Are you wondering how to effectively initiate a forensic audit engagement? Crafting a clear and professional letter is essential to set the right tone and outline the specifics of your engagement. In this article, we'll guide you through a comprehensive letter template that covers everything from objectives to timelines, ensuring that you communicate your intentions effectively. So, let's dive in and explore how to create the perfect letter for a forensic audit engagement!

Scope of Engagement

The forensic audit engagement encompasses a comprehensive examination of financial records (documents detailing financial transactions) and related processes to uncover potential fraud, mismanagement, or regulatory non-compliance within the organization (a specific entity or business undergoing scrutiny). Key objectives include assessing the integrity of financial statements (formal records that summarize the financial activities) and identifying discrepancies (unexplained differences in data). The engagement will utilize specialized techniques, including data analytics (the process of examining raw data to draw conclusions), interviews with personnel (discussions with employees for insights), and transaction testing (evaluating actual financial transactions for accuracy). The auditing team will focus on pertinent periods (specific timeframes being investigated) and significant accounts (specific categories of financial transactions), ensuring that all relevant evidence is collected, documented, and analyzed thoroughly to support findings and recommendations.

Objectives and Deliverables

The forensic audit engagement focuses on investigating financial discrepancies and ensuring compliance with regulatory standards. Objectives include identifying potential fraud, assessing internal controls, and providing insights into financial reporting practices. Deliverables encompass a comprehensive audit report detailing findings, recommendations for improving internal processes, and support documentation for any legal implications. In addition, a presentation of the findings to stakeholders may be scheduled to facilitate understanding and strategic decision-making. The engagement aims to enhance organizational integrity and safeguard against future financial misconduct.

Roles and Responsibilities

The forensic audit engagement involves a comprehensive examination of financial records to uncover misconduct, fraud, or financial discrepancies. Key responsibilities of the forensic auditor include gathering evidence through document review, conducting interviews with personnel, and analyzing transactions within the accounting software such as QuickBooks or SAP. Another critical role involves presenting findings, typically in a detailed report intended for stakeholders or legal authorities, outlining irregularities with specific documentation and case references. Stakeholders, including management and legal counsel, must ensure open communication and provide access to necessary records, while the auditor remains independent and objective throughout the investigation process. Adhering to standards set by organizations like the Association of Certified Fraud Examiners (ACFE) is essential for maintaining credibility and effectiveness in the audit.

Confidentiality and Data Security

Forensic audit engagements require strict adherence to confidentiality and data security protocols to protect sensitive information. Audit teams must utilize secure communication methods, such as encrypted emails and virtual private networks (VPNs), to transmit financial data related to suspicious activities. Access controls should limit data viewing to authorized personnel only, ensuring that all participating auditors have signed non-disclosure agreements. Physical security measures are essential in safeguarding data, including secure locations for filing cabinets and restricted access to audit documentation. Regular training sessions on data privacy regulations (e.g., GDPR, HIPAA) should be conducted to keep team members updated on best practices. Adherence to these protocols minimizes risks of data breaches and ensures the integrity of the forensic audit process.

Fees and Payment Terms

The forensic audit engagement involves comprehensive analysis and investigation, particularly concerning financial records and compliance with legal standards. Fees typically reflect the complexity and duration of the audit process, often ranging from $100 to $500 per hour, depending on the expertise of the forensic accountant involved. Payment terms generally require a retainer fee upfront, which may be a percentage of the estimated total charges, ensuring commitment to the audit process. Invoices for additional hours or expenses incurred during the audit may occur bi-weekly or monthly, detailing all work performed in specific areas such as fraud detection, financial discrepancies, or regulatory violations. Late payment penalties might also apply, often around 1.5% per month, motivating timely payment from clients. Clear documentation and transparency in fees and payments foster trust between the forensic accounting team and clients, essential for effective collaboration and successful audit outcomes.

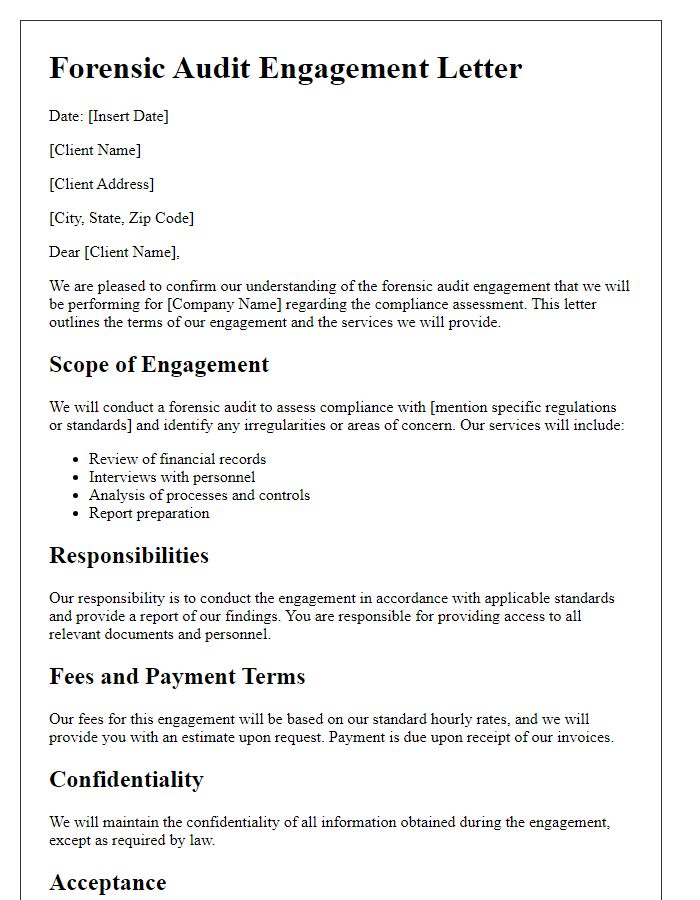

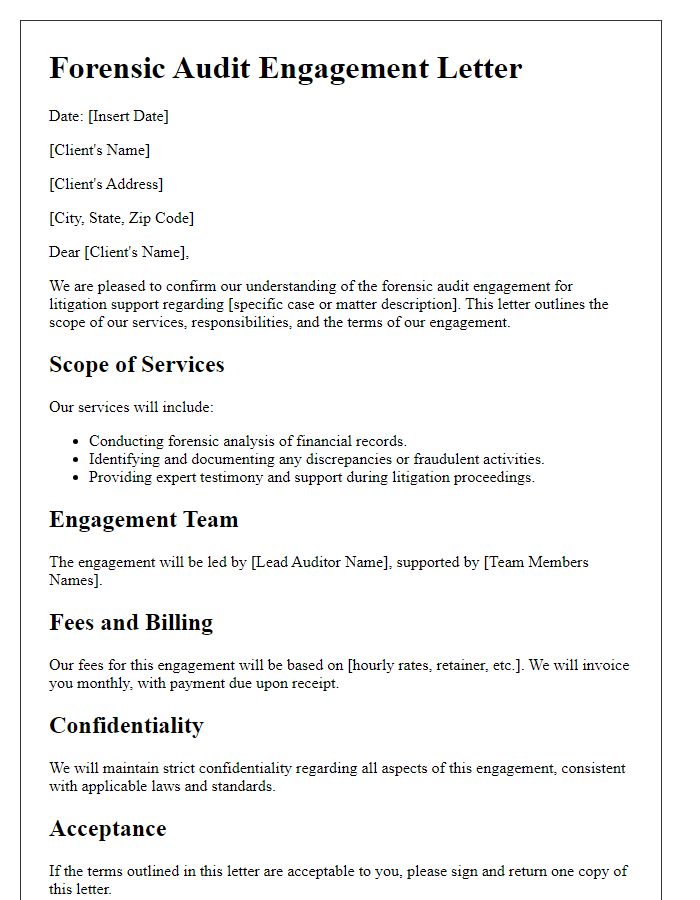

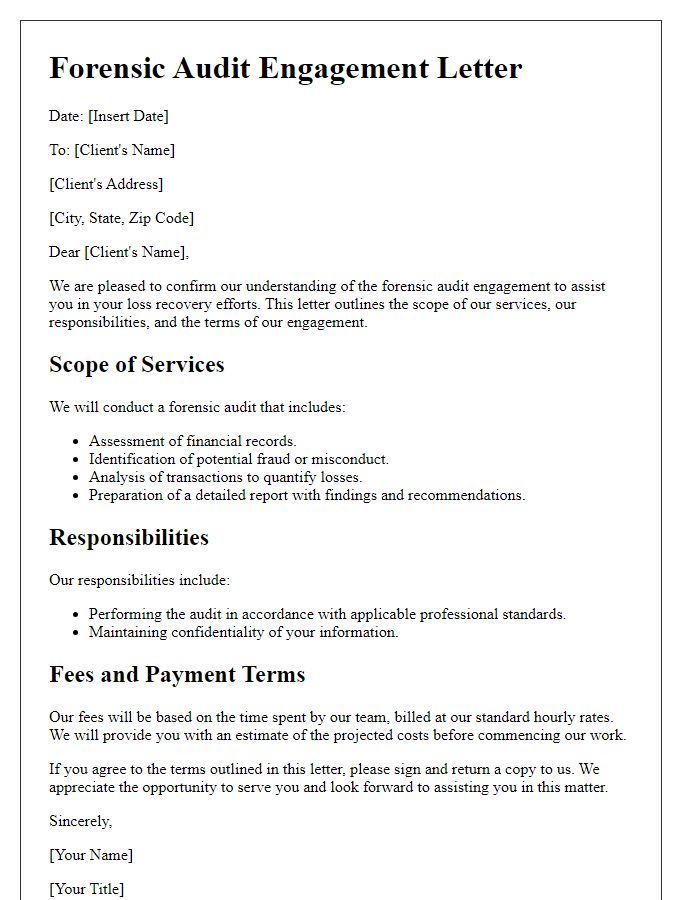

Letter Template For Forensic Audit Engagement Samples

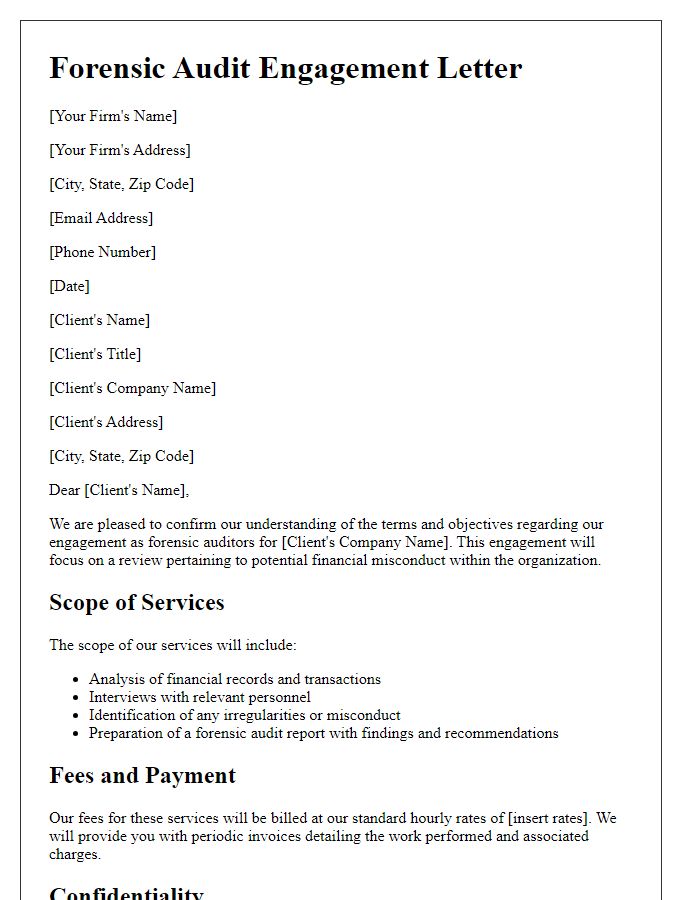

Letter template of forensic audit engagement for financial misconduct review

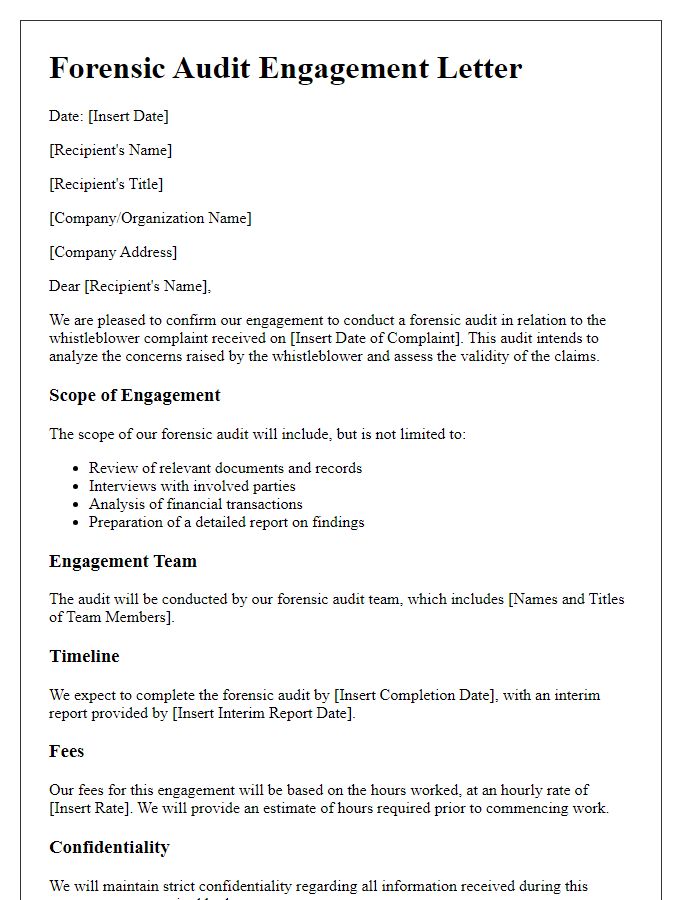

Letter template of forensic audit engagement for whistleblower complaint analysis

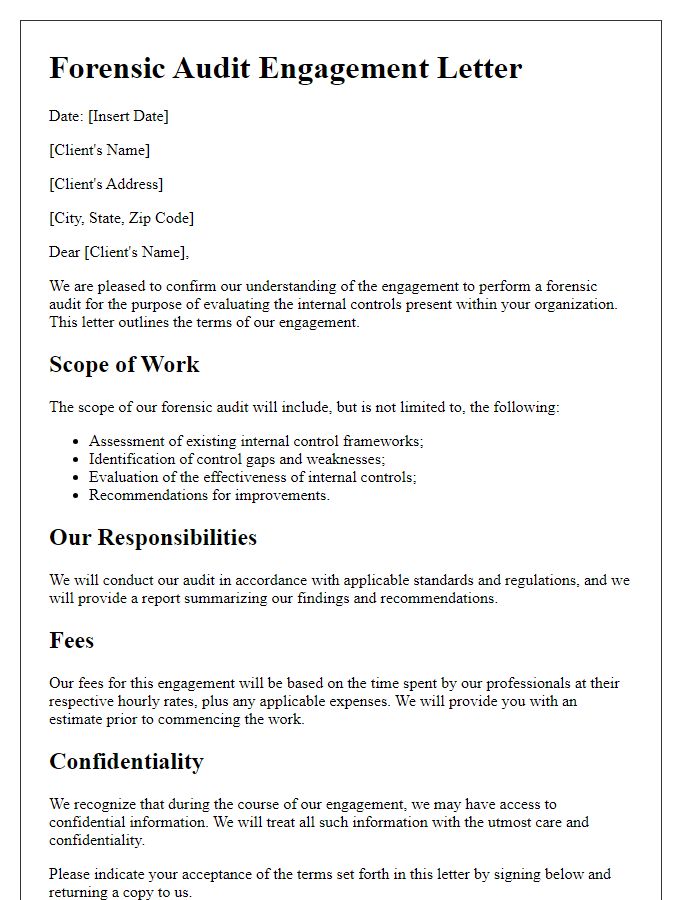

Letter template of forensic audit engagement for internal control evaluation

Letter template of forensic audit engagement for asset misappropriation inquiry

Letter template of forensic audit engagement for risk management analysis

Letter template of forensic audit engagement for transaction verification

Comments