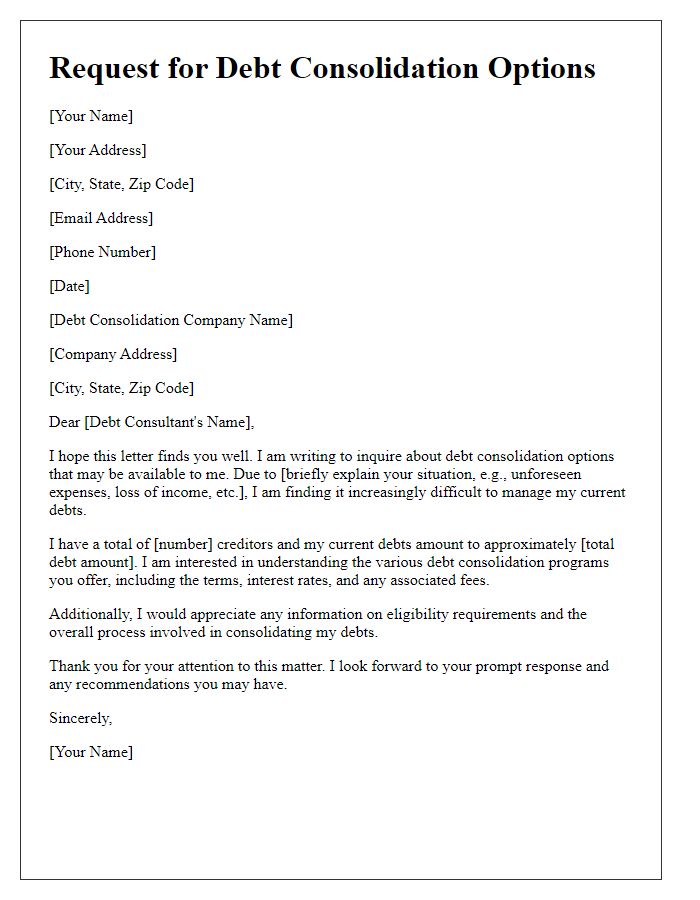

Are you feeling overwhelmed by debt and searching for a way to regain control of your finances? Debt consolidation could be the solution you've been looking for, offering a simplified way to manage multiple debts with a single monthly payment. This approach not only alleviates stress but can also help improve your credit score over time. Ready to explore how debt consolidation can work for you? Read more to find out!

Borrower's financial overview

A comprehensive debt consolidation analysis involves a detailed borrower's financial overview that highlights key metrics such as total debt amount ($25,000 in credit card bills), monthly income (approximately $3,500 from employment), existing credit score (e.g., 620 indicating fair credit), and monthly expenses (around $2,800 including rent and utilities). An assessment of the debt-to-income ratio (DTI) is crucial, often regarding a threshold of 36% or lower. Key financial obligations include varying interest rates (ranging between 15% to 25% for credit cards) and payment due dates that could affect cash flow. The analysis also considers potential savings from consolidating higher-interest debts into a single lower-interest loan, potentially facilitated through providers like personal loans from online lenders or local credit unions, which may offer rates as low as 6% based on creditworthiness. Understanding these variables equips borrowers to make informed decisions about managing their financial health more effectively.

Details of existing debts

A comprehensive overview of existing debts is critical for effective debt consolidation analysis. Common elements to consider include total outstanding balances across various creditors, such as credit cards from brands like Visa and Mastercard, usually carrying high interest rates (averaging 15-20%). Monthly payment amounts should be noted, including those for personal loans (with terms typically ranging from 3 to 5 years), which may possess fixed interest rates. Evaluate potential late fees or penalties associated with missed payments, affecting overall financial health. It's essential to identify whether debts are secured, such as a mortgage loan secured against property, or unsecured, such as medical bills. Additionally, the impact of credit scores, often weighed between 300 to 850, should be considered, as a lower score may indicate higher interest rates during consolidation. Understanding the terms of these debts provides a foundation for a tailored debt management strategy.

Proposed consolidation terms

Debt consolidation proposals typically include a comprehensive overview of the restructuring process, detailing the total amount of debt, interest rates involved, and potential new terms. Consolidation terms might encompass a lower interest rate, often ranging between 5% to 10%, offering significant savings compared to higher rates from individual debts (some exceeding 25%). The proposed monthly payment could be structured to fit a 3 to 5-year repayment plan, allowing for manageable installments. Furthermore, lenders might outline specific fees associated with consolidation, such as origination fees which can be around 1% to 4% of the total loan amount, in addition to potential impacts on credit scores during the transition. This analysis aims to provide a clearer financial pathway while ensuring obligations are met without overwhelming financial strain.

Potential savings and benefits

Debt consolidation provides multiple financial advantages, particularly in reducing overall monthly payments. For instance, consolidating high-interest debts, such as credit card balances averaging 15-25% interest rates, into a single personal loan with a lower rate, often around 6-10%, can significantly alleviate financial stress. This approach can lead to monthly savings of several hundred dollars depending on total debt amounts. Additionally, debt consolidation simplifies repayment schedules by combining multiple payments into one manageable monthly amount, aiding in budgeting and reducing the likelihood of missed payments, which can result in late fees or additional interest charges. Furthermore, successful consolidation endeavors can contribute positively to credit scores over time, as timely payments on a single loan can improve credit utilization ratios and payment history. Overall, this strategic financial move allows consumers to regain control of their finances while potentially saving thousands on interest payments in the long run.

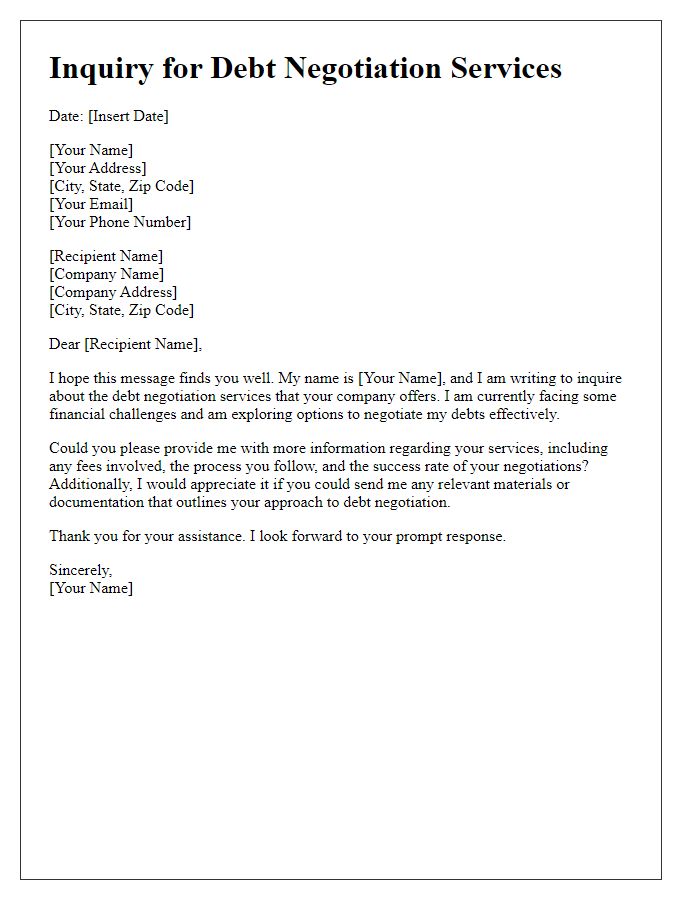

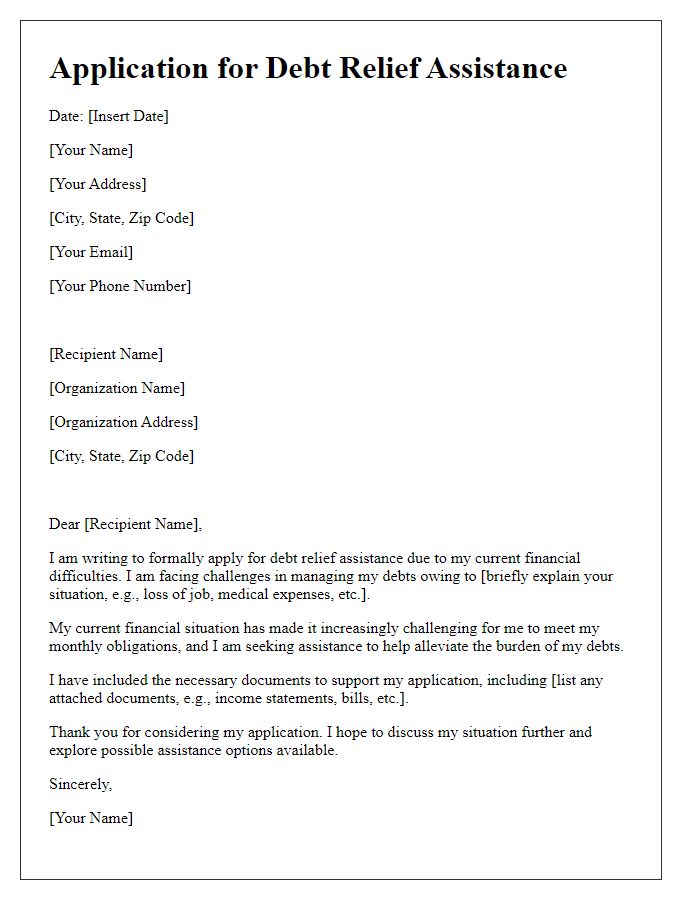

Alternative financial solutions

Debt consolidation analysis reveals multiple alternative financial solutions for individuals facing overwhelming debt. Options include personal loans from credit unions or banks, allowing borrowers to combine high-interest debt into a single lower-rate loan. Balance transfer credit cards provide a promotional 0% APR for an initial period, often 12 to 18 months, enabling users to pay off outstanding balances without accruing interest. Home equity loans or lines of credit offer homeowners the chance to tap into their property's equity, typically providing lower interest rates. Additionally, debt management plans organized through non-profit credit counseling agencies can help negotiate better repayment terms. Each option requires careful consideration of associated fees, interest rates, and risks to ensure that the chosen path aligns with long-term financial goals.

Comments