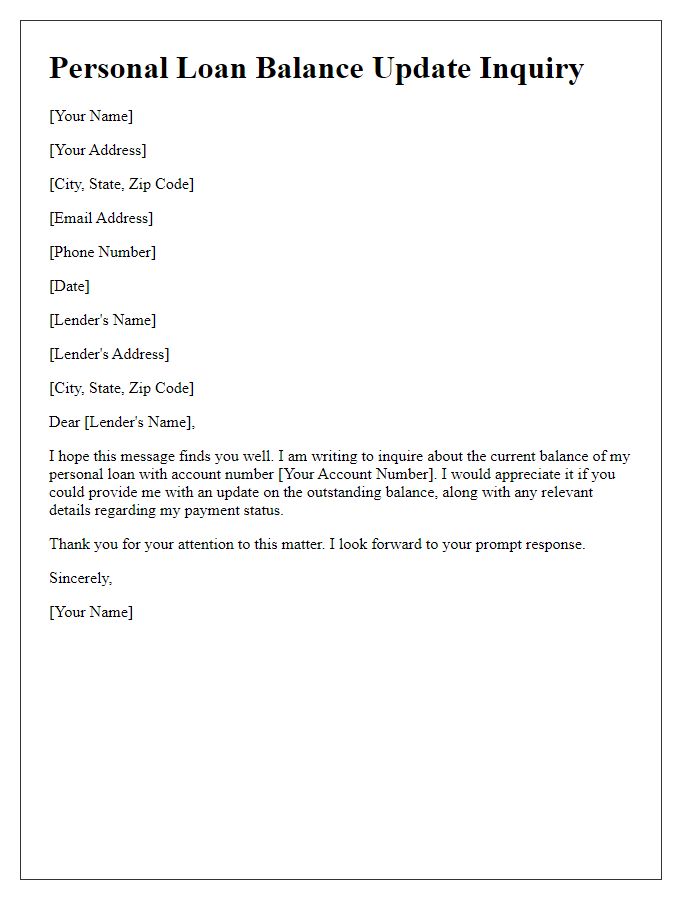

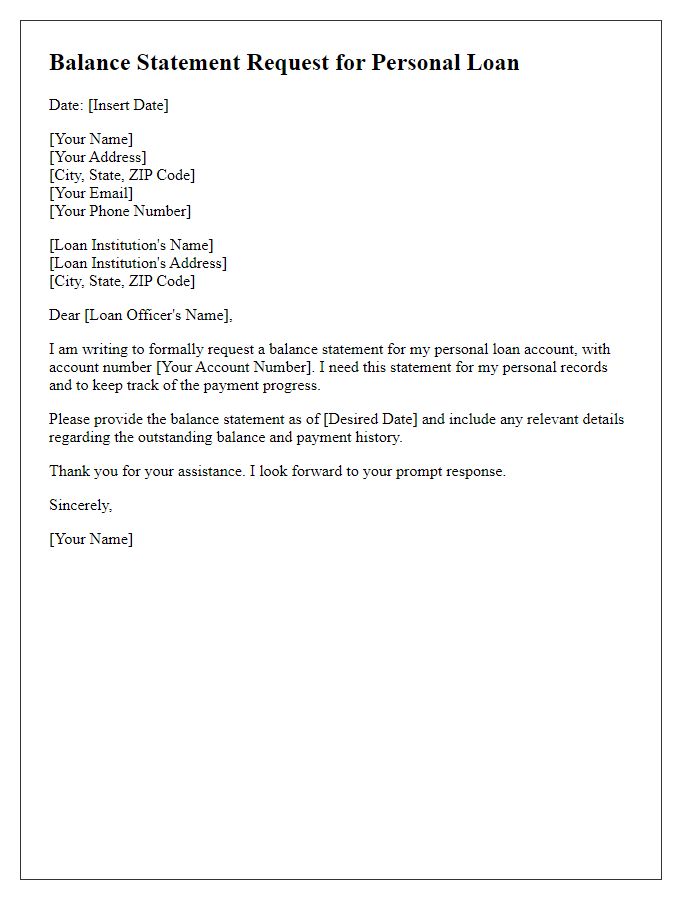

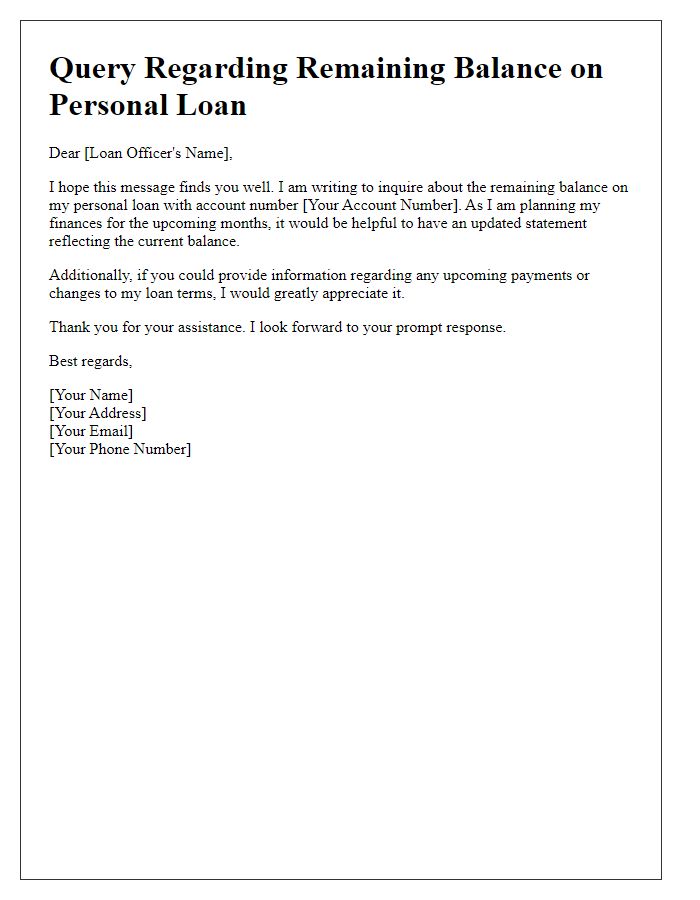

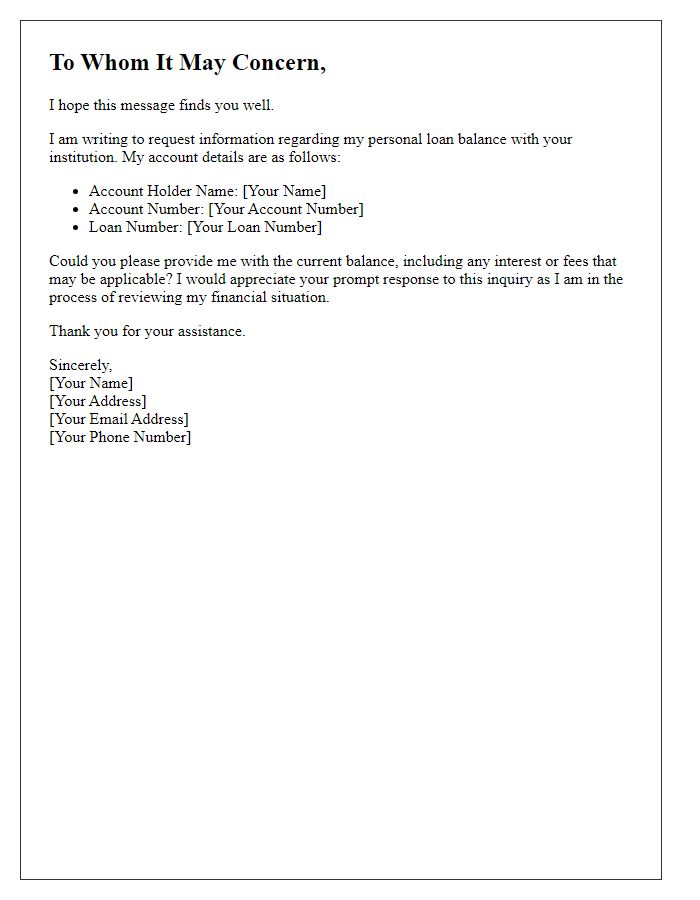

Letter Template For Personal Loan Balance Inquiry Samples

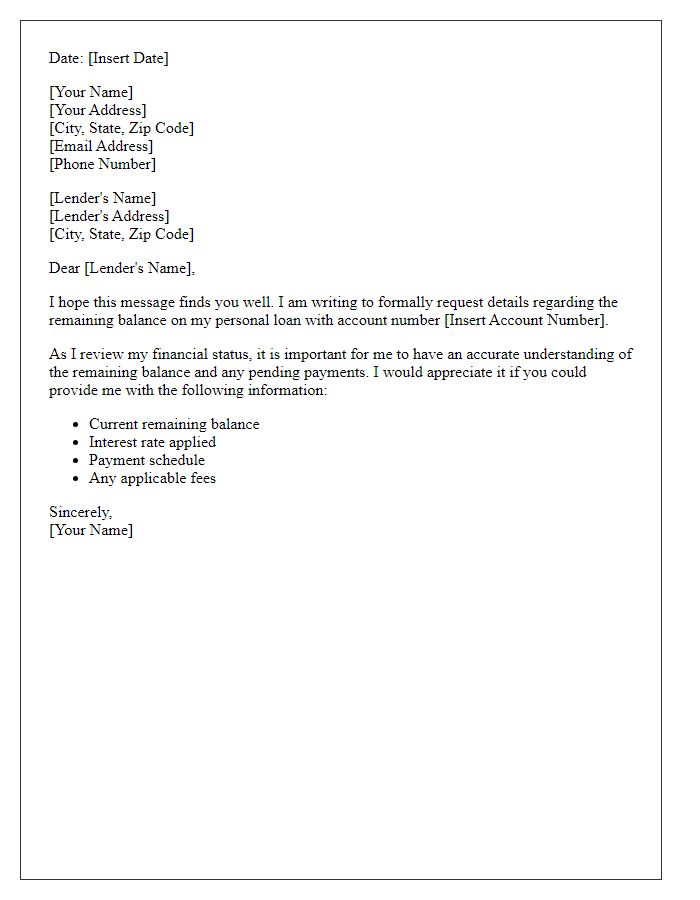

Letter template of request for details on personal loan remaining balance

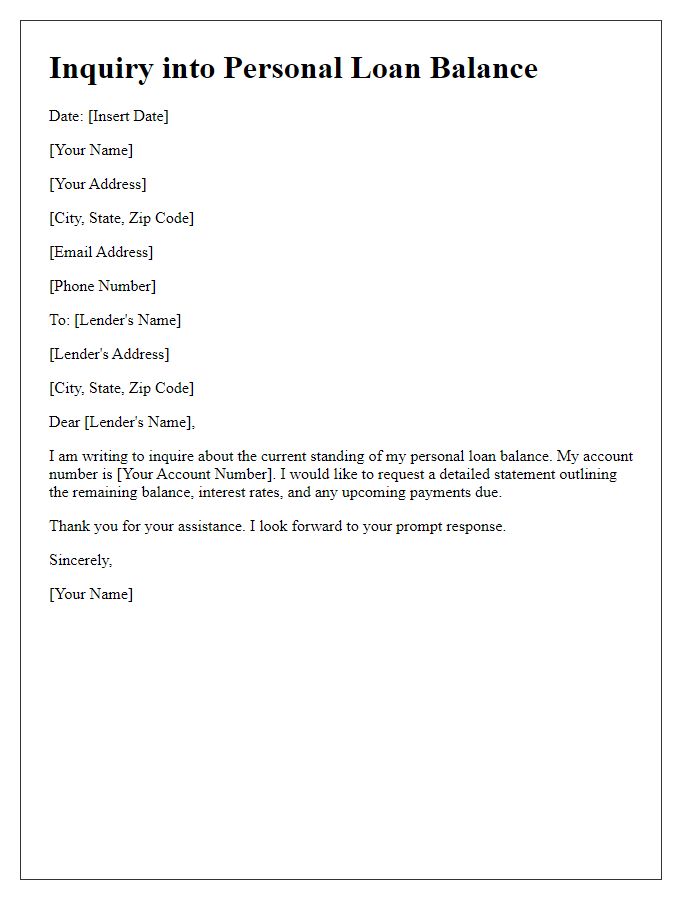

Letter template of inquiry into current standing of personal loan balance

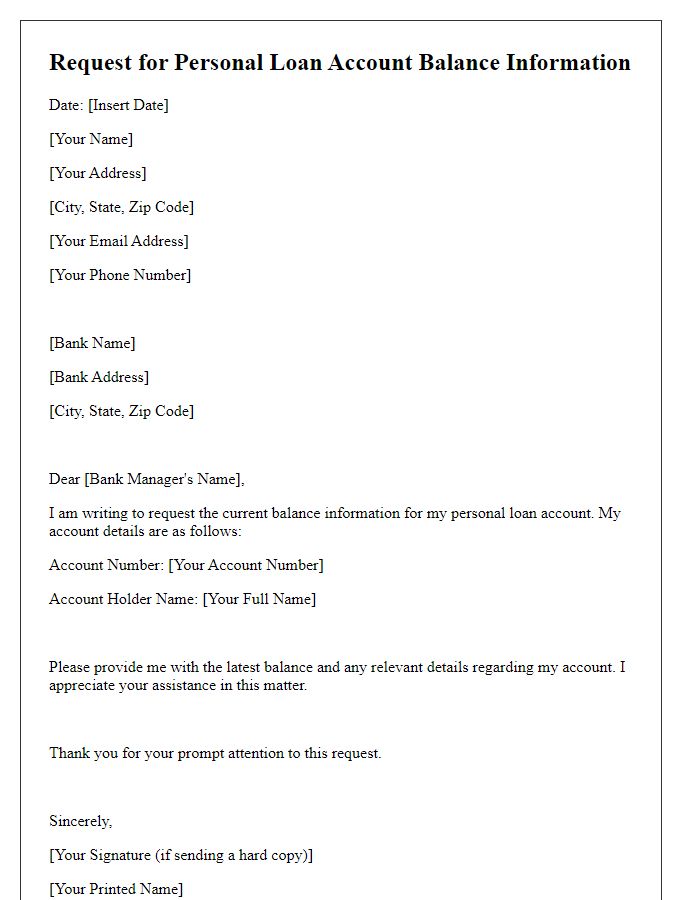

Letter template of request for personal loan account balance information

Comments