Are you curious about how your savings account is growing? It's always exciting to see how interest rates can impact your hard-earned money, and we're here to keep you informed! In this update, we'll break down the latest interest rates and what they mean for your savings. So, stick around to discover how you can make the most of your account and boost your financial future!

Account holder's full name and address

Account holders with savings accounts can experience interest rate adjustments based on financial institution policies and prevailing economic conditions. For example, as of October 2023, many banks in the United States have adjusted their interest rates, with average rates ranging from 0.01% to 5.00% APY, depending on account type and balance thresholds. Customers may receive a formal notification at their registered address regarding any changes, which can detail specific percentages, effective dates, and implications for account growth. Ensuring that the customer's full name and address are accurately documented is crucial for successful communication from the bank regarding such updates.

Updated interest rate percentage

Savings account holders at major financial institutions such as banks or credit unions will soon notice an updated interest rate percentage (now at 1.25% annually) applicable to their savings accounts. This adjustment reflects economic changes and central bank policies (Federal Reserve rates) that vary periodically. Customers should monitor their account statements for the effective date of this new rate, which may enhance their compounding interest earnings over time. The updated percentage could significantly impact savings growth, especially for account balances exceeding $5,000, where the interest accrued might surpass $62.50 annually under this new arrangement.

Effective date of new rate

The recent update regarding savings account interest rates reflects a new percentage aimed at encouraging customer savings. The revised interest rate, effective from January 1, 2024, increases to 1.5% per annum for all standard savings accounts. This change applies to accounts held at prominent financial institutions such as Chase Bank and Bank of America, which frequently reassess their interest offerings. Customers can expect this adjustment to enhance their earnings over time, particularly with compounded monthly interest contributing to overall growth. Customers are encouraged to review their account statements post-effective date to track changes in their accrued interest.

Benefits or features of the account

Savings accounts provide individuals with a secure place to store their money while earning interest. Interest rates can vary widely, typically ranging from 0.01% to 2.00%, depending on the financial institution and account type. Many accounts come with features such as compound interest, which allows earnings to grow more quickly over time, as interest is calculated on both the initial principal and the accumulated interest. Institutions like Bank of America and Chase offer online banking options, enabling easy monitoring of account balances and transactions. Additional benefits may include no monthly maintenance fees if certain balance thresholds are met, making it easier for individuals to save without incurring extra costs. Many savings accounts also provide FDIC insurance coverage, protecting deposits up to $250,000, ensuring financial security for account holders.

Contact information for inquiries

Savings account interest rates can fluctuate, influencing the growth of your savings over time. Federal Reserve policy changes often dictate these variations, potentially leading to adjustments in rates offered by various banks. For instance, as of October 2023, a national average savings account interest rate might hover around 0.05% APY (Annual Percentage Yield), reflecting a trend toward lower yields due to a persistently low interest rate environment. Customers seeking further clarification regarding their specific account interest rate or seeking alternative savings options can contact the customer service department of their financial institution, typically available via phone or online chat, during business hours.

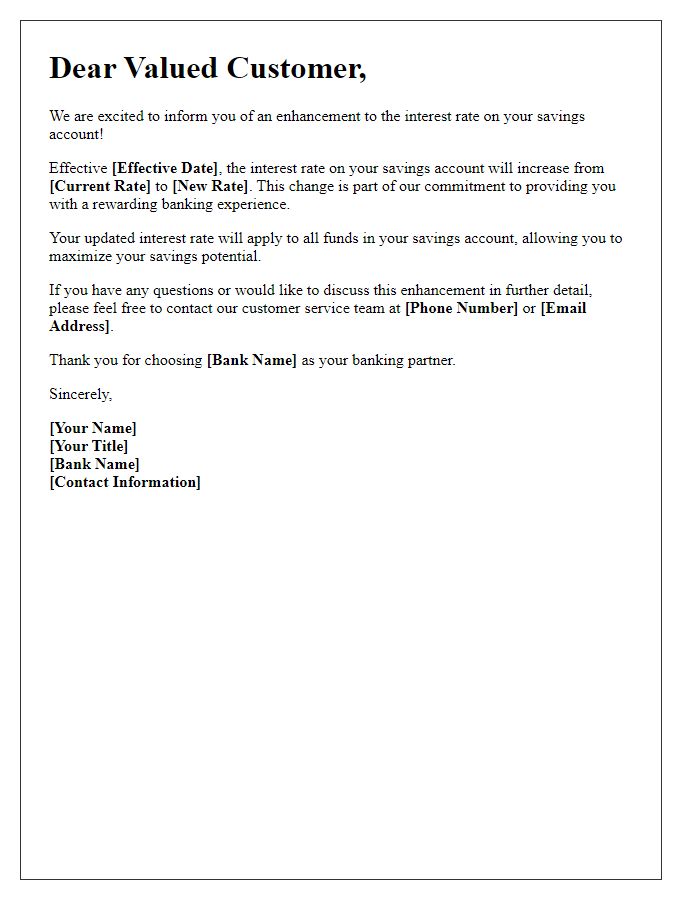

Letter Template For Savings Account Interest Update Samples

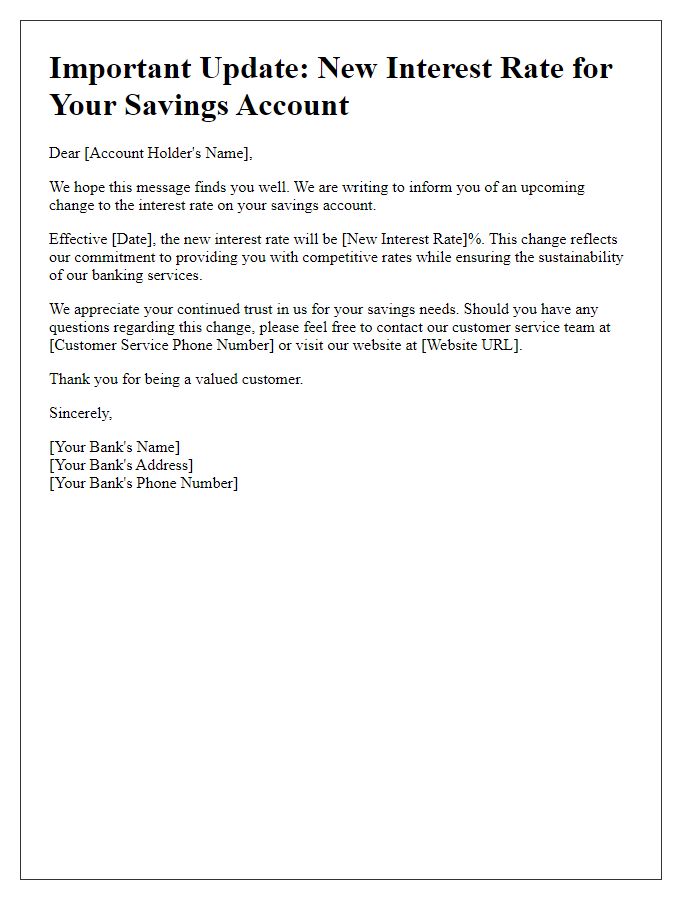

Letter template of savings account interest rate modification notification.

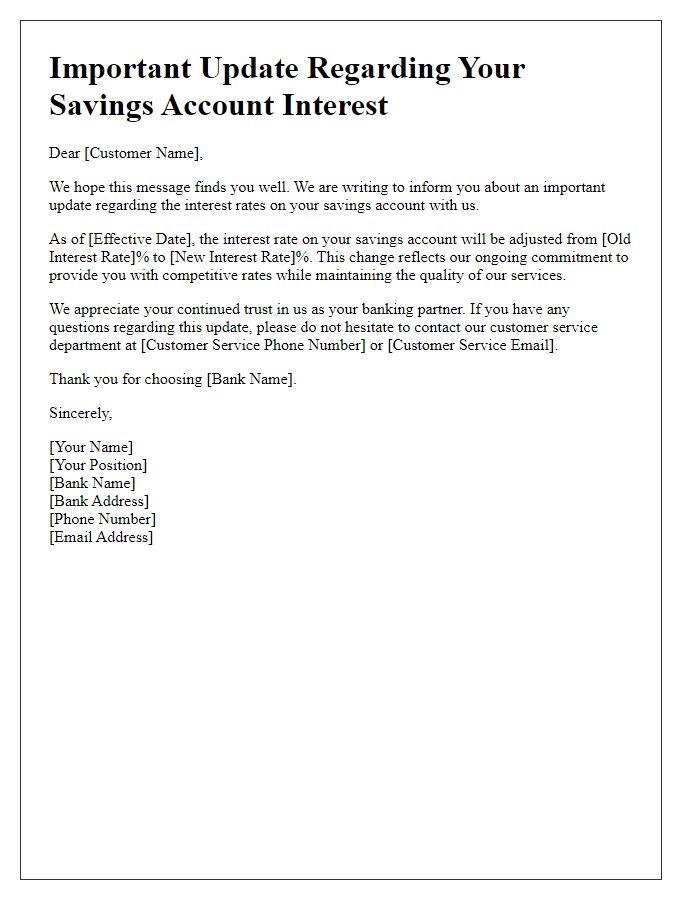

Letter template of notification regarding savings account interest changes.

Comments