Are you looking to authorize a bank account but unsure how to get started? Writing a letter for bank account authorization can be a straightforward task when you break it down step by step. It's essential to include specific details like account numbers and the parties involved to ensure everything goes smoothly. So, let's dive into the specifics and explore a helpful template that you can use for your authorization needs!

Clearly state the purpose

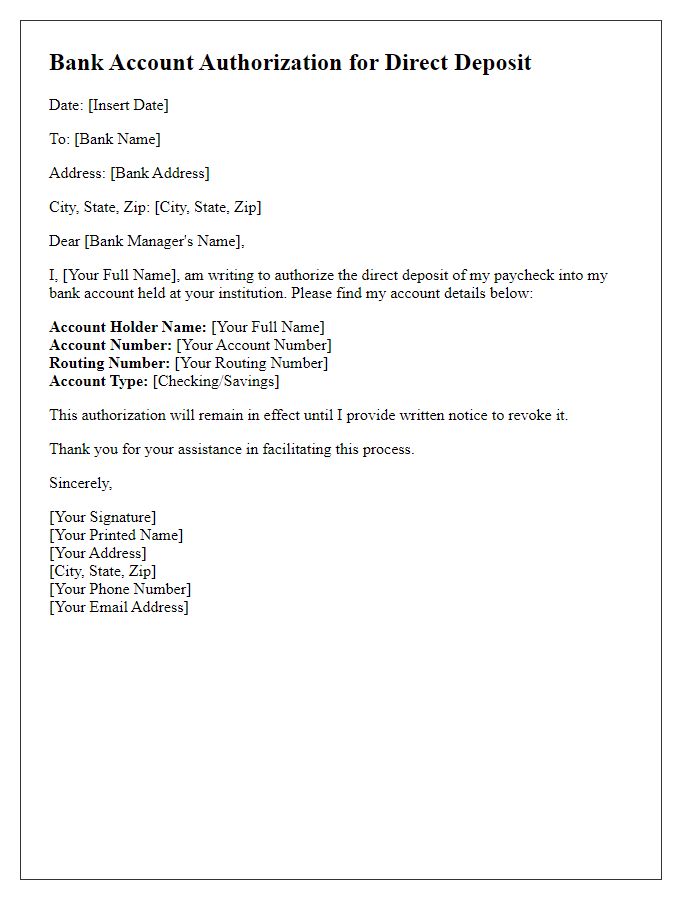

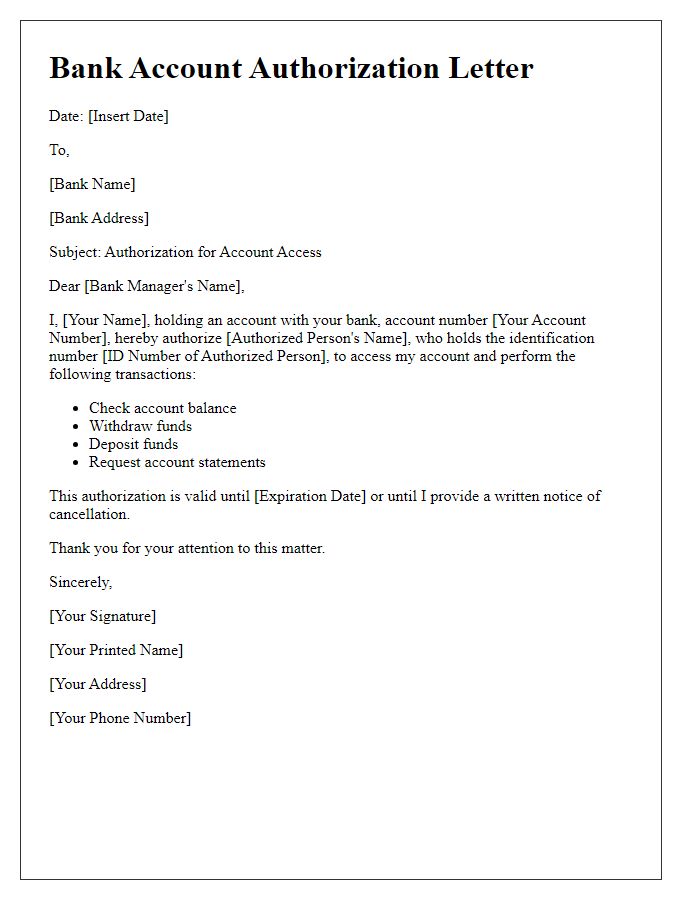

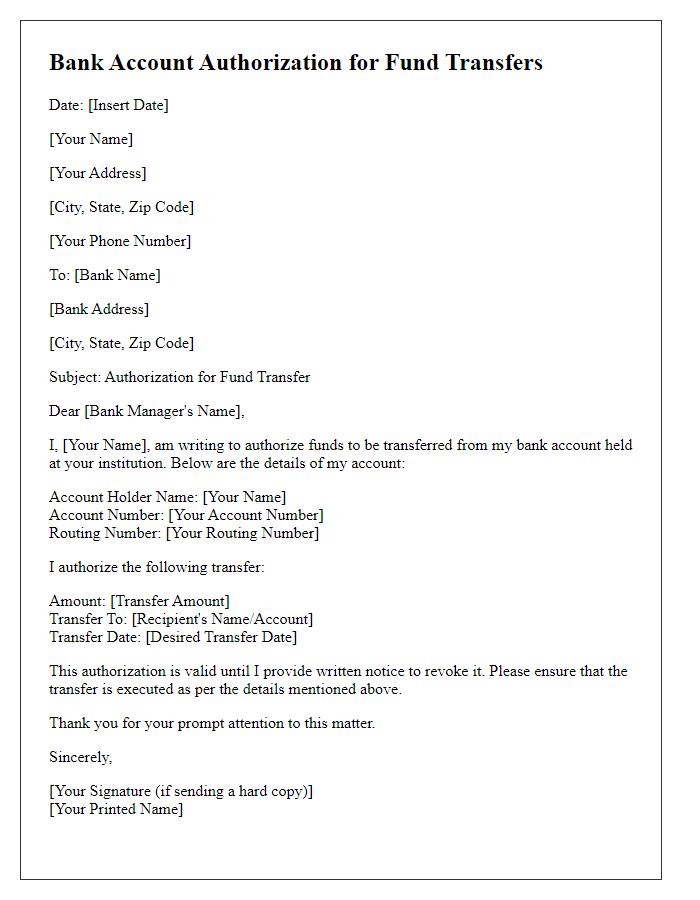

Bank account authorization is a process through which individuals grant permission to specific entities to access or manage their financial accounts, typically in the context of services related to payroll, loan disbursements, or financial planning. This authorization may involve entities such as employers, financial advisors, or lending institutions to perform transactions on behalf of the individual. Necessary documentation usually includes personal identification numbers, account numbers, and signature verification to prevent unauthorized access. The request often needs to be submitted in writing and may follow specific protocols dictated by financial institutions, emphasizing the importance of clarity in stating the exact purpose of the authorization.

Include account details

Unauthorized access to a bank account can lead to identity theft and financial loss. Banks often require a formal authorization letter to permit access to an account by another individual. Key components in the letter include the account holder's full name, account number (typically a 10 or 12-digit number), and other details such as branch name and account type (savings, checking). The letter should clearly state the reason for the authorization, specify the individual being granted access, and include contact information for any necessary follow-up. It is also important to provide the date and sign the letter for verification. Documenting clear and precise authorization helps banks comply with legal regulations and protect both the account holder and the institution.

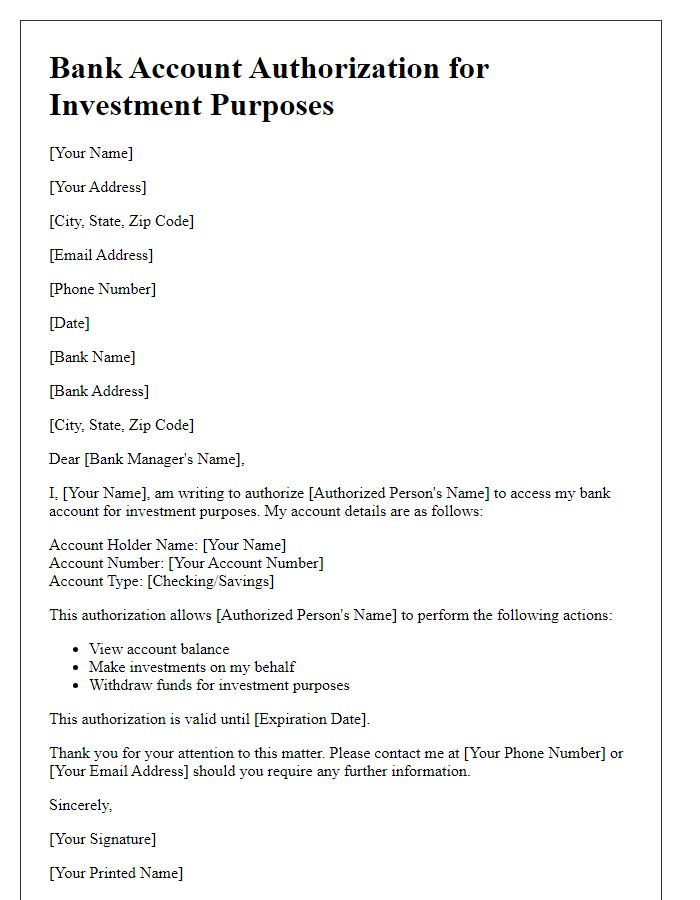

Specify authorized person's information

Authorization for bank account access requires specific details for identification. The authorized person's name should be clearly stated, along with identification details such as a government-issued ID number, address, and date of birth. The authorization letter should also include the account holder's name, account number, and bank branch information. Clear limits on the authorized actions, such as fund withdrawals or account inquiries, should be specified to avoid ambiguity. The letter should be signed by the account holder, with a dated signature to validate the authorization. This provides the bank with a succinct record of granted permissions, ensuring compliance with financial regulations.

Include authorization duration

A bank account authorization allows an individual or organization to access and manage a bank account on behalf of the account holder. Typically, this document includes essential details such as the name of the account holder (individual or entity), account number (specific identifier), and the authorized person's name (individual permitted to access the account). The duration of the authorization must be clearly stated, often specified as a start date and an end date (for example, from January 1, 2024, to June 30, 2024), ensuring clarity on how long the authorization is valid. Furthermore, it may contain provisions for specific actions permitted, such as checking balances, making withdrawals, or transferring funds. Signatures of both the account holder and the authorized person may be required to validate the authorization.

Provide signatures and contact information

Bank account authorization requires detailed documentation to ensure security and proper identification for financial transactions. Signatures, which act as legal confirmation of consent, must be clearly provided by all account holders. Contact information, including phone numbers and email addresses, is essential for communication regarding account matters. Ensuring accurate details protects the account from unauthorized access and potential fraud while maintaining transparent communication with the financial institution. Additionally, this authorization process often requires specific forms, possibly unique to the bank, to be thoroughly filled out and submitted for processing.

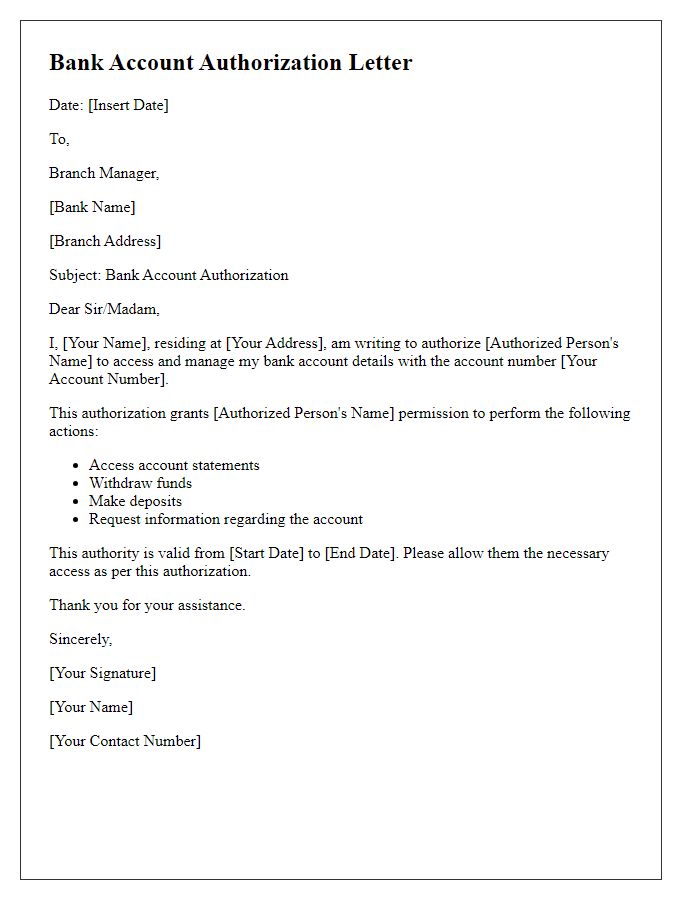

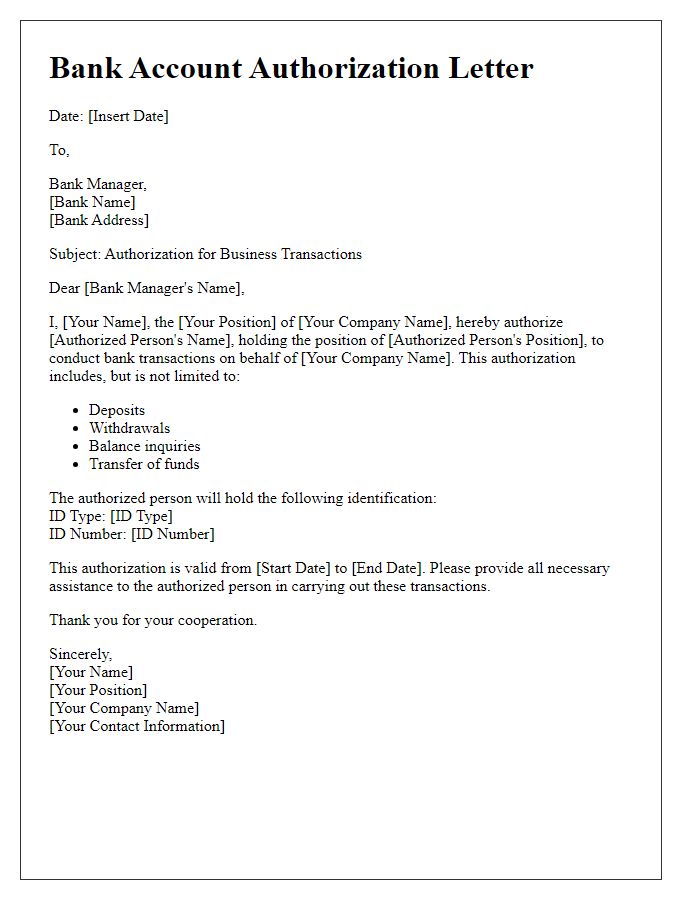

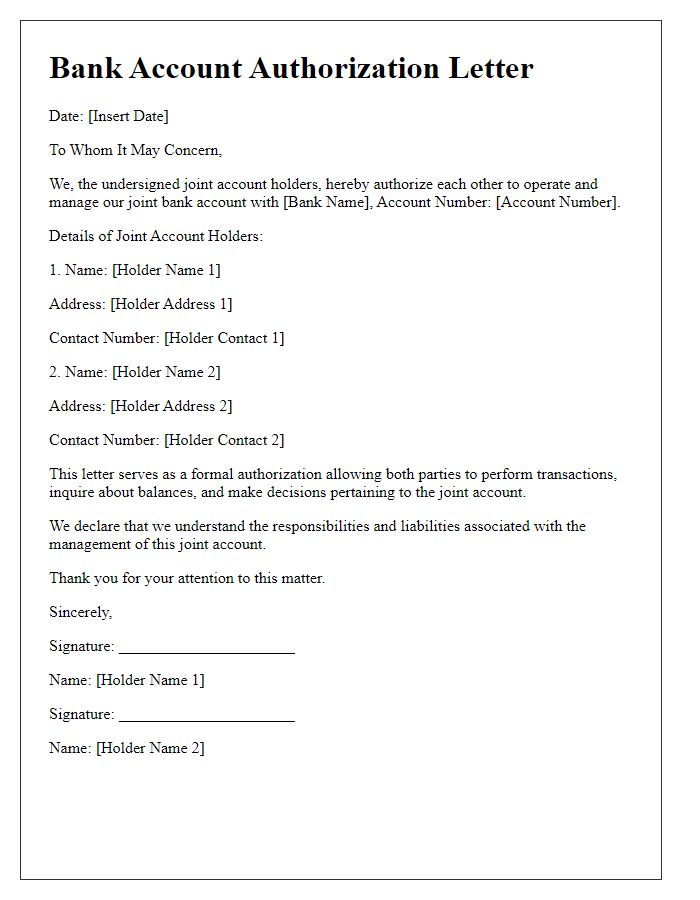

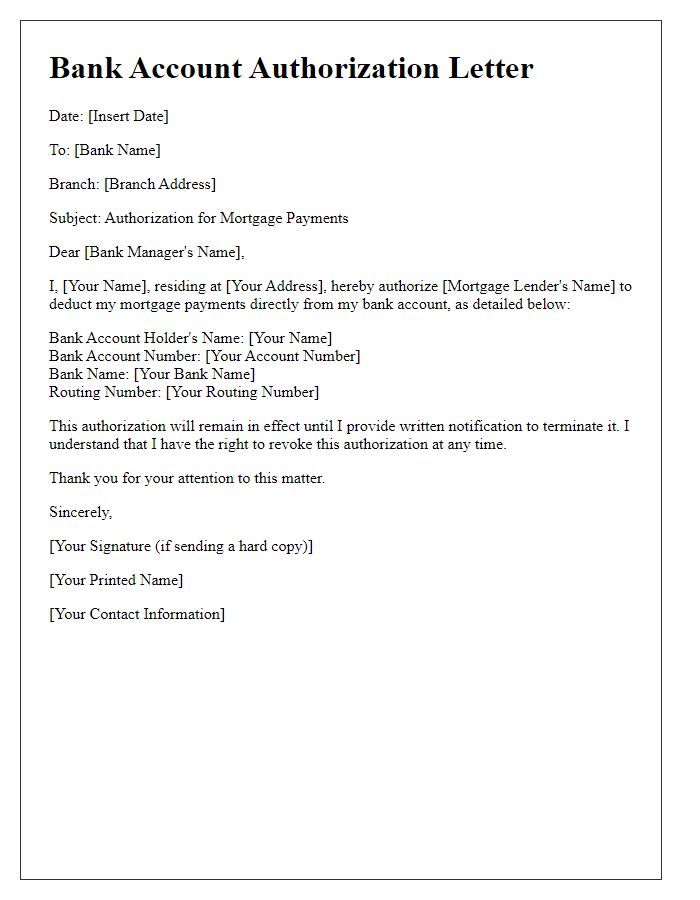

Letter Template For Bank Account Authorization Samples

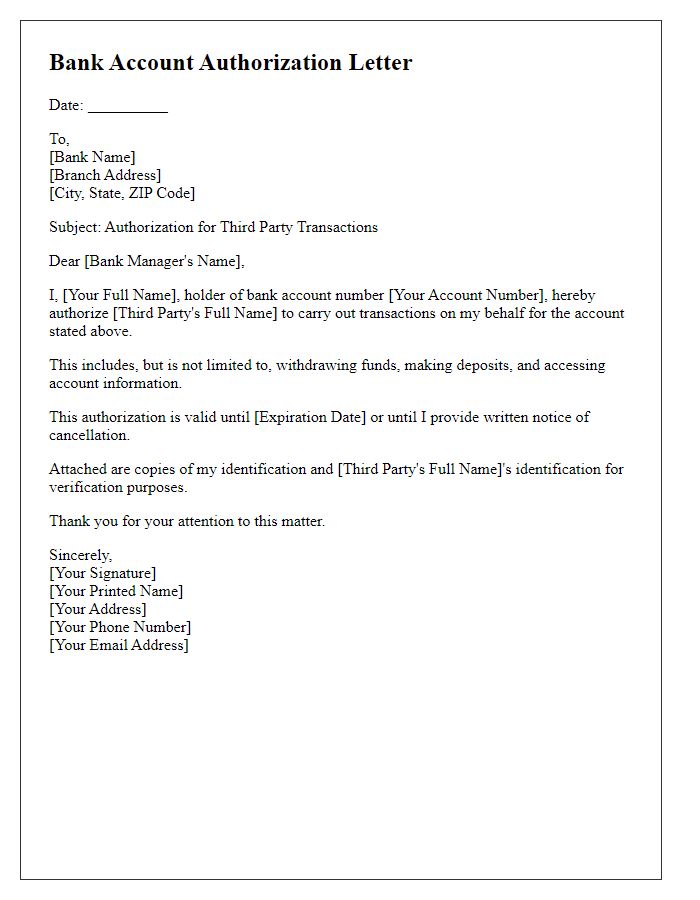

Letter template of bank account authorization for Third Party transactions

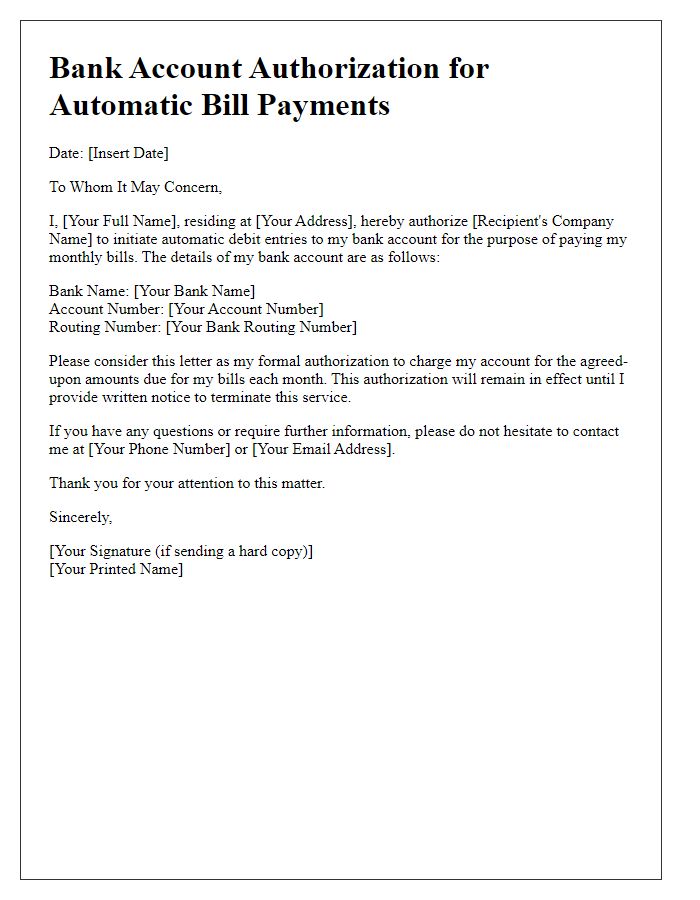

Letter template of bank account authorization for automatic bill payments

Comments