In today's ever-evolving business landscape, understanding and mitigating audit risks is crucial for safeguarding your organization's assets and reputation. Every company, regardless of its size, faces unique challenges that require tailored strategies to navigate potential pitfalls effectively. By recognizing the importance of proactive measures, you can fortify your financial practices and enhance stakeholder confidence. Curious about how to develop an effective audit risk mitigation strategy? Let's explore this essential topic further!

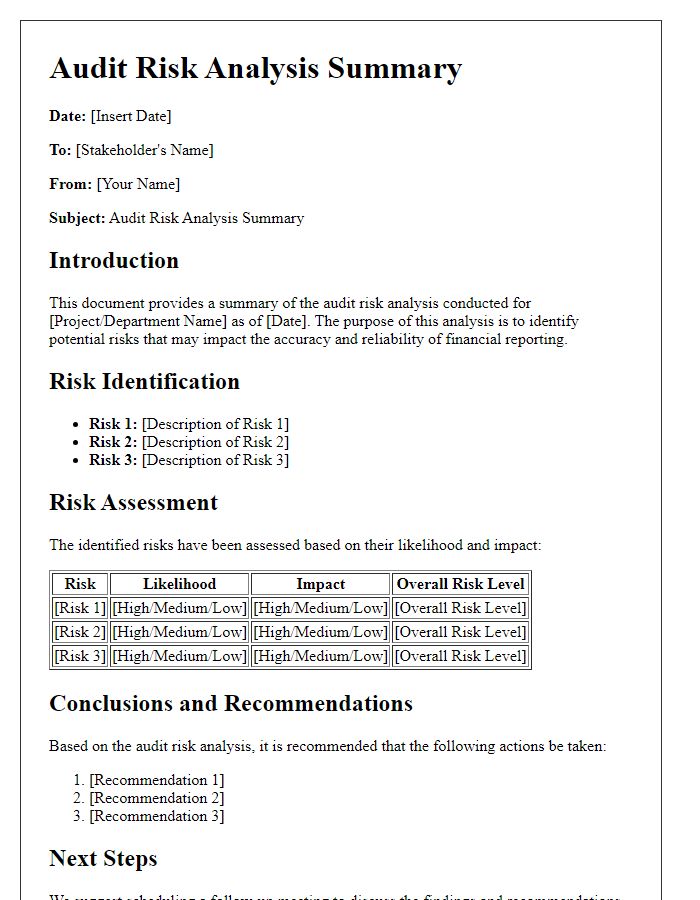

Clear identification of risks

Identifying risks related to financial audits involves analyzing various factors that may compromise the accuracy and integrity of financial statements. Common threats include fraudulent activities, such as asset misappropriation, occurring in corporate environments (for example, Fortune 500 companies) where internal controls might be weak. Complex financial transactions, witnessed during mergers and acquisitions between companies can present difficulties in accounting practices. Regulatory compliance failures, particularly with laws like the Sarbanes-Oxley Act, can lead to significant penalties and reputational damage. External risks include economic downturns that can impact revenue recognition, affecting cash flow projections in the retail sector. A thorough risk assessment process requires continuous monitoring to respond promptly to emerging threats.

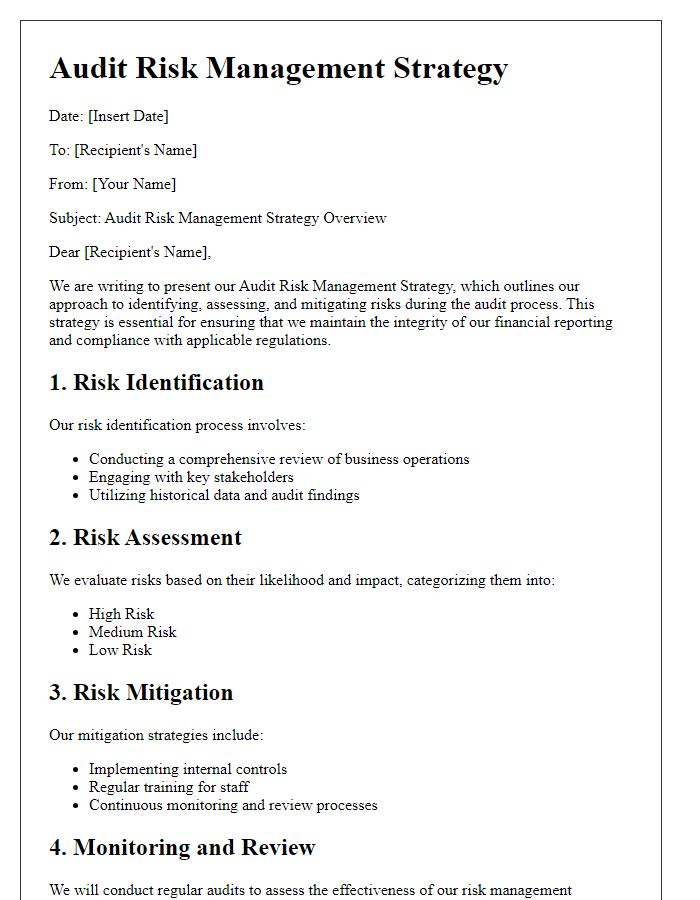

Detailed action plans

A thorough audit risk mitigation strategy necessitates detailed action plans that address specific vulnerabilities within the financial reporting process. The identification of potential fraud risks, such as revenue recognition errors or inappropriate expense classifications, is crucial. Implementing a robust internal control system can help ensure compliance with regulatory frameworks like the Sarbanes-Oxley Act, inherently safeguarding financial integrity. Regular training sessions for employees on ethics and compliance can enhance awareness of fraud prevention measures. Scheduled audits by third-party firms should complement internal reviews to provide an unbiased evaluation of financial processes and controls. Continuous monitoring systems equipped with analytics tools can proactively highlight anomalies in data patterns, allowing for timely corrective actions. Documentation procedures, including maintenance of audit trails, must be established to substantiate all transactions and support the accuracy of financial statements.

Assignment of responsibilities

Implementing an effective audit risk mitigation strategy involves clearly defined responsibilities among team members. In an organizational context, the Chief Financial Officer (CFO) oversees overall financial compliance and risk management processes. The Internal Audit Manager supervises the auditing teams, establishes audit plans for fiscal year 2023, and ensures proper execution of controls. Department Heads, such as the Sales Manager or Supply Chain Manager, are responsible for ensuring their teams adhere to established policies and procedures, conducting regular self-assessments, and reporting any discrepancies. Additionally, the Compliance Officer monitors regulatory changes and ensures that all departments stay aligned with legal requirements, providing training sessions as necessary. Assigning these responsibilities promotes accountability, fosters a culture of transparency, and enhances the effectiveness of risk mitigation strategies within the organization.

Timelines for implementation

Timelines for implementing audit risk mitigation strategies are critical for ensuring compliance and maintaining operational integrity within organizations. A recommended timeline could involve an initial assessment phase lasting approximately four weeks, during which potential risks are identified, categorized, and prioritized based on their impact and likelihood. Following the assessment, a planning phase of about two weeks should be allocated for developing specific mitigation strategies tailored to address identified risks. This would include consulting with key stakeholders across departments such as finance, operations, and IT to ensure comprehensive coverage. The actual implementation phase may take between one to three months, depending on the complexity of the strategies and the resources available. Continuous monitoring and review should occur at six-month intervals, allowing for adjustments to reduce emerging risks associated with changes in regulations, technology, or operational practices. Timelines must remain flexible to account for unforeseen challenges.

Continuous monitoring and review

Continuous monitoring and review processes are essential in mitigating audit risks, particularly in organizations managing complex financial systems like enterprise resource planning (ERP) software. Maintaining current standards, such as the International Financial Reporting Standards (IFRS), necessitates frequent assessments to identify discrepancies and operational weaknesses. Key performance indicators (KPIs) should be regularly analyzed, with particular attention to anomalies that could indicate potential irregularities. For example, unexpected fluctuations in revenue, exceeding thresholds of 10% deviation from historical averages, may signal underlying issues. Furthermore, implementing automated monitoring tools can enhance the real-time detection of risks, allowing for timely interventions. Regular review meetings involving cross-functional teams, including finance, compliance, and IT, can foster a culture of accountability and transparency, ensuring that corrective measures are promptly enacted.

Comments