Are you wondering how to stay on top of your insurance audit reminders? It's easy to overlook these important notifications among your busy schedule, but keeping track is essential for maintaining coverage and preventing unforeseen issues. In this article, we'll share tips and templates to streamline the process, ensuring you never miss a crucial deadline again. So, let's dive in and discover how you can simplify your insurance management today!

Subject Line Optimization

An effective subject line for an insurance audit reminder could be "Urgent: Upcoming Insurance Audit Notification." This concise subject line clearly states the urgency of the email while specifying the action needed regarding the insurance audit. Incorporating specifics such as the audit date (e.g., "Scheduled for [Insert Date]") could enhance clarity and prompt timely responses. Additional context like "Ensure Compliance and Prepare Documents" may also strengthen the importance of the audit process, motivating recipients to prioritize their preparations.

Personalization and Greeting

Insurance audits serve as essential evaluations to ensure compliance and accuracy in policyholder records. These audits typically focus on financial documentation related to premiums, claims, and coverage specifics. A recent audit conducted by an insurance firm may require submission of various documents, including tax returns, loss runs, and payroll records for accurate risk assessment. Specific deadlines, often set 30 days from the initial notification, dictate the timeline for required submissions to avoid policy lapses or increased premiums. An effective reminder communicates the importance of timely document provision, emphasizing the audit's role in verifying coverage and ensuring proper claim handling.

Clear and Concise Message

Insurance audits are essential for maintaining compliance with regulatory standards and ensuring accurate financial reporting. Scheduled audits typically occur annually, often in the first quarter, to assess policy adherence and evaluate claim accuracy. Entities, such as insurance companies, must prepare necessary documentation, including financial statements, loss runs, and underwriting files. The audit process, usually conducted by certified public accountants (CPAs), aims to identify discrepancies and enhance operational efficiency. Timely reminders for audits ensure that all relevant stakeholders stay informed and prepared, preventing potential penalties and fostering transparency throughout the organization.

Important Dates and Deadlines

Insurance audits require timely attention to specific dates and deadlines to ensure compliance and maintain coverage. For instance, many insurers mandate the submission of annual audit reports by March 15, 2024, covering the preceding fiscal year. Additionally, policyholders must prepare financial records, including income statements and balance sheets, in accordance with Generally Accepted Accounting Principles (GAAP) to facilitate the audit process. Accurate documentation (such as payroll records, tax returns, and previous audit findings) is crucial during this phase. Failure to meet these deadlines can result in penalties or lapses in coverage, emphasizing the importance of adhering to these crucial timelines.

Contact Information and Support Details

Insurance audits require meticulous preparation and organization. Insurers often communicate important updates regarding coverage adjustments. Regular audits assess risk and ensure compliance, making them crucial for policyholders in various sectors, including health, automotive, and property insurance. The auditing process involves documentation collection, assessment of previous claims (often spanning the past five years), and verification of coverage details. Insured parties must maintain accurate records, including financial statements and regulatory filings, to simplify this process. Timely submission of required documents ensures adherence to compliance guidelines set forth by regulatory bodies such as the National Association of Insurance Commissioners (NAIC). This proactive approach reduces potential liability and aids in optimizing insurance premiums.

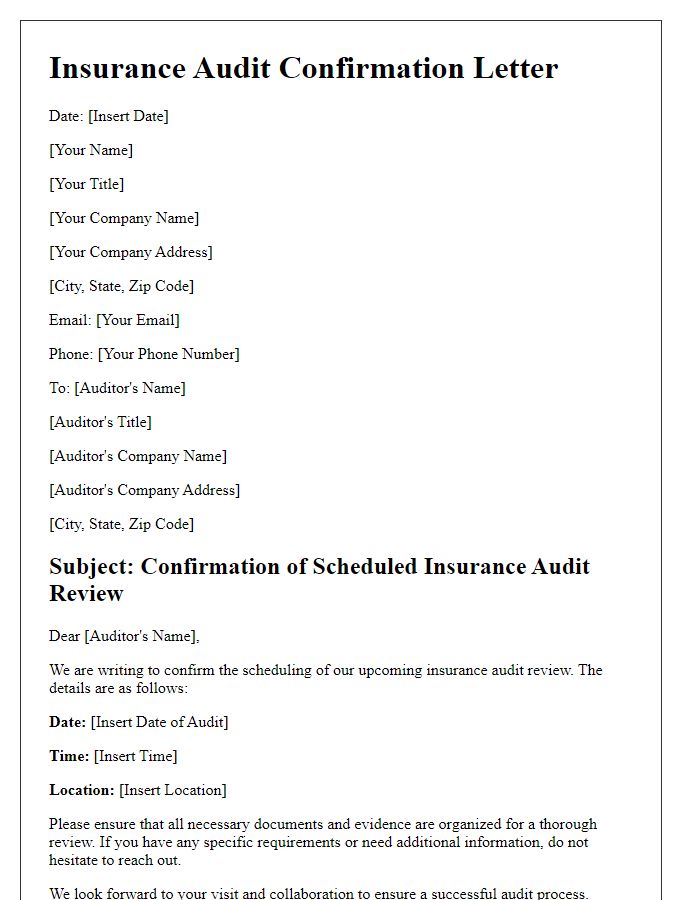

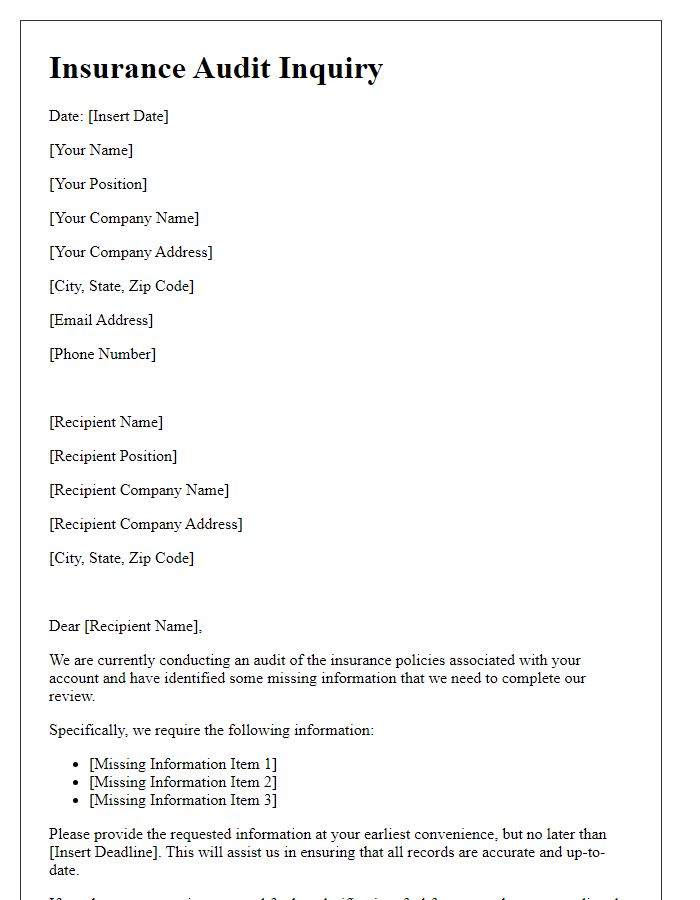

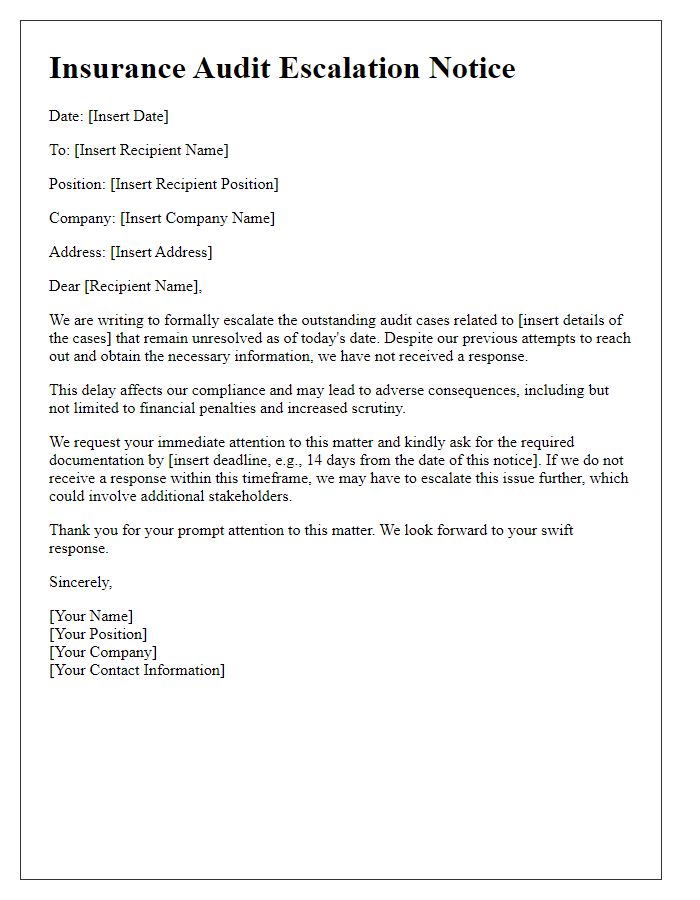

Letter Template For Insurance Audit Reminder Samples

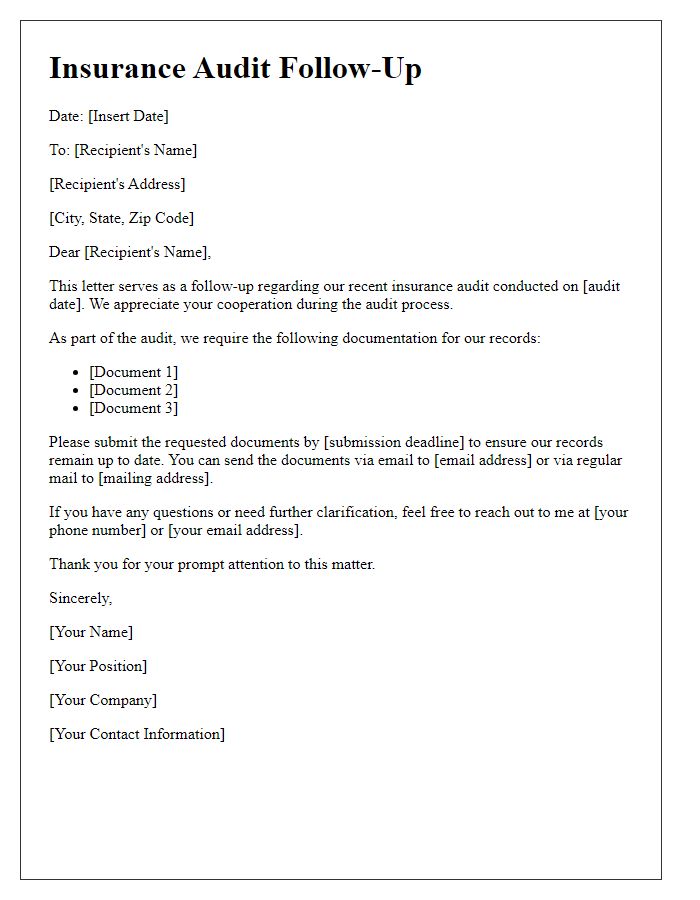

Letter template of insurance audit follow-up for documentation submission.

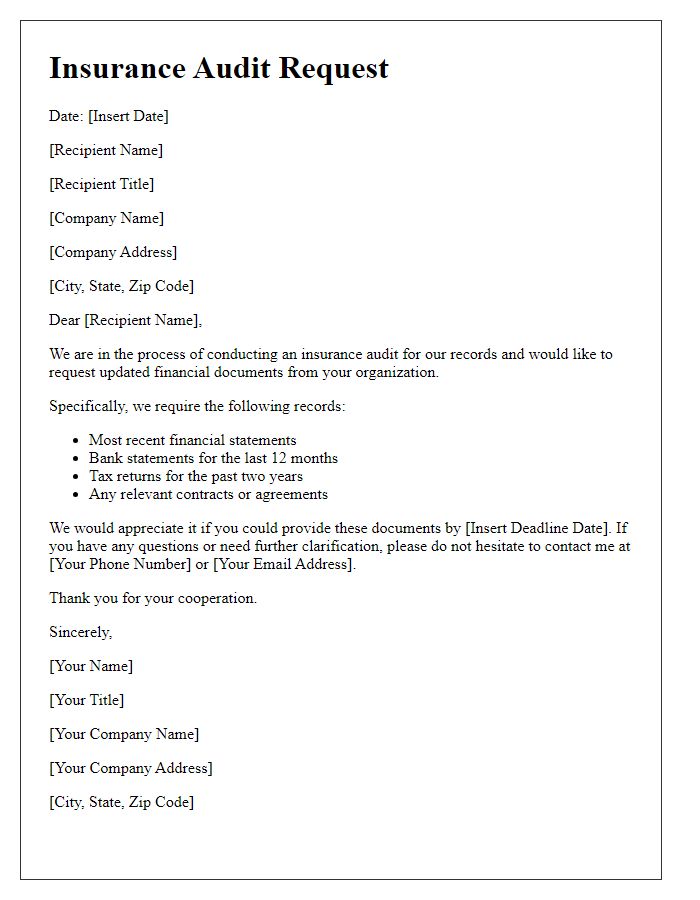

Letter template of insurance audit request for updated financial records.

Comments