Are you facing a payment dispute that feels overwhelming? You're not alone! Many individuals and businesses encounter issues regarding payments, and understanding how to effectively address these disputes can make all the difference. In this article, we'll explore a comprehensive letter template designed to help you resolve payment disputes with ease, so stick around and learn how to tackle your payment concerns with confidence!

Clear Identification of Parties Involved

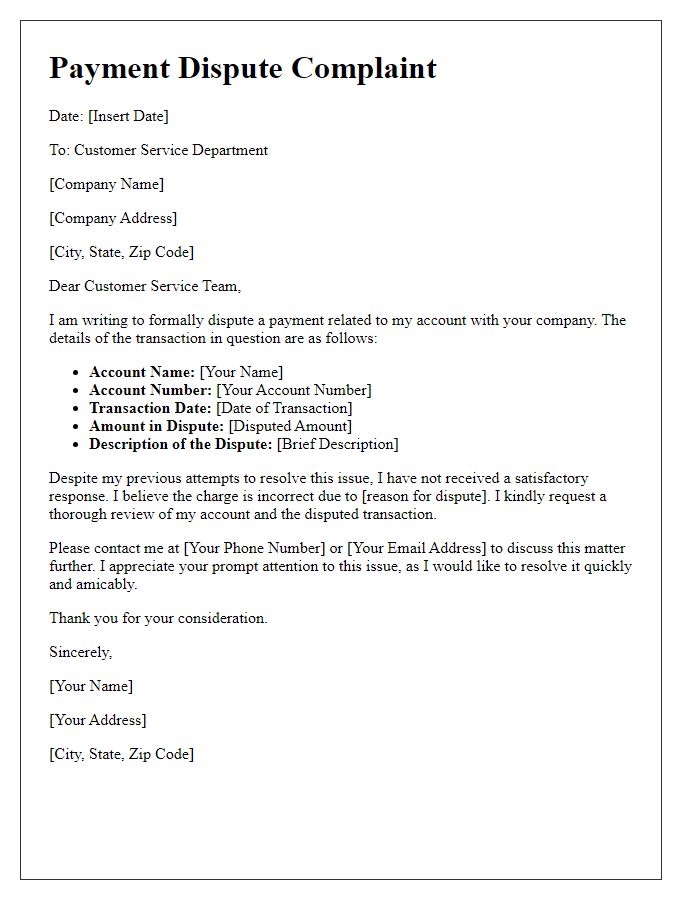

In payment dispute resolutions, clear identification of parties involved is crucial. Complainants, such as consumers or business entities, must detail their full names, addresses, and contact information to establish legitimacy. Respondents, usually service providers or sellers, should also provide their company names, registered addresses, and relevant contact details. The inclusion of identification numbers, such as tax identification numbers or business registration numbers, enhances clarity. Additionally, transaction details like invoice numbers and payment dates assist in pinpointing the specific dispute, creating a structured and transparent framework for resolution.

Detailed Explanation of Dispute

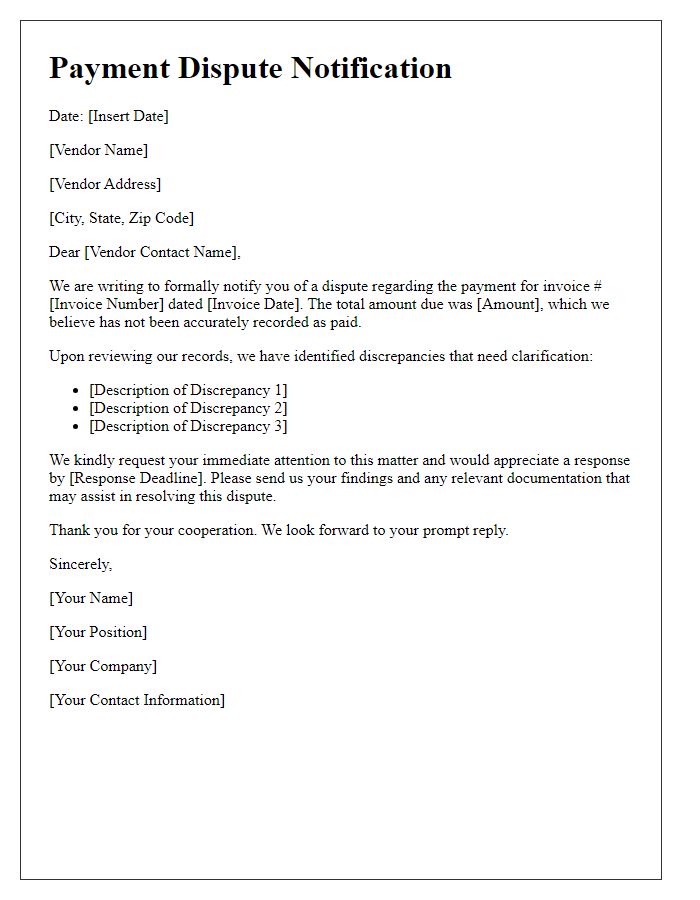

A payment dispute frequently arises in business transactions, impacting financial operations significantly. An invoice discrepancy can lead to misunderstandings regarding payment amounts; for instance, if a client receives an invoice for $1,500 instead of the agreed $1,200, it triggers immediate concern. Documentation such as contracts (often signed and dated) and previous correspondence (emails outlining terms of agreement) becomes crucial in clarifying the issue. Timelines are also essential; delays in payment often exceed standard 30-day terms, heightening tension. Additionally, payment methods (such as credit card vs. bank transfer) can complicate resolutions, especially if processing fees affect total amounts. Effective resolution may require involvement of mediators or legal counsel, particularly in disputes exceeding a specific monetary threshold, often set at $500 for small claims.

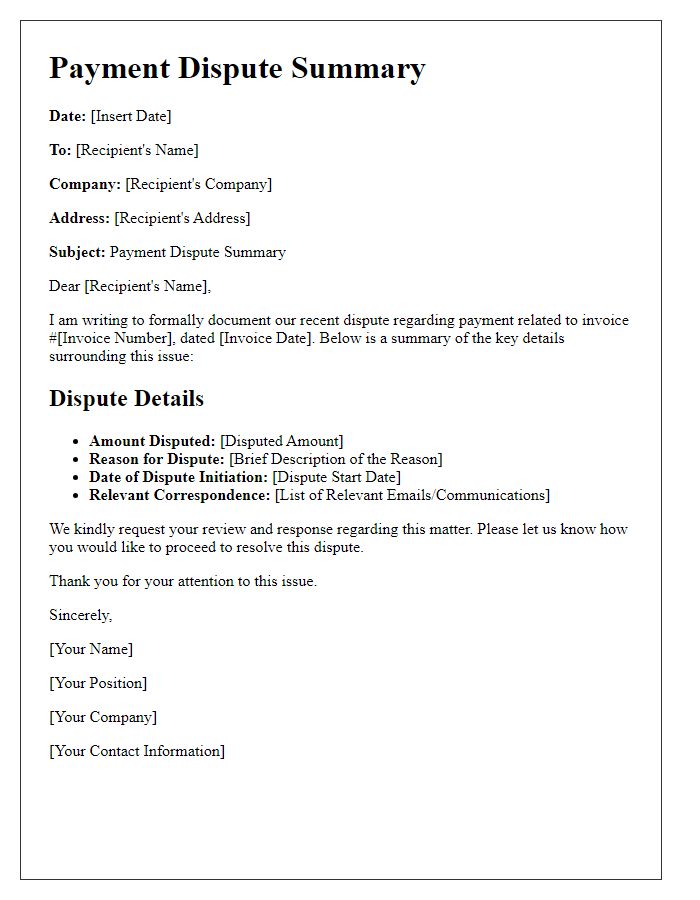

Relevant Payment Documentation

Payment disputes can arise from various issues, such as incorrect charges, unauthorized transactions, or failure to receive services or products. Gathering relevant payment documentation is crucial for resolving these disputes effectively. Essential documentation includes invoices detailing the charged amounts, receipts confirming payment methods, bank statements illustrating transaction dates and amounts, and correspondence related to the issue. Additionally, any evidence of delivery or service completion, such as tracking numbers or signed contracts, can bolster claims. Clear organization of this documentation streamlines the dispute resolution process, allowing for prompt and accurate evaluation by financial institutions, vendors, or legal entities involved.

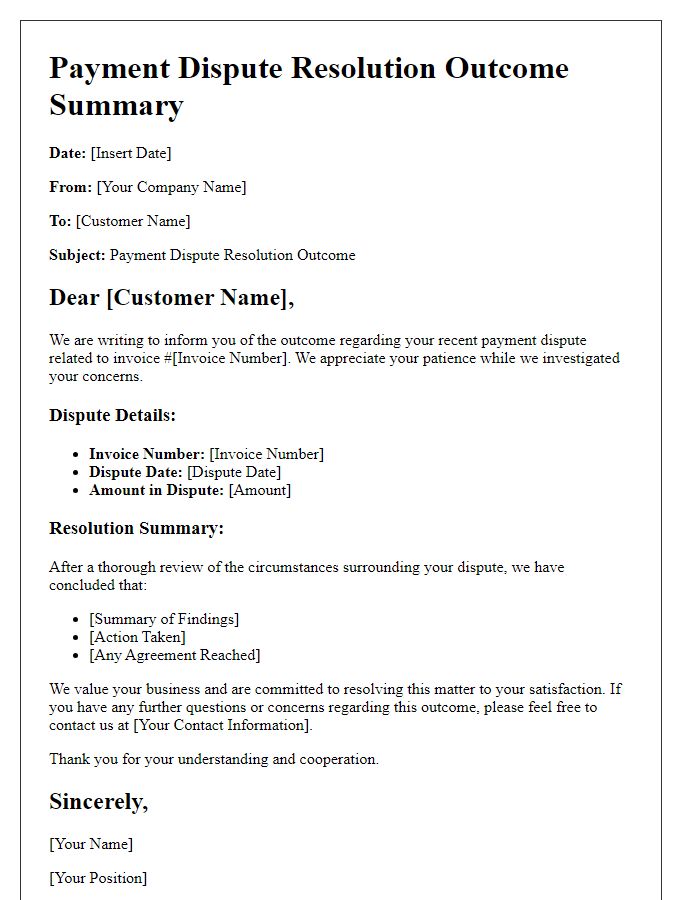

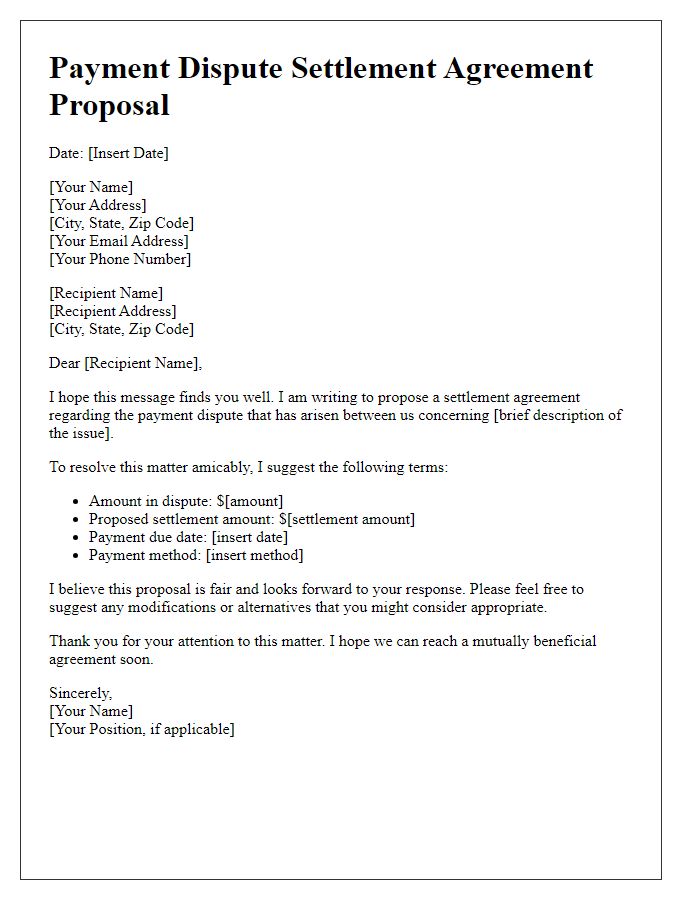

Proposed Resolution or Settlement Terms

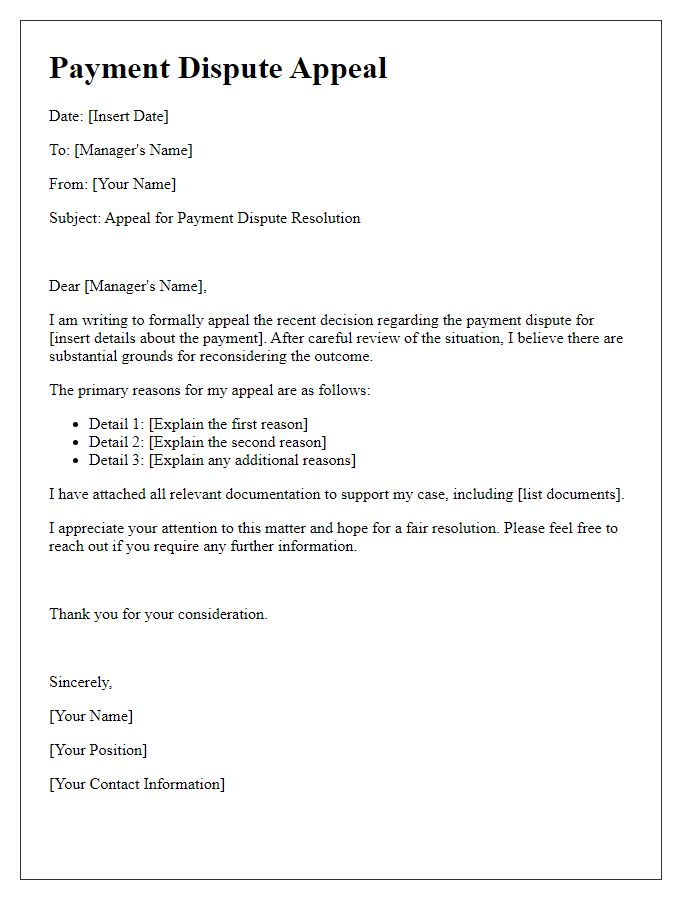

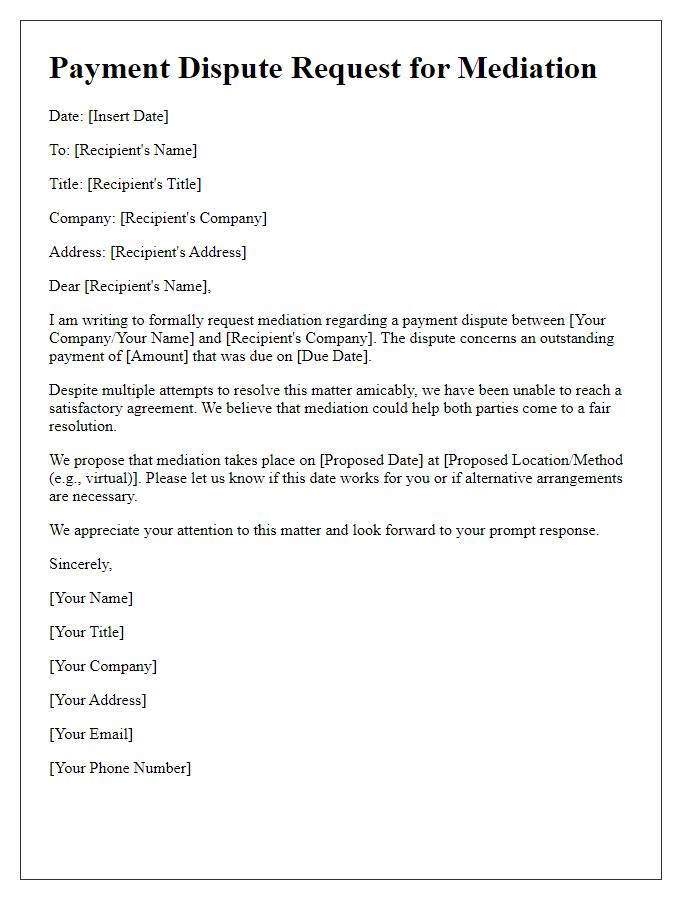

Unresolved payment disputes often arise within business transactions, sometimes involving sums exceeding thousands of dollars due to invoicing errors or service dissatisfaction. A proposed resolution often includes a negotiated settlement, which may entail a partial refund (for example, 20% to 50% of the original invoice amount), a payment plan over an agreed timeframe (such as three months), or credit towards future services (valued at the disputed amount). Documentation must accompany the resolution, including detailed invoices, communication logs, and written agreements for clarity. Additionally, timely responses (within 14 days) from both parties are crucial to expedite the resolution process and minimize legal actions, which can be costly and time-consuming.

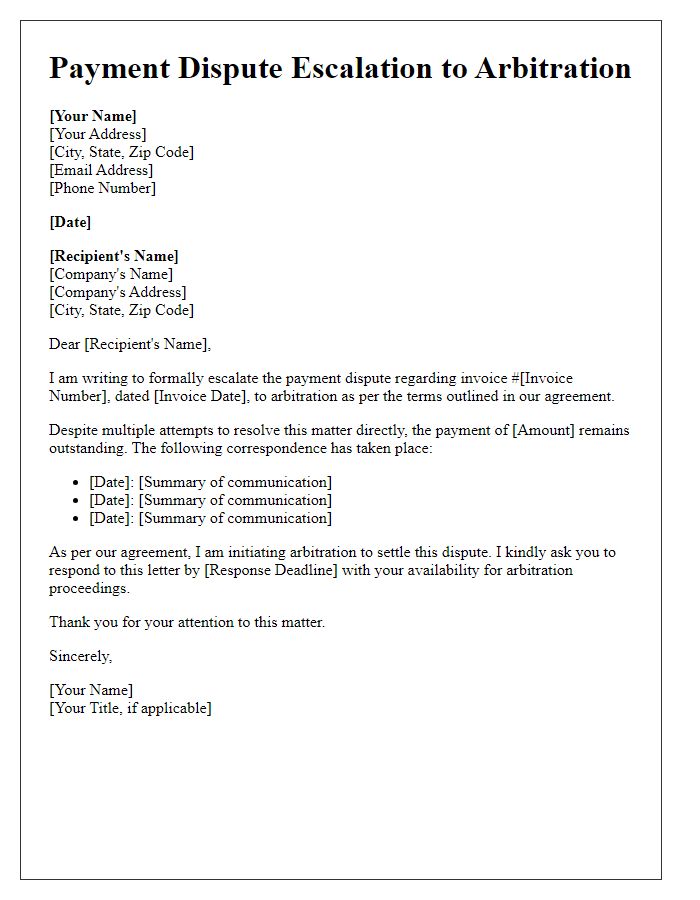

Deadline for Response or Next Steps

Payment disputes often arise in business transactions, particularly when addressing invoices or service contracts with clients or vendors. Response deadlines are critical in these situations, typically ranging from 7 to 30 days, depending on company policy and contract stipulations. Clear communication regarding next steps can involve outlining the process for submitting evidence or documentation (such as receipts, emails, or contracts) to support the claim. In addition, mentioning pertinent laws or regulations, like the Fair Debt Collection Practices Act (FDCPA) in the United States, can lend authority to the dispute process. Prompt resolution is essential to maintaining good business relationships and ensuring satisfaction for all parties involved.

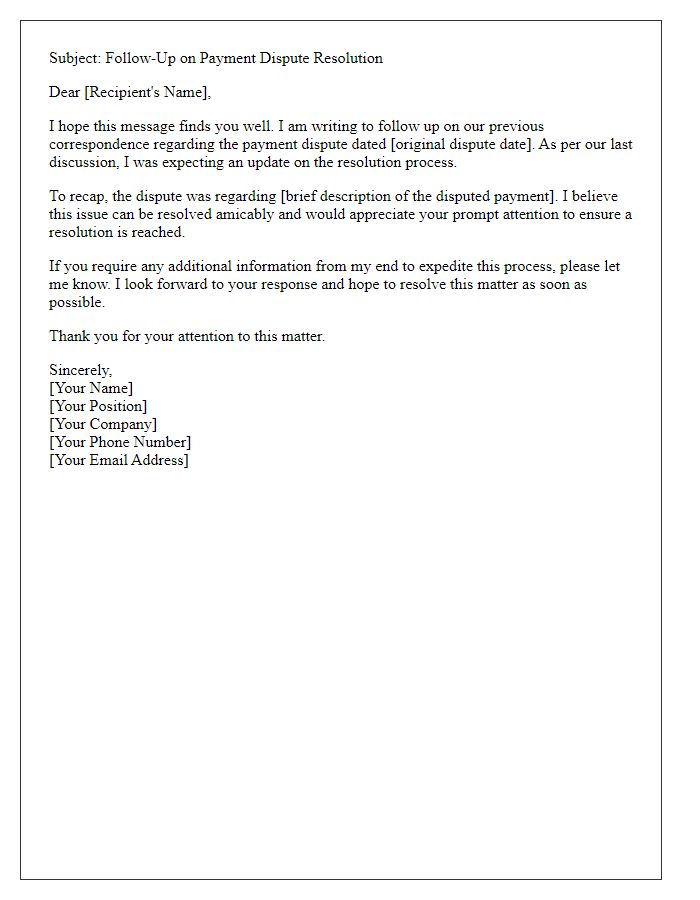

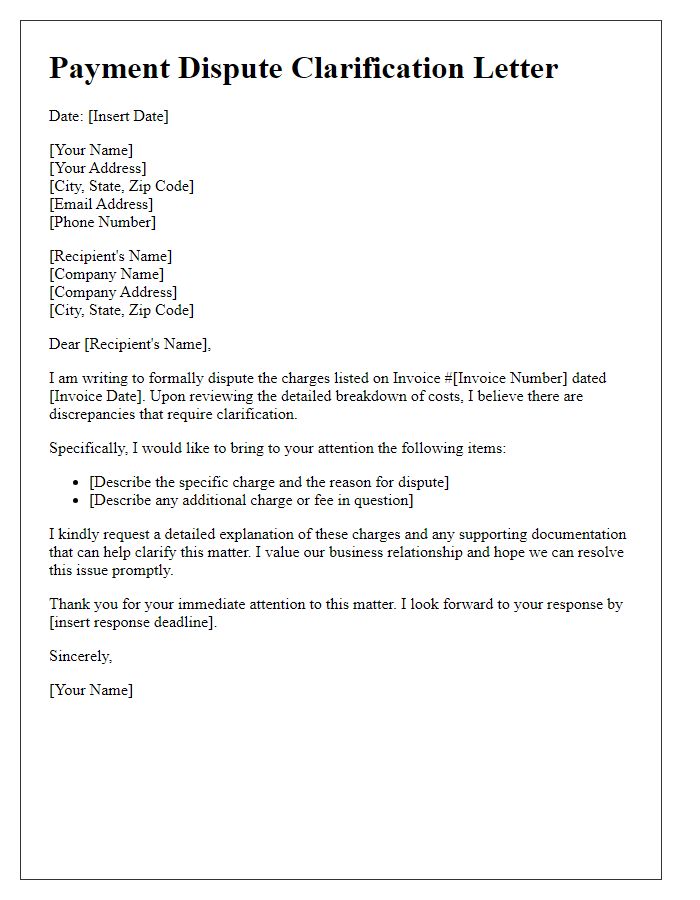

Letter Template For Payment Dispute Resolution Samples

Letter template of payment dispute formal complaint to customer service.

Comments