Are you looking to streamline your audit corrective actions? Crafting the perfect letter template can make all the difference in communicating your findings effectively. This guide will walk you through essential elements to include, ensuring your message is clear and professional. So, grab a cup of coffee and dive in to discover how to optimize your audit process!

Specific issue identification

The audit corrective actions process necessitates detailed identification of specific issues observed during evaluations. For instance, non-compliance with regulatory standards, such as the Occupational Safety and Health Administration (OSHA) regulations, could lead to significant penalties for organizations. Affected areas must be clearly outlined, including any discrepancies in safety protocols or insufficient employee training sessions. Records indicate that 75% of safety drills were not conducted per schedule in the past quarter, highlighting a critical lapse in operational procedures. Furthermore, documentation errors, such as missing signatures on inspection checklists, can jeopardize accountability. Addressing these issues promptly is essential to mitigate risks, enhance compliance, and ensure organizational integrity.

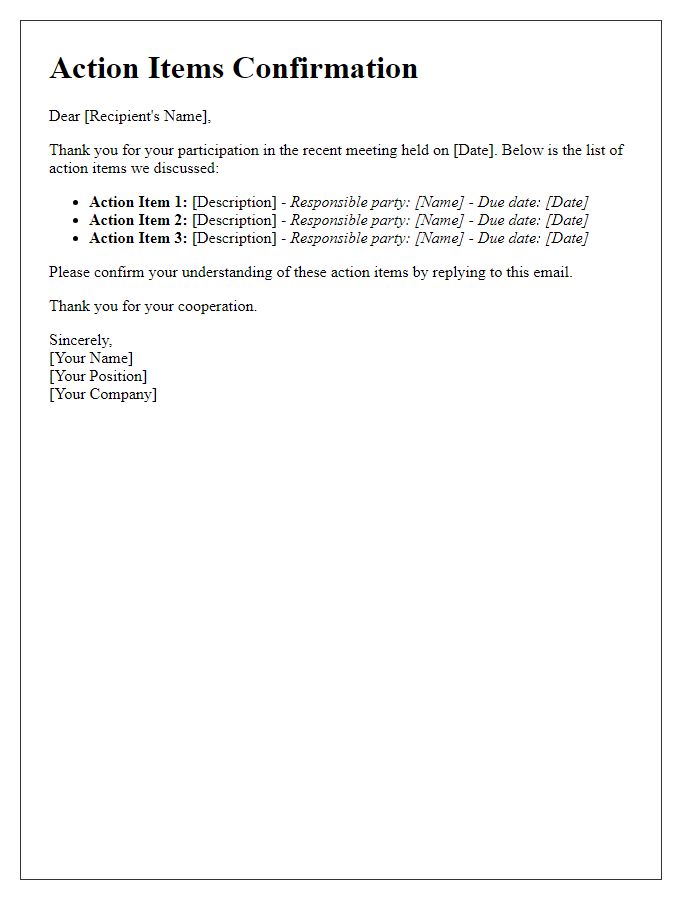

Detailed corrective action plan

A comprehensive corrective action plan is essential for addressing audit findings in organizations. It typically includes identification of key issues, such as non-compliance with financial regulations or operational inefficiencies. Each issue is analyzed for root causes, ranging from inadequate internal controls to insufficient staff training. Specific corrective actions are outlined, detailing the responsible department, such as finance or operations, and setting timelines for resolution, often within 30 to 90 days. Monitoring mechanisms, like regular progress reports and follow-up audits, are implemented to ensure effectiveness. Key performance indicators are established to measure improvements, with an emphasis on sustainability and prevention of future occurrences. This structured approach fosters accountability and enhances overall organizational integrity.

Responsible party designation

Designating responsible parties for audit corrective actions is crucial for effective implementation and accountability. Each corrective action, identified in audit reports from reputable organizations such as the International Organization for Standardization (ISO), must have a designated individual or team to oversee its execution. These parties are typically selected from relevant departments depending on the nature of the findings, such as compliance, finance, or operations. Timelines should also be clearly established, often requiring completion within a specified period of 30 to 90 days post-audit. Frequent progress reviews can be scheduled to ensure that the designated parties remain accountable and any obstacles to implementation are addressed promptly. This structured approach enhances transparency and improves overall audit results.

Timeline for implementation

Implementing corrective actions following an audit involves a structured timeline to ensure resolution of identified issues. The first step occurs immediately upon receiving the audit report, where a meeting is scheduled within five business days to discuss findings and assign responsibilities. Within two weeks, a detailed action plan is developed, outlining specific tasks, deadlines, and responsible parties. By the one-month mark, initial corrective actions are expected to be implemented and documented. A follow-up review takes place after two months to evaluate the effectiveness of these actions. Finally, a comprehensive evaluation report is submitted three months post-audit, reflecting improvements and outlining any further steps needed to fully address the audit findings.

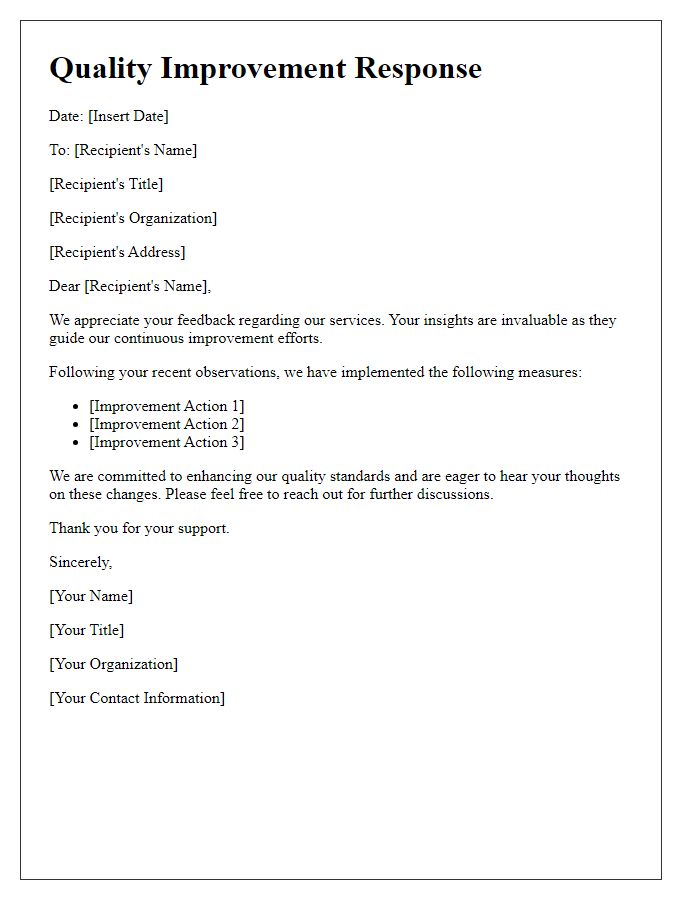

Monitoring and evaluation plan

A well-structured monitoring and evaluation plan is crucial for ensuring effective audit corrective actions, particularly in organizations like educational institutions or businesses. Regular assessments of compliance (following established regulations, such as ISO 9001) and performance indicators (like customer satisfaction scores) are essential for identifying areas needing improvement. Specific metrics, such as error rates (aiming for less than 2% for financial audits) and timelines (ensuring corrective actions are completed within 30 days), guide progress tracking. Furthermore, documentation of findings should occur in designated reports (monthly performance reviews) to facilitate transparency and accountability. Stakeholder engagement through feedback mechanisms enhances adjustment strategies, fostering a culture of continuous improvement within the organization.

Comments