Hey there! Are you looking to streamline your financial processes and ensure secure transactions? Confirming beneficiary accounts is a crucial step that not only adds a layer of security but also allows for smoother financial operations. Let's dive into the essentials of crafting a clear and effective letter for beneficiary account confirmationâyour ultimate guide is just a click away!

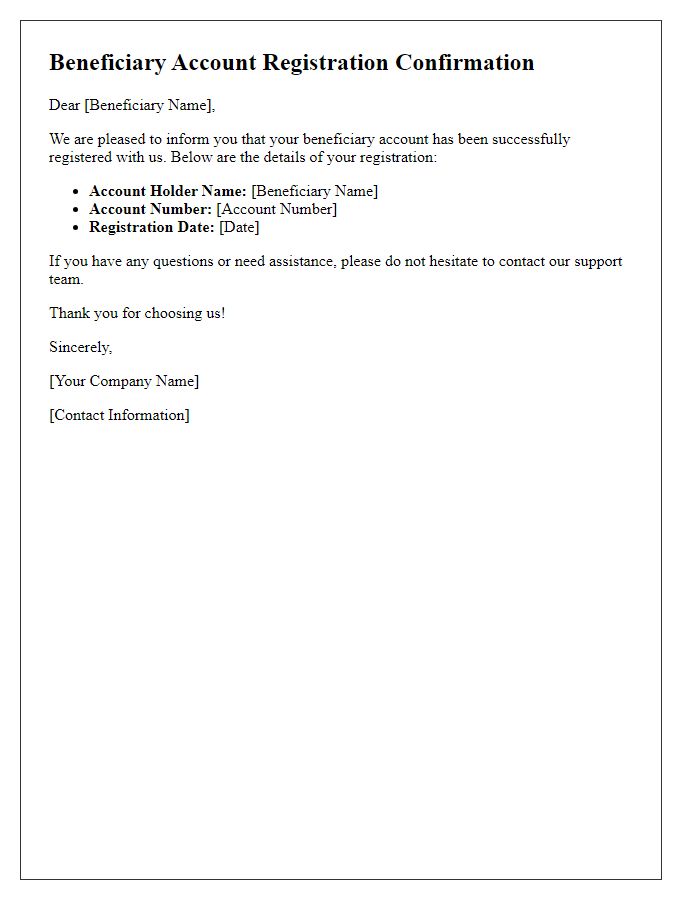

Clear Account Details

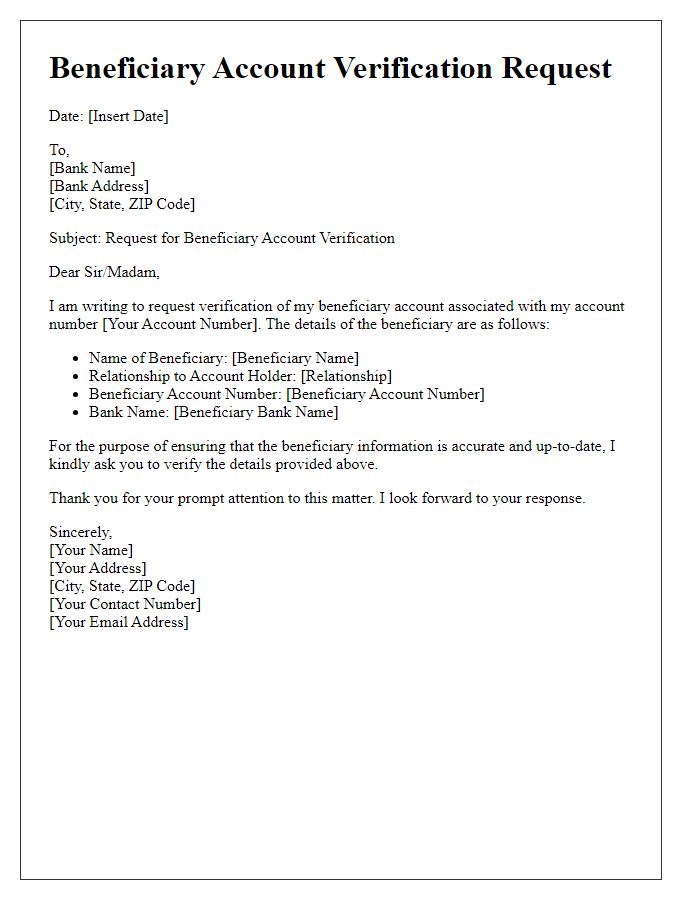

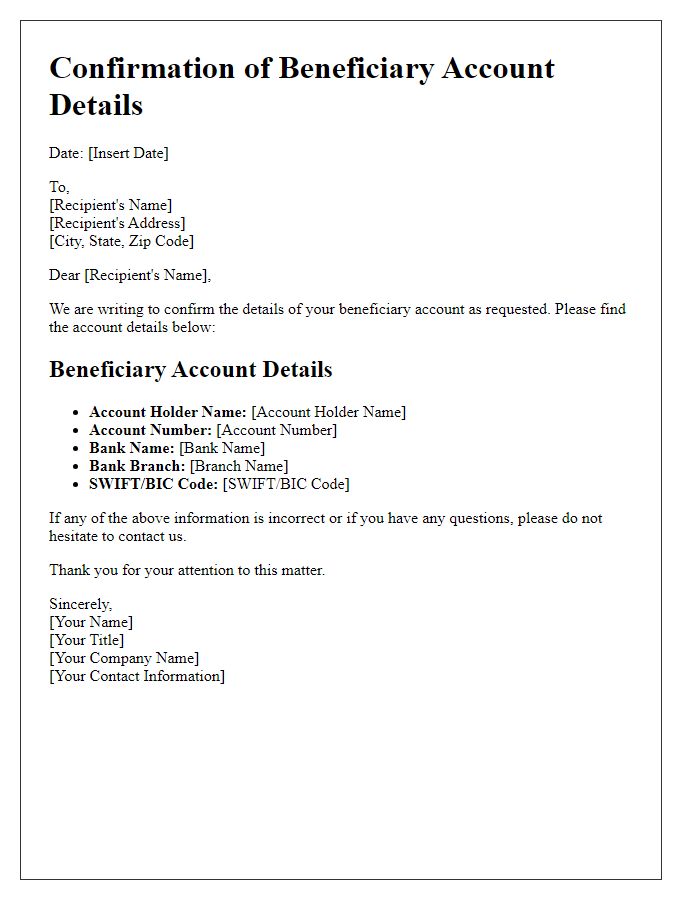

Beneficiary account confirmation requires a comprehensive understanding of the account details for accurate processing. Essential information includes the bank's name (e.g., Bank of America), account number (a unique identifier typically consisting of 10-12 digits), and routing number (a 9-digit code utilized for identification). Additionally, the type of account (such as checking or savings) and the account holder's name (the individual or entity who owns the account) are critical. Confirmation may occur via a secure method, such as encrypted email or official documentation, ensuring the information is safeguarded against unauthorized access. Overall, verifying these details helps ensure the successful transfer of funds and compliance with financial regulations.

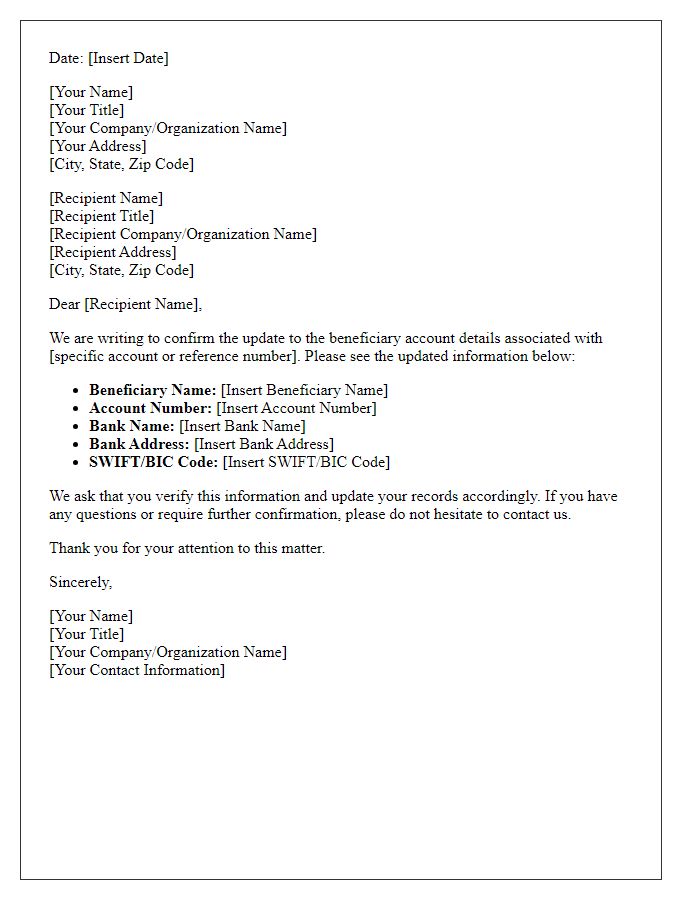

Formal Confirmation Language

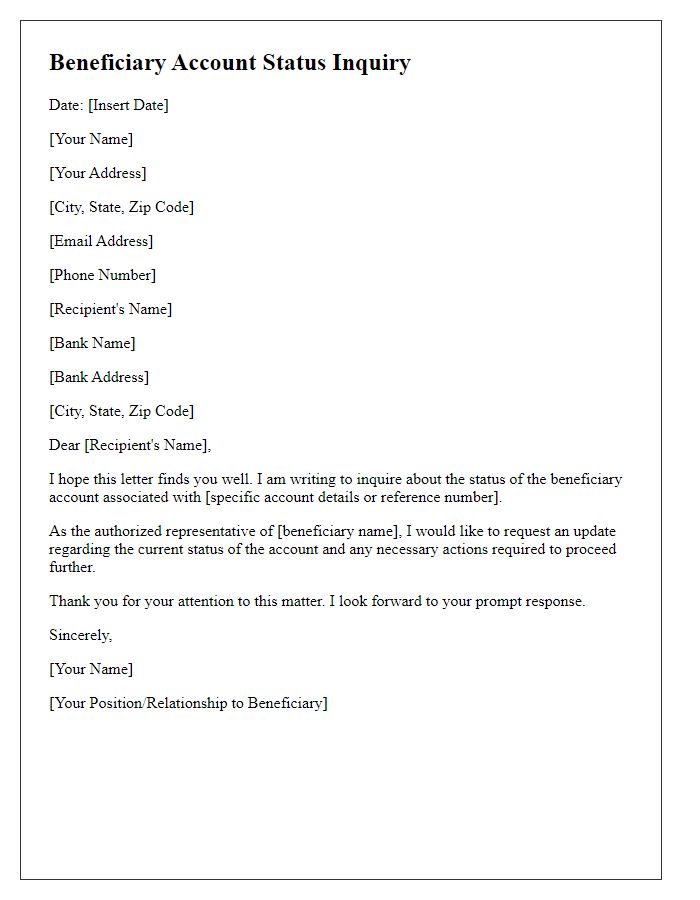

Beneficiary account confirmation is a crucial process in financial transactions. It involves verifying the authenticity of bank accounts designated for receiving funds. Institutions like banks or payment processors use this confirmation to ensure the account holder's identity aligns with the transaction details. Key elements of this confirmation include the beneficiary's full name, account number, bank name, and branch address. Errors or inaccuracies in these details can lead to complications such as delayed payments or misdirected funds. Typically, a formal confirmation letter will encapsulate all necessary information while adhering to industry standards and regulatory requirements. This process mitigates risks associated with fraudulent activities, thus fostering trust in financial transactions.

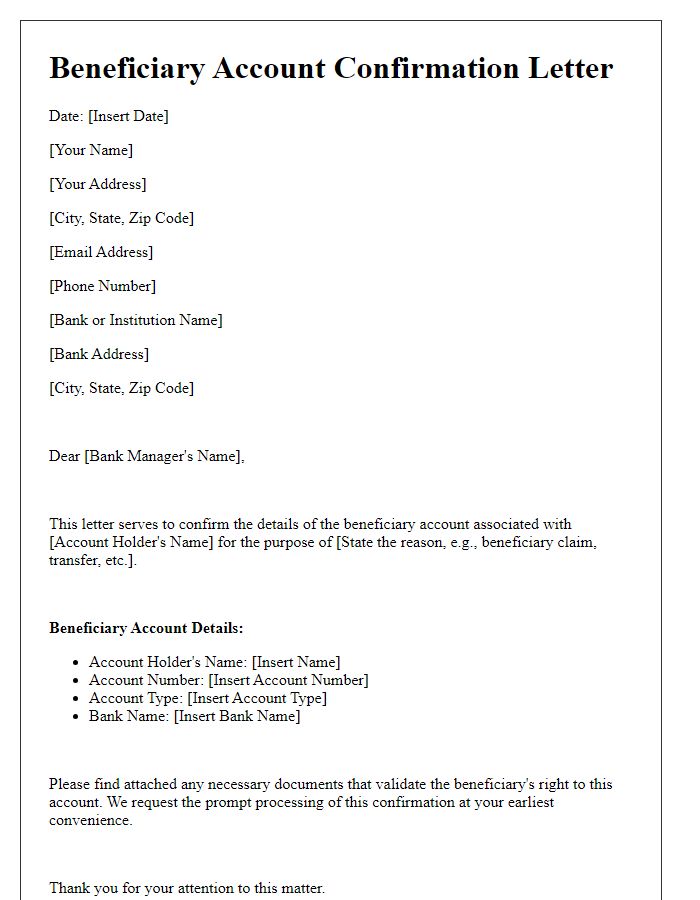

Contact Information for Queries

Beneficiary account confirmation requires essential contact information for addressing queries. Normally includes beneficiary name, account number (often unique to each financial institution), and bank name (such as Bank of America or HSBC). Additionally, it may specify communication methods like phone number (including area code) or email address for direct inquiries. Prominent consideration for security entails specifying whether to use encrypted communication modes for sensitive information exchange. Accurate details ensure efficient query resolution and maintain financial compliance.

Security and Privacy Assurance

Beneficiary account confirmation is crucial in financial transactions, ensuring the security and privacy of sensitive information. Institutions often implement robust verification processes to safeguard personal data during the confirmation of beneficiary accounts, such as bank accounts or payment systems. For instance, the verification process may involve multi-factor authentication, requiring users to provide additional information like a one-time password (OTP) sent to their registered mobile number or email address. Additionally, encryption protocols, such as SSL (Secure Sockets Layer), protect data transmission during the confirmation process, preventing unauthorized access. Regular audits and compliance with regulations, such as GDPR (General Data Protection Regulation) in the European Union, bolster security measures, ensuring that beneficiary information remains confidential and secure.

Instructions for Next Steps

Beneficiary account confirmation is crucial for ensuring seamless transactions. Upon successful verification, recipients should provide documentation, such as a government-issued ID or utility bill, to confirm their identity and address. Banks like JPMorgan Chase often require account numbers, routing numbers, and validated signatures for processing requests. After submission, it may take up to five business days for verification to complete. Once confirmed, beneficiaries can access account features, including direct deposits and transfer functionalities, streamlining their financial management. Ensuring timely and accurate confirmations supports efficient monetary transactions and enhances financial security for all parties involved.

Comments