Are you considering transferring your investment account but unsure where to start? It can feel daunting, but understanding the process and knowing what to include in your letter can make all the difference. In this article, we'll guide you through a simple and effective letter template that will help streamline your account transfer. So, let's dive in and explore the essential elements you need to craft a successful transfer request!

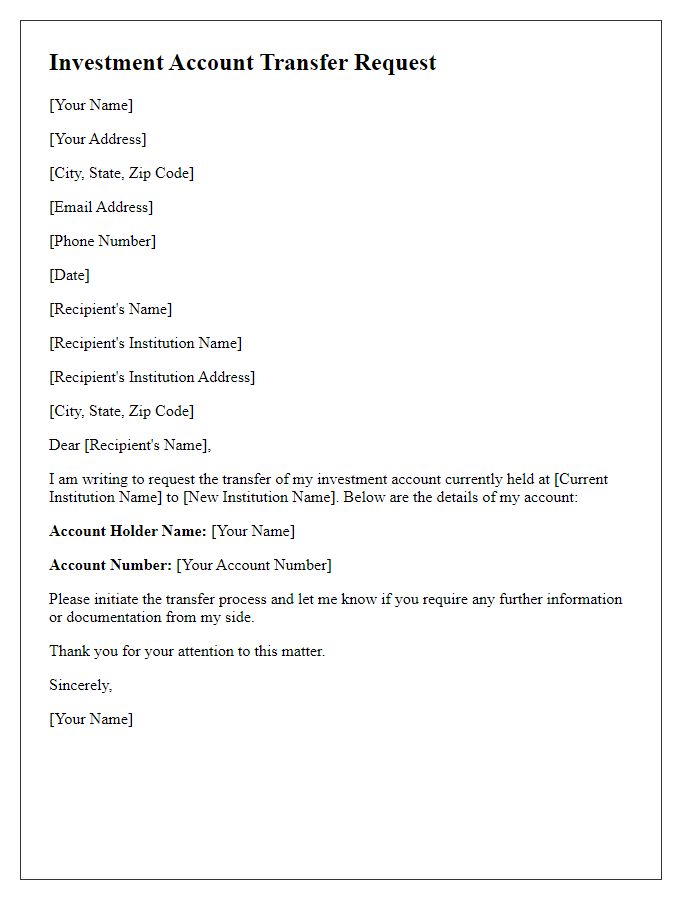

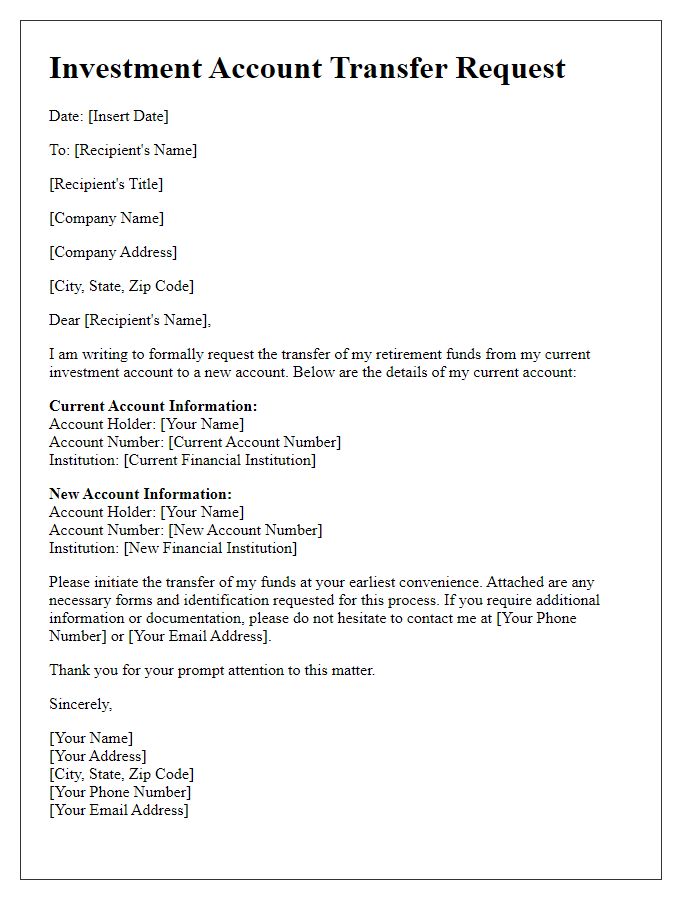

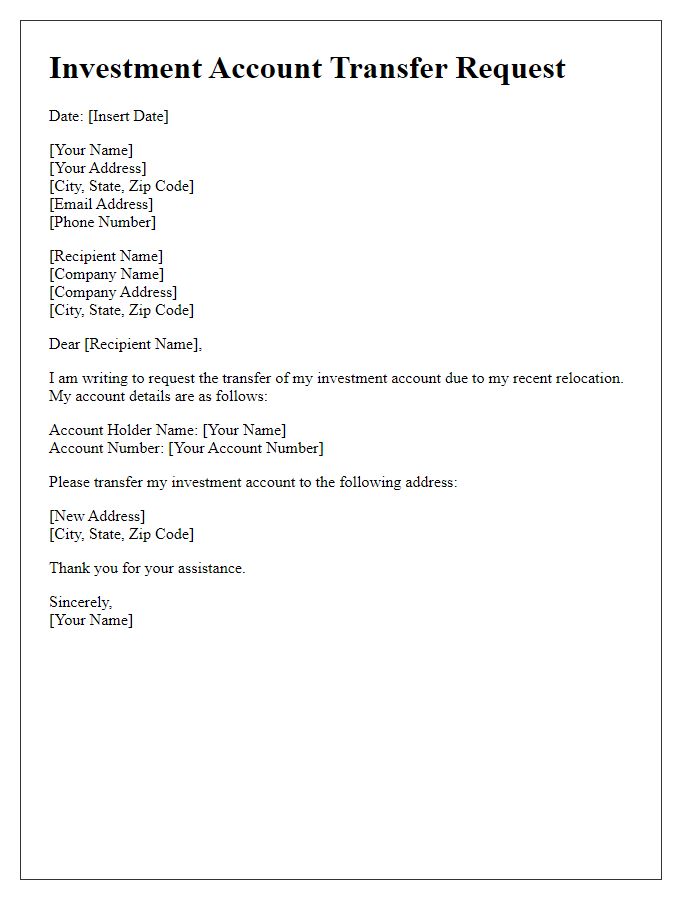

Account details and numbers

Investment account transfers involve several key elements, including account details such as account numbers and financial institutions. For example, transferring an investment account from Vanguard, known for its mutual funds and ETFs, to Fidelity Investments. The Vanguard account number, typically a 10-12 digit figure, is essential for identifying the account during the transfer process. Fidelity requires the receiving account number to process the transfer efficiently. Notably, the transfer may take 5-7 business days, and additional documents, such as a transfer form, may be necessary to complete the transaction. Maintaining accurate records of both accounts can help ensure a seamless transition.

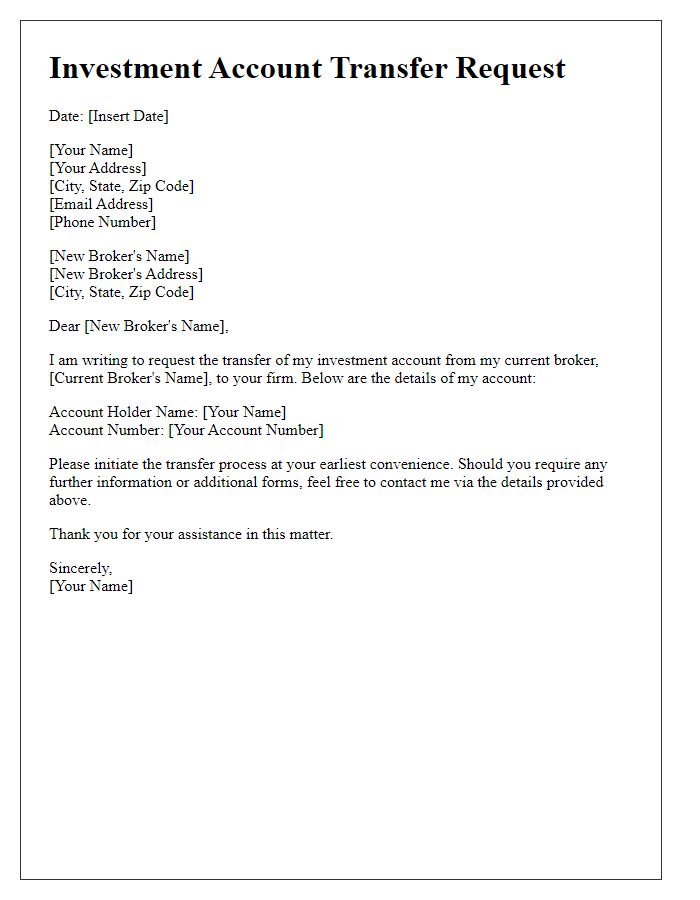

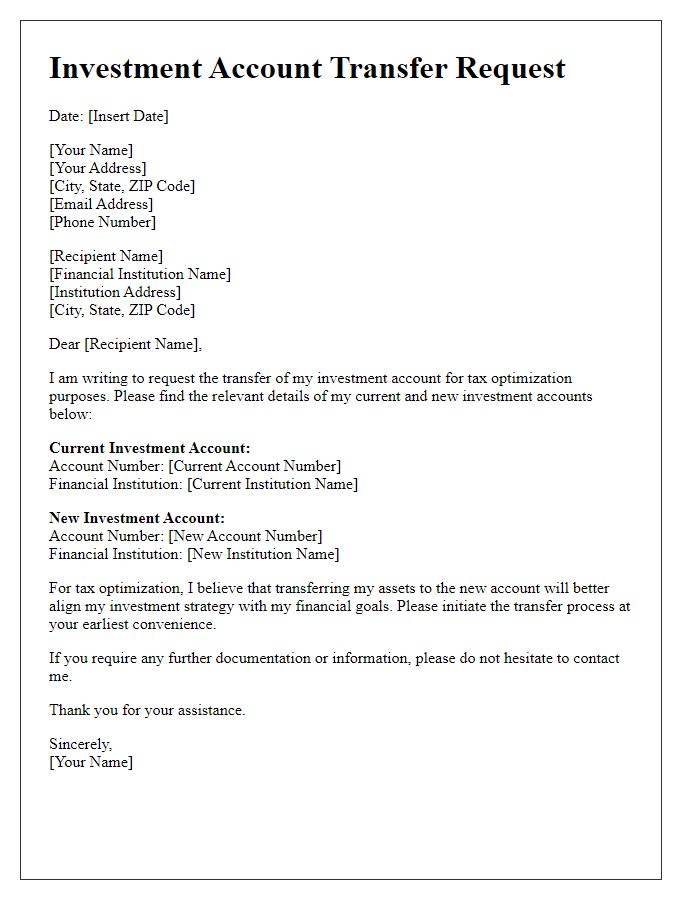

Transfer instructions and specifications

To transfer an investment account, specific instructions and detailed requirements must be followed. First, identification of the account holder is essential, including providing full names, addresses, and Social Security numbers or Tax Identification numbers. The transfer request should specify the type of account, such as Individual Retirement Account (IRA) or brokerage account. The receiving institution must also be clearly identified, including its name, address, and relevant account numbers. A completed transfer form from the transferring institution is typically necessary, along with any additional authorizations required. It is crucial to note any associated fees or transfer timelines, which can vary by financial institutions. Such transfers also typically require a signature from the account holder, affirming consent to process the transfer. Prompt communication with both institutions will facilitate a smoother transition of funds and assets.

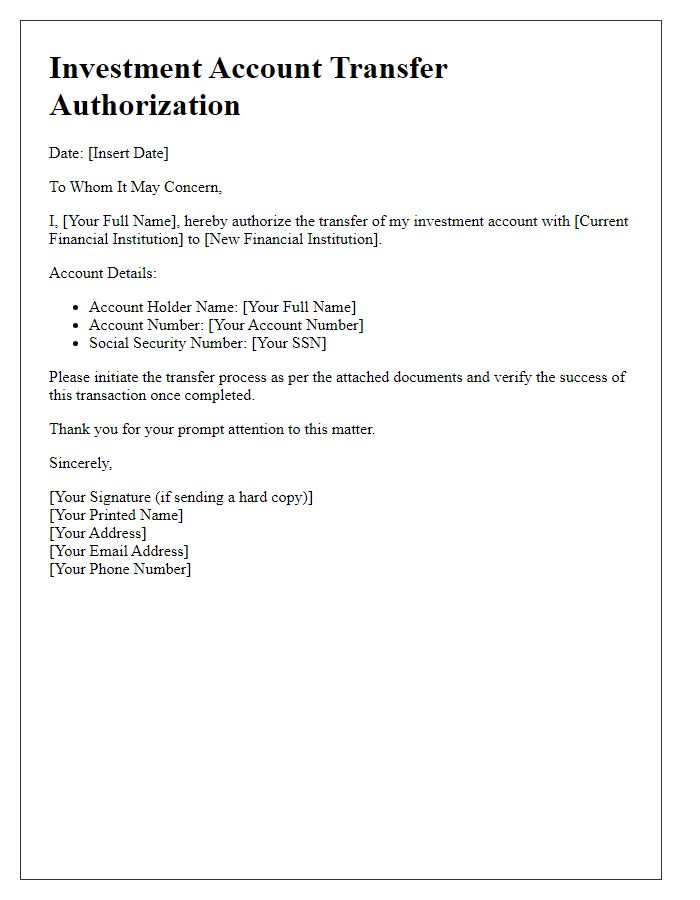

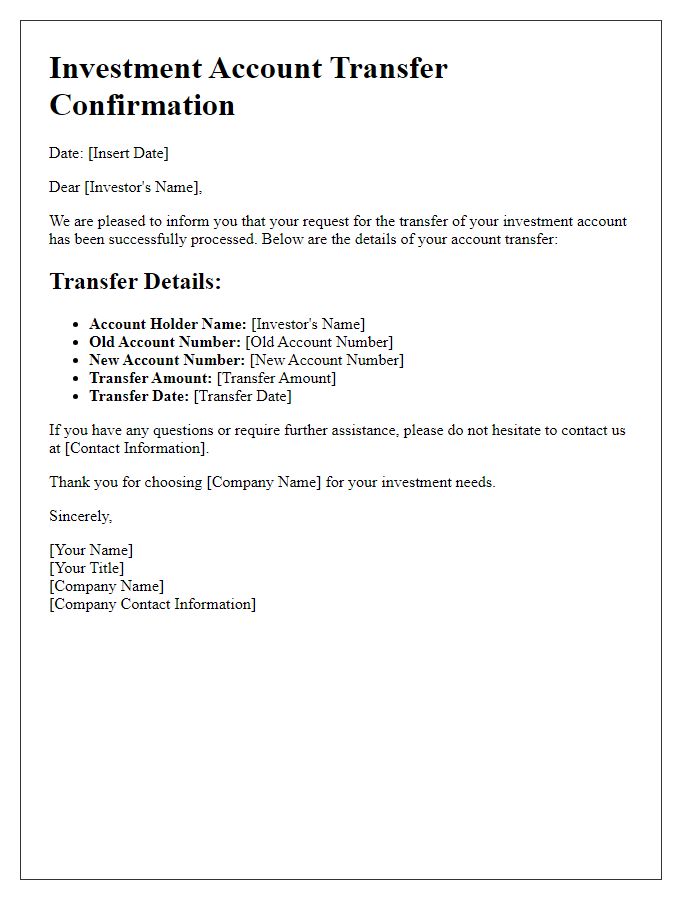

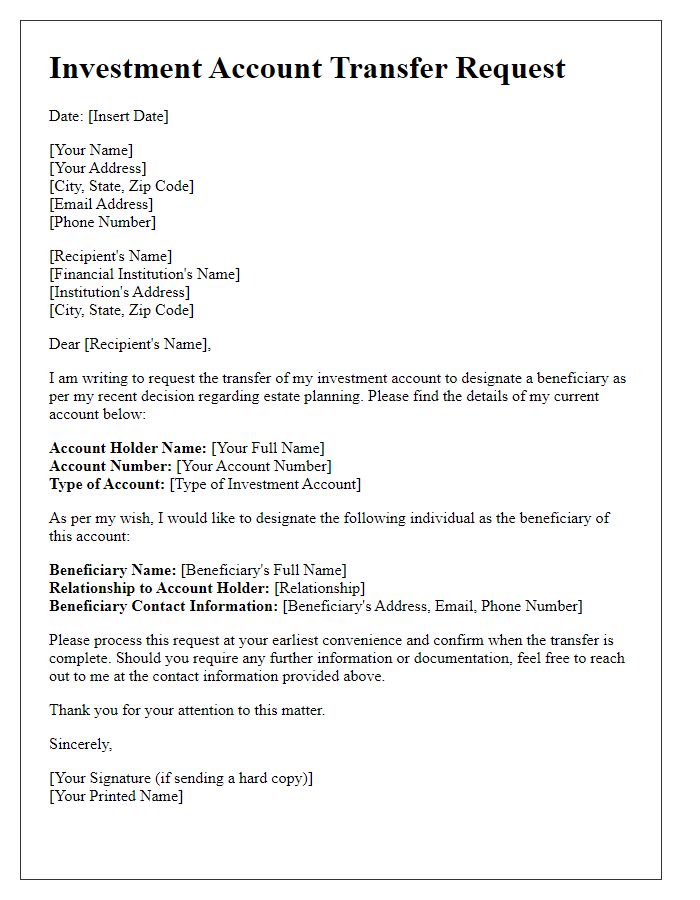

Authorized signatures and contact information

An investment account transfer process requires precise documentation of authorized signatures from account holders. Typically, this involves submission of a transfer form that includes contact information for both the transferring and receiving financial institutions. The form should contain details such as full names, account numbers, and addresses. Authorized signatures should be clear, matching the signatures on file with each institution to ensure compliance with regulations. The transfer process may also require additional identification documents to verify the identity of account holders and authorize the transfer effectively, thus preventing fraud.

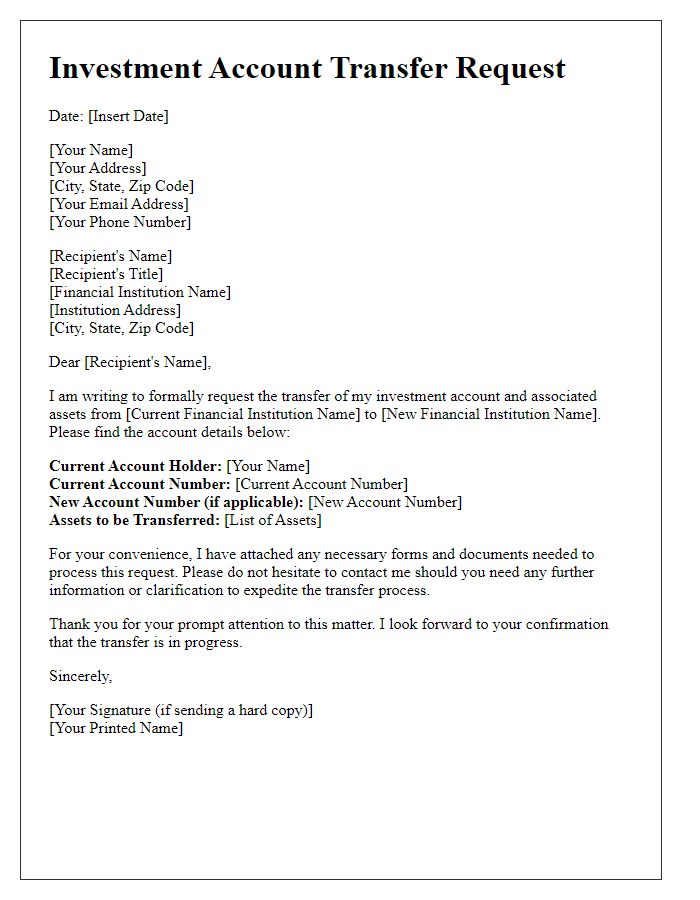

Compliance with regulatory requirements

Transferring investment accounts involves strict adherence to regulatory requirements to ensure the protection of investor assets and compliance with financial laws. Financial institutions, such as brokerage firms, must verify the identity of account holders, ensuring alignment with Know Your Customer (KYC) guidelines established by regulatory bodies like the Financial Industry Regulatory Authority (FINRA). Document submissions include account statements, investment objectives, and signatures to confirm authorization. Compliance also mandates timely reporting of transfers to relevant authorities, depending on jurisdiction, to prevent fraud and money laundering. Regulatory oversight by organizations, such as the Securities and Exchange Commission (SEC), enforces these standards, safeguarding the transfer process and maintaining market integrity.

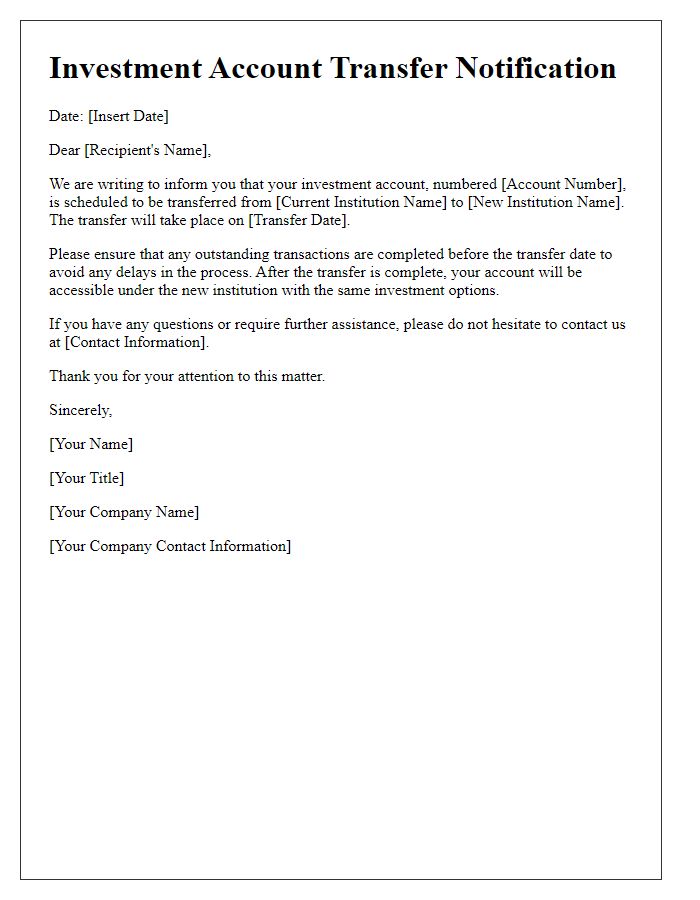

Timeline and expected processing duration

The investment account transfer process involves multiple stages, each with specific timelines that can vary based on various factors. The initial request typically requires submission of transfer forms (usually within 1-2 business days) to the current financial institution. Processing at the originating institution can take anywhere from 5 to 10 business days. Upon completion, the financial institution transfers assets (stocks, bonds, mutual funds) to the new account. The receiving institution may take an additional 3 to 7 business days for the assets to reflect in the new account. In total, investors should anticipate a transfer duration of approximately 2 to 4 weeks for a complete transfer process from initiation to final account settlement. During this time, communication with both institutions is crucial for ensuring all documentation is correct and any potential delays are addressed promptly.

Comments