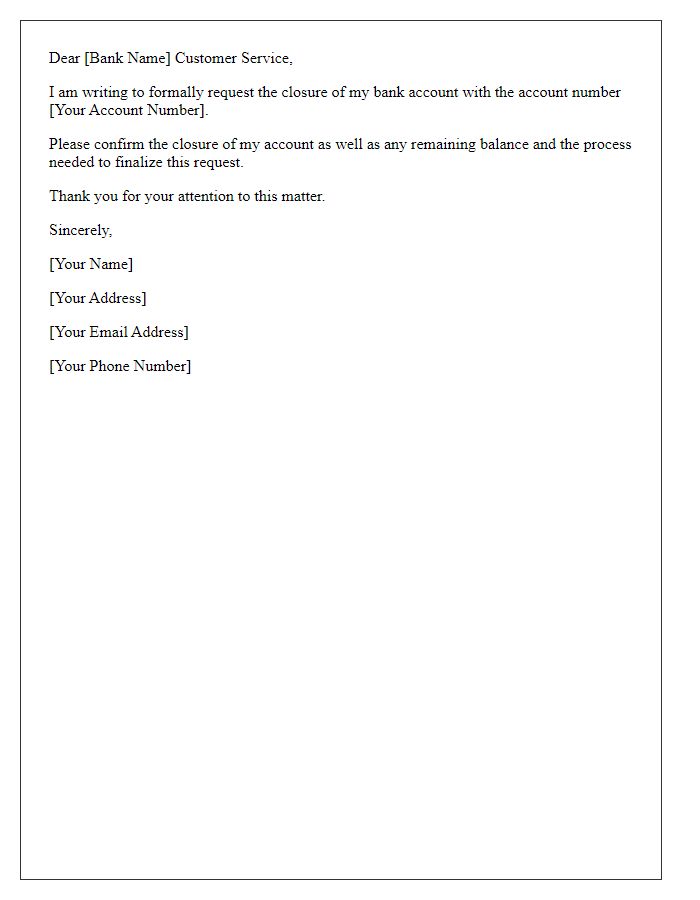

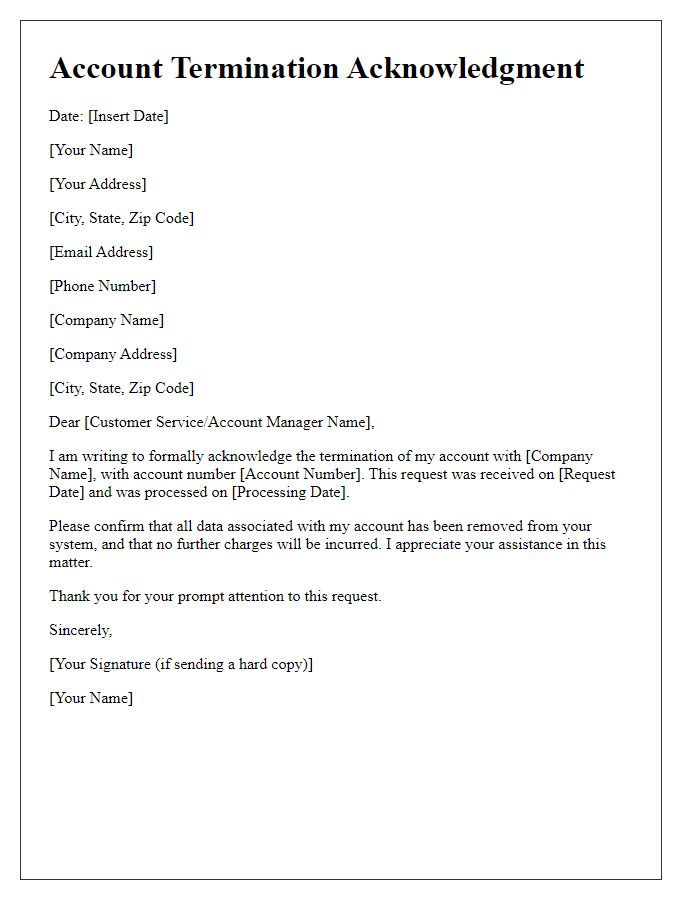

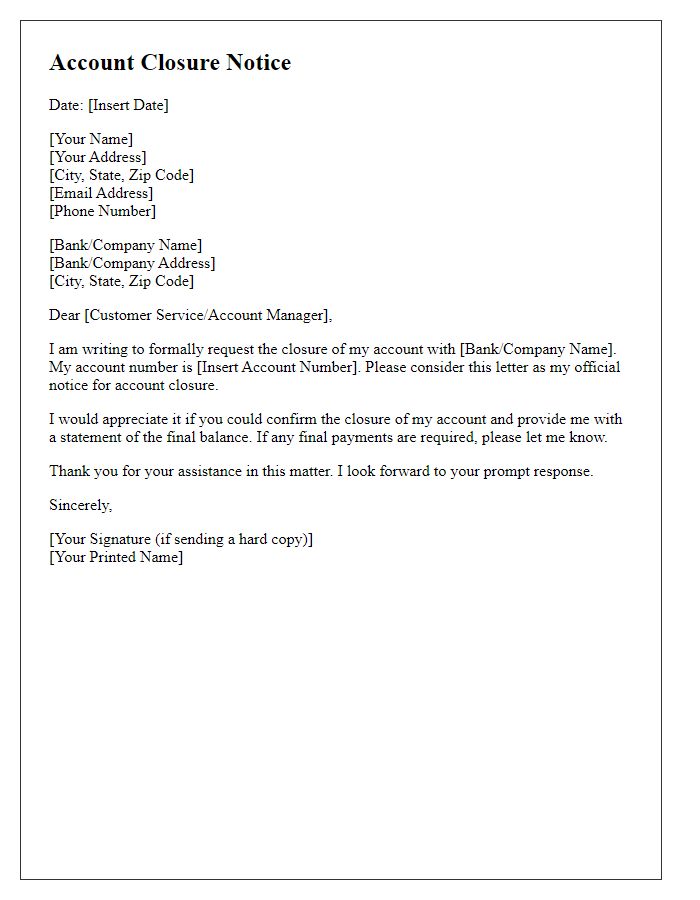

Hey there! If you've ever needed to close an account, you know how important it is to have a clear confirmation letter for your records. This simple yet essential document not only serves as proof of your request but also ensures that everything is wrapped up neatly. In our latest article, we'll walk you through a helpful template to craft your own account closure confirmation letter with ease. So, let's dive in and make the process smoother for you!

Business Letterhead

Account closure confirmation often follows a formal process involving acknowledgment and verification of termination requests. Closure letters usually include essential information such as account numbers, customer details, and closure dates. Ensuring clarity in communication is critical for preventing misunderstandings. Customer service representatives typically handle such communications, documenting details meticulously to maintain records. This confirmation may also include any final transactions or remaining balances, guiding clients on how to proceed further. A structured approach enhances professionalism, fostering trust between the business and its clients, particularly in sectors like finance or telecommunications.

Account Details

Account closure confirmation occurs when a financial institution, such as a bank, processes a request to terminate an account, often linked to customer details like name, account number, and date of closure. Customers may be informed via formal communication methods, indicating confirmation and final account balance. This process often involves a review of any linked services, like debit cards or online banking, which must also be deactivated. It's essential to ensure all outstanding transactions or fees are settled before closure to avoid future complications. Documentation related to account history may also be retained for reference, complying with regulations and guidelines established by financial authorities.

Closure Confirmation Statement

Account closure confirmation provides verification of the termination of a financial account, often related to banking or investment services. This statement typically includes essential details, such as account number (e.g., 123456789), closure date (e.g., October 1, 2023), and the final balance (e.g., $0.00). It serves as an official document that signifies the end of the account's activity. Many institutions highlight the reason for closure, ensuring transparency, especially if it involves a specific directive from the account holder. Furthermore, it may mention any remaining obligations, such as pending transactions or fees, advising account holders to consult customer service if they have further inquiries. Such documentation is crucial for personal records and future reference should disputes arise.

Final Balance Information

Closing an account, such as a bank account or membership account, typically involves confirming the final balance. This process ensures that all transactions are settled and that any remaining funds are clearly communicated to the account holder. When an account closes, the final balance should detail any outstanding fees or credits that might apply. It is essential to specify the total amount that will be either transferred to another account or issued as a refund, along with the method of delivery, like a check or electronic transfer. Additionally, providing a timeline for when the account closure will take effect adds clarity, informing customers they will no longer have access to the account after a specific date.

Customer Service Contact Information

Account closure confirmation outlines the finalization of a customer's request to close their account with a financial institution, such as a bank or credit union. This process typically involves verifying personal information, including account numbers and identification details, to ensure security and accuracy. The closure confirmation may include important notes regarding final transactions, any remaining balance, or potential fees. Additionally, customer service contact information should be provided, allowing customers to reach out for support regarding their account status or future inquiries. Clarity in communication is crucial for ensuring customers understand the implications of account closure and have access to assistance if needed.

Comments